|

市場調查報告書

商品編碼

1750596

生物感測器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biosensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

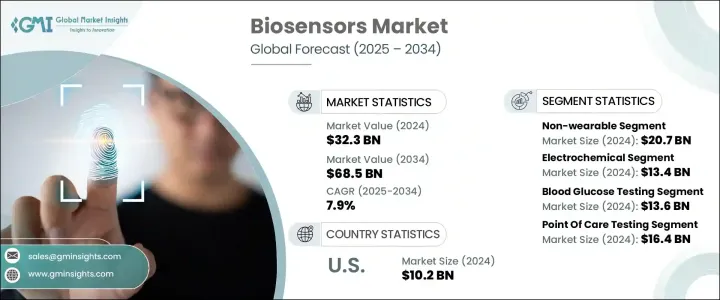

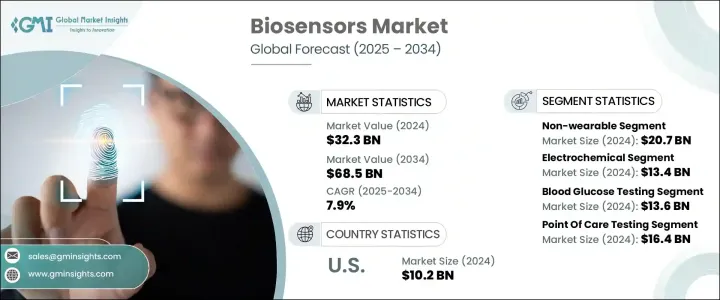

2024年,全球生物感測器市場規模達323億美元,預計2034年將以7.9%的複合年成長率成長,達到685億美元。這得益於生物感測器在多個領域(尤其是醫療保健領域)的應用日益增多,生物感測器在檢測生物訊號方面發揮著至關重要的作用。這些設備靈敏度高、精準度高,能夠快速檢測生物標記,有助於早期診斷各種疾病。此外,生物感測器在藥物研發和生物醫藥領域的應用日益廣泛,也進一步支撐了市場的成長。攜帶式生物感測器的需求不斷成長,尤其是在亞太和歐洲等地區,加上技術進步,是推動該產業發展的關鍵因素。

推動生物感測器市場成長的另一個關鍵因素是糖尿病和心血管疾病等慢性疾病的日益流行,這些疾病需要持續監測和管理,以避免嚴重的併發症。例如,如果不加以控制,糖尿病可能導致嚴重的健康問題,如腎衰竭、中風或下肢截肢。這導致對能夠即時監測血糖水平的設備的需求日益成長,使患者能夠在必要時立即採取行動。除了糖尿病之外,心血管疾病的發生率也在上升,因此對透過生物感測器等先進診斷工具進行早期發現和持續管理的需求日益成長。這些技術透過提供及時資料,幫助制定更精準的治療方案,有助於改善患者的治療效果。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 323億美元 |

| 預測值 | 685億美元 |

| 複合年成長率 | 7.9% |

2024年,非穿戴式生物感測器市場規模達207億美元。這些感測器整合到用於即時診斷的診斷設備中,因其易用性、高精度以及無需用戶持續互動即可提供即時結果的能力而備受青睞。隨著醫療保健提供者尋求高效及時的診斷工具,預計對這些非穿戴式裝置的需求將會成長。諸如靈敏度提升、微型化和數位連接等技術創新,增強了它們在臨床環境中的有效性和可用性。

電化學生物感測器領域佔據相當大的市場佔有率,佔41.6%,2024年達到134億美元。這些生物感測器廣泛應用於醫療設備,例如糖尿病患者的血糖儀以及監測心臟生物標記和血液氣體的系統。心血管疾病和糖尿病等慢性疾病的盛行率不斷上升,推動了對電化學感測器作為重要診斷工具的需求。

受慢性病病例(尤其是糖尿病和心臟病)數量不斷成長的推動,美國生物感測器市場在2024年達到了102億美元的產值。儘管監管環境嚴格,美國仍然是包括生物感測器在內的創新醫療技術開發、批准和商業化的中心。 FDA等監管機構越來越重視加快新型生物感測器技術的核准流程,並認知到其在改善醫療保健結果方面的關鍵作用。

為了鞏固市場地位,各公司正專注於創新和合作。許多公司在研發方面投入巨資,以開發靈敏度和精度更高的更先進的生物感測器技術。與醫療保健提供者和研究機構的合作有助於推動創新。此外,一些公司正在努力擴展其產品組合,以滿足各種醫療需求,例如針對特定疾病的生物感測器和穿戴式健康監測設備。賽默飛世爾科技、Masimo 和丹納赫等市場領導者正在採用這些策略來提升其市場佔有率,並在這個快速成長的行業中保持競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 生物感測器在醫療領域的應用日益廣泛

- 全球糖尿病盛行率上升

- 亞太地區和歐洲對攜帶式生物感測器的需求很高

- 不斷進步的技術

- 產業陷阱與挑戰

- 嚴格的監管情景

- 產品開發成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 穿戴

- 不穿戴式

第6章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 電化學

- 光學的

- 熱的

- 壓電

- 其他技術

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 血糖檢測

- 膽固醇檢測

- 血氣分析

- 妊娠測試

- 藥物研發

- 傳染病檢測

- 其他應用

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 即時檢驗

- 家庭醫療保健診斷

- 研究實驗室

- 其他最終用戶

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 瑞士

- 亞太地區

- 中國

- 日本

- 印度

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Abbott Laboratories

- ARKRAY

- Bio-Rad Laboratories

- Biosensors International Group

- Dexcom

- Danaher

- F. Hoffmann-La Roche

- Masimo

- Nova Biomedical

- Platinum Equity Advisors

- PHC Holdings

- Pinnacle Technology

- Siemens Healthineers

- Thermo Fisher Scientific

- Trividia Health

目錄

第 11 章:方法論與範圍

第 12 章:執行摘要

第 13 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 生物感測器在醫療領域的應用日益廣泛

- 全球糖尿病盛行率上升

- 亞太地區和歐洲對攜帶式生物感測器的需求很高

- 不斷進步的技術

- 產業陷阱與挑戰

- 嚴格的監管情景

- 產品開發成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第 14 章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 15 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 穿戴

- 不穿戴式

第 16 章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 電化學

- 光學的

- 熱的

- 壓電

- 其他技術

第 17 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 血糖檢測

- 膽固醇檢測

- 血氣分析

- 妊娠測試

- 藥物研發

- 傳染病檢測

- 其他應用

第 18 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 即時檢驗

- 家庭醫療保健診斷

- 研究實驗室

- 其他最終用戶

第 19 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 瑞士

- 亞太地區

- 中國

- 日本

- 印度

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

第20章:公司簡介

- Abbott Laboratories

- ARKRAY

- Bio-Rad Laboratories

- Biosensors International Group

- Dexcom

- Danaher

- F. Hoffmann-La Roche

- Masimo

- Nova Biomedical

- Platinum Equity Advisors

- PHC Holdings

- Pinnacle Technology

- Siemens Healthineers

- Thermo Fisher Scientific

- Trividia Health

The Global Biosensors Market was valued at USD 32.3 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 68.5 billion by 2034, driven by increasing applications of biosensors across several sectors, particularly healthcare, where they play a crucial role in detecting biological signals. These devices offer high sensitivity and precision, allowing for the quick detection of biomarkers that aid in the early diagnosis of various diseases. Additionally, the expanding use of biosensors in drug discovery and biomedicine further supports the market's growth. The growing demand for portable biosensors, especially in regions like Asia Pacific and Europe, alongside technological advancements, is key factor propelling the industry.

Another key factor driving the growth of the biosensors market is the increasing prevalence of chronic conditions, such as diabetes and cardiovascular diseases, which require continuous monitoring and management to avoid serious complications. For example, diabetes, if left unmanaged, can lead to severe health issues like kidney failure, stroke, or lower limb amputations. This has led to a growing demand for devices that can offer real-time monitoring of blood glucose levels, allowing patients to take immediate action when necessary. In addition to diabetes, cardiovascular diseases are also on the rise, creating an increasing need for early detection and ongoing management through advanced diagnostic tools like biosensors. These technologies are helping improve patient outcomes by providing timely data that allows for more precise treatment plans.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.3 Billion |

| Forecast Value | $68.5 Billion |

| CAGR | 7.9% |

The non-wearable biosensor segment accounted for USD 20.7 billion in 2024. These sensors, integrated into diagnostic devices used for point-of-care testing, are valued for their ease of use, high accuracy, and ability to provide immediate results without continuous user interaction. As healthcare providers seek efficient and timely diagnostic tools, the demand for these non-wearable devices is expected to rise. Technological innovations such as improved sensitivity, miniaturization, and digital connectivity enhance their effectiveness and usability in clinical settings.

The electrochemical biosensor segment holds a substantial share of the market, representing 41.6% share, which was USD 13.4 billion in 2024. These biosensors are widely used in medical devices such as glucose meters for diabetic patients and in systems that monitor cardiac biomarkers and blood gases. The increasing prevalence of chronic conditions, including cardiovascular diseases and diabetes, drives the demand for electrochemical sensors as essential diagnostic tools.

United States Biosensors Market generated USD 10.2 billion in 2024, driven by the rising number of chronic disease cases, especially diabetes and heart-related conditions. Despite a strict regulatory environment, the U.S. remains a hub for the development, approval, and commercialization of innovative medical technologies, including biosensors. Regulatory bodies like the FDA are increasingly focused on accelerating the approval process for new biosensor technologies, recognizing their critical role in improving healthcare outcomes.

To strengthen their position in the market, companies are focusing on innovation and partnerships. Many firms invest heavily in R&D to develop more advanced biosensor technologies with greater sensitivity and precision. Collaborations with healthcare providers and research institutions help in driving innovation. Furthermore, some companies are working to expand their product portfolios to cater to various medical needs, such as disease-specific biosensors and wearable health monitoring devices. Market leaders, such as Thermo Fisher Scientific, Masimo, and Danaher, are adopting these strategies to enhance their market presence and remain competitive in this rapidly growing industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing application of biosensors in medical field

- 3.2.1.2 Rising prevalence of diabetes globally

- 3.2.1.3 High demand for portable biosensors in Asia Pacific and Europe

- 3.2.1.4 Increasing technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High cost of product development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable

- 5.3 Non-wearable

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electrochemical

- 6.3 Optical

- 6.4 Thermal

- 6.5 Piezoelectric

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By Applications, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood glucose testing

- 7.3 Cholesterol testing

- 7.4 Blood gas analysis

- 7.5 Pregnancy testing

- 7.6 Drug discovery

- 7.7 Infectious disease testing

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Point of care testing

- 8.3 Home healthcare diagnostics

- 8.4 Research laboratories

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Switzerland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 ARKRAY

- 10.3 Bio-Rad Laboratories

- 10.4 Biosensors International Group

- 10.5 Dexcom

- 10.6 Danaher

- 10.7 F. Hoffmann-La Roche

- 10.8 Masimo

- 10.9 Nova Biomedical

- 10.10 Platinum Equity Advisors

- 10.11 PHC Holdings

- 10.12 Pinnacle Technology

- 10.13 Siemens Healthineers

- 10.14 Thermo Fisher Scientific

- 10.15 Trividia Health

Table of Contents

Chapter 11 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 12 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 13 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing application of biosensors in medical field

- 3.2.1.2 Rising prevalence of diabetes globally

- 3.2.1.3 High demand for portable biosensors in Asia Pacific and Europe

- 3.2.1.4 Increasing technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High cost of product development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 14 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 15 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable

- 5.3 Non-wearable

Chapter 16 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electrochemical

- 6.3 Optical

- 6.4 Thermal

- 6.5 Piezoelectric

- 6.6 Other technologies

Chapter 17 Market Estimates and Forecast, By Applications, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood glucose testing

- 7.3 Cholesterol testing

- 7.4 Blood gas analysis

- 7.5 Pregnancy testing

- 7.6 Drug discovery

- 7.7 Infectious disease testing

- 7.8 Other applications

Chapter 18 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Point of care testing

- 8.3 Home healthcare diagnostics

- 8.4 Research laboratories

- 8.5 Other end users

Chapter 19 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Switzerland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

Chapter 20 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 ARKRAY

- 10.3 Bio-Rad Laboratories

- 10.4 Biosensors International Group

- 10.5 Dexcom

- 10.6 Danaher

- 10.7 F. Hoffmann-La Roche

- 10.8 Masimo

- 10.9 Nova Biomedical

- 10.10 Platinum Equity Advisors

- 10.11 PHC Holdings

- 10.12 Pinnacle Technology

- 10.13 Siemens Healthineers

- 10.14 Thermo Fisher Scientific

- 10.15 Trividia Health