|

市場調查報告書

商品編碼

1755286

船屋市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Houseboats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

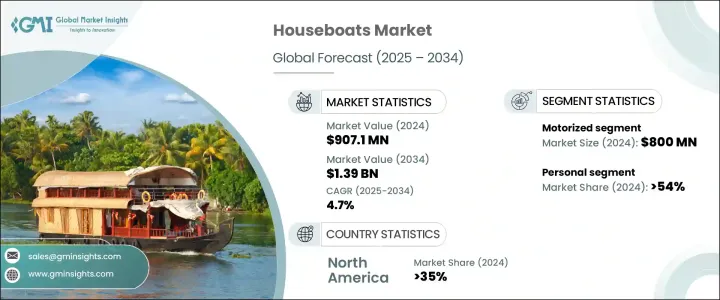

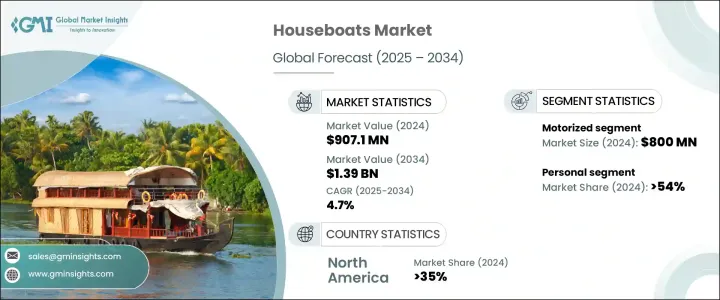

2024 年全球船屋市場價值為 9.071 億美元,預計到 2034 年將以 4.7% 的複合年成長率成長,達到 13.9 億美元,這得益於日益擁擠的城市環境以及人們探索替代住房解決方案,對於尋求逃離城市過度擁擠的城市居民來說,這是一種日益擁擠的選擇。永續生活的技術進步提升了船屋的吸引力,現在船屋融合了太陽能板、鋰電池系統、節能電器和廢水處理裝置等綠色功能。這些環保船屋越來越受到有環保意識的消費者的歡迎,具有離網功能並減少碳足跡。遠距工作的興起也為船屋創造了用作住宅和移動辦公空間的機會,高速網際網路和符合人體工學的工作空間現在通常整合到船屋設計中。

此外,船屋在旅遊業中也備受關注,尤其是在尋求客製化豪華水上住宿的富裕旅客群體中。機動船屋的需求日益成長,尤其是在北美和歐洲,因為它們可以自由探索各種水道,無需拖船。這種靈活、移動的生活方式趨勢正在推動船屋市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.071億美元 |

| 預測值 | 13.9億美元 |

| 複合年成長率 | 4.7% |

2024年,機動船屋市場佔據主導地位,市場規模達8億美元,預計未來幾年將持續成長。這些機動船隻深受追求高階設施(如按摩浴缸、家庭劇院和美食廚房)的高階旅行者的青睞,他們不僅能享受酒店般的便利設施,還能享受獨特而個性化的旅行體驗。船屋正成為遊艇和海濱別墅的可行替代方案,尤其對於那些追求舒適性和便利性的旅客。這種吸引力正推動高階市場顯著成長,尤其是在歐洲和北美等個人化水上旅遊需求日益成長的地區。

就最終用戶而言,市場分為個人和商業兩部分,其中個人部分在2024年將佔據54%的佔有率。船屋日益被視為一種經濟高效且靈活的住房解決方案,尤其是在房地產成本高昂的城市。這些船隻擁有獨特的優勢,例如移動性強和可能免稅,使其成為各種人群的理想選擇,包括退休人員、首次購房者以及追求極簡生活方式的個人。此外,個人船屋配備了太陽能和水循環系統等永續設施,順應了日益成長的環保生活潮流。

2024 年,北美船屋市場佔有 35% 的佔有率。美國擁有龐大的通航水道網路,包括河流和湖泊,這使得船屋在休閒和居住用途中越來越受歡迎。隨著越來越多的消費者,尤其是千禧世代和 Z 世代,追求環保的生活方式,對離網、自給自足的船屋的需求正在上升,尤其是配備太陽能電池板和其他永續技術的船屋。美國市場受益於政府鼓勵採用節能技術的激勵措施和政策,進一步推動了船屋作為永久住宅或遠距工作站的使用。這一趨勢不僅促進了船屋產業的成長,也刺激了基礎設施發展,包括碼頭和泊位設施的建設。

全球船屋產業的主要參與者包括 Gibson Boats、Sumerset Houseboats、Destination Yachts、Barkmet Boats、Trifecta Houseboats、AH Wadia Boat、Catamaran Cruisers、Grandeur Marine International、La Mare Houseboats 和 Fanyetent。為了鞏固市場地位,船屋行業的公司正致力於將尖端的永續技術融入其產品中。這些技術包括太陽能電池板、鋰電池系統和環保材料,以吸引具有環保意識的消費者。此外,製造商還透過提供智慧家居整合、高速網路和豪華內飾等高階功能來增強船屋的吸引力,將其產品定位為高階生活空間。為了滿足日益成長的行動辦公空間和離網生活的需求,公司也在調整其設計以適應遠距辦公趨勢。與碼頭和其他濱水開發項目的合作正在幫助公司擴大業務範圍並建立基礎設施,以支持不斷成長的船屋市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 製造商

- 服務提供者

- 技術提供者

- 最終用途

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 價格傳導至終端市場

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 對貿易的影響

- 利潤率分析

- 成本細分分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 人們對環保浮動房屋的興趣日益濃厚

- 奢華水上生活需求激增

- 內陸水道旅遊活動增加

- 城市住房短缺催生浮動住房替代方案

- 產業陷阱與挑戰

- 高級船屋模型成本高

- 有限的停靠和繫泊基礎設施

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依船屋分類,2021 年至 2034 年

- 主要趨勢

- 運河風格

- 浮橋

- 漂浮之家

- 雙體船式

- 全船體

- 其他

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 機動

- 非機動車

第7章:市場估計與預測:依規模,2021 - 2034 年

- 主要趨勢

- 高達 30 英尺

- 30-50英尺

- 50英尺以上

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 個人的

- 商業的

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 東南亞

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- AH Wadia Boat

- Barkmet Boats

- Bravada Yachts

- Catamaran Cruisers

- Destination Yachts

- Fantasy Yachts

- Fanyetent

- Gibson Boats

- Grandeur Marine International

- Harbor Cottage Houseboats

- Horizon Yachts

- La Mare Houseboats

- Lakeview Yachts

- Navgathi

- Sharpe Houseboats

- Stardust Cruisers

- Sumerset Houseboats

- Sunstar Houseboats

- Thurston Manufacturing

- Trifecta Houseboats

The Global Houseboats Market was valued at USD 907.1 million in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 1.39 billion by 2034, driven by the increasingly congested, and exploring alternative housing solutions, as an appealing option for city dwellers seeking refuge from urban overcrowding. Technological advancements in sustainable living are boosting the appeal of houseboats, which now incorporate green features such as solar panels, lithium battery systems, energy-efficient appliances, and wastewater treatment units. These eco-friendly houseboats are becoming popular among environmentally conscious consumers, offering off-grid capabilities and reduced carbon footprints. The rise of remote work has also created opportunities for houseboats to serve as both residential and mobile office spaces, with high-speed internet and ergonomic workspaces now commonly integrated into houseboat designs.

Additionally, houseboats are attracting attention in the tourism industry, particularly among affluent travelers seeking customized, luxury waterborne accommodations. Motorized houseboats are seeing rising demand, particularly in North America and Europe, as they provide the freedom to explore various waterways without the need for a towing vessel. This trend towards flexible, mobile living is contributing to the growth of the houseboats market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $907.1 Million |

| Forecast Value | $1.39 Billion |

| CAGR | 4.7% |

The motorized houseboat segment dominated the market in 2024, accounting for USD 800 million, and is expected to see continued growth in the coming years. These motorized vessels are popular among luxury travelers seeking high-end features like jacuzzis, home theaters, and gourmet kitchens, offering a unique and customized way to travel while enjoying hotel-like amenities. Houseboats are becoming a viable alternative to yachts and waterfront villas, particularly for those who desire both comfort and mobility. This appeal is driving significant growth in the premium segment of the market, especially in regions like Europe and North America, where the demand for personalized aquatic tourism is increasing.

In terms of end-users, the market is split between personal and commercial segments, with the personal segment holding a 54% share in 2024. Houseboats are increasingly seen as a cost-effective and flexible housing solution, especially in cities with high property costs. These vessels offer the unique advantage of being mobile and potentially tax-free, making them an attractive option for various demographics, including retirees, first-time homebuyers, and individuals seeking a minimalist lifestyle. Furthermore, personal houseboats are equipped with sustainable features such as solar power and water recycling systems, aligning with the growing trend of eco-conscious living.

North America Houseboats Market held a 35% share in 2024. The U.S. boasts a vast network of navigable waterways, including rivers and lakes, which supports the increasing popularity of houseboats for both recreational and residential purposes. The demand for off-grid, self-sufficient houseboats, especially those equipped with solar panels and other sustainable technologies, is rising as more consumers, particularly millennials and Gen Z, seek eco-friendly lifestyles. The U.S. market benefits from government incentives and policies that encourage the adoption of energy-efficient technologies, further driving the use of houseboats as permanent homes or remote workstations. This trend is not only fostering growth in the houseboats sector but also stimulating infrastructure development, including the construction of marinas and docking facilities.

Key players in the Global Houseboats Industry include Gibson Boats, Sumerset Houseboats, Destination Yachts, Barkmet Boats, Trifecta Houseboats, AH Wadia Boat, Catamaran Cruisers, Grandeur Marine International, La Mare Houseboats, and Fanyetent. To strengthen their market position, companies in the houseboats industry are focusing on incorporating cutting-edge, sustainable technologies into their offerings. These include solar panels, lithium battery systems, and eco-friendly materials that appeal to environmentally conscious consumers. Additionally, manufacturers are enhancing the appeal of houseboats by offering high-end features such as smart home integration, high-speed internet, and luxury interiors, positioning their products as premium living spaces. To meet the rising demand for mobile workspaces and off-grid living, companies are also adapting their designs to accommodate remote work trends. Partnerships with marinas and other waterfront developments are helping companies expand their reach and build infrastructure to support the growing houseboats market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Service provider

- 3.2.3 Technology provider

- 3.2.4 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Cost breakdown analysis

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising interest in eco-friendly floating homes

- 3.9.1.2 Surge in luxury waterborne living demand

- 3.9.1.3 Increased tourism activities on inland waterways

- 3.9.1.4 Urban housing shortages fueling floating alternatives

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost of premium houseboat models

- 3.9.2.2 Limited docking and mooring infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Houseboats, 2021 - 2034 ($Mn & Units)

- 5.1 Key trends

- 5.2 Canal-style

- 5.3 Pontoon

- 5.4 Floating-home

- 5.5 Catamaran-style

- 5.6 Full-hull

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn & Units)

- 6.1 Key trends

- 6.2 Motorized

- 6.3 Non-Motorized

Chapter 7 Market Estimates & Forecast, By Size, 2021 - 2034 ($Mn & Units)

- 7.1 Key trends

- 7.2 Upto 30 feet

- 7.3 30-50 feet

- 7.4 Above 50 feet

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn & Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Argentina

- 9.5.3 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AH Wadia Boat

- 10.2 Barkmet Boats

- 10.3 Bravada Yachts

- 10.4 Catamaran Cruisers

- 10.5 Destination Yachts

- 10.6 Fantasy Yachts

- 10.7 Fanyetent

- 10.8 Gibson Boats

- 10.9 Grandeur Marine International

- 10.10 Harbor Cottage Houseboats

- 10.11 Horizon Yachts

- 10.12 La Mare Houseboats

- 10.13 Lakeview Yachts

- 10.14 Navgathi

- 10.15 Sharpe Houseboats

- 10.16 Stardust Cruisers

- 10.17 Sumerset Houseboats

- 10.18 Sunstar Houseboats

- 10.19 Thurston Manufacturing

- 10.20 Trifecta Houseboats