|

市場調查報告書

商品編碼

1755221

電容式觸覺感測器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Capacitive Tactile Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

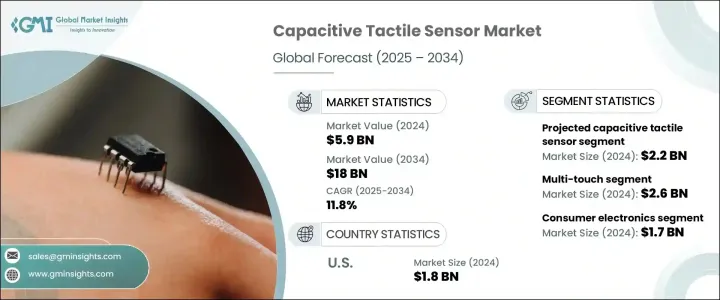

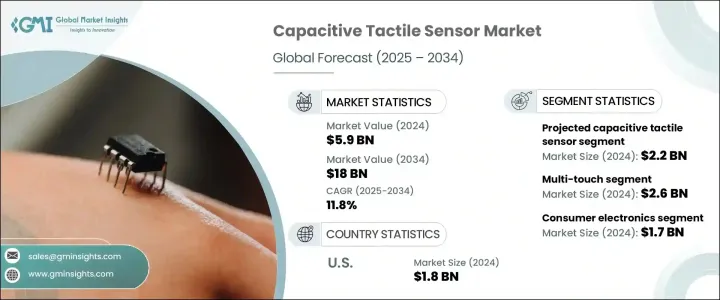

2024年,全球電容式觸覺感測器市場規模達59億美元,預計2034年將以11.8%的複合年成長率成長,達到180億美元。這得益於機器人和自動化領域需求的不斷成長,以及這類感測器在消費性電子產品和智慧型手機領域的廣泛應用。電容式觸覺感測器有助於實現靈敏、可靠且互動的觸控介面,因此在各行各業都備受追捧。隨著機器人技術日益融入醫療保健、物流和製造等領域,幫助機器人感知壓力、紋理和抓握力的觸覺感測器的需求也顯著成長。人機互動的日益成長趨勢以及對更智慧、更直覺設備的渴望,進一步推動了市場擴張。

在川普政府執政期間,對中國進口產品徵收關稅擾亂了電容式觸覺感測器市場。這些感測器使用的許多材料都來自中國,而新增的關稅導致生產成本上升,國際供應鏈的不確定性加劇。企業被迫重新考慮其採購策略,一些企業選擇多元化生產和供應商,以降低成本和風險。儘管面臨這些挑戰,但機器人技術的持續應用以及對先進觸控技術日益成長的需求,推動了從工業到消費性電子等一系列應用領域對電容式觸覺感測器的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 59億美元 |

| 預測值 | 180億美元 |

| 複合年成長率 | 11.8% |

投射電容式觸覺感測器市場在2024年創收22億美元。這類感測器以其高靈敏度、耐用性和處理多點觸控功能的能力而聞名,使其成為消費性電子、汽車應用、工業系統和醫療設備的理想選擇。它們尤其因其在惡劣環境下的可靠性、防潮、防塵和抗干擾能力而備受青睞,使其成為各行各業關鍵應用的理想選擇。隨著使用者介面日益互動和直覺,投射電容式感測器正成為觸控螢幕和控制面板等應用的首選技術。

市場進一步根據觸控功能進行細分,其中多點觸控細分市場在2024年將達到26億美元。多點觸控感測器能夠辨識多個同時輸入,進而提升使用者體驗和功能。隨著對互動式和直覺式介面的需求持續成長,尤其是在智慧型手機、平板電腦、汽車資訊娛樂系統和工業控制面板領域,多點觸控細分市場有望顯著成長。電容式感應和手勢辨識技術的創新,推動了多點觸控解決方案在消費性電子和工業應用的普及。

受德國強勁的汽車和工業自動化產業推動,2024年德國電容式觸覺感測器市場規模達3.357億美元。德國在精密工程和高品質產品方面的聲譽促進了對先進人機介面 (HMI) 技術的需求。工業4.0的推動以及對智慧醫療設備和穿戴式裝置日益成長的需求,也推動了對電容式觸覺感測器的需求,這些感測器將被應用於下一代應用。

全球電容式觸覺感測器市場的主要參與者包括 Nissha Co., Ltd.、Integrated Silicon Solution Inc.、Interlink Electronics, Inc.、Sensel, Inc.、STMicroelectronics 和 Synaptics Incorporated。為了鞏固其在電容式觸覺感測器市場的地位,各公司專注於產品創新,旨在提高感測器的性能、靈敏度和耐用性。在研發方面的大量投入正幫助各公司推出新的感測器技術,以滿足消費性電子、汽車和工業應用中日益成長的觸控和手勢識別需求。各公司也致力於將感測器整合到更緊湊、更節能的解決方案中,以順應小型化和永續性的市場趨勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 機器人與自動化的興起

- 穿戴式電子產品和智慧紡織品的需求不斷成長

- 義肢和復健設備的成長

- 醫療機器人和微創手術的激增

- 智慧型手機和消費性設備的整合度不斷提高

- 產業陷阱與挑戰

- 易受環境干擾

- 有限的多軸力檢測

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 投射電容式觸覺感測器

- 表面電容式觸覺感測器

- 自電容觸覺感測器

- 其他

第6章:市場估計與預測:按觸控功能,2021 - 2034 年

- 主要趨勢

- 單點觸控

- 多點觸控

- 手勢辨識功能已啟用

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 消費性電子產品

- 汽車

- 醫療保健

- 工業和製造業

- 航太與國防

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Azoteq

- Bosch Sensortec

- Integrated Silicon Solution Inc.

- Interlink Electronics, Inc.

- Nissha Co., Ltd.

- PPS UK Limited

- Semtech Corp.

- Sensel, Inc.

- STMicroelectronics

- Synaptics Incorporated

- Tangio Printed Electronics

- TouchNetix

The Global Capacitive Tactile Sensor Market was valued at USD 5.9 billion in 2024 and is estimated to grow at a CAGR of 11.8% to reach USD 18 billion by 2034, attributed to the increasing demand for robotics and automation, as well as the expanding use of these sensors in consumer electronics and smartphones. Capacitive tactile sensors help enable sensitive, reliable, and interactive touch interfaces, making them highly sought after in various industries. As robotics becomes more integrated into sectors like healthcare, logistics, and manufacturing, the need for tactile sensors that help robots sense pressure, texture, and grip force has significantly risen. The growing trend of human-robot interaction and the desire for smarter, more intuitive devices further drive market expansion.

During the Trump administration, tariffs on Chinese imports disrupted the capacitive tactile sensor market. Many of the materials used in these sensors were sourced from China, and the added tariffs led to higher production costs and increased uncertainty in international supply chains. Companies were forced to reconsider their sourcing strategies, with some diversifying production and suppliers to reduce costs and mitigate risks. Despite these challenges, the continued adoption of robotics and the increasing demand for advanced touch technologies have fueled the demand for capacitive tactile sensors across a range of applications, from industrial to consumer electronics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $18 Billion |

| CAGR | 11.8% |

The projected capacitive tactile sensor segment generated USD 2.2 billion in 2024. These sensors are known for their high sensitivity, durability, and ability to handle multi-touch functionality, making them ideal for use in consumer electronics, automotive applications, industrial systems, and medical devices. They are especially favored for their reliability in harsh environments, resisting moisture, dust, and interference, making them an attractive option for critical applications in various industries. As user interfaces become increasingly interactive and intuitive, projected capacitive sensors are becoming the technology of choice for applications such as touchscreens and control panels.

The market is further divided based on touch capability, with the multi-touch segment generating USD 2.6 billion in 2024. Multi-touch sensors enable the recognition of multiple simultaneous inputs, enhancing user experience and functionality. As demand for interactive and intuitive interfaces continues to rise, particularly in smartphones, tablets, automotive infotainment systems, and industrial control panels, the multi-touch segment is poised for significant growth. Innovations in capacitive sensing and gesture recognition technologies raise the adoption of multi-touch solutions across consumer and industrial applications.

Germany Capacitive Tactile Sensor Market accounted for USD 335.7 million in 2024, driven by the country's strong automotive and industrial automation sectors. Germany's reputation for precision engineering and high-quality products fosters the demand for advanced human-machine interface (HMI) technologies. The push for Industry 4.0 and the increasing need for smart medical devices and wearables boost the demand for capacitive tactile sensors, incorporated into next-generation applications.

Key players in the Global Capacitive Tactile Sensor Market include Nissha Co., Ltd., Integrated Silicon Solution Inc., Interlink Electronics, Inc., Sensel, Inc., STMicroelectronics, and Synaptics Incorporated. To strengthen their presence in the capacitive tactile sensor market, companies focus on product innovation, aiming to improve sensor performance, sensitivity, and durability. Significant investments in research and development (R&D) are helping firms introduce new sensor technologies that cater to the growing demand for touch and gesture recognition in consumer electronics, automotive, and industrial applications. Companies are also working on integrating sensors into more compact, energy-efficient solutions, in line with market trends toward miniaturization and sustainability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key material

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rise of robotics & automation

- 3.3.1.2 Increasing demand for wearable electronics and smart textiles

- 3.3.1.3 Growth in prosthetics and rehabilitation devices

- 3.3.1.4 Surge in medical robotics and minimally invasive surgery

- 3.3.1.5 Growing integration in smartphones and consumer devices

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Susceptibility to environmental interference

- 3.3.2.2 Limited multi-axis force detection

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Projected capacitive tactile sensor

- 5.3 Surface capacitive tactile sensor

- 5.4 Self-capacitive tactile sensors

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Touch Capability, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Single-touch

- 6.3 Multi-touch

- 6.4 Gesture recognition enabled

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.3 Automotive

- 7.4 Healthcare & medical

- 7.5 Industrial & manufacturing

- 7.6 Aerospace & defense

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Azoteq

- 9.2 Bosch Sensortec

- 9.3 Integrated Silicon Solution Inc.

- 9.4 Interlink Electronics, Inc.

- 9.5 Nissha Co., Ltd.

- 9.6 PPS UK Limited

- 9.7 Semtech Corp.

- 9.8 Sensel, Inc.

- 9.9 STMicroelectronics

- 9.10 Synaptics Incorporated

- 9.11 Tangio Printed Electronics

- 9.12 TouchNetix