|

市場調查報告書

商品編碼

1750569

公用事業規模數位化變電站市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Utility Scale Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

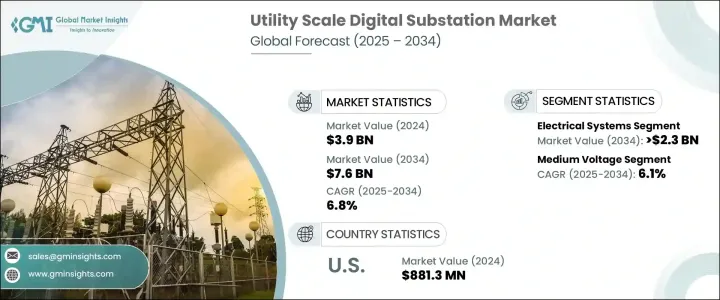

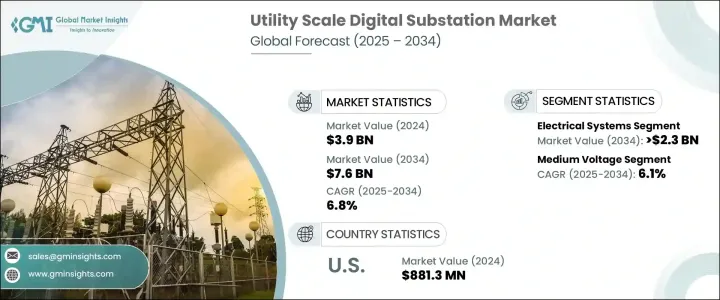

2024 年全球公用事業規模數位變電站市場價值為 39 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長,達到 76 億美元,這得益於對更高效、更可靠的配電系統日益成長的需求,尤其是向再生能源的轉變。老化的基礎設施正在進行升級,以納入數位變電站,其中包括智慧電錶、自動化系統和先進的監控功能。這種現代化增強了公用事業公司監控即時資料和更好地管理配電的能力。透過部署高級計量基礎設施 (AMI) 和監控與資料收集 (SCADA) 系統,公用事業公司不僅可以減少能源損失,還可以提高電網的反應和可靠性。這些數位解決方案可實現即時監控、負載平衡和更快的故障檢測,這對於現代電網的高效運作至關重要。

隨著能源消費模式的演變和電網複雜性的不斷成長,數位技術不再是可有可無的,而是不可或缺的。公用事業公司面臨越來越大的壓力,需要確保可靠性、最大限度地減少停電,並平衡供應與波動的需求,同時整合多種再生能源。這種動態格局需要即時資料視覺性、快速決策和智慧自動化,而數位解決方案具備獨特的優勢,能夠滿足這些需求。數位化變電站有助於將傳統電網基礎設施轉變為更靈活、更具適應性的網路。這些系統支援預測性維護、故障偵測和自動回應機制,從而減少停機時間和營運效率低下。它們還允許營運商遠端監控資產,並最佳化日益分散的電網中的能源流動。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 76億美元 |

| 複合年成長率 | 6.8% |

2034年,公用事業規模數位化變電站市場的電氣系統部分規模將達23億美元。這得歸功於對高壓輸電線路升級的持續投資,以及不斷加大再生能源併入國家電網的力度。隨著越來越多的太陽能、風能和水力發電併網,需要強大的電氣系統來管理波動並確保長距離平穩輸電。對老化輸電網路進行現代化升級的需求日益成長,這促使公用事業公司投資配備智慧自動化和容錯技術的下一代變電站組件。

同時,中壓市場預計將保持強勁成長勢頭,到2034年複合年成長率將達到6.1%。這一成長與分散式能源系統的興起息息相關,其中本地化發電和智慧微電網正日益受到青睞。中壓電網是將電力從變電站輸送到終端用戶的骨幹,特別是在工業園區、住宅區和商業區。政府和私營能源供應商正擴大將資金投入到支持負載預測、尖峰需求控制和資產最佳化的數位中壓解決方案中——所有這些功能對於建立彈性靈活的能源電網都至關重要。

2024年,美國公用事業規模數位化變電站市場規模達8.813億美元。為了適應不斷變化的能源格局,美國正在大力推動電力基礎設施現代化。公用事業公司正在積極淘汰傳統系統,轉而採用全自動數位化變電站,這些變電站能夠提供更完善的系統診斷、預測性維護能力和更精簡的營運。這項轉型得到了聯邦政府旨在提高電網可靠性和加速智慧能源技術應用的措施和資助計畫的大力支持。

市場的主要參與者包括 ABB、百通、思科系統、伊頓、Efacec、通用電氣、日立能源、Larsen & Toubro Limited、Netcontrol Group、施耐德電氣、西門子、四方集團、Tesco Automation、德州儀器和東芝。為了鞏固市場地位,公用事業規模數位變電站市場的公司正在採用一系列策略。他們專注於開發和改進創新技術,增強產品供應以滿足不斷變化的能源分配需求,並與公用事業和能源供應商建立合作夥伴關係以擴大市場範圍。對數位基礎設施和自動化的策略性投資也幫助這些公司保持競爭力。此外,他們專注於全球擴張,確保他們能夠支援全球大型基礎設施項目,同時滿足日益成長的智慧電網解決方案需求。這些策略有助於公司提高市場地位,並為在這個不斷擴大的行業中實現成長做好準備。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 變電所自動化系統

- 通訊網路

- 電氣系統

- 監控系統

- 其他

第6章:市場規模及預測:依架構,2021 - 2034

- 主要趨勢

- 過程

- 灣

- 車站

第7章:市場規模及預測:按電壓,2021 - 2034

- 主要趨勢

- 低的

- 中等的

- 高的

第 8 章:市場規模與預測:按安裝量,2021 年至 2034 年

- 主要趨勢

- 新的

- 翻新

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- ABB

- Belden

- Cisco Systems

- Eaton

- Efacec

- General Electric

- Grid to Great

- Hitachi Energy

- Larsen & Toubro Limited

- Netcontrol Group

- Schneider Electric

- Siemens

- SIFANG

- Tesco Automation

- Texas Instruments Incorporated

- Toshiba

The Global Utility Scale Digital Substation Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 7.6 billion by 2034, fueled by the rising demand for more efficient and reliable power distribution systems, especially with the shift toward renewable energy sources. Aging infrastructure is being upgraded to incorporate digital substations, which include smart meters, automated systems, and advanced monitoring capabilities. This modernization enhances the ability of utilities to monitor real-time data and better manage electricity distribution. By deploying Advanced Metering Infrastructure (AMI) and Supervisory Control and Data Acquisition (SCADA) systems, utilities can not only reduce energy loss but also boost grid responsiveness and reliability. These digital solutions enable real-time monitoring, load balancing, and faster fault detection, which are vital for the efficient operation of modern power networks.

As energy consumption patterns evolve and the complexity of power grids continues to grow, digital technologies are no longer optional-they're essential. Utilities are under increasing pressure to ensure reliability, minimize outages, and balance supply with fluctuating demand, all while integrating a diverse mix of renewable energy sources. This dynamic landscape demands real-time data visibility, rapid decision-making, and intelligent automation, which digital solutions are uniquely equipped to deliver. Digital substations help transform conventional grid infrastructure into more flexible and adaptive networks. These systems enable predictive maintenance, fault detection, and automated response mechanisms that reduce downtime and operational inefficiencies. They also allow operators to remotely monitor assets and optimize energy flows across increasingly decentralized power networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 6.8% |

The electrical systems component of the utility-scale digital substations market will reach USD 2.3 billion by 2034. This is due to consistent investments in upgrading high-voltage transmission lines and increasing efforts to integrate renewable energy into national grids. As more solar, wind, and hydro sources come online, robust electrical systems are necessary to manage fluctuations and ensure smooth transmission over long distances. The growing need to modernize aging transmission networks is pushing utilities to invest in next-gen substation components equipped with intelligent automation and fault-tolerant technology.

Meanwhile, the medium voltage segment is expected to maintain strong momentum, growing at a CAGR of 6.1% through 2034. This growth is tied to the rise of decentralized energy systems, where localized power generation and smart microgrids are gaining traction. Medium voltage networks are the backbone for distributing electricity from substations to end users, particularly in industrial parks, residential developments, and commercial zones. Governments and private energy providers are increasingly channeling funds into digital medium voltage solutions that support load forecasting, peak demand control, and asset optimization-all critical functions for a resilient and flexible energy grid.

United States Utility Scale Digital Substation Market was valued at USD 881.3 million in 2024. The country is making major strides in modernizing its power infrastructure to meet the evolving energy landscape. Utilities are actively phasing out legacy systems in favor of fully automated digital substations, which offer improved system diagnostics, predictive maintenance capabilities, and streamlined operations. This transition is heavily supported by federal initiatives and funding programs aimed at enhancing grid reliability and accelerating the adoption of smart energy technologies.

Key players in the market include ABB, Belden, Cisco Systems, Eaton, Efacec, General Electric, Hitachi Energy, Larsen & Toubro Limited, Netcontrol Group, Schneider Electric, Siemens, SIFANG, Tesco Automation, Texas Instruments Incorporated, and Toshiba. To strengthen their market position, companies in the utility-scale digital substation market are employing a range of strategies. They focus on developing and refining innovative technologies, enhancing their product offerings to meet the evolving needs of energy distribution, and forming partnerships with utilities and energy providers to expand their market reach. Strategic investments in digital infrastructure and automation are also helping these companies stay competitive. Furthermore, they focus on global expansion, ensuring they can support large-scale infrastructure projects worldwide while meeting the increasing demand for smart grid solutions. These strategies help companies improve their market standing and position themselves for growth in this expanding sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 New

- 8.3 Refurbished

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Belden

- 10.3 Cisco Systems

- 10.4 Eaton

- 10.5 Efacec

- 10.6 General Electric

- 10.7 Grid to Great

- 10.8 Hitachi Energy

- 10.9 Larsen & Toubro Limited

- 10.10 Netcontrol Group

- 10.11 Schneider Electric

- 10.12 Siemens

- 10.13 SIFANG

- 10.14 Tesco Automation

- 10.15 Texas Instruments Incorporated

- 10.16 Toshiba