|

市場調查報告書

商品編碼

1690154

EaaS(能源即服務)-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Energy As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

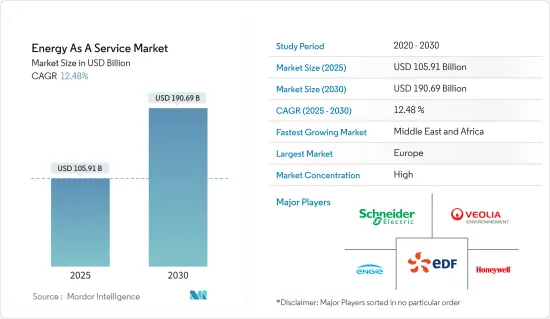

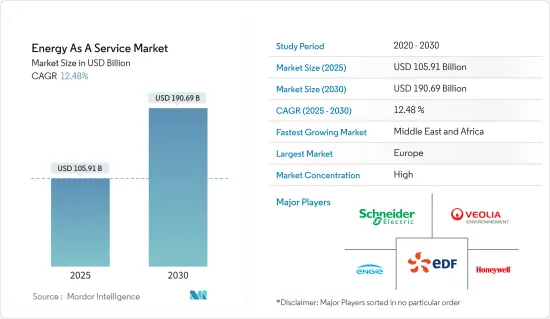

能源即服務 (EaaS) 市場規模預計在 2025 年達到 1,059.1 億美元,預計到 2030 年將達到 1906.9 億美元,預測期內(2025-2030 年)的複合年成長率為 12.48%。

主要亮點

- 從中期來看,商業和工業領域擴大採用分散式能源發電、嚴格的能源效率法規以及政府的支持措施預計將在預測期內推動市場發展。

- 然而,新興經濟體缺乏意識和技術成本高可能會阻礙預測期內的市場成長。

- 然而,能源即服務(EaaS)的概念仍處於起步階段,尤其是在新興國家。但在已開發國家,服務是按需提供的。印度、越南和印尼等能源消費量大的新興經濟體可能會在預測期內為能源即服務 (EaaS) 市場創造充足的機會。

- 北美佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。

EaaS(能源即服務)市場趨勢

商業領域佔據市場主導地位

- 由於人均收入的提高、人口的成長以及電器產品數量的增加,全球商業建築領域的用電量正在快速成長。住宅和商業領域的能源使用對於節能宣傳活動至關重要。

- 商業部分包括教育機構、公司辦公室、資料中心、醫院、機場、銀行等作為能源即服務 (EaaS) 行業的商業終端用戶。

- 各類商業建築均含有區域能源系統、商業及服務建築等能源應用,導致能源消費量較高。全球對電力的需求正在大幅成長。 2022 年發電量約為 26,662.7 TWh。全球商業領域對電力的需求也在增加。

- 能源效率歷來是商業領域面臨的主要挑戰。缺乏意識和高資本要求往往是商業領域廣泛採用能源效率舉措的巨大障礙。

- 能源即服務(EaaS)等各種能源模式消除了資金障礙,並提供了多種節省能源和成本的方法。該服務提供完整、高效的商業空間設置,從安裝電氣元件到建造微電網。

- EaaS 使業主和企業能夠將其能源系統升級為屋頂太陽能等清潔、永續的技術。消費者可以節省電力公司的電費。

- 2022年1月,法國電信業者Orange SA與電力公司Engie SA簽署了EaaS契約,在其位於西非象牙海岸共和國的資料中心安裝355kW的太陽能電池板。作為協議的一部分,Engie 將在屋頂和車棚上安裝太陽能電池板,以幫助 Orange 位於非洲的旗艦資料中心每年產生 527MWh 的電力。

- 此外,2021年12月,Schneider Electric宣布推出GREENext。該合資企業將透過混合太陽能和電池微電網技術為商業和工業客戶提供即服務。

- 隨著人口的成長,能源需求和能源節約對於長期永續性至關重要。該私人營業單位在政府的支持下,正專注於商業領域,以擴大其未來的服務。

北美經濟強勁成長

- 北美是各行業採用 EaaS 的主要地區之一。特別是在商業領域,正在採取各種計劃來提高能源效率並有助於降低營運成本。

- 美國實施了按績效付費的方式來實現能源效率。據估計,這種方法可以幫助減少近15%的能源消耗。這種方法為各種能源和公共產業公司擴大其服務線以提供有助於節約電力的服務創造了機會。

- 例如,在加州,能源效率政策規定,強制性計畫下實現的能源節省中至少 60% 必須由第三方服務供應商提供。因此,該地區的此類措施可能會在預測期內促進市場成長。

- 此外,美國和加拿大的能源服務供應商正在投資智慧電網和智慧電錶系統,因為他們使用先進的資料分析來幫助消費者最佳化能源消耗。據能源效率研究所稱,預計 2021 年美國將安裝 1.15 億個智慧電錶,比 2018 年成長 27.7%。因此,增加該地區對智慧電錶的投資可能會推動市場走向更分散數位化的電網,從而促進該地區 EaaS 市場的成長。

- 綜上所述,北美未來能源即服務 (EaaS) 市場可能會經歷顯著成長。

EaaS(能源即服務)產業概覽

能源即服務 (EaaS) 市場正在整合。市場上的主要企業(不分先後順序)包括施耐德電氣 SE、Engie SA、霍尼韋爾國際公司、威立雅環境 SA 和法國電力 (EDF) SA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2028 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 對 EaaS(能源即服務)的需求不斷增加

- 商業和工業領域擴大採用分散式能源發電

- 限制因素

- 新興經濟體缺乏意識且技術成本高

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 最終用戶

- 商業的

- 工業的

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Schneider Electric SE

- Engie SA

- Honeywell International Inc.

- Veolia Environnement SA

- Electricite de France(EDF)SA

- Johnson Controls International PLC

- Bernhard

- Enel SpA

- Spark Community Investment Co.

第7章 市場機會與未來趨勢

- 印度、越南、印尼等能源消費量大的新興國家對 EaaS 的需求不斷增加

簡介目錄

Product Code: 70377

The Energy As A Service Market size is estimated at USD 105.91 billion in 2025, and is expected to reach USD 190.69 billion by 2030, at a CAGR of 12.48% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of distributed energy generation in commercial and industrial sectors, stringent energy efficiency regulations, and supportive government initiatives are expected to drive the market during the forecast period.

- On the other hand, the lack of awareness in developing economies and high technological costs will likely hinder the market's growth during the forecast period.

- Nevertheless, the Energy as a service concept is still nascent, especially in developing countries. However, in developed countries, the service is on-demand. Developing countries like India, Vietnam, and Indonesia with high energy consumption will likely create ample opportunities for the Energy as a service market during the forecast period.

- North America dominates the market and will likely witness the highest CAGR during the forecast period, with most of the demand coming from countries like the United States and Canada.

Energy as a Service (EaaS) Market Trends

Commercial Segment to Dominate the Market

- Electricity use in the global commercial building sector is increasing rapidly due to increasing per capita income, the growing population, and the increasing number of electrical appliances. Energy use in the residential and commercial sectors is essential for energy conservation campaigns.

- The commercial segment includes educational institutions, corporate offices, data centers, hospitals, airports, and banks as commercial end users of the energy as a service (EaaS) industry.

- Different commercial buildings include energy applications, such as district energy systems and mercantile and service, with higher energy consumption. The electricity demand is increasing significantly across the world. In 2022, around 26,662.7 TWh was generated. The demand for electricity across the commercial sector is also increasing worldwide.

- Historically, energy-efficiency initiatives posed a significant challenge for the commercial sector. Lack of awareness and high capital requirements are often substantial barriers to the widespread adoption of energy-efficiency initiatives in the commercial sector.

- Various energy models like the energy as a service (EaaS) removed the capital barrier and provided multiple methods to save energy and costs. The service offers the complete set-up for efficient commercial space, from installing electrical components to building microgrids.

- EaaS allows owners and companies to upgrade their energy systems to clean and sustainable technologies such as rooftop solar PV. The consumers may save electricity bills from the utility company.

- In January 2022, French telecommunications company Orange SA signed an EaaS contract with utility Engie SA to install 355 kW solar panels at its data center in Cote d'Ivoire, West Africa. Engie will install the panels on rooftops and carports as part of the agreement to help Orange's main African data center generate 527 MWh of electricity annually.

- Moreover, in December 2021, Schneider Electric announced the launch of GREENext. This joint venture will provide energy-as-a-service to commercial and industrial customers through solar and battery hybrid microgrid technology.

- With a growing population, energy requirements and energy conservation are essential to maintain sustainability for a longer duration. Private entities, with government support, are concentrating on the commercial segment to expand their services in the future.

North America to Witness Significant Growth

- North America is one of the prominent regions implementing EaaS in various sectors. Especially in the commercial industry, the region adopted various projects to increase energy efficiency and help reduce operating expenses.

- The United States inducted a pay-for-performance approach to achieve energy efficiency. The approach is estimated to help reduce energy consumption by nearly 15%. This approach created an opportunity for various energy or utility companies to extend a service line that can provide services to save electricity.

- For instance, in California, energy efficiency policies mandated that at least 60% of the savings achieved in obligation schemes need to be delivered by third-party service providers. Thus, such measurement in the region will likely help the market grow during the forecast period.

- Furthermore, energy service providers in the United States and Canada are investing in smart grid and smart metering systems, as they use advanced data analytics to enable consumers to optimize energy consumption. According to the Institute of Energy Efficiency, in 2021, an estimated 115 million units of smart meters were installed in the United States, an increase of 27.7% compared to 2018. Thus, increasing investments in smart meters in the region may drive the market toward a more decentralized and digitalized grid network, which may aid the growth of the EaaS market in the region.

- Owing to the points mentioned above, North America is likely to witness significant growth in the energy as a service market in the future.

Energy as a Service (EaaS) Industry Overview

The energy as a service market is consolidated. Some of the key players in the market (in no particular order) include Schneider Electric SE, Engie SA, Honeywell International Inc., Veolia Environnement SA, and Electricite de France (EDF) SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Energy As A Service

- 4.5.1.2 Increasing Adoption of Distributed Energy Generation in Commercial and Industrial Sectors

- 4.5.2 Restraints

- 4.5.2.1 Lack of Awareness in Developing Economies and High Technological Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Commercial

- 5.1.2 Industrial

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schneider Electric SE

- 6.3.2 Engie SA

- 6.3.3 Honeywell International Inc.

- 6.3.4 Veolia Environnement SA

- 6.3.5 Electricite de France (EDF) SA

- 6.3.6 Johnson Controls International PLC

- 6.3.7 Bernhard

- 6.3.8 Enel SpA

- 6.3.9 Spark Community Investment Co.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for EaaS in Developing countries like India, Vietnam, and Indonesia with High Energy Consumption

02-2729-4219

+886-2-2729-4219