|

市場調查報告書

商品編碼

1750519

非包裝泡棉市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nonpackaging Foam Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

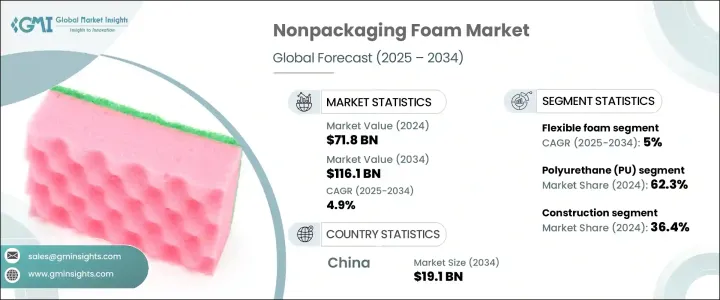

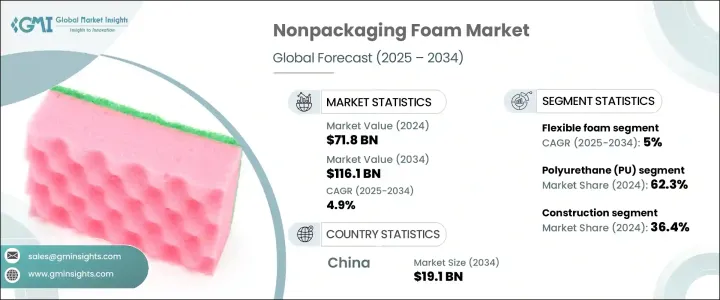

2024年,全球非包裝泡棉市場規模達718億美元,預計到2034年將以4.9%的複合年成長率成長,達到1161億美元,這主要得益於建築、汽車、家具、電子和醫療保健等行業對輕質耐用絕緣材料日益成長的需求。隨著工業的不斷發展,非包裝泡棉因其多功能性、高性能以及滿足各種應用特定需求的能力而變得至關重要。製造商越來越注重開發永續的泡沫解決方案,例如生物基、可回收和可生物分解的泡沫,以應對環境問題並滿足北美、歐洲以及亞太新興市場的嚴格法規要求。

永續發展措施在塑造非包裝泡沫市場方面發揮重要作用。企業正在投資閉迴路回收系統,以減少對石化原料的依賴,並支持循環經濟措施。這一趨勢在北美和歐洲尤為突出,這些國家的政府正在加強環境政策,鼓勵開發環保產品。在亞太地區,受基礎設施和製造業擴張的推動,非包裝泡沫的需求正在快速成長,尤其是在中國等國家,建築業和汽車業是主要的成長動力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 718億美元 |

| 預測值 | 1161億美元 |

| 複合年成長率 | 4.9% |

市場依產品類型細分,主要分為軟質泡棉和硬質泡棉兩大類。軟質泡棉2024年的市場規模為477億美元,預計到2034年將達到778億美元,複合年成長率為5%,這得益於其廣泛的應用領域,包括家具、床上用品、汽車內裝和隔音材料。人體工學床墊和輕量化汽車零件等注重舒適性的產品需求日益成長,推動了軟性泡棉的擴張。此外,消費者日益轉向永續、低VOC配方以及電子商務的興起,也進一步刺激了對軟質泡棉的需求。

2024年,聚氨酯 (PU) 泡棉在非包裝泡棉市場中佔據了62.3%的佔有率,這得益於其在隔熱、汽車內飾和家具緩衝等應用領域的卓越多功能性。該材料輕質且耐熱性優異,使其成為注重能源效率和舒適度的行業的理想選擇。聚氨酯泡棉易於客製化,可滿足不同行業的特定需求,這進一步推動了其需求。聚氨酯泡沫能夠模製成各種密度和形狀,既可用於剛性用途,也可用於軟性用途,從而擴大了其在各個市場的用途。

2024年,中國非包裝泡棉市場規模達117億美元,預計年複合成長率將達5.1%,到2034年將達到191億美元,主要得益於建築和汽車產業需求的激增。政府加大對基礎建設的投資,刺激了對隔熱、隔音和結構泡沫等材料的需求。此外,電動車(EV)的興起也為泡棉的應用帶來了新的機遇,尤其是在汽車產業,該產業對輕質節能材料的需求正在不斷成長。隨著這些產業的持續擴張,中國非包裝泡棉市場,尤其是聚氨酯泡棉市場,將持續成長。

全球非包裝泡棉市場的領導者包括亨斯邁集團、巴斯夫、井上集團和科思創。這些公司正致力於擴大產能、豐富產品線並推動永續發展計畫。透過利用泡沫生產領域的技術進步並專注於環保解決方案,這些企業旨在鞏固其在競爭激烈的市場中的地位。此外,他們還在投資策略合作夥伴關係、收購和區域擴張,以滿足全球對非包裝泡棉日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計

- 主要進口國

- 國家 1

- 國家 2

- 國家 3

- 主要出口國

- 國家 1

- 國家 2

- 國家 3

- 主要進口國

- 利潤率分析

- 監管格局

- 衝擊力

- 成長動力

- 節能建築材料需求不斷成長

- 汽車和家具行業的輕量化和舒適性要求

- 新興市場工業化與基礎設施快速發展

- 產業陷阱與挑戰

- 泡沫廢料和VOC排放的環境問題和法規

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 價值鏈分析

- 原物料供應商

- 泡沫製造商

- 製造商和轉換商

- 分銷商和零售商

- 最終用途產業

- 價值鏈最佳化策略

- 成本結構分析

- 定價分析

- 環境法規和合規要求

- 產品標準和認證

- 進出口法規

- 監管對市場成長的影響

- 未來監理趨勢

- 永續性和環境影響

- 按材料類型評估價格點

- 非包裝泡棉的環境足跡

- 永續泡沫解決方案

- 生物基泡沫

- 可回收泡沫

- 可生物分解泡沫

- 回收和廢棄物管理

- 循環經濟舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 軟性泡沫

- 硬質泡沫

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 聚氨酯(PU)

- 聚苯乙烯(PS)

- 聚乙烯(PE)

- 聚丙烯(PP)

- 橡膠泡沫

- 其他

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 建造

- 汽車

- 家具和床上用品

- 電子產品

- 衛生保健

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- BASF

- Armacell International

- Covestro

- Dow

- FXI Holdings

- Huntsman Corporation

- INOAC Corporation

- JSP Corporation

- Recticel

- Saint-Gobain

- Sheela Foam

- UFP Technologies

- Wanhua Chemical Group

- Woodbridge Group

- Zotefoams

The Global Nonpackaging Foam Market was valued at USD 71.8 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 116.1 billion by 2034, driven by the increasing demand for lightweight, durable insulating materials in sectors such as construction, automotive, furniture, electronics, and healthcare. As industries continue to expand, nonpackaging foam has become essential due to its versatility, performance, and ability to meet the specific needs of various applications. Manufacturers are increasingly focusing on developing sustainable foam solutions, such as bio-based, recyclable, and biodegradable options, to address environmental concerns and meet stringent regulations in North America, Europe, and emerging markets in Asia-Pacific.

Sustainability efforts are playing a significant role in shaping the nonpackaging foam market. Companies are investing in closed-loop recycling systems, which reduce the reliance on petrochemical feedstocks and support circular economy initiatives. This trend is particularly prominent in North America and Europe, where governments are tightening environmental policies and encouraging the development of eco-friendly products. In Asia-Pacific, the demand for nonpackaging foam is growing rapidly, driven by the expansion of infrastructure and manufacturing sectors, especially in countries such as China, where construction and automotive industries are key growth drivers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $71.8 Billion |

| Forecast Value | $116.1 Billion |

| CAGR | 4.9% |

The market is segmented by product type, with flexible and rigid foam being the two main categories. Flexible foam generated USD 47.7 billion in 2024 and is projected to reach USD 77.8 billion by 2034, growing at a 5% CAGR due to its broad range of applications, including furniture, bedding, automotive interiors, and acoustic insulation. The growing demand for comfort-focused products, such as ergonomic mattresses and lightweight vehicle components, is driving the expansion of flexible foam. Additionally, the increasing shift toward sustainable, low-VOC formulations and the rise of e-commerce have further boosted the demand for flexible foam.

Polyurethane (PU) foam segment in the nonpackaging foam market held 62.3% share in 2024, attributed to its exceptional versatility in applications such as thermal insulation, automotive interiors, and cushioning for furniture. The material's lightweight nature and excellent thermal resistance make it an ideal choice for industries that prioritize energy efficiency and comfort. PU foam is easily customizable to meet the specific needs of different sectors, which further drives its demand. Its capacity to be molded into a wide range of densities and forms enables it to serve both rigid and flexible purposes, expanding its utility across various markets.

China Nonpackaging Foam Market generated USD 11.7 billion in 2024 and is expected to grow at a CAGR of 5.1%, reaching USD 19.1 billion by 2034, driven by the surging demand in the construction and automotive sectors. Increased government investment in infrastructure development is fueling the need for materials like insulation, soundproofing, and structural foam. Additionally, the rise of electric vehicles (EVs) has introduced new opportunities for foam usage, particularly in the automotive industry, where demand for lightweight, energy-efficient materials is on the rise. As these sectors continue to expand, the market for nonpackaging foam, especially PU foam, is poised for sustained growth in China.

Leading players in the Global Nonpackaging Foam Market include Huntsman Corporation, BASF, INOAC Corporation, and Covestro. These companies are focusing on expanding their production capacities, enhancing product offerings, and advancing sustainability initiatives. By leveraging technological advancements in foam production and focusing on eco-friendly solutions, these players aim to strengthen their position in the competitive market. Moreover, they are investing in strategic partnerships, acquisitions, and regional expansions to meet the growing demand for nonpackaging foam globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade Statistics

- 3.3.1 Major importing countries

- 3.3.1.1 Country 1

- 3.3.1.2 Country 2

- 3.3.1.3 Country 3

- 3.3.2 Major exporting countries

- 3.3.2.1 Country 1

- 3.3.2.2 Country 2

- 3.3.2.3 Country 3

- 3.3.1 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for energy-efficient building materials

- 3.6.1.2 Lightweight and comfort requirements in automotive and furniture sectors

- 3.6.1.3 Rapid industrialization and infrastructure development in emerging markets

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental concerns and regulations on foam waste and VOC emissions

- 3.6.2.2 Volatility in raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

- 3.10.1 Raw material suppliers

- 3.10.2 Foam manufacturers

- 3.10.3 Fabricators and converters

- 3.10.4 Distributors and retailers

- 3.10.5 End-use industries

- 3.10.6 Value chain optimization strategies

- 3.10.7 Cost structure analysis

- 3.11 Pricing Analysis

- 3.11.1 North America

- 3.11.2 Europe

- 3.11.3 Asia Pacific

- 3.11.4 Latin America

- 3.11.5 Middle East and Africa

- 3.12 Environmental regulations and compliance requirements

- 3.12.1 Product standards and certifications

- 3.12.2 Import/export regulations

- 3.12.3 Regulatory impact on market growth

- 3.12.4 Future regulatory trends

- 3.13 Sustainability and environmental impact

- 3.13.1 Price point assessment by material type

- 3.13.2 Environmental footprint of nonpackaging foam

- 3.13.3 Sustainable foam solutions

- 3.13.4 Bio-based foams

- 3.13.5 Recyclable foams

- 3.13.6 Biodegradable foams

- 3.13.7 Recycling and waste management

- 3.13.8 Circular economy initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Flexible foam

- 5.3 Rigid foam

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Polyurethane (PU)

- 6.3 Polystyrene (PS)

- 6.4 Polyethylene (PE)

- 6.5 Polypropylene (PP)

- 6.6 Rubber foam

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Automotive

- 7.4 Furniture & bedding

- 7.5 Electronics

- 7.6 Healthcare

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 BASF

- 9.2 Armacell International

- 9.3 Covestro

- 9.4 Dow

- 9.5 FXI Holdings

- 9.6 Huntsman Corporation

- 9.7 INOAC Corporation

- 9.8 JSP Corporation

- 9.9 Recticel

- 9.10 Saint-Gobain

- 9.11 Sheela Foam

- 9.12 UFP Technologies

- 9.13 Wanhua Chemical Group

- 9.14 Woodbridge Group

- 9.15 Zotefoams