|

市場調查報告書

商品編碼

1750529

電子煙市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測E-cigarette Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

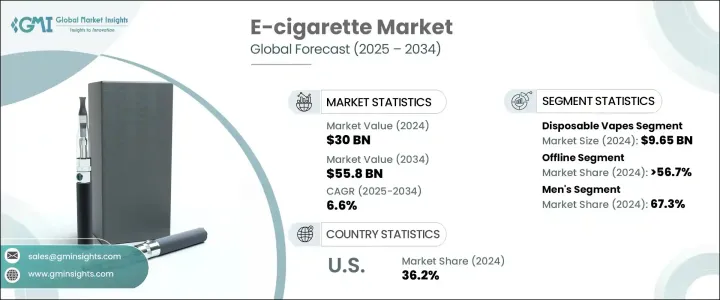

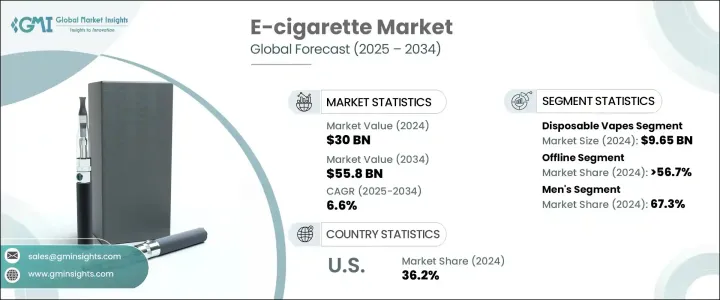

2024年,全球電子煙市場規模達300億美元,預計到2034年將以6.6%的複合年成長率成長,達到558億美元。推動這一成長的因素包括:便捷且口味多樣的一次性電子煙日益普及。 Instagram、TikTok和YouTube等社群媒體平台的興起也在推廣電子煙方面發揮了重要作用,尤其是在年輕族群中。網紅經常展示電子煙產品,強調其易用性和誘人的口味,這有助於電子煙的正常化和美化。此外,技術進步也推動了配備藍牙和GPS等功能的「智慧」電子煙的發展,以滿足追求個人化體驗的科技愛好者的需求。

出於環保考慮,一些品牌將永續材料融入其產品中,以滿足日益成長的環保需求。這種轉變不僅是對消費者偏好的回應,也是更廣泛努力的一部分,旨在符合國際永續發展標準,減少製造過程的環境足跡。企業在裝飾產品中使用再生材料、負責任採購的木材和可生物分解的替代品。這些環保創新不僅吸引了注重環保的買家,也有助於在競爭激烈的市場中提升品牌的差異化。此外,製造商正在開發更耐用、維護成本更低的材料,從而減少頻繁更換的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 300億美元 |

| 預測值 | 558億美元 |

| 複合年成長率 | 6.6% |

2024年,一次性電子煙市場規模達96.5億美元,預計2025年至2034年期間的複合年成長率將達到7%。這類設備因其簡潔、便攜和口味多樣而備受青睞。它們預注油,無需充電,可立即使用,對於新用戶或追求輕鬆體驗的用戶來說,是一個極具吸引力的選擇。便利商店、加油站和其他零售場所的一次性電子煙供應充足,進一步提升了其普及度。

線下零售通路在2024年佔據了56.7%的市場佔有率,預計到2034年將繼續以5.6%的速度成長。消費者重視店內體驗,這使得他們在購買前可以品嚐不同的口味和尼古丁含量。實體店也為品牌提供了透過產品展示、促銷優惠和活動與顧客互動的機會,從而培養信任和品牌忠誠度。

2024年美國電子煙市場將佔據36.2%的市場佔有率,這得益於市場對吸煙替代品的旺盛需求,以及透過上市前煙草產品申請(PMTA)程序驗證產品的監管措施。主流電子煙品牌的出現以及產品在零售店的廣泛供應,進一步鞏固了美國電子煙市場的地位。

電子煙產業的主要參與者包括 Blu、Elf Bar、GeekVape、Innokin、Lost Mary、Lost Vape、MC、MOK、PAX、Pulze、SMOK、Suorin、Vaporesso 和 Vuse。為了加強市場影響力,電子煙產業的公司正在採取多種策略。這些策略包括擴大產品組合以滿足不同的消費者偏好、投資研發以創新和提高產品質量,以及加強線上和線下行銷力度以覆蓋更廣泛的受眾。此外,公司也專注於遵守監管標準,以確保產品安全並贏得消費者信任。他們還與零售商和有影響力的人士合作,以提高品牌知名度和消費者參與度。此外,一些公司正在探索產品設計和包裝方面的永續實踐,以吸引具有環保意識的消費者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 衝擊力

- 有多種口味可供選擇

- 消費者意識不斷提高

- 社群媒體影響力的提升

- 產業陷阱與挑戰

- 監管不確定性和限制

- 青少年電子煙氾濫與大眾的強烈反對

- 成長潛力分析

- 消費者行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年(十億美元)

- 主要趨勢

- Cigalikes

- 電子煙

- 免洗電子煙

- Pod 電子煙

- 盒子改裝

第6章:市場估計與預測:按類別,2021 - 2034 年(十億美元)

- 主要趨勢

- 打開

- 關閉

第7章:市場估計與預測:按口味,2021 - 2034 年(十億美元)

- 主要趨勢

- 菸草

- 植物

- 水果

- 甜的

- 飲料

- 其他

第8章:市場估計與預測:按價格,2021-2034 年(十億美元)

- 主要趨勢

- 低的

- 中等的

- 高的

第9章:市場估計與預測:按使用者分類,2021 - 2034 年(十億美元)

- 主要趨勢

- 男士

- 女性

第10章:市場估計與預測:按營運模式,2021 - 2034 年(十億美元)

- 主要趨勢

- 手動的

- 自動的

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年(十億美元)

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 電子煙專賣店

- 便利商店和加油站

- 其他

第 12 章:市場估計與預測:按地區,2021 年至 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第13章:公司簡介

- Blu

- Elf Bar

- GeekVape

- Innokin

- Lost Mary

- Lost Vape

- MC

- MOK

- PAX

- Pulze

- SMOK

- Suorin

- Vaporesso

- Vuse

The Global E-cigarette Market was valued at USD 30 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 55.8 billion by 2034, driven by several factors, including the increasing popularity of disposable vapes, which offer convenience and a variety of flavors. The rise of social media platforms like Instagram, TikTok, and YouTube has also played a significant role in promoting e-cigarettes, particularly among younger audiences. Influencers often showcase e-cigarette products, highlighting their ease of use and appealing flavors, which have contributed to the normalization and glamorization of vaping. Additionally, technological advancements have led to the development of "smart" e-cigarettes equipped with features like Bluetooth and GPS, catering to tech-savvy users seeking a personalized experience.

Environmental concerns have prompted some brands to incorporate sustainable materials into their products, addressing the growing demand for eco-friendly options. This shift is not only a response to consumer preferences but also part of broader efforts to align with international sustainability standards and reduce the environmental footprint of manufacturing processes. Companies use recycled content, responsibly sourced wood, and biodegradable alternatives in decking products. These eco-conscious innovations not only appeal to green-minded buyers but also contribute to brand differentiation in a competitive market. In addition, manufacturers are developing materials that offer extended durability and require less maintenance, reducing the need for frequent replacements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30 Billion |

| Forecast Value | $55.8 Billion |

| CAGR | 6.6% |

In 2024, the disposable vapes segment generated USD 9.65 billion and is expected to grow at a CAGR of 7% during 2025=2034. These devices are favored for their simplicity, portability, and variety of flavors. They are prefilled, require no charging, and are ready to use, making them an attractive option for new users or those seeking a hassle-free experience. The availability of disposable vapes in convenience stores, gas stations, and other retail locations has further increased their accessibility.

The offline retail channels segment accounted for 56.7% share in 2024 and is expected to continue growing at a rate of 5.6% until 2034. Consumers appreciate the in-store experience, which allows them to sample flavors and nicotine levels before purchasing. Physical stores also provide opportunities for brands to engage with customers through product demonstrations, promotional offers, and events, fostering trust and brand loyalty.

U.S. E-cigarette Market in 2024, accounting for a 36.2% share attributed to the high demand for smoking alternatives and regulatory actions that have validated products through the Premarket Tobacco Product Application (PMTA) process. The presence of major e-cigarette brands and the widespread availability of products in retail outlets have further strengthened the market position in the U.S.

Key players in the e-cigarette industry include Blu, Elf Bar, GeekVape, Innokin, Lost Mary, Lost Vape, MC, MOK, PAX, Pulze, SMOK, Suorin, Vaporesso, and Vuse. To strengthen their market presence, companies in the e-cigarette industry are adopting several strategies. These include expanding their product portfolios to cater to diverse consumer preferences, investing in research and development to innovate and improve product quality, and enhancing their online and offline marketing efforts to reach a broader audience. Additionally, companies are focusing on compliance with regulatory standards to ensure product safety and gain consumer trust. Collaborations and partnerships with retailers and influencers are also being pursued to increase brand visibility and consumer engagement. Furthermore, some companies are exploring sustainable practices in product design and packaging to appeal to environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Availability of a variety of flavors

- 3.3.2 Rising consumer awareness

- 3.3.3 Increase in social media influences

- 3.4 Industry pitfalls & challenges

- 3.4.1 Regulatory uncertainty & restrictions

- 3.4.2 Youth vaping epidemic & public backlash

- 3.5 Growth potential analysis

- 3.6 Consumer behavior analysis

- 3.6.1 Demographic trends

- 3.6.2 Factors affecting buying decisions

- 3.6.3 Consumer product adoption

- 3.6.4 Preferred distribution channel

- 3.6.5 Preferred price range

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Cigalikes

- 5.3 Vape Pens

- 5.4 Disposable vapes

- 5.5 Pod vapes

- 5.6 Box mods

Chapter 6 Market Estimates & Forecast, By Category, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Open

- 6.3 Close

Chapter 7 Market Estimates & Forecast, By Flavor, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Tobacco

- 7.3 Botanical

- 7.4 Fruit

- 7.5 Sweet

- 7.6 Beverage

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By User, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Men

- 9.3 Women

Chapter 10 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Manual

- 10.3 Automatic

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company website

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarket

- 11.3.2 Specialty vape shops

- 11.3.3 Convenience stores and gas stations

- 11.3.4 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 Blu

- 13.2 Elf Bar

- 13.3 GeekVape

- 13.4 Innokin

- 13.5 Lost Mary

- 13.6 Lost Vape

- 13.7 MC

- 13.8 MOK

- 13.9 PAX

- 13.10 Pulze

- 13.11 SMOK

- 13.12 Suorin

- 13.13 Vaporesso

- 13.14 Vuse