|

市場調查報告書

商品編碼

1871198

精準營養穿戴式感測器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Precision Nutrition Wearable Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

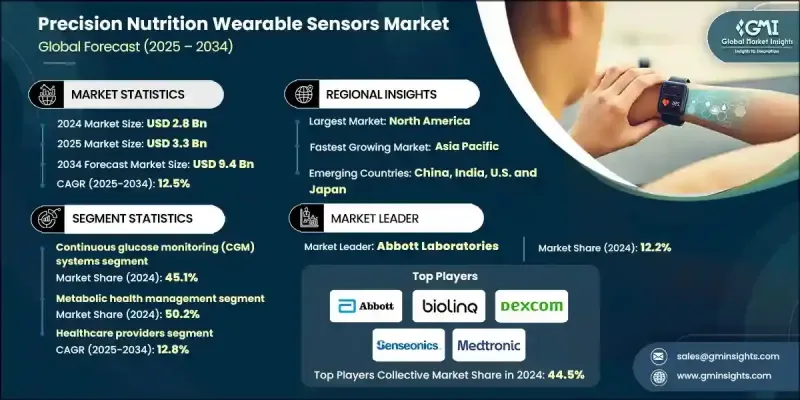

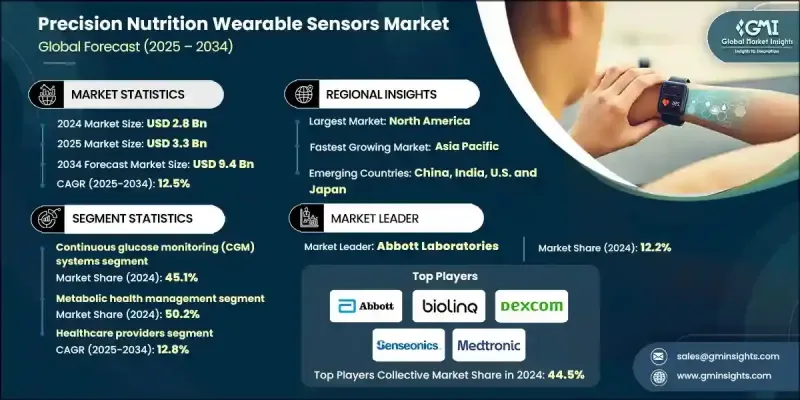

2024 年全球精準營養穿戴式感測器市場價值為 28 億美元,預計到 2034 年將以 12.5% 的複合年成長率成長至 94 億美元。

由於健康監測技術的進步和人們對個人化營養日益成長的興趣,市場正在不斷擴張。這些感測器能夠即時追蹤關鍵生理指標,例如水分含量、營養攝取量、代謝率和身體活動量。透過提供精準的監測,它們能夠幫助消費者和醫療保健專業人員制定個人化的營養計劃,改善健康狀況,並預防與飲食相關的疾病。健康意識的提高、智慧型裝置的普及以及生活方式相關疾病盛行率的上升,都催生了強勁的需求。新興市場在可支配收入增加和對個人化健康解決方案的認知不斷提高的推動下,展現出巨大的成長機會。多參數感測器、人工智慧驅動的分析以及與其他健康設備的整合等方面的創新,預計將加速市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 94億美元 |

| 複合年成長率 | 12.5% |

2024年,持續血糖監測(CGM)系統市佔率達到45.1%,這反映了其在糖尿病管理和營養追蹤領域數十年的臨床驗證。成熟的製造流程、感測器精度和完善的監管框架是該領域佔據主導地位的重要因素。

代謝健康管理領域預計在2024年將佔據50.2%的市場。此領域涵蓋糖尿病、肥胖症和代謝症候群等疾病的監測和最佳化。市場對即時代謝資料的臨床需求旺盛,這些數據有助於制定個人化干涉措施、精準治療方案、調整藥物劑量,並預防代謝併發症的進展。

北美精準營養穿戴式感測器市場佔據42.2%的市場佔有率,複合年成長率達12.6%,預計2024年美國市場規模將達到9.216億美元。該地區的領先地位得益於先進的醫療基礎設施、有利的監管環境以及健康技術的高普及率。美國食品藥物管理局(FDA)針對穿戴式生物感測器所製定的清晰監管路徑,在確保安全性和有效性的同時,也促進了創新。

全球精準營養穿戴式感測器市場的主要企業包括 Biolinq Inc.、Dexcom Inc.、雅培 (Abbott Laboratories)、Epicore Biosystems、美敦力 (Medtronic plc)、DayTwo Inc.、Nutrisense Inc.、Senseonics Holdings Inc.、Genesis Healthcare Co. 和 Prenetics Global Limited。這些企業專注於產品創新,整合人工智慧驅動的分析技術,並開發多參數感測器以提高準確性和易用性。與醫療服務提供者和研究機構建立策略合作夥伴關係,有助於進行臨床驗證並提升產品可信度。拓展分銷管道和瞄準新興市場有助於擴大全球影響力。企業重視合規性,以加速核准流程和市場推廣。個人化解決方案、訂閱式監測服務以及與行動應用程式的無縫設備整合,增強了客戶參與度。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按產品類別

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼說明:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依技術類型分類,2021-2034年

- 主要趨勢

- 持續血糖監測儀(CGM)

- 基於汗液的生物感測器

- 生物阻抗感測器

- 光學感測器

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 代謝健康管理

- 血糖監測與糖尿病管理

- 酮症追蹤應用程式

- 代謝靈活性評估

- 運動營養與運動表現

- 水合用監測系統

- 電解質平衡追蹤

- 乳酸測定

- 臨床營養治療

- 疾病管理應用

- 治療監測系統

- 藥物依從性追蹤

- 一般健康與預防

- 生活方式最佳化平台

- 膳食依從性監測

- 預防保健應用

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫療保健提供者

- 醫院整合系統

- 診所監測計劃

- 遠距醫療平台整合

- 直接面對消費者

- 個人消費者採用

- 健身愛好者群

- 注重健康的使用者群體

- 企業健康計劃

- 雇主贊助的健康計劃

- 保險公司合作關係

- 職業健康應用

- 研究機構

- 臨床試驗申請

- 學術研究項目

- 藥物開發支持

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Abbott Laboratories

- Biolinq Inc

- DayTwo Inc

- Dexcom Inc

- Epicore Biosystems

- Genesis Healthcare Co.

- Medtronic plc

- Nutrisense Inc

- Prenetics Global Limited

- Senseonics Holdings Inc

The Global Precision Nutrition Wearable Sensors Market was valued at USD 2.8 Billion in 2024 and is estimated to grow at a CAGR of 12.5% to reach USD 9.4 Billion by 2034.

The market is expanding due to advancements in health-monitoring technologies and growing interest in personalized nutrition. These sensors provide real-time tracking of key physiological metrics such as hydration, nutrient intake, metabolic rate, and physical activity. By offering accurate monitoring, they enable both consumers and healthcare professionals to tailor nutrition plans, enhance health outcomes, and prevent diet-related conditions. The rising health awareness, proliferation of smart devices, and increasing prevalence of lifestyle-related diseases are creating strong demand. Emerging markets are presenting significant growth opportunities, driven by higher disposable incomes and growing awareness of personalized health solutions. Innovations in multi-parameter sensors, AI-driven analytics, and integration with other health devices are expected to accelerate market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $9.4 Billion |

| CAGR | 12.5% |

The continuous glucose monitoring (CGM) systems segment held a 45.1% share in 2024, reflecting decades of clinical validation in managing diabetes and nutritional tracking. The maturity of manufacturing, sensor accuracy, and established regulatory frameworks contribute to the segment's dominance.

The metabolic health management segment held a 50.2% share in 2024. This includes monitoring and optimizing conditions such as diabetes, obesity, and metabolic syndrome. The high demand stems from the clinical need for real-time metabolic data, which supports personalized interventions, helps in precise therapy prescriptions, adjusts medication dosages, and prevents the progression of metabolic complications.

North America Precision Nutrition Wearable Sensors Market captured 42.2% share, with a CAGR of 12.6%, and the U.S. market was valued at USD 921.6 million in 2024. The region's leadership is supported by advanced healthcare infrastructure, a favorable regulatory environment, and high adoption of health technologies. The FDA's clear regulatory pathways for wearable biosensors reinforce innovation while ensuring safety and efficacy.

Leading companies in the Global Precision Nutrition Wearable Sensors Market include Biolinq Inc., Dexcom Inc., Abbott Laboratories, Epicore Biosystems, Medtronic plc, DayTwo Inc., Nutrisense Inc., Senseonics Holdings Inc., Genesis Healthcare Co., and Prenetics Global Limited. Companies in the Precision Nutrition Wearable Sensors Market focus on product innovation, integrating AI-powered analytics, and developing multi-parameter sensors to improve accuracy and usability. Strategic partnerships with healthcare providers and research institutions enable clinical validation and credibility. Expanding distribution channels and targeting emerging markets help increase global reach. Companies emphasize regulatory compliance to speed up approvals and market adoption. Personalized solutions, subscription-based monitoring services, and seamless device integration with mobile apps strengthen customer engagement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Continuous glucose monitors (CGMs)

- 5.3 Sweat-based biosensors

- 5.4 Bioimpedance sensors

- 5.5 Optical sensors

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Metabolic health management

- 6.2.1 Glucose monitoring & diabetes management

- 6.2.2 Ketosis tracking applications

- 6.2.3 Metabolic flexibility assessment

- 6.3 Sports nutrition & performance

- 6.3.1 Hydration monitoring systems

- 6.3.2 Electrolyte balance tracking

- 6.3.3 Lactate measurement

- 6.4 Clinical nutrition therapy

- 6.4.1 Disease management applications

- 6.4.2 Therapeutic monitoring systems

- 6.4.3 Medication adherence tracking

- 6.5 General wellness & prevention

- 6.5.1 Lifestyle optimization platforms

- 6.5.2 Dietary compliance monitoring

- 6.5.3 Preventive health applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Healthcare providers

- 7.2.1 Hospital integration systems

- 7.2.2 Clinic-based monitoring programs

- 7.2.3 Telehealth platform integration

- 7.3 Direct-to-consumer

- 7.3.1 Individual consumer adoption

- 7.3.2 Fitness enthusiast segment

- 7.3.3 Health-conscious user demographics

- 7.4 Corporate wellness programs

- 7.4.1 Employer-sponsored health initiatives

- 7.4.2 Insurance company partnerships

- 7.4.3 Occupational health applications

- 7.5 Research institutions

- 7.5.1 Clinical trial applications

- 7.5.2 Academic research programs

- 7.5.3 Pharmaceutical development support

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Biolinq Inc

- 9.3 DayTwo Inc

- 9.4 Dexcom Inc

- 9.5 Epicore Biosystems

- 9.6 Genesis Healthcare Co.

- 9.7 Medtronic plc

- 9.8 Nutrisense Inc

- 9.9 Prenetics Global Limited

- 9.10 Senseonics Holdings Inc