|

市場調查報告書

商品編碼

1755308

汽車內部環境照明系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Interior Ambient Lighting System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

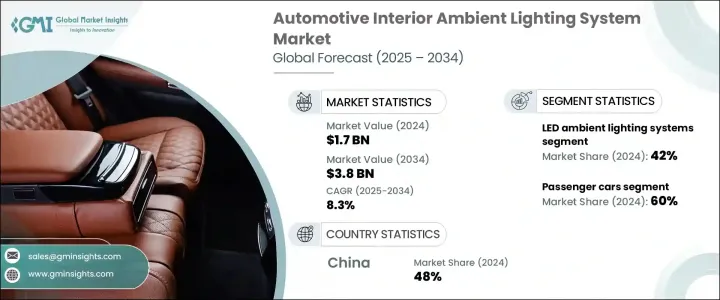

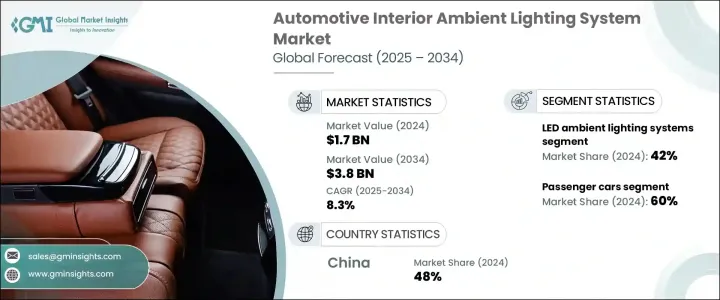

2024 年全球汽車內部環境照明系統市值為 17 億美元,預計到 2034 年將以 8.3% 的複合年成長率成長,達到 38 億美元,這得益於消費者對提升車內舒適度和美觀度的需求不斷成長、高檔汽車普及率不斷上升以及 LED 和 OLED 等照明技術的進步。這些技術使得可客製化、節能且外觀吸引人的照明解決方案成為可能。印度、中國、巴西和東南亞等新興市場的汽車產業擴張促進了對包括環境照明在內的先進車載功能的需求。隨著可支配收入的增加和城市化進程的加快,消費者越來越尋求能夠提供個人化駕駛體驗的汽車,這促使汽車製造商整合時尚且可自訂的車內照明,從而促進市場成長。

LED技術憑藉其高能源效率、更長的使用壽命以及設計靈活性,在這一成長中發揮著重要作用。與傳統照明解決方案相比,LED更節能,亮度更高。此外,其緊湊的尺寸支持創新的內裝設計,有助於汽車製造商提升車輛的美觀和功能性。 OLED和LED創新對於提升汽車內裝的吸引力、提高安全性、滿足消費者對高階功能的需求以及降低能源消耗至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 38億美元 |

| 複合年成長率 | 8.3% |

2024年,LED環境照明系統市場佔有42%的佔有率,預計2034年的複合年成長率將達到9%。 LED技術的普及得益於其低功耗、更長的使用壽命和靈活的設計。 LED燈的優點尤其在於其可提供可自訂的色彩選項和動態照明效果,從而提升車內美學體驗。對於希望在競爭激烈的市場中脫穎而出的汽車製造商來說,這種客製化功能是一個強大的賣點。由於能夠將這些燈整合到中階車型中,對於那些希望以較低成本提供豪華配置的汽車製造商來說,LED燈是一個相當吸引人的選擇。

2024年,乘用車市場佔了60%的市場佔有率,這得益於高產量以及消費者對舒適性、安全性和美觀性日益成長的需求。隨著可支配收入的增加,消費者越來越追求能夠提供高階駕駛體驗的車輛。氣氛燈可以增強車內環境,已成為高階和大眾市場汽車的關鍵配置。汽車製造商正在擴大此類照明系統在緊湊型和中檔車等一系列車型中的應用,以吸引更年輕、更精通科技的買家。諸如可自訂顏色、與娛樂系統同步以及車門照明增強等功能正成為標配。

中國汽車內裝氣氛照明系統市場佔48%的市場佔有率,2024年市場規模達4.482億美元,這得益於消費者對個人化座艙體驗的偏好、技術進步以及政府扶持政策的推動。電動車對先進氛圍照明系統的需求尤其強勁,製造商正在整合尖端照明功能,以增強內裝的未來感。政府推出的節能技術獎勵措施也推動了LED照明系統的普及,從而促進了兼顧美觀和駕駛員安全性的氛圍照明解決方案的成長。

汽車內部環境照明系統市場的主要參與者包括法雷奧、史丹利電氣、Innotec Group、瑪涅蒂·馬瑞利、小糸製作所、歐司朗、Lumileds Holding、麥格納國際和海拉。為了鞏固市場地位,汽車內部環境照明系統產業的公司正專注於產品創新,尤其是在 LED 和 OLED 等節能照明技術方面。製造商正在擴展其產品組合,以包括可自訂的照明解決方案,以增強車輛美感並滿足消費者對個人化車內體驗的需求。此外,這些公司正在投資研發,以提高能源效率,延長照明系統的使用壽命,並創造有助於提升駕駛體驗的動態照明效果。與汽車製造商建立策略合作夥伴關係也至關重要,因為這些合作有助於將先進的照明功能整合到各種車型中。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 系統整合商

- 技術提供者

- OEM

- 售後市場供應商和經銷商

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 按產品

- 按地區

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 車輛個性化需求不斷成長

- 照明技術進步

- 新興市場汽車產業快速成長

- 增強美感和舒適度

- 安全和駕駛輔助功能

- 產業陷阱與挑戰

- 初始成本高

- 安裝維護複雜

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品,2021 - 2034 年

- 主要趨勢

- LED 環境照明系統

- OLED環境照明系統

- 光纖環境照明系統

- 雷射環境照明系統

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車

- 中型商用車

- 重型商用車

- 電動車(Evs)

第7章:市場估計與預測:按安裝區域,2021 - 2034 年

- 主要趨勢

- 儀表板照明

- 腳部空間照明

- 門板照明

- 其他

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場安裝

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- CML Innovative

- HELLA

- Innotec Group

- Jiangsu Jingliang

- Koito Electric

- Koito Manufacturing

- Lumenpulse

- Lumileds Holding

- Magna International

- Magneti Marelli

- Mitsubishi Electric

- OSRAM

- Stanley Electric

- STANLEY Electric

- TCL Automotive

- Valeo

- Varroc Lighting Systems

- Wells Vehicle Electronics

- Xenon Automotives

- ZKW Group

The Global Automotive Interior Ambient Lighting System Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 3.8 billion by 2034, driven by increasing consumer demand for enhanced in-vehicle comfort and aesthetics, rising adoption of premium vehicles, and advancements in lighting technologies like LED and OLED. These technologies allow for customizable, energy-efficient, and visually appealing lighting solutions. The expansion of the automotive sector in emerging markets such as India, China, Brazil, and Southeast Asia contributes to the demand for advanced in-vehicle features, including ambient lighting. With rising disposable incomes and urbanization, consumers are increasingly seeking vehicles that offer personalized driving experiences, which has pushed automakers to integrate stylish and customizable interior lighting, contributing to market growth.

LED technology plays a significant role in this growth due to its energy efficiency, longer lifespan, and the flexibility it offers in design. LEDs are more power-efficient and provide greater brightness compared to traditional lighting solutions. Furthermore, their compact size supports innovative interior designs, which helps automakers enhance vehicle aesthetics and functionality. OLED and LED innovations are crucial for boosting the appeal of automotive interiors, improving safety, and meeting consumer demand for premium features while lowering energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 billion |

| Forecast Value | $3.8 billion |

| CAGR | 8.3% |

In 2024, the LED ambient lighting systems segment held a 42% share and is expected to grow at a CAGR of 9% during 2034. The popularity of LED technology can be attributed to its low power consumption, longer lifespan, and design flexibility. LED lights are particularly advantageous as they can offer customizable color options and dynamic lighting effects, which elevate the aesthetic experience inside vehicles. This customization is a strong selling point for automakers looking to differentiate their vehicles in a competitive market. The ability to integrate these lights into mid-range vehicles has made them an appealing choice for automakers aiming to offer luxury features at a lower cost.

In 2024, the passenger car segment held a 60% share, driven by high production volumes and growing consumer demand for comfort, safety, and aesthetic features. As disposable incomes rise, consumers are increasingly seeking vehicles that offer a premium driving experience. Ambient lighting, which enhances the interior environment, has become a key feature in high-end and mass-market vehicles. Automakers are expanding the availability of these lighting systems across a range of models, including compact and mid-range cars, to appeal to younger, tech-savvy buyers. Features such as customizable colors, synchronization with entertainment systems, and door lighting enhancements are becoming standard offerings.

China Automotive Interior Ambient Lighting System Market held 48% share and generated USD 448.2 million in 2024 driven by a combination of consumer preferences for personalized in-cabin experiences, technological advancements, and supportive government policies. The demand for advanced ambient lighting systems is particularly strong in electric vehicles, where manufacturers are integrating cutting-edge lighting features to enhance the futuristic appeal of their interiors. Government incentives promoting energy-efficient technologies have encouraged the adoption of LED lighting systems, contributing to the growth of ambient lighting solutions that improve both aesthetics and driver safety.

Key players in the Automotive Interior Ambient Lighting System Market include Valeo, Stanley Electric, Innotec Group, Magneti Marelli, Koito Manufacturing, OSRAM, Lumileds Holding, Magna International, and HELLA. To strengthen their market presence, companies in the automotive interior ambient lighting system industry are focusing on product innovation, particularly in energy-efficient lighting technologies like LED and OLED. Manufacturers are expanding their portfolios to include customizable lighting solutions that enhance vehicle aesthetics and meet consumer demand for personalized in-cabin experiences. Additionally, these companies are investing in research and development to improve energy efficiency, prolong the lifespan of lighting systems, and create dynamic lighting effects that contribute to an enhanced driving experience. Strategic partnerships with automakers are also key, as these collaborations help integrate advanced lighting features into a wide range of vehicle models.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators

- 3.2.4 Technology providers

- 3.2.5 OEM

- 3.2.6 Aftermarket suppliers and distributors

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 By Product

- 3.6.2 By Region

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for vehicle personalization

- 3.11.1.2 Technological advancements in lighting

- 3.11.1.3 Rapid growth of the automotive industry in emerging markets

- 3.11.1.4 Enhanced aesthetic appeal and comfort

- 3.11.1.5 Safety and driver assistance features

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial costs

- 3.11.2.2 Complex installation and maintenance

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 LED ambient lighting systems

- 5.3 OLED ambient lighting systems

- 5.4 Fiber optic ambient lighting systems

- 5.5 Laser ambient lighting systems

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

- 6.4 Electric vehicles (Evs)

Chapter 7 Market Estimates & Forecast, By Installation Area, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Dashboard lighting

- 7.3 Footwell lighting

- 7.4 Door panel lighting

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket installations

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 CML Innovative

- 10.2 HELLA

- 10.3 Innotec Group

- 10.4 Jiangsu Jingliang

- 10.5 Koito Electric

- 10.6 Koito Manufacturing

- 10.7 Lumenpulse

- 10.8 Lumileds Holding

- 10.9 Magna International

- 10.10 Magneti Marelli

- 10.11 Mitsubishi Electric

- 10.12 OSRAM

- 10.13 Stanley Electric

- 10.14 STANLEY Electric

- 10.15 TCL Automotive

- 10.16 Valeo

- 10.17 Varroc Lighting Systems

- 10.18 Wells Vehicle Electronics

- 10.19 Xenon Automotives

- 10.20 ZKW Group