|

市場調查報告書

商品編碼

1750577

燃料電池市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

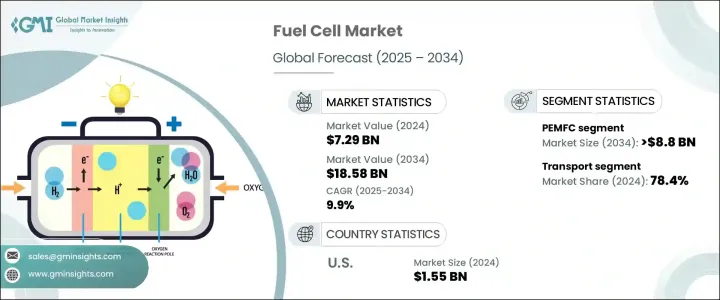

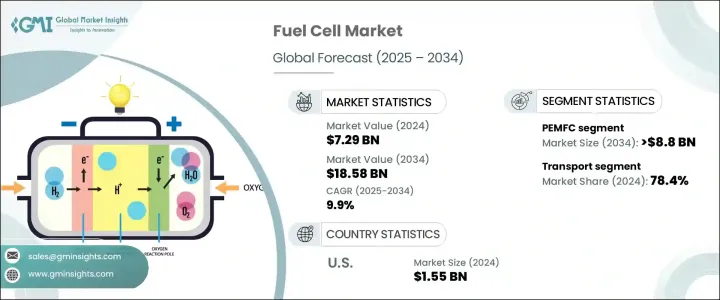

2024年,全球燃料電池市場規模達72.9億美元,預計隨著對清潔、可靠、高效電源的需求持續成長,到2034年將以9.9%的複合年成長率成長,達到185.8億美元。推動這一成長的因素包括偏遠地區和離網地區電力需求的不斷成長,以及旨在減少排放的環境法規的日益嚴格。隨著各行各業將重點轉向永續性和經濟高效的電力解決方案,燃料電池正逐漸成為頗具前景的替代方案。與傳統技術相比,燃料電池系統因其高運作效率、更低的環境影響和更具競爭力的價格而特別具有吸引力。

燃料電池在製造業中被廣泛採用,而不間斷電源和低排放解決方案在該領域至關重要。燃料電池發電時污染極低的特性引起了政府和私人企業的關注。隨著越來越多的國家推出旨在減少碳足跡和提高能源效率的政策,燃料電池在各種應用中的使用正在穩步成長。金融機構和政府機構正在投入大量資金進行研發,以推動該領域的技術進步。隨著創新的不斷推進,燃料電池預計將在商業和住宅能源系統中變得越來越可行。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 72.9億美元 |

| 預測值 | 185.8億美元 |

| 複合年成長率 | 9.9% |

公共和私營部門的投資也促進了市場的成長。全球各地的組織正在加緊努力,開發先進技術,以提高燃料電池的性能、效率和價格負擔能力。這些舉措正在鼓勵各行各業的企業將燃料電池系統作為其能源轉型策略的一部分。為了響應這些發展,對下一代燃料電池系統的需求正在迅速成長。

在各類燃料電池中,質子交換膜燃料電池 (PEMFC) 市場規模預計到 2034 年將超過 88 億美元。這類燃料電池以其低工作溫度和快速啟動時間而聞名,是各種應用的理想選擇,涵蓋從備用電源解決方案到攜帶式能源系統以及汽車應用。隨著這些技術不斷發展和可靠性的提升,其在資料中心、住宅建築和行動基礎設施等領域的應用預計將大幅成長。

從應用角度來看,市場分為固定式、可攜式和運輸式。 2024年,運輸領域佔據了市場主導地位,佔總市佔率的78.4%以上。該領域正見證著燃料電池系統在電動自行車、無人機和商用車隊中的加速應用。運輸業日益重視減排和向更綠色技術的轉型,這推動了氫燃料電池系統的整合。隨著氫氣生產和分配基礎設施的完善,這些系統在包括海上物流和商業航運在內的各種運輸應用中的部署預計將擴大。

以美國為首的北美燃料電池市場也正在穩步發展。光是美國市場,2022年的價值就超過15.2億美元,2023年達到15.3億美元,2024年達到15.5億美元。預計到2034年,整個北美市場的複合年成長率將超過6%。採用甲烷綜合重整技術的現場製氫站的開發,為燃料基礎設施提供了經濟高效的解決方案,從而促進了區域應用。這些進步為燃料電池在公共和私營部門的廣泛應用創造了更有利的環境。

目前,全球燃料電池市場由幾個關鍵參與者主導,他們不斷透過創新和協作來鞏固市場地位。排名前五的公司——康明斯、巴拉德動力系統、富士電機、東芝公司和普拉格能源——合計佔據全球約40%的市場。他們的策略包括與能源公司、汽車製造商和研究機構結盟,以增強產品供應並加速技術開發。這些合作努力正在擴大燃料電池技術的覆蓋範圍,並為商業化開闢新的途徑。

戰略合作夥伴關係、合資企業以及政府和私營部門加強的資金投入正在加速研發步伐。這些努力不僅推動了創新,也提高了燃料電池解決方案的可擴展性和市場成熟度。因此,該產業正朝著實現大規模部署邁進,這將對全球能源格局產生重大影響。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 策略舉措

- 戰略儀表板

- 公司標竿分析

- 創新與技術格局

第5章:燃料電池市場:依產品分類,2021 - 2034 年

- 主要趨勢

- 質子交換膜燃料電池

- 直接甲醇燃料電池

- 固態氧化物燃料電池

- 平安金融中心及亞洲金融中心

- MCFC

第6章:燃料電池市場:依應用分類,2021 - 2034

- 主要趨勢

- 固定式

- < 200 千瓦

- 200千瓦-1兆瓦

- ≥1兆瓦

- 便攜的

- 運輸

- 海洋

- 鐵路

- 燃料電池電動車

- 其他

第7章:燃料電池市場:按燃料,2021 - 2034

- 主要趨勢

- 氫

- 氨

- 甲醇

- 碳氫化合物

第8章:燃料電池市場:依規模,2021 - 2034

- 主要趨勢

- 小規模

- 大規模

第9章:燃料電池市場:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業和工業

- 資料中心

- 軍事和國防

- 公用事業和政府

- 運輸

第10章:燃料電池市場:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 奧地利

- 亞太地區

- 日本

- 韓國

- 中國

- 印度

- 菲律賓

- 越南

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 拉丁美洲

- 巴西

- 秘魯

- 墨西哥

第 11 章:公司簡介

- Cummins

- Ballard Power Systems

- Plug Power

- Nuvera Fuel Cells

- Nedstack Fuel Cell Technology

- Bloom Energy

- Panasonic Corporation

- Doosan Fuel Cell

- Aisin Corporation

- Ceres

- SFC Energy

- Toshiba Corporation

- Robert Bosch

- TW Horizon Fuel Cell Technologies

- AFC Energy

- FuelCell Energy

- Fuji Electric

- Hyundai Motor Company

The Global Fuel Cell Market was valued at USD 7.29 billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 18.58 billion by 2034 as the need for clean, reliable, and efficient power sources continues to grow. This growth is being driven by an increasing demand for power in remote and off-grid locations, as well as by tightening environmental regulations aimed at reducing emissions. As industries shift their focus toward sustainability and cost-effective power solutions, fuel cells are emerging as a promising alternative. These systems are particularly attractive due to their high operational efficiency, lower environmental impact, and competitive pricing compared to conventional technologies.

Fuel cells are being widely adopted in the manufacturing sector, where uninterrupted power supply and low-emission solutions are critical. Their capability to produce electricity with minimal pollution has drawn the attention of governments and private players alike. With a growing number of countries rolling out policies focused on reducing carbon footprints and improving energy efficiency, the use of fuel cells across a range of applications is expanding steadily. Financial institutions and government bodies are pouring significant investments into research and development to drive technological advancements in this space. As innovation progresses, fuel cells are expected to become increasingly viable for both commercial and residential energy systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.29 Billion |

| Forecast Value | $18.58 Billion |

| CAGR | 9.9% |

Investments from both public and private sectors are also contributing to the growth of the market. Organizations across the globe are stepping up efforts to develop advanced technologies that improve the performance, efficiency, and affordability of fuel cells. These initiatives are encouraging companies across multiple industries to adopt fuel cell systems as part of their energy transition strategies. In response to these developments, the demand for next-generation fuel cell systems is growing rapidly.

Among the various types of fuel cells, the Proton Exchange Membrane Fuel Cell (PEMFC) segment is expected to surpass USD 8.8 billion by 2034. These fuel cells are known for their low operating temperature and quick startup times, making them ideal for a variety of applications, from backup power solutions to portable energy systems and automotive uses. As these technologies evolve and become more reliable, their use in sectors such as data centers, residential buildings, and mobile infrastructure is anticipated to increase significantly.

In terms of application, the market is categorized into stationary, portable, and transport sectors. The transport segment dominated the market in 2024, accounting for more than 78.4% of the total share. This segment is witnessing accelerated adoption of fuel cell systems in electric bikes, unmanned aerial vehicles, and commercial fleets. The transportation sector's increasing focus on reducing emissions and transitioning to greener technologies is propelling the integration of hydrogen fuel cell systems. As infrastructure for hydrogen production and distribution improves, the deployment of these systems across various transport applications, including maritime logistics and commercial shipping, is expected to expand.

The North American fuel cell market, led by the United States, is also witnessing steady progress. The US market alone recorded a value of over USD 1.52 billion in 2022, USD 1.53 billion in 2023, and reached USD 1.55 billion in 2024. Across the continent, the market is forecasted to grow at a CAGR of over 6% through 2034. The development of on-site hydrogen generation stations using integrated methane reforming technologies has provided cost-effective solutions for fueling infrastructure, thus boosting regional adoption. These advancements are creating a more favorable environment for the widespread deployment of fuel cells in both public and private sectors.

The global fuel cell market is currently shaped by the presence of several key players who are continuously working to strengthen their market position through innovation and collaboration. The top five companies-Cummins, Ballard Power Systems, Fuji Electric, Toshiba Corporation, and Plug Power-collectively account for around 40% of the global market share. Their strategies include forming alliances with energy companies, automotive manufacturers, and research institutions to enhance product offerings and accelerate technology development. These collaborative efforts are expanding the reach of fuel cell technology and opening new avenues for commercialization.

Strategic partnerships, joint ventures, and increased funding from both government and private entities are accelerating the pace of research and development. These efforts are not only driving innovation but also improving the scalability and market readiness of fuel cell solutions. As a result, the industry is moving closer to achieving large-scale deployment, with significant implications for the global energy landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Fuel Cell Market, By Product, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 PEMFC

- 5.3 DMFC

- 5.4 SOFC

- 5.5 PAFC & AFC

- 5.6 MCFC

Chapter 6 Fuel Cell Market, By Application, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Stationary

- 6.2.1 < 200 kW

- 6.2.2 200 kW - 1 MW

- 6.2.3 ≥ 1 MW

- 6.3 Portable

- 6.4 Transport

- 6.4.1 Marine

- 6.4.2 Railways

- 6.4.3 FCEVs

- 6.4.4 Others

Chapter 7 Fuel Cell Market, By Fuel, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Hydrogen

- 7.3 Ammonia

- 7.4 Methanol

- 7.5 Hydrocarbons

Chapter 8 Fuel Cell Market, By Size, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Small scale

- 8.3 Large scale

Chapter 9 Fuel Cell Market, By End Use, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial & industrial

- 9.4 Data centers

- 9.5 Military and defense

- 9.6 Utilities & government

- 9.7 Transportation

Chapter 10 Fuel Cell Market, By Region, 2021 - 2034 (USD Million & MW)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Austria

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 South Korea

- 10.4.3 China

- 10.4.4 India

- 10.4.5 Philippines

- 10.4.6 Vietnam

- 10.5 Middle East & Africa

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Peru

- 10.6.3 Mexico

Chapter 11 Company Profiles

- 11.1 Cummins

- 11.2 Ballard Power Systems

- 11.3 Plug Power

- 11.4 Nuvera Fuel Cells

- 11.5 Nedstack Fuel Cell Technology

- 11.6 Bloom Energy

- 11.7 Panasonic Corporation

- 11.8 Doosan Fuel Cell

- 11.9 Aisin Corporation

- 11.10 Ceres

- 11.11 SFC Energy

- 11.12 Toshiba Corporation

- 11.13 Robert Bosch

- 11.14 TW Horizon Fuel Cell Technologies

- 11.15 AFC Energy

- 11.16 FuelCell Energy

- 11.17 Fuji Electric

- 11.18 Hyundai Motor Company