|

市場調查報告書

商品編碼

1667122

甲板船市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Deck Boat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

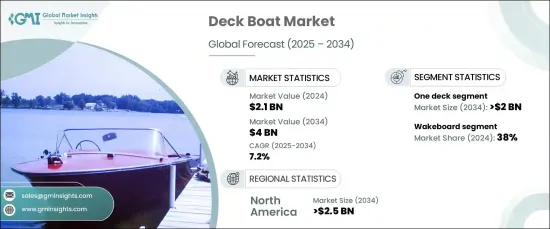

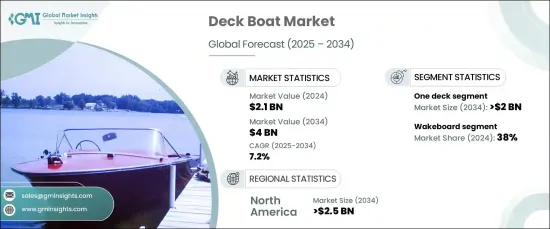

全球甲板船市場將在未來幾年內激增,2024 年的估值將達到 21 億美元,預計 2025 年至 2034 年的複合年成長率為 7.2%。 這一令人印象深刻的成長軌跡反映了全球對水上娛樂活動日益成長的興趣,包括滑水和釣魚等熱門活動,這些活動繼續對多功能和高性能甲板的需求。隨著可支配收入的不斷成長,越來越多的消費者將休閒划船作為生活方式的選擇,並得到電力推進系統和先進導航功能等技術進步的支持。

這些創新不僅提升了划船體驗,而且還鼓勵了迎合有環保意識的買家的環保設計。在歐洲和北美等優先考慮永續性的市場中,電動船舶正在成為首選。隨著消費者擴大尋求兼具效率、永續性和先進技術的產品,這些因素共同推動了甲板船市場實現強勁成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 40億美元 |

| 複合年成長率 | 7.2% |

具有環保意識的買家尤其喜歡配備電力推進系統的節能甲板船,因為這些船隻符合全球減少排放的努力。製造商透過整合永續功能(包括再生能源解決方案和低排放引擎)來滿足這一需求。北美和歐洲等地區對環保設計的重視尤其明顯,這些地區的監管框架和消費者偏好推動創新。這種轉變不僅解決了環境問題,也增強了甲板船作為前瞻性休閒選擇的吸引力,進一步提升了其市場滲透率。

甲板船市場根據甲板數量進行細分,包括一層甲板、兩層甲板和其他甲板。 2024 年,單層甲板船佔據了 53% 的市場佔有率,預計到 2034 年將創造 20 億美元的市場價值。單甲板船非常適合巡航、釣魚和水上運動等活動,特別受到重視易於操作和低維護的家庭和首次購船者的歡迎。材料和引擎技術的進步不斷提高其性能,確保它們仍然是休閒船舶愛好者的首選。

根據應用,市場迎合滑水、釣魚、尾流衝浪和其他娛樂活動。由於滑水運動在年輕一代中越來越受歡迎,滑水運動將在 2024 年佔據 38% 的市場佔有率。先進的拖曳系統、壓載裝置和衝浪門等功能正在改變滑水體驗,使得具有這些功能的甲板船備受追捧。隨著越來越多的愛好者熱衷於休閒水上運動,沿海和湖泊設施的改善將進一步推動這一領域的成長。

2024 年,北美佔據甲板船市場的 61% 佔有率,預計到 2034 年將創造 25 億美元的市場價值。以家庭為中心的設計,特別適合沿海和湖區的活動,仍然是該地區市場表現強勁的關鍵因素。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 原物料供應商

- 船舶製造商 (OEM)

- 經銷商/分銷商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 成本明細分析

- 專利分析

- 重要新聞及舉措

- 監管格局

- 技術差異化

- 導航和安全系統

- 連線功能

- 電力和混合動力推進

- 衝擊力

- 成長動力

- 休閒划船活動需求不斷成長

- 水上活動和花式滑水越來越受歡迎

- 消費者對多功能甲板船的偏好日益增加

- 新興市場的可支配所得不斷增加

- 產業陷阱與挑戰

- 初始成本和擁有費用高

- 豪華車型和專業車型的維護成本

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依甲板數量,2021 - 2034 年

- 主要趨勢

- 一

- 二

- 其他

第 6 章:市場估計與預測:按引擎馬力 (HP),2021 - 2034 年

- 主要趨勢

- <100 馬力

- 100 匹馬力至 200 匹馬力

- 200 匹馬力至 300 匹馬力

- 300 匹馬力至 400 匹馬力

- >400 馬力

第 7 章:市場估計與預測:按規模,2021 - 2034 年

- 主要趨勢

- 小型(20 英尺以下)

- 中型(20 英尺至 24 英尺)

- 大型(24 英尺以上)

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 寬版滑水

- 釣魚

- 尾流衝浪

- 其他

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Bateaux Princecraft

- Bayliner

- Brunswick

- Correct Craft

- Crownline

- Four Winns

- Glastron

- Key West Boats

- Malibu Boats

- Marine Products

- MasterCraft Boat

- Monterey Boats

- NauticStar Boats

- Polaris

- Rinker

- Sea Ray

- Southwind Boats

- Starcraft Marine

- Stingray Boats

- Tahoe

The Global Deck Boat Market is set to surge in the coming years, with a valuation of USD 2.1 billion in 2024 and an anticipated CAGR of 7.2% from 2025 to 2034. This impressive growth trajectory reflects rising global interest in water-based recreation, including popular activities like wakeboarding and fishing, which continue to drive demand for versatile and high-performance deck boats. With growing disposable incomes, more consumers are embracing recreational boating as a lifestyle choice, supported by technological advancements such as electric propulsion systems and sophisticated navigation features.

These innovations are not only elevating the boating experience but are also encouraging eco-friendly designs that cater to environmentally conscious buyers. In markets like Europe and North America, where sustainability is a priority, electric-powered boats are emerging as a preferred option. These factors collectively position the deck boat market for robust growth as consumers increasingly seek products that combine efficiency, sustainability, and advanced technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $4 Billion |

| CAGR | 7.2% |

Eco-conscious buyers are particularly drawn to energy-efficient deck boats equipped with electric propulsion systems, as these vessels align with the global push toward reducing emissions. Manufacturers are responding to this demand by integrating sustainable features, including renewable energy solutions and low-emission engines. The emphasis on eco-friendly designs is particularly pronounced in regions like North America and Europe, where regulatory frameworks and consumer preferences are driving innovation. This shift not only addresses environmental concerns but also enhances the appeal of deck boats as a forward-thinking recreational choice, further boosting their market penetration.

The deck boat market is segmented by the number of decks, including one deck, two decks, and others. In 2024, single-deck boats commanded a 53% market share and are projected to generate USD 2 billion by 2034. These boats remain the go-to choice for their affordability, lightweight construction, and multifunctional design. Ideal for activities such as cruising, fishing, and water sports, single-deck boats are particularly popular among families and first-time buyers who value ease of operation and low maintenance. Advancements in materials and engine technology are continuously enhancing their performance, ensuring they remain a top choice for recreational boaters.

By application, the market caters to wakeboarding, fishing, wake surfing and other recreational activities. Wakeboarding captured 38% of the market share in 2024, driven by its growing popularity among younger generations. Features like advanced tow systems, ballast setups, and surf gates are transforming the wakeboarding experience, making deck boats with these capabilities highly sought after. Enhanced coastal and lake facilities are further fueling this segment's growth as more enthusiasts embrace recreational water sports.

North America dominated the deck boat market with a 61% share in 2024 and is projected to generate USD 2.5 billion by 2034. In the United States, a combination of rising disposable incomes, the popularity of water sports, and cutting-edge technological advancements in boat engines and navigation systems are driving the demand for recreational boats. Family-oriented designs, particularly suited for activities in coastal and lake regions, remain a key factor contributing to the region's strong market performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Boat manufacturers (OEMs)

- 3.2.3 Dealers/distributors

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Cost breakdown analysis

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Technology differentiators

- 3.9.1 Navigation and safety systems

- 3.9.2 Connectivity features

- 3.9.3 Electric and hybrid propulsion

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for recreational boating activities

- 3.10.1.2 Increasing popularity of water sports and wakeboarding

- 3.10.1.3 Growing consumer preference for versatile deck boats

- 3.10.1.4 Increasing disposable income in emerging markets

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost and ownership expenses

- 3.10.2.2 Maintenance costs for luxury and specialized models

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Number of Decks, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 One

- 5.3 Two

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Engine Horsepower (HP), 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 <100 HP

- 6.3 100 HP to 200 HP

- 6.4 200 HP to 300 HP

- 6.5 300 HP to 400 HP

- 6.6 >400 HP

Chapter 7 Market Estimates & Forecast, By Size, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Small (below 20 ft)

- 7.3 Medium (20 ft to 24 ft)

- 7.4 Large (above 24 ft)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Wakeboard

- 8.3 Fishing

- 8.4 Wake surf

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bateaux Princecraft

- 10.2 Bayliner

- 10.3 Brunswick

- 10.4 Correct Craft

- 10.5 Crownline

- 10.6 Four Winns

- 10.7 Glastron

- 10.8 Key West Boats

- 10.9 Malibu Boats

- 10.10 Marine Products

- 10.11 MasterCraft Boat

- 10.12 Monterey Boats

- 10.13 NauticStar Boats

- 10.14 Polaris

- 10.15 Rinker

- 10.16 Sea Ray

- 10.17 Southwind Boats

- 10.18 Starcraft Marine

- 10.19 Stingray Boats

- 10.20 Tahoe