|

市場調查報告書

商品編碼

1755219

單模光纖市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Single-Mode Optical Fiber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

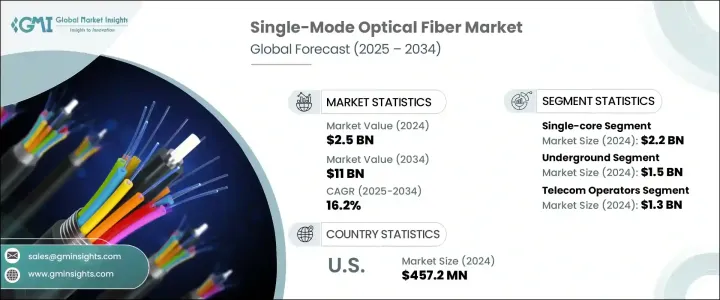

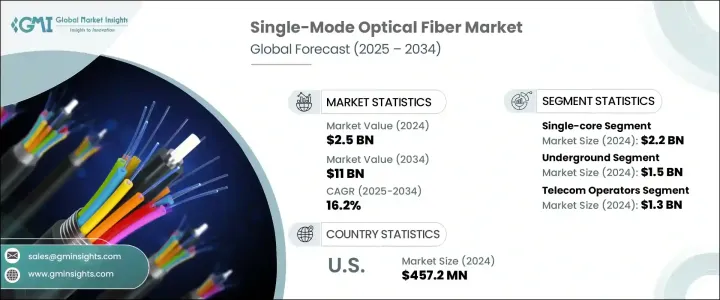

2024年,全球單模光纖市場規模達25億美元,預計2034年將以16.2%的複合年成長率成長,達到110億美元。 5G網路的全球部署以及雲端運算和物聯網擴張帶來的資料流量激增,推動了這一急劇成長。隨著網路基礎設施對更快速度和更廣覆蓋範圍的需求,電信業者紛紛轉向單模光纖,因其能夠在遠距離傳輸資料的同時最大程度地降低訊號損耗。向下一代數位連接的轉變正在推動各行各業的採用,其中,智慧城市、自治系統和超大規模資料中心等頻寬密集型應用依賴可靠的高容量光纖網路。

過去,為了提升國內製造商的競爭力,推出了一系列貿易限制措施,例如對某些進口產品徵收關稅,但效果好壞參半。這些措施雖然支持了本土生產,但也擾亂了國際供應鏈,推高了光纖的進口成本。這導致光纖網路部署的延遲和不確定性。儘管如此,5G網路的快速部署仍然是全球單模光纖需求的主要驅動力,它能夠實現基地台和資料中心之間更高速度和更低延遲的連接。該技術適用於長距離、大容量資料傳輸,使其成為擴展全球行動和固定寬頻基礎設施的關鍵。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 25億美元 |

| 預測值 | 110億美元 |

| 複合年成長率 | 16.2% |

單芯光纖市場在2024年創造了22億美元的市場規模,成為主導類別。這一成長主要得益於其與全球現有電信基礎設施的廣泛兼容性。單芯單模光纖(SMF)憑藉其低色散和低衰減的特性,被廣泛整合到長途和城域網路中。隨著電信營運商不斷推進升級,這些光纖無需更換原有系統即可實現高效能擴展。 FTTH的快速部署和5G連接的不斷發展,進一步強化了單芯設計在跨區域向最終用戶快速可靠地提供服務方面的作用。

2024年,地下部署市場規模達15億美元。在人口密集的城市環境中,對隱蔽且受保護的基礎設施的需求持續推動地下安裝的趨勢。城市發展和智慧城市計畫正在鼓勵電信業者採用地下電纜系統,以保持美觀並防止外部損壞。這些部署也符合各國的國家寬頻策略,要求建造具有高彈性、高容量且能抵禦環境因素影響的基礎設施。地下網路對於城域和城際資料傳輸日益重要,它為資料中心、企業園區和存取環網提供了可靠的效能。

美國單模光纖市場在2024年創收4.572億美元,預計2034年將持續成長。全國範圍內的5G部署需要更大的光纖回程容量,以支援低延遲和高速資料傳輸。聯邦政府的資助計畫為寬頻擴張創造了強勁勢頭,推動了對先進長距離光纖網路的需求。超大規模資料中心基礎設施的成長持續增加對連接各種設施的高頻寬光纖連接的需求,從而進一步推動單模光纖在國內部署中的採用。

全球單模光纖市場的主要參與者包括康寧、康普、普睿司曼、LS Cable and System、長飛光纖光纜、住友電工、Humanetics、HTGD、Nike森、藤倉、Birla Furukawa 和古河馬達。為了鞏固更強大的市場地位,單模光纖公司將創新、成本效益和地理擴張放在首位。許多公司正在大力投資研發具有更低衰減和更高傳輸容量的光纖,使其成為 5G、FTTH 和超大規模資料網路等不斷發展的應用的理想選擇。與電信營運商和基礎設施供應商的策略合作夥伴關係正在加快產品在各地區的採用速度。製造商也在最佳化生產流程並擴大新興市場的設施覆蓋範圍,以縮短交貨時間和降低物流成本。此外,材料採購多元化和增強供應鏈彈性已成為關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 來自雲端服務和物聯網的資料流量不斷增加

- 5G網路全球部署

- FTTH(光纖到府)需求不斷成長

- 智慧城市和基礎設施項目

- 向工業自動化和工業4.0轉變

- 產業陷阱與挑戰

- 城市環境中的複雜安裝

- 激烈的市場競爭與價格壓力

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依核心,2021 年至 2034 年

- 主要趨勢

- 單核

- 雙核心

- 多核心

第6章:市場估計與預測:依部署,2021 年至 2034 年

- 主要趨勢

- 地下

- 水下

- 電線桿

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 政府/國防

- 電信營運商

- 雲端提供者

- 石油和天然氣

- 工業自動化

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- AFL

- Birla Furukawa

- CommScope

- Corning Incorporated

- Exail

- Fujikura

- Furukawa

- HTGD

- Humanetics

- LS Cable & System

- Nexans

- Optical Cable Corporation

- Prysmian Group

- Sr. Indus Electro Systems Pvt. Ltd

- STL Tech

- Sumitomo Electric Industries, Ltd.

- Yangtze Optical Fiber & Cable

- ZTT

The Global Single-Mode Optical Fiber Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 16.2% to reach USD 11 billion by 2034. This sharp increase is being fueled by the global implementation of 5G networks and the explosion of data traffic driven by cloud computing and IoT expansion. As network infrastructure demands faster speeds and broader coverage, telecom providers are turning to single-mode fibers for their ability to transmit data over extended distances with minimal signal loss. The shift toward next-gen digital connectivity is propelling adoption across industries, where bandwidth-intensive applications like smart cities, autonomous systems, and hyperscale data centers rely on reliable high-capacity fiber networks.

Past trade restrictions, such as tariffs on certain imports, were introduced to improve competitiveness for domestic manufacturers but had mixed results. While they supported local production, they also disrupted international supply chains and pushed up the cost of importing optical fibers. This led to delays and uncertainty in fiber network deployments. Despite this, the rapid rollout of 5G networks remains the key driver of global demand for single-mode optical fiber, enabling higher speed and lower latency connectivity between base stations and data centers. The technology's suitability for long-distance, high-volume data transmission makes it essential for expanding mobile and fixed broadband infrastructure worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $11 Billion |

| CAGR | 16.2% |

The single-core segment generated USD 2.2 billion in 2024, making it the dominant category. This growth is primarily supported by its broad compatibility with existing global telecom infrastructure. Single-core SMFs are widely integrated into long-distance and metro networks because of their low dispersion and attenuation characteristics. As telecom providers push forward with upgrades, these fibers enable high-performance expansion without the need for replacing legacy systems. The fast pace of FTTH deployment and growing 5G connectivity further reinforce the role of single-core designs in enabling rapid and reliable service delivery to end users across regions.

The underground deployment segment generated USD 1.5 billion in 2024. The need for concealed and protected infrastructure in dense urban landscapes continues to drive the trend toward underground installation. Urban development and smart city initiatives are encouraging telecom operators to adopt underground cable systems to maintain aesthetics and safeguard against external damage. These deployments also align with national broadband strategies in various countries, calling for resilient and high-capacity infrastructure capable of withstanding environmental factors. Underground networks are increasingly essential for metro and intercity data transport, offering reliable performance for data centers, enterprise parks, and access rings.

U.S. Single-Mode Optical Fiber Market generated USD 457.2 million in 2024 and is projected to grow through 2034. National 5G deployments are demanding greater fiber backhaul capacity to support low latency and high-speed data transfers. Federal funding initiatives have created strong momentum in broadband expansion, driving demand for advanced long-distance optical fiber networks. Growth in hyperscale data center infrastructure continues to increase demand for high-bandwidth fiber connections linking various facilities, further boosting single-mode fiber adoption in domestic deployments.

Key industry players in the Global Single-Mode Optical Fiber Market include Corning, CommScope, Prysmian, LS Cable and System, Yangtze Optical Fiber and Cable, Sumitomo Electric, Humanetics, HTGD, Nexans, Fujikura, Birla Furukawa, and Furukawa. To secure a stronger market position, single-mode optical fiber companies are prioritizing innovation, cost efficiency, and geographic expansion. Many are heavily investing in R&D to develop fibers with lower attenuation and higher transmission capacity, making them ideal for evolving applications like 5G, FTTH, and hyperscale data networks. Strategic partnerships with telecom operators and infrastructure providers are enabling faster product adoption across regions. Manufacturers are also optimizing production processes and expanding facility footprints in emerging markets to reduce lead times and logistics costs. In addition, diversification of material sourcing and strengthening supply chain resilience have become crucial strategies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing data traffic from cloud services & IoT

- 3.3.1.2 Global rollout of 5G network

- 3.3.1.3 Growing demand for FTTH (fiber to the home)

- 3.3.1.4 Smart city and infrastructure projects

- 3.3.1.5 Shift towards industrial automation and industry 4.0

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Complex installation in urban environments

- 3.3.2.2 Intense market competition and price pressure

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Core, 2021 – 2034 (USD Million & Megameter)

- 5.1 Key trends

- 5.2 Single-core

- 5.3 Dual-core

- 5.4 Multi-core

Chapter 6 Market Estimates and Forecast, By Deployment, 2021 – 2034 (USD Million & Megameter)

- 6.1 Key trends

- 6.2 Underground

- 6.3 Underwater

- 6.4 Utility poles

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million & Megameter)

- 7.1 Key trends

- 7.2 Government/defense

- 7.3 Telecom operators

- 7.4 Cloud providers

- 7.5 Oil & gas

- 7.6 Industrial automation

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Megameter)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AFL

- 9.2 Birla Furukawa

- 9.3 CommScope

- 9.4 Corning Incorporated

- 9.5 Exail

- 9.6 Fujikura

- 9.7 Furukawa

- 9.8 HTGD

- 9.9 Humanetics

- 9.10 LS Cable & System

- 9.11 Nexans

- 9.12 Optical Cable Corporation

- 9.13 Prysmian Group

- 9.14 Sr. Indus Electro Systems Pvt. Ltd

- 9.15 STL Tech

- 9.16 Sumitomo Electric Industries, Ltd.

- 9.17 Yangtze Optical Fiber & Cable

- 9.18 ZTT