|

市場調查報告書

商品編碼

1755223

車輛控制單元市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vehicle Control Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

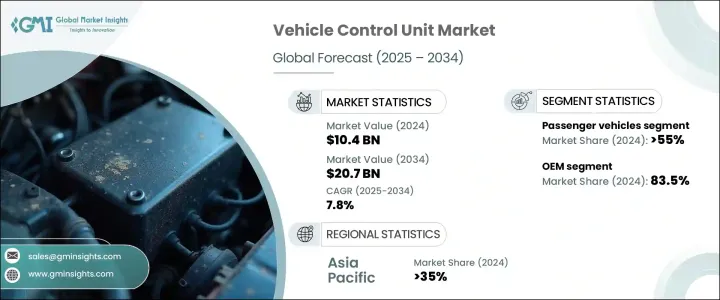

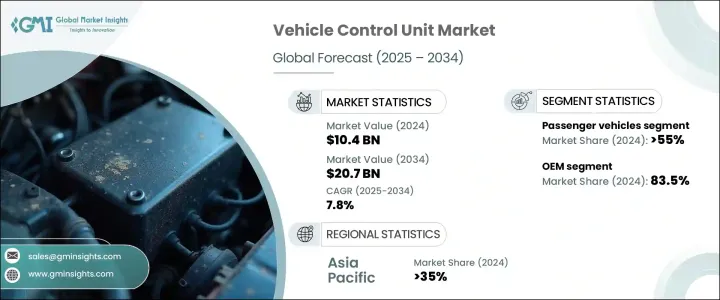

2024年,全球車輛控制單元市場規模達104億美元,預計到2034年將以7.8%的複合年成長率成長,達到207億美元。市場成長的動力源自於電動車(EV)的日益普及,這需要車輛控制單元(VCU)來高效管理電池系統、電動馬達、再生煞車和充電操作等複雜功能。與傳統內燃機汽車不同,電動車依賴多個需要即時協調的連網系統。車輛控制單元(VCU)是此過程的核心,可改善能源管理、安全性和車輛智慧化。隨著永續發展法規的收緊和激勵措施的增加,汽車製造商正在加速電動車的生產,這反過來又增加了全球對更先進、更具可擴展性的車輛控制單元(VCU)解決方案的需求。

由於向軟體定義車輛架構的轉變,市場也不斷擴張。汽車製造商正在整合車輛控制單元 (VCU),以實現無線 (OTA) 更新、即時診斷和集中式車輛監控。這些系統支援模組化功能升級和自適應效能管理。此外,商用車和乘用車對 ADAS 和自動駕駛技術的需求不斷成長,進一步推動了對高性能車輛控制單元 (VCU) 的需求。透過處理來自各種感測器的輸入,車輛控制單元 (VCU) 可支援車道輔助、緊急煞車和自適應巡航控制等智慧駕駛功能,這使得它們在現代車輛設計中至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 104億美元 |

| 預測值 | 207億美元 |

| 複合年成長率 | 7.8% |

2024年,乘用車市場規模達50億美元,佔55%的市場佔有率,尤其是美國、中國和歐洲等主要市場。隨著新車型搭載日益複雜的數位功能下線,對整合式車輛控制單元(VCU)的需求持續激增。乘用車正引領向電動和混合動力傳動系統的轉型,這需要跨多個數位子系統的全面協調。 VCU使這種整合無縫銜接,確保車輛實現最佳性能,同時支援資訊娛樂、安全和駕駛輔助系統。

2024年, OEM領域佔據市場主導地位,佔83.5%的佔有率。車輛控制單元在製造過程中嵌入車輛系統,這使得OEM成為主要的整合商。這些單元必須進行客製化,以適應不同車輛平台和品牌的架構。 OEM與一級供應商之間的合作確保了VCU的開發兼顧法規合規性和整合效率。隨著對集中式運算和軟體優先車輛設計的日益青睞,OEM正在部署VCU以支援諸如OTA功能、雲端服務和即時系統升級等高級功能,從而進一步擴大其市場覆蓋範圍。

2024年,亞太地區車輛控制單元市場佔35%的佔有率。作為全球領先的汽車製造中心之一,中國受益於強大的國內生產能力、低成本製造以及積極的政府支持。電動車和智慧汽車的激勵計劃,以及自主研發的車輛控制單元 (VCU) 技術的進步,使中國在車輛控制單元 (VCU) 的應用方面處於領先地位。中國對智慧出行和節能汽車的大力推動,正在加速車輛控制單元在新車型平台上的推廣。

全球車輛控制單元市場的主要參與者包括 ASI Robots、大陸集團、羅伯特·博世、英飛凌、電裝、採埃孚股份公司、意法半導體、恩智浦半導體、多萊科和德爾福科技。這些公司正在利用一系列策略來確保市場競爭地位。核心策略包括開發支援車輛電氣化和 ADAS 的模組化 VCU 平台,以及與汽車製造商合作進行客製化整合。主要參與者正在投資人工智慧驅動的 VCU 解決方案、雲端連接和 OTA 更新框架。此外,許多公司正在擴大其在亞洲和歐洲的製造能力,以滿足不斷成長的全球需求,同時遵守不斷發展的汽車安全和軟體法規。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 衝擊力

- 成長動力

- 電動車的成長

- 先進駕駛輔助系統和自動化的興起

- 連接和資訊娛樂需求

- 嚴格的排放和安全法規

- 產業陷阱與挑戰

- 開發和實施成本高

- 網路安全風險日益增加

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電動車(EV)

- 燃料電池電動車(FCEV)

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 越野車

- 掀背車

- 商用車

- 輕型商用車

- 平均血紅素 (MCV)

- 丙型肝炎病毒

- 非公路車輛

第7章:市場估計與預測:依功能分類,2021 - 2034 年

- 主要趨勢

- 動力傳動系統控制

- 電池管理系統 (BMS) 整合

- 高級駕駛輔助系統 (ADAS)

- 資訊娛樂和連接

- 自動駕駛系統

- 其他

第8章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 16位

- 32位

- 64位

第9章:市場估計與預測:按組成部分,2021 - 2034 年

- 主要趨勢

- 硬體

- 微控制器/微處理器

- 記憶單元

- 輸入/輸出介面

- 電源管理元件

- 其他

- 軟體

- 作業系統

- 控制演算法

- 診斷系統

- 使用者介面

- 其他

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- OEM

- 售後市場

第 11 章:市場估計與預測:按通訊類型,2021 年至 2034 年

- 主要趨勢

- CAN(控制器區域網路)

- LIN(本地互連網路)

- FlexRay(靈活資料速率網路)

- 乙太網路

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第13章:公司簡介

- ASI Robots

- Continental

- Delphi Technologies

- Denso

- Dorleco

- Embitel

- Hitachi Astemo

- Huawei Technologies

- Infineon

- Nidec Corporation

- NXP Semiconductors

- Pues Corporation

- Renesas Electronics Corporation

- Robert Bosch

- Samino Inc

- STMicroelectronics

- Texas Instruments

- Valeo

- Vitesco Technologies

- ZF Friedrichshafen

The Global Vehicle Control Unit Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 20.7 billion by 2034. The market growth is driven by the rising adoption of electric vehicles (EVs), which require VCUs to efficiently manage complex functions such as battery systems, electric motors, regenerative braking, and charging operations. Unlike traditional internal combustion vehicles, EVs rely on multiple interconnected systems that need real-time coordination. VCUs are central to this process, improving energy management, safety, and vehicle intelligence. As sustainability regulations tighten and incentives increase, automakers are accelerating EV production, which in turn is increasing the need for more advanced and scalable VCU solutions globally.

The market is also expanding due to the shift towards software-defined vehicle architectures. Automakers are integrating VCUs to enable over-the-air (OTA) updates, real-time diagnostics, and centralized vehicle monitoring. These systems allow for modular feature upgrades and adaptive performance management. Additionally, rising demand for ADAS and autonomous technologies in both commercial and passenger vehicles is further boosting the need for high-performance VCUs. By processing input from a wide range of sensors, VCUs facilitate intelligent driving functions such as lane assistance, emergency braking, and adaptive cruise control-making them vital in modern vehicle designs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $20.7 Billion |

| CAGR | 7.8% |

In 2024, the passenger vehicle segment generated USD 5 billion, claiming 55% share especially in leading markets such as the United States, China, and Europe. As newer vehicles roll off assembly lines with increasingly sophisticated digital features, the demand for integrated VCUs continues to surge. Passenger cars are leading the transition to electric and hybrid drivetrains, which require comprehensive coordination across multiple digital subsystems. VCUs make this integration seamless, ensuring optimal vehicle performance while supporting infotainment, safety, and driver-assist systems.

The OEM segment led the market in 2024, capturing 83.5% share. Vehicle control units are embedded into vehicle systems during the manufacturing process, making OEMs the primary integrators. These units must be customized to suit the architecture of different vehicle platforms and brands. Collaborations between OEMs and Tier 1 suppliers ensure that VCUs are developed with regulatory compliance and integration efficiency in mind. With a growing preference for centralized computing and software-first vehicle design, OEMs are deploying VCUs to support advanced functionalities like OTA capabilities, cloud-based services, and real-time system upgrades, which further expands their market footprint.

Asia Pacific Vehicle Control Unit Market held 35% share in 2024. As one of the top automotive manufacturing hubs globally, China benefits from strong domestic production capabilities, low-cost manufacturing, and proactive government support. Incentive programs for electric and intelligent vehicles, as well as advancements in homegrown VCU technologies, have positioned China at the forefront of VCU adoption. The country's push for smart mobility and energy-efficient vehicles is accelerating the rollout of VCUs across new vehicle platforms.

Key players in the Global Vehicle Control Unit Market include ASI Robots, Continental AG, Robert Bosch, Infineon, Denso, ZF Friedrichshafen AG, STMicroelectronics, NXP Semiconductors, Dorleco, and Delphi Technologies. These companies are leveraging a range of strategies to secure competitive positioning in the market. Core approaches include the development of modular VCU platforms that support vehicle electrification and ADAS, as well as partnerships with automakers for customized integration. Major players are investing in AI-driven VCU solutions, cloud connectivity, and OTA update frameworks. Additionally, many are expanding their manufacturing capabilities in Asia and Europe to meet rising global demand while complying with evolving automotive safety and software regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Propulsion

- 2.2.3 Vehicle

- 2.2.4 Functionality

- 2.2.5 Capacity

- 2.2.6 Component

- 2.2.7 Distribution Channel

- 2.2.8 Communication Type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of electric vehicles

- 3.2.1.2 Rise of advanced driver assistance systems and automation

- 3.2.1.3 Connectivity and infotainment demand

- 3.2.1.4 Stringent emission and safety regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High development and implementation costs

- 3.2.2.2 Growing cybersecurity risks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 ICE

- 5.3 Electric Vehicles (EVs)

- 5.4 Fuel Cell Electric Vehicles (FCEVs)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger Vehicles

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial Vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

- 6.4 Off-highway Vehicles

Chapter 7 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Powertrain control

- 7.3 Battery management system (BMS) integration

- 7.4 Advanced driver assistance systems (ADAS)

- 7.5 Infotainment and connectivity

- 7.6 Autonomous driving systems

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 16-bit

- 8.3 32-bit

- 8.4 64-bit

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Hardware

- 9.2.1 Microcontrollers/microprocessors

- 9.2.2 Memory units

- 9.2.3 Input/output interfaces

- 9.2.4 Power management components

- 9.2.5 Others

- 9.3 Software

- 9.3.1 Operating systems

- 9.3.2 Control algorithms

- 9.3.3 Diagnostic systems

- 9.3.4 User interfaces

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Communication Type, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 CAN (Controller Area Network)

- 11.3 LIN (Local Interconnect Network)

- 11.4 FlexRay (Flexible Data-Rate Network)

- 11.5 Ethernet

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Southeast Asia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 ASI Robots

- 13.2 Continental

- 13.3 Delphi Technologies

- 13.4 Denso

- 13.5 Dorleco

- 13.6 Embitel

- 13.7 Hitachi Astemo

- 13.8 Huawei Technologies

- 13.9 Infineon

- 13.10 Nidec Corporation

- 13.11 NXP Semiconductors

- 13.12 Pues Corporation

- 13.13 Renesas Electronics Corporation

- 13.14 Robert Bosch

- 13.15 Samino Inc

- 13.16 STMicroelectronics

- 13.17 Texas Instruments

- 13.18 Valeo

- 13.19 Vitesco Technologies

- 13.20 ZF Friedrichshafen