|

市場調查報告書

商品編碼

1755267

人工智慧和機器學習操作化軟體市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測AI and Machine Learning Operationalization Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

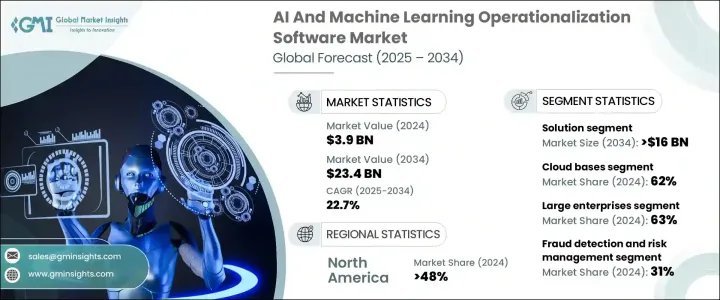

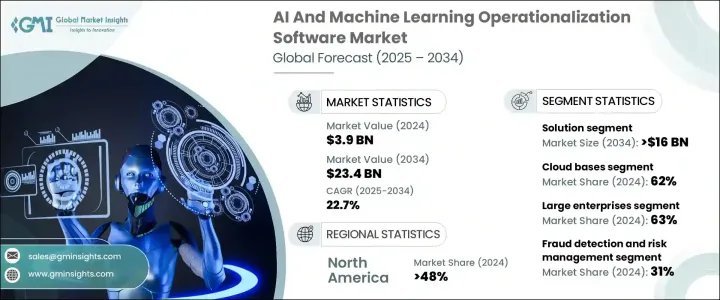

2024年,全球人工智慧和機器學習營運化軟體市場規模達39億美元,預計到2034年將以22.7%的複合年成長率成長,達到234億美元。這得益於數據驅動決策需求的不斷成長,以及企業對可擴展、自動化模型部署的需求日益成長。各組織機構正在迅速採用這些解決方案,以簡化人工智慧工作流程、減少營運摩擦、確保合規性並加速創新,尤其是在製造業、金融業、醫療保健業和電子商務業等行業。

隨著人工智慧和機器學習應用成為核心業務營運不可或缺的一部分,企業尋求強大的平台來即時部署、監控和維護模型。手動模型管理的低效率正推動市場向能夠提供大規模人工智慧全生命週期支援的平台發展,以確保所有營運環節的準確性和速度始終保持一致。企業尋求能夠在不斷變化的營運環境中保持一致性、韌性和靈活性的平台。企業明顯轉向使用能夠簡化機器學習工作流程複雜性的工具,從而使組織能夠有效率地從實驗階段過渡到全面實施。企業現在正在尋求能夠消除技術障礙並簡化資料擷取、特徵工程、模型驗證和部署後監控等流程的平台。這種轉變正在減少對大型資料科學團隊的依賴,並賦能跨職能使用者(從分析師到 IT 團隊)進行人工智慧專案協作。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 234億美元 |

| 複合年成長率 | 22.7% |

2024年,解決方案細分市場創造了23億美元的收入,到2034年將達到160億美元。這一勢頭凸顯了人們對全週期人工智慧軟體的日益依賴,這些軟體能夠簡化從資料準備到即時模型監控的所有流程。企業正在轉向這些解決方案,以加快部署進度並更快地創造價值,尤其是在內部資料科學專業知識有限的環境中。透過提供自動化和可擴展性,這些平台對於財務、營運、行銷和客戶體驗等業務部門至關重要。

2024年,雲端部署領域佔據了62%的佔有率,這得益於其適應性、成本效益以及與現有數位生態系統的無縫整合。雲端基礎設施使企業能夠集中和協調分散式團隊中的AI功能(例如模型版本控制、治理和協作),從而確保一致的效能和更快的迭代周期。它在推動AI訪問民主化方面發揮的作用,使其成為在不同業務環境中擴展營運的首選。

2024年,北美人工智慧和機器學習營運化軟體市場佔據了48%的市場佔有率,這得益於成熟的人工智慧實施、強勁的雲端運算應用以及對人工智慧研發的持續投入。在美國,對監管合規性、營運透明度和競爭敏捷性的高度關注,促使企業在企業規模的人工智慧營運方面投入大量資金。

DataRobot、Google雲端、IBM、H2O.ai、微軟、SAS Institute、亞馬遜網路服務 (AWS)、Dataiku、Databricks、C3.ai。領先的公司在平台整合、使用者介面改進和雲端原生功能方面投入大量資金。許多公司專注於建立統一的環境,提供涵蓋模型訓練、部署、治理和監控的全生命週期 AI 支援。此外,公司正在與雲端服務供應商和企業軟體供應商建立策略聯盟,以擴大覆蓋範圍並增強功能。對自動化 MLOps 功能、無程式碼/低程式碼環境和預先建置 AI 工作流程的投資,使非技術團隊能夠更廣泛地採用該技術。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 製造商

- 零件供應商

- 技術提供者

- 服務提供者

- 最終用途

- 利潤率分析

- 技術與創新格局

- 重要新聞和舉措

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 各行各業對人工智慧/機器學習的採用日益增多

- 需要可擴展且自動化的機器學習工作流程

- 雲端原生人工智慧解決方案的興起

- 透過人工智慧投資創造商業價值的壓力

- 產業陷阱與挑戰

- 缺乏模型透明度和可解釋性

- 與現有基礎設施的整合複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 軟體

- 模型開發和訓練軟體

- 模型部署軟體

- 模型監控管理軟體

- 資料管理軟體

- 服務

- 專業服務

- 託管服務

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第7章:市場估計與預測:依組織規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 預測分析

- 詐欺偵測和風險管理

- 客戶體驗管理

- 自然語言處理 (NLP) 和文本分析

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 銀行、金融服務和保險(BFSI)

- 醫療保健和生命科學

- 零售與電子商務

- IT和電信

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Alteryx

- Amazon Web Services (AWS)

- Aporia

- C3.ai

- Cloudera

- Databricks

- Dataiku

- DataRobot

- Domino Data Lab

- Google Cloud

- H2O.ai

- IBM Watson

- Infosys Nia

- Microsoft Azure

- Oracle

- Palantir Technologies

- Qlik

- RapidMiner

- SAS Institute

- Seldon

The Global AI and Machine Learning Operationalization Software Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 22.7% to reach USD 23.4 billion by 2034, propelled by increasing demand for data-driven decision-making and the growing need for scalable, automated model deployment across enterprises. Organizations are rapidly adopting these solutions to streamline AI workflows, reduce operational friction, ensure regulatory compliance, and accelerate innovation-especially within sectors like manufacturing, finance, healthcare, and e-commerce.

As artificial intelligence and machine learning applications become integral to core business operations, companies seek robust platforms to deploy, monitor, and maintain models in real-time. The inefficiency of manual model management is driving the market toward platforms that offer full lifecycle support for AI at scale, ensuring consistent accuracy and speed across operations. Enterprises seek platforms that maintain consistency, resilience, and flexibility across evolving operational landscapes. There's a clear shift toward tools that simplify the complexities of machine learning workflows, allowing organizations to move from experimentation to full-scale implementation efficiently. Businesses are now seeking platforms that abstract technical hurdles and streamline processes such as data ingestion, feature engineering, model validation, and post-deployment monitoring. This transition is reducing reliance on large data science teams and empowering cross-functional users-from analysts to IT teams-to collaborate on AI initiatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 22.7% |

In 2024, the solutions segment generated USD 2.3 billion and will reach USD 16 billion by 2034. This momentum underscores the increasing reliance on full-cycle AI software that streamlines everything from data preparation to real-time model monitoring. Enterprises are turning to these solutions to accelerate deployment timelines and drive value faster, particularly in environments where in-house data science expertise is limited. By offering automation and scalability, these platforms are becoming essential for business units across finance, operations, marketing, and customer experience.

Cloud-based deployment segment held a 62% share in 2024, driven by its adaptability, cost-effectiveness, and seamless integration with existing digital ecosystems. Cloud infrastructure allows enterprises to centralize and coordinate AI functions-like model versioning, governance, and collaboration-within distributed teams, ensuring consistent performance and faster iteration cycles. Its role in democratizing AI access has made it the preferred choice for scaling operations across diverse business environments.

North America AI and Machine Learning Operationalization Software Market held a 48% share in 2024, bolstered by mature AI implementation, robust cloud adoption, and continuous investment in AI R&D. In the U.S., heightened focus on regulatory compliance, operational transparency, and competitive agility is prompting companies to invest heavily in operationalizing AI at enterprise scale.

DataRobot, Google Cloud, IBM, H2O.ai, Microsoft, SAS Institute, Amazon Web Services (AWS), Dataiku, Databricks, C3.ai. Leading firms invest heavily in platform integration, user interface improvements, and cloud-native functionality. Many focus on building unified environments that offer full-lifecycle AI support-spanning model training, deployment, governance, and monitoring. Additionally, companies are forming strategic alliances with cloud providers and enterprise software vendors to expand reach and enhance functionality. Investments in automated MLOps capabilities, no-code/low-code environments, and prebuilt AI workflows enable wider adoption across non-technical teams.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.3.1 Manufacturers

- 3.3.2 Component suppliers

- 3.3.3 Technology providers

- 3.3.4 Service providers

- 3.3.5 End use

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing adoption of ai/ml across industries

- 3.9.1.2 Need for scalable and automated ml workflows

- 3.9.1.3 Rise of cloud-native ai solutions

- 3.9.1.4 Pressure to generate business value from ai investments

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Lack of model transparency and explainability

- 3.9.2.2 Integration complexity with existing infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Model development and training software

- 5.2.2 Model deployment software

- 5.2.3 Model monitoring and management software

- 5.2.4 Data management software

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud based

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Small and medium enterprises (SMEs)

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Predictive analytics

- 8.3 Fraud detection and risk management

- 8.4 Customer experience management

- 8.5 Natural language processing (NLP) and text analytics

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Banking, financial services, and insurance (BFSI)

- 9.3 Healthcare and life sciences

- 9.4 Retail and e-commerce

- 9.5 IT and telecommunications

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Alteryx

- 11.2 Amazon Web Services (AWS)

- 11.3 Aporia

- 11.4 C3.ai

- 11.5 Cloudera

- 11.6 Databricks

- 11.7 Dataiku

- 11.8 DataRobot

- 11.9 Domino Data Lab

- 11.10 Google Cloud

- 11.11 H2O.ai

- 11.12 IBM Watson

- 11.13 Infosys Nia

- 11.14 Microsoft Azure

- 11.15 Oracle

- 11.16 Palantir Technologies

- 11.17 Qlik

- 11.18 RapidMiner

- 11.19 SAS Institute

- 11.20 Seldon