|

市場調查報告書

商品編碼

1755299

視訊作為感測器的市場機會、成長動力、產業趨勢分析以及 2025 - 2034 年預測Video as a Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

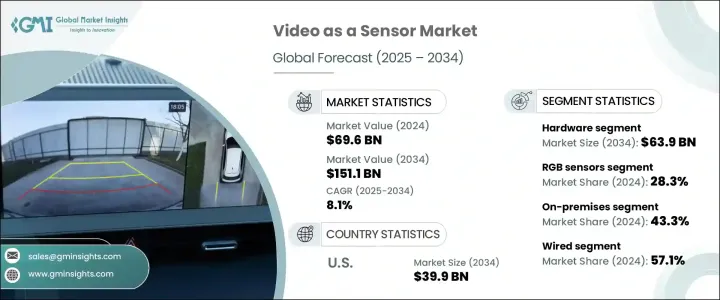

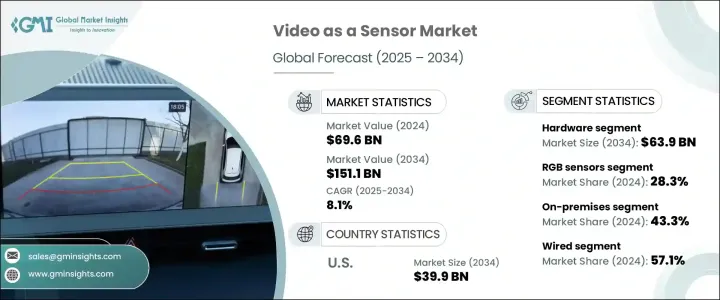

2024年,全球視訊感測器市場規模達696億美元,預計2034年將以8.1%的複合年成長率成長,達到1511億美元。這一成長主要源自於各行各業對態勢感知日益成長的需求。隨著各行各業重視即時環境監測和快速決策,視訊感測器正部署為將視覺資料轉化為可操作洞察的關鍵工具。人工智慧與視訊來源的整合提升了監控效率,從而能夠更快地進行解讀並改善安全響應。國防、工業自動化和醫療保健等行業正在將智慧視訊感測器整合到其現有基礎設施中,以提升營運控制、安全標準和響應能力,從而鞏固市場的成長勢頭。

對進口中國零件徵收關稅造成了成本壓力,尤其是在攝影機模組和成像感測器等硬體方面。這些貿易變化擾亂了供應鏈,延長了交貨時間,導致生產和採購延遲。通貨膨脹加劇和政府預算緊縮為採購流程帶來了新的複雜性,往往導致核准時間延長,並推遲了先進監控技術的實施。這些經濟限制因素給公共部門機構帶來了壓力,迫使其優先安排支出,這可能會影響視訊感測器解決方案在關鍵產業的推廣速度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 696億美元 |

| 預測值 | 1511億美元 |

| 複合年成長率 | 8.1% |

硬體市場正在經歷顯著成長,預計到2034年將達到639億美元。這一成長主要源自於對能夠即時進行設備資料分析的智慧、整合AI的成像系統的需求激增。此類系統對於降低延遲、最大限度地減少網路負載以及在動態營運環境中實現快速自主決策至關重要。

隨著熱視訊感測器在醫院、邊境檢查站和大型公共場所等敏感環境中得到更廣泛的應用,預計到2034年,熱感測器市場規模將達到444億美元。這些感測器不僅在增強安全性和監控方面發揮至關重要的作用,而且還透過在故障發生前識別工業設備的溫度異常來支援預測性維護操作。

到2034年,美國視訊感測器市場規模將達到399億美元。智慧城市基礎設施、國防現代化以及國土安全日益受到重視等因素的融合,正在塑造這一應用曲線。這些發展,加上基於邊緣的視訊分析技術的創新,正在推動該技術在政府和私營部門的應用領域成為主流。

影響該市場的關鍵公司包括Teledyne Technologies、OmniVision Technologies Inc.、佳能公司、索尼公司和意法半導體。視訊感測器產業的領先公司正專注於創新、合作夥伴關係和人工智慧整合,以增強其全球影響力。各公司正在擴大研發計劃,以打造具有邊緣處理能力的下一代影像解決方案,從而實現更快、更安全的資料處理。他們正在與國防、醫療保健和工業領域的企業建立策略聯盟與合作關係,以根據特定產業的需求客製化產品。製造商也在本地化零件採購,以減少對不穩定供應鏈的依賴,並抵消貿易關稅的影響。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 對即時態勢感知的需求不斷成長

- 智慧城市和基礎設施項目的擴展

- 安全和監控要求增加

- 人工智慧視訊分析的普及

- 軍事預算成長

- 產業陷阱與挑戰

- 與遺留系統的整合複雜性

- 即時處理中的延遲

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依組件,2021-2034

- 主要趨勢

- 硬體

- 軟體

- 服務

第6章:市場估計與預測:按感測器類型,2021-2034

- 主要趨勢

- RGB感測器

- 紅外線(IR)感測器

- 熱感應器

- 深度感測器

- 多光譜感測器

第7章:市場估計與預測:依部署模式,2021-2034

- 主要趨勢

- 本地

- 基於雲端

- 基於邊緣

第8章:市場估計與預測:依連結性,2021-2034

- 主要趨勢

- 有線

- 無線的

第9章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 安防與監控

- 交通監控與智慧移動

- 工業自動化與機器人技術

- 零售分析

- 醫療保健和患者監測

- 環境監測

- 農業和畜牧業監控

- 其他

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Avnet EMEA

- BAE Systems plc

- Canon Inc.

- Excelitas Technologies Corp.

- FLUKE Corporation

- Hamamatsu Photonics KK

- InfraTec GmbH

- Intevac, Inc.

- IRCameras LLC

- L3Harris Technologies

- Leonardo DRS

- Lynred

- New Imaging Technologies (NIT)

- OmniVision Technologies Inc.

- Photonis Technologies

- Sony Corporation

- STMicroelectronics

- Teledyne Technologies Incorporated

- Thales Group

- Xenics NV

The Global Video as a Sensor Market was valued at USD 69.6 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 151.1 billion by 2034. The growth is driven by the rising demand for situational awareness across various sectors. As industries prioritize real-time environmental monitoring and rapid decision-making, video sensors are being deployed as critical tools that convert visual data into actionable insights. Integration of AI with video feeds enhances surveillance efficiency, allowing for faster interpretation and improved safety responses. Industries such as defense, industrial automation, and healthcare are integrating smart video sensors into their existing infrastructure to elevate operational control, security standards, and responsiveness, reinforcing the market's upward trajectory.

The imposition of tariffs on imported Chinese components has created cost pressures, particularly on hardware like camera modules and imaging sensors. These trade shifts disrupted the supply chain and extended lead times, resulting in delayed production and procurement. Rising inflation and tightening government budgets have introduced new layers of complexity to procurement processes, often resulting in longer approval times and delayed implementation of advanced surveillance technologies. These economic constraints are placing pressure on public sector agencies to prioritize spending, which may impact the pace at which video as a sensor solution is rolled out across critical sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.6 Billion |

| Forecast Value | $151.1 Billion |

| CAGR | 8.1% |

The hardware component of the market is experiencing notable traction, projected to reach USD 63.9 billion by 2034. This growth is largely driven by the surge in demand for intelligent, AI-integrated imaging systems capable of real-time, on-device data analysis. Such systems are pivotal for reducing latency, minimizing network load, and enabling quick, autonomous decision-making in dynamic operational settings.

The thermal sensors segment is expected to reach USD 44.4 billion by 2034 as thermal video sensors are witnessing broader integration across sensitive environments like hospitals, border checkpoints, and large-scale public spaces. These sensors play a vital role not only in enhancing safety and monitoring but also in supporting predictive maintenance operations by identifying temperature anomalies in industrial equipment before failure occurs.

United States Video as a Sensor Market reached USD 39.9 billion by 2034. The adoption curve is being shaped by the convergence of smart city infrastructure, defense modernization, and heightened emphasis on homeland security. These developments, alongside innovation in edge-based video analytics, are pushing the technology into the mainstream across both government and private sector applications.

Key companies influencing this market include Teledyne Technologies, OmniVision Technologies Inc., Canon Inc., Sony Corporation, and STMicroelectronics. Leading firms in the video as a sensor industry are focusing on innovation, partnerships, and AI integration to strengthen their global footprint. Companies are expanding R&D initiatives to create next-gen imaging solutions with edge-processing capabilities for faster and more secure data handling. Strategic alliances and collaborations are being formed with defense, healthcare, and industrial players to tailor offerings for sector-specific needs. Manufacturers are also localizing component sourcing to reduce reliance on volatile supply chains and counteract trade tariff impacts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for real-time situational awareness

- 3.3.1.2 Expansion of smart cities and infrastructure projects

- 3.3.1.3 Increased security and surveillance requirements

- 3.3.1.4 Proliferation of AI-powered video analytics

- 3.3.1.5 Growth in military budget

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Integration complexity with legacy systems

- 3.3.2.2 Latency in real-time processing

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Sensor Type, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 RGB sensors

- 6.3 Infrared (IR) sensors

- 6.4 Thermal sensors

- 6.5 Depth sensors

- 6.6 Multispectral sensors

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

- 7.4 Edge-based

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Wired

- 8.3 Wireless

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Security & surveillance

- 9.3 Traffic monitoring & smart mobility

- 9.4 Industrial automation & robotics

- 9.5 Retail analytics

- 9.6 Healthcare & patient monitoring

- 9.7 Environmental monitoring

- 9.8 Agriculture & livestock monitoring

- 9.9 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avnet EMEA

- 11.2 BAE Systems plc

- 11.3 Canon Inc.

- 11.4 Excelitas Technologies Corp.

- 11.5 FLUKE Corporation

- 11.6 Hamamatsu Photonics K.K.

- 11.7 InfraTec GmbH

- 11.8 Intevac, Inc.

- 11.9 IRCameras LLC

- 11.10 L3Harris Technologies

- 11.11 Leonardo DRS

- 11.12 Lynred

- 11.13 New Imaging Technologies (NIT)

- 11.14 OmniVision Technologies Inc.

- 11.15 Photonis Technologies

- 11.16 Sony Corporation

- 11.17 STMicroelectronics

- 11.18 Teledyne Technologies Incorporated

- 11.19 Thales Group

- 11.20 Xenics NV