|

市場調查報告書

商品編碼

1750525

商業能源即服務 (EaaS) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Energy as a Service (EaaS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

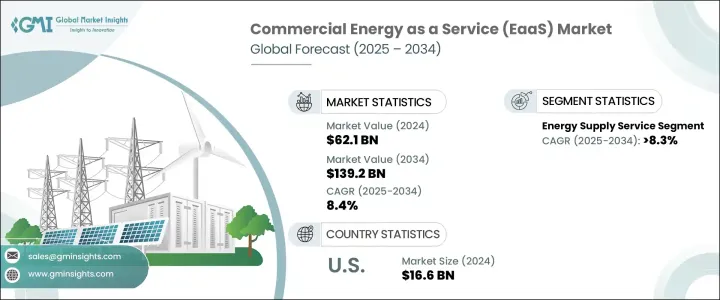

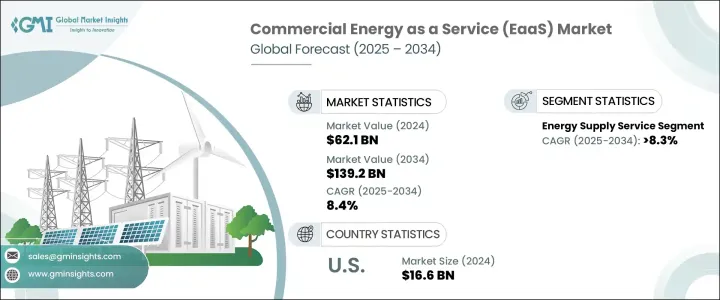

2024年,全球商業能源即服務市場規模達6,21億美元,預計2034年將以8.4%的複合年成長率成長,達到1,392億美元。這主要得益於能源成本的上漲、商業建築能源負荷的波動性以及對永續能源解決方案的需求。企業正在轉向以服務為基礎的能源採購,這使其能夠降低初始資本支出並增強能源管理,從而推動EaaS在各商業產業中得到更廣泛的應用。此外,涉及再生能源發電、能源效率升級和長期節能的大規模合作正在加速市場擴張。

隨著企業越來越重視永續發展,他們正在採用高效環保的能源解決方案,從而推動市場成長。這些服務模式提供了經濟高效的選擇,無需前期投資能源基礎設施,使企業能夠使用再生能源和先進技術,而無需承擔所有財務負擔。此外,電網規模電池儲能系統的日益普及預計將增加對能源即服務 (EaaS) 的需求,尤其是在商業領域。暖氣、冷氣和交通運輸等各領域的電氣化程度不斷提高,進一步促進了這些服務的普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 621億美元 |

| 預測值 | 1392億美元 |

| 複合年成長率 | 8.4% |

預計能源效率與最佳化服務領域將在2025年至2034年間以8.7%的複合年成長率強勁成長,這得益於商業設施在降低營運成本的同時實現雄心勃勃的永續發展目標的壓力日益增大。隨著企業致力於減少碳足跡並最佳化能源使用,這些服務正成為設施管理策略中不可或缺的一部分。能源監控軟體、智慧感測器、即時能源儀錶板和預測分析等創新技術能夠實現對暖通空調系統、照明和電力基礎設施的精確控制和性能最佳化。

到2034年,營運和維護 (O&M) 服務領域預計將創造632億美元的市場規模,這得益於現代能源基礎設施日益複雜化和數位化的推動。如今,商業建築已整合智慧電錶、現場再生能源、電池儲能和綜合能源管理系統,並配備持續的技術支援和預測性維護,以確保最佳性能。從被動服務模式轉向主動服務模式的轉變,以及物聯網診斷和人工智慧故障檢測技術,有助於減少停機時間並延長資產壽命。

2024年,北美商業能源即服務 (EaaS) 市場佔據31%的市場佔有率,這得益於積極推動碳中和以及日益成長的現代化老化商業基礎設施的需求。在有利的監管政策和清潔能源稅收優惠政策的支持下,美國擴大採用整合再生能源發電、儲能和需求面管理的 EaaS 解決方案。虛擬發電廠 (VPP) 的興起,使商業消費者能夠將過剩能源容量或靈活負載貨幣化,這正在獲得越來越大的關注,並進一步提升了 EaaS 的價值主張。

施耐德電氣、西門子和霍尼韋爾等公司專注於提供整合的、可客製化的能源解決方案。透過開發先進技術和節能產品,他們滿足了日益成長的永續商業能源服務需求。策略夥伴關係和協作在擴大其市場影響力方面也發揮著至關重要的作用。業內參與者正在加大對智慧電網、電池儲能和再生能源解決方案的投資,以提供全面的能源即服務 (EaaS) 服務。此外,他們正在改進客戶服務模式,並採用數據驅動的解決方案來更好地管理能源績效,這有助於增強其市場影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 衝擊力

- 有多種口味可供選擇

- 消費者意識不斷提高

- 社群媒體影響力的提升

- 產業陷阱與挑戰

- 監管不確定性和限制

- 青少年電子煙氾濫與大眾的強烈反對

- 成長潛力分析

- 消費者行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年(十億美元)

- 主要趨勢

- Cigalikes

- 電子煙

- 免洗電子煙

- Pod 電子煙

- 盒子改裝

第6章:市場估計與預測:按類別,2021 - 2034 年(十億美元)

- 主要趨勢

- 打開

- 關閉

第7章:市場估計與預測:依口味,2021 - 2034 年(十億美元)

- 主要趨勢

- 菸草

- 植物

- 水果

- 甜的

- 飲料

- 其他

第8章:市場估計與預測:按價格,2021-2034 年(十億美元)

- 主要趨勢

- 低的

- 中等的

- 高的

第9章:市場估計與預測:按使用者分類,2021 - 2034 年(十億美元)

- 主要趨勢

- 男士

- 女性

第10章:市場估計與預測:按營運模式,2021 年至 2034 年(十億美元)

- 主要趨勢

- 手動的

- 自動的

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年(十億美元)

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 電子煙專賣店

- 便利商店和加油站

- 其他

第 12 章:市場估計與預測:按地區,2021 年至 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第13章:公司簡介

- Blu

- Elf Bar

- GeekVape

- Innokin

- Lost Mary

- Lost Vape

- MC

- MOK

- PAX

- Pulze

- SMOK

- Suorin

- Vaporesso

- Vuse

The Global Commercial Energy as a Service Market was valued at USD 62.1 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 139.2 billion by 2034 driven by increasing energy costs, the variability of energy loads in commercial buildings, and the demand for sustainable energy solutions. Companies are shifting to service-based energy procurement, enabling them to lower their initial capital expenditure and enhance energy management, leading to broader adoption of EaaS across various commercial industries. Additionally, large-scale partnerships involving renewable energy generation, energy efficiency upgrades, and long-term savings are accelerating market expansion.

As businesses increasingly prioritize sustainability, they are adopting energy solutions that are both efficient and environmentally friendly, fueling market growth. These service models provide cost-effective options that eliminate the need for upfront investments in energy infrastructure, enabling businesses to access renewable energy and advanced technologies without bearing all the financial burden. Moreover, the rising implementation of grid-scale battery energy storage systems is expected to increase the demand for EaaS, particularly in commercial spaces. The growing electrification of various sectors such as heating, cooling, and transportation further complements the uptake of these services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $62.1 Billion |

| Forecast Value | $139.2 Billion |

| CAGR | 8.4% |

The energy efficiency and optimization services segment is anticipated to grow at a robust CAGR of 8.7% from 2025 to 2034, driven by the increasing pressure on commercial facilities to lower operational expenses while aligning with ambitious sustainability goals. As businesses aim to reduce their carbon footprint and optimize energy use, these services are becoming integral to facility management strategies. Innovations such as energy monitoring software, intelligent sensors, real-time energy dashboards, and predictive analytics enable precise control and performance optimization of HVAC systems, lighting, and electrical infrastructure.

The operations and maintenance (O&M) services segment is poised to generate USD 63.2 billion by 2034, underpinned by the rising complexity and digitalization of modern energy infrastructure. Commercial buildings now incorporate smart meters, on-site renewables, battery storage, and integrated energy management systems, all with ongoing technical support and predictive maintenance to ensure peak performance. The shift from reactive to proactive servicing models, powered by IoT-enabled diagnostics and AI-based fault detection, is helping reduce downtime and extend asset life.

North America Commercial Energy as a Service (EaaS) Market held a 31% share in 2024, supported by the aggressive push toward carbon neutrality and the rising need to modernize aging commercial infrastructure. The U.S. is seeing increased adoption of EaaS solutions that integrate renewable generation, energy storage, and demand-side management, supported by favorable regulatory policies and clean energy tax incentives. The emergence of virtual power plants (VPPs), which enable commercial consumers to monetize excess energy capacity or flexible load, is gaining traction and further enhancing the value proposition of EaaS.

Companies like Schneider Electric, Siemens, and Honeywell focus on offering integrated, customizable energy solutions. By developing advanced technologies and energy-efficient products, they meet the growing demand for sustainable commercial energy services. Strategic partnerships and collaborations also play a crucial role in expanding their market footprint. Players in the industry are increasingly investing in smart grids, battery storage, and renewable energy solutions to offer comprehensive EaaS offerings. Furthermore, they are enhancing their customer service models and adopting data-driven solutions for better energy performance management, which helps to strengthen their presence in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Availability of a variety of flavors

- 3.3.2 Rising consumer awareness

- 3.3.3 Increase in social media influences

- 3.4 Industry pitfalls & challenges

- 3.4.1 Regulatory uncertainty & restrictions

- 3.4.2 Youth vaping epidemic & public backlash

- 3.5 Growth potential analysis

- 3.6 Consumer behavior analysis

- 3.6.1 Demographic trends

- 3.6.2 Factors affecting buying decisions

- 3.6.3 Consumer product adoption

- 3.6.4 Preferred distribution channel

- 3.6.5 Preferred price range

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Cigalikes

- 5.3 Vape Pens

- 5.4 Disposable vapes

- 5.5 Pod vapes

- 5.6 Box mods

Chapter 6 Market Estimates & Forecast, By Category, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Open

- 6.3 Close

Chapter 7 Market Estimates & Forecast, By Flavor, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Tobacco

- 7.3 Botanical

- 7.4 Fruit

- 7.5 Sweet

- 7.6 Beverage

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By User, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Men

- 9.3 Women

Chapter 10 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Manual

- 10.3 Automatic

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company website

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarket

- 11.3.2 Specialty vape shops

- 11.3.3 Convenience stores and gas stations

- 11.3.4 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 Blu

- 13.2 Elf Bar

- 13.3 GeekVape

- 13.4 Innokin

- 13.5 Lost Mary

- 13.6 Lost Vape

- 13.7 MC

- 13.8 MOK

- 13.9 PAX

- 13.10 Pulze

- 13.11 SMOK

- 13.12 Suorin

- 13.13 Vaporesso

- 13.14 Vuse