|

市場調查報告書

商品編碼

1750518

即飲茶市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測RTD Tea Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

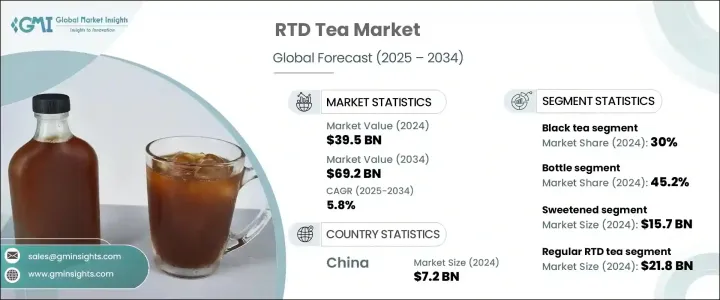

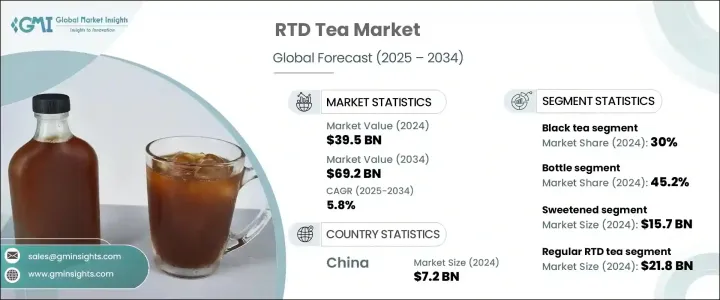

2024年,全球即飲茶市場規模達395億美元,預計到2034年將以5.8%的複合年成長率成長,達到692億美元,這得益於消費者健康意識的不斷提升以及對便捷飲品的需求不斷成長。隨著越來越多的人尋求更健康的含糖飲料替代品,即飲茶因其富含綠茶、抹茶和花草茶等天然成分而廣受歡迎。消費者越來越青睞清潔標章產品,並尋求能夠提供額外健康益處的飲料,例如抗氧化劑、益生菌和適應原。永續性也發揮著重要作用,可回收包裝材料已成為影響購買決策的關鍵因素。

與軟性飲料和含糖果汁相比,即飲茶是一種更健康、低卡路里的選擇,深受上班族、運動員和注重健康的人士的喜愛。它在超市、便利商店、自動販賣機和線上平台隨處可見,適合所有年齡層的人。根據種類不同,即飲茶具有多種健康益處,從提神醒腦的綠茶和紅茶,到幫助消化的草本茶或康普茶。它便於攜帶、口味多樣,且具有許多健康益處,是許多尋求美味便捷飲品的消費者的理想之選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 395億美元 |

| 預測值 | 692億美元 |

| 複合年成長率 | 5.8% |

瓶裝包裝佔據即飲茶市場的最大佔有率,2024 年將佔據 45.2% 的市場佔有率,預計到 2034 年將以 6% 的複合年成長率穩步成長。瓶裝即飲茶之所以受到消費者的青睞,很大程度上得益於其方便用戶使用的設計,尤其是可重複密封的瓶蓋,使其成為活躍、忙碌生活方式的理想選擇。這些瓶裝茶能夠有效抵抗外在因素,長期維持產品的口感、新鮮度和營養完整性。瓶裝茶結構堅固,易於搬運和儲存,特別適用於零售和自動販賣機環境。

2024年,加糖即飲茶市場規模達157億美元。這個類別在廣泛的消費者群體中引起了強烈共鳴,提供各種口味,既能滿足微甜口味,也能滿足重甜口味的偏好。其受歡迎程度源自於其清爽的口感和熟悉感,使其成為追求即時口味滿足的人士的首選飲品。儘管加糖即飲茶佔據主導地位,但隨著越來越多注重健康的消費者要求降低糖含量並提供更健康的選擇,該細分市場正在逐漸演變。這種轉變促使各大品牌不斷創新,推出天然甜味劑和低卡路里配方,以平衡享受與健康。

2024年,亞太地區即飲茶市場規模達72億美元,預計到2034年複合年成長率將達5.6%。中國在該市場的領先地位深深植根於其對茶的文化熱愛、強大的國內生產能力以及消費者對功能性茶益處日益成長的認知。隨著中國城鎮人口的成長和生活節奏的加快,即飲茶的便利性和便攜性正成為隨時隨地補充水分的必需品。此外,傳統風味與現代健康益處的融合,使即飲茶成為年輕健康人群的首選飲品。

聯合利華、雀巢、三得利控股、百事可樂和可口可樂等公司專注於拓展產品線,尤其是在功能性茶領域。這些公司正在投資永續包裝解決方案,提供風味創新,並與當地經銷商合作,以加強其在關鍵市場的影響力。透過提高零售和線上通路的可及性,並專注於以健康為重點的創新,這些公司旨在在不斷成長的即飲茶市場中佔據更大的佔有率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要進口國

註:以上貿易統計僅針對重點國家。

- 產業價值鏈分析

- 產品概述

- 茶葉加工方法

- 即飲茶生產流程

- 保存技術

- 風味增強技術

- 市場動態

- 市場促進因素

- 對健康和功能性飲料的需求不斷成長

- 都市化進程加快,生活方式更加忙碌

- 口味和茶混合的創新

- 市場限制

- 來自其他 RTD 飲料的激烈競爭

- 原料(茶葉)價格波動

- 市場機會

- 市場挑戰

- 市場促進因素

- 產業衝擊力

- 成長潛力分析

- 產業陷阱與挑戰

- 監管框架和標準

- 食品安全法規

- 標籤要求

- 有機和天然產品認證

- 健康聲明法規

- 製造流程分析

- 茶葉萃取方法

- 混合和配方

- 巴氏殺菌與保存

- 封裝技術

- 原料分析與採購策略

- 定價分析

- 永續性和環境影響評估

- PESTLE 分析

- 波特五力分析

第4章:競爭格局

- 介紹

- 戰略框架

- 併購

- 合資與合作

- 新產品開發

- 擴張策略

- 競爭基準測試

- 供應商格局

- 競爭定位矩陣

- 戰略儀表板

- 品牌定位與消費者認知分析

- 新參與者的市場進入策略

第5章:市場規模及預測:依產品類型 2021 - 2034

- 主要趨勢

- 紅茶

- 甜紅茶

- 無糖紅茶

- 調味紅茶

- 綠茶

- 加糖綠茶

- 無糖綠茶

- 調味綠茶

- 涼茶

- 洋甘菊

- 薄荷

- 路易波士茶

- 其他草藥茶

- 水果茶

- 柑橘

- 莓果

- 熱帶

- 混合水果

- 烏龍茶

- 白茶

- 抹茶

- 康普茶

- 其他

第6章:市場規模及預測:依包裝,2021 - 2034

- 主要趨勢

- 瓶子

- PET瓶

- 玻璃瓶

- 其他瓶型

- 罐頭

- 鋁罐

- 鋼罐

- 紙箱

- 無菌紙盒

- 山牆頂紙箱

- 袋裝

- 其他

第7章:市場規模及預測:依甜度分類,2021 - 2034

- 主要趨勢

- 加糖

- 普通糖

- 高果糖玉米糖漿

- 蜂蜜和天然甜味劑

- 減少糖

- 無醣

- 人工甜味劑

- 阿斯巴甜

- 三氯蔗糖

- 甜菊糖

- 其他

第8章:市場規模及預測:依功能優勢,2021 - 2034 年

- 主要趨勢

- 一般即飲茶

- 強化即飲茶

- 富含維生素

- 富含礦物質

- 抗氧化增強

- 功能性即飲茶

- 提升能量

- 免疫支持

- 消化健康

- 放鬆和緩解壓力

- 有機即飲茶

- 清潔標籤即飲茶

第9章:市場規模及預測:按配銷通路,2021 - 2034

- 主要趨勢

- 超市和大賣場

- 便利商店

- 專賣店

- 網路零售

- 餐飲服務

- 咖啡館和餐廳

- 速食連鎖店

- 機構餐飲

- 自動販賣機

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲的Rets

第 11 章:公司簡介

- The Coca-Cola Company

- PepsiCo, Inc

- Unilever PLC

- Nestle SA

- Suntory Holdings Limited

- ITO EN, Ltd.

- Danone SA

- Arizona Beverages USA

- Keurig Dr Pepper Inc.

- Tata Consumer Products Limited

- Starbucks Corporation

- Honest Tea (Coca-Cola)

- Lipton (Unilever/PepsiCo)

- Tejava (Crystal Geyser Water Company)

- Harney & Sons

- The Republic of Tea

- Numi Organic Tea

- Pokka Corporation

- Oi Ocha (ITO EN)

- Vita Coco

- GT's Living Foods (Kombucha)

- Health-Ade Kombucha

- Steaz

- Pure Leaf (Unilever/PepsiCo)

- Gold Peak (Coca-Cola)

- Snapple (Keurig Dr Pepper)

- Tazo (Unilever)

- Fuze Tea (Coca-Cola)

The Global RTD Tea Market was valued at USD 39.5 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 69.2 billion by 2034, driven by increasing health awareness among consumers and the rising demand for convenient beverage options. As more people look for healthier alternatives to sugary drinks, RTD tea has gained popularity for its natural ingredients like green tea, matcha, and herbal teas. There is a growing preference for clean-label products, and consumers are seeking beverages that offer added health benefits such as antioxidants, probiotics, and adaptogens. Sustainability also plays a significant role, with recyclable packaging materials becoming a key factor in purchasing decisions.

RTD tea serves as a healthier, low-calorie option compared to soft drinks and sugary juices, making it a favorite among office workers, athletes, and health-conscious individuals. It is widely accessible through supermarkets, convenience stores, vending machines, and online platforms, catering to people of all ages. Depending on the variant, RTD tea offers various health benefits, from boosting mental alertness with green and black teas to aiding digestion with herbal or kombucha options. Its portability, variety of flavors, and health advantages make it an ideal choice for many consumers looking for a tasty, convenient drink.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $39.5 Billion |

| Forecast Value | $69.2 Billion |

| CAGR | 5.8% |

The bottle-based packaging segment commands the largest portion of the RTD tea market, holding a substantial 45.2% share in 2024 and projected to grow steadily at a 6% CAGR through 2034. Bottled RTD teas are preferred by consumers largely due to their user-friendly design, particularly the resealable caps that make them ideal for active, on-the-go lifestyles. These bottles offer superior protection against external elements, preserving the product's taste, freshness, and nutritional integrity over time. Their sturdy build, easy handling, and storage, especially in retail and vending environments.

The sweetened RTD tea segment generated USD 15.7 billion in 2024. This category resonates strongly with a wide consumer base, offering a variety of flavors that cater to both mildly sweet and heavily sweetened preferences. Its popularity stems from its refreshing taste and familiarity, making it a go-to beverage for those seeking instant gratification in flavor. Despite its dominance, the segment is gradually evolving as more health-conscious consumers demand reduced sugar content and better-for-you options. This shift has prompted brands to innovate with naturally sweetened and low-calorie formulations to balance indulgence with wellness.

Asia-Pacific RTD Tea Market generated USD 7.2 billion in 2024 and is anticipated to have a CAGR of 5.6% through 2034. China's leadership in the market is deeply rooted in its cultural affinity for tea, strong domestic production capabilities, and increasing consumer awareness around the benefits of functional teas. As the nation's urban population grows and lifestyles become more fast-paced, the convenience and portability of RTD teas are becoming essential for on-the-go hydration. Additionally, the fusion of traditional flavors with modern health benefits has positioned RTD teas as a preferred beverage among the younger, health-aware population.

Companies like Unilever PLC, Nestle S.A., Suntory Holdings, PepsiCo Inc., and The Coca-Cola Company focus on expanding their product ranges, particularly in the functional tea segment. These companies are investing in sustainable packaging solutions, offering flavors, and partnering with local distributors to strengthen their presence in key markets. By improving accessibility through retail and online channels and focusing on health-focused innovations, these players aim to capture more of the growing RTD tea market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.4 Industry value chain analysis

- 3.5 Product overview

- 3.5.1 Tea processing methods

- 3.5.2 RTD tea production process

- 3.5.3 Preservation technologies

- 3.5.4 Flavor enhancement techniques

- 3.6 Market dynamics

- 3.6.1 Market drivers

- 3.6.1.1 Rising demand for healthy and functional beverages

- 3.6.1.2 Increasing urbanization and busy lifestyles

- 3.6.1.3 Innovation in flavors and tea blends

- 3.6.2 Market Restraints

- 3.6.2.1 High competition from other RTD beverages

- 3.6.2.2 Fluctuating raw material (tea leaf) prices

- 3.6.3 Market opportunities

- 3.6.4 Market challenges

- 3.6.1 Market drivers

- 3.7 Industry impact forces

- 3.7.1 Growth potential analysis

- 3.7.2 Industry pitfalls & challenges

- 3.8 Regulatory framework & standards

- 3.8.1 Food safety regulations

- 3.8.2 Labeling requirements

- 3.8.3 Organic & natural product certifications

- 3.8.4 Health claim regulations

- 3.9 Manufacturing process analysis

- 3.9.1 Tea extraction methods

- 3.9.2 Blending & formulation

- 3.9.3 Pasteurization & preservation

- 3.9.4 Packaging technologies

- 3.10 Raw material analysis & procurement strategies

- 3.11 Pricing analysis

- 3.12 Sustainability & environmental impact assessment

- 3.13 PESTLE analysis

- 3.14 Porter's Five Forces Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Brand positioning & consumer perception analysis

- 4.8 Market entry strategies for new players

Chapter 5 Market Size and Forecast, By Product Type 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Black tea

- 5.2.1 Sweetened black tea

- 5.2.2 Unsweetened black tea

- 5.2.3 Flavored black tea

- 5.3 Green tea

- 5.3.1 Sweetened green tea

- 5.3.2 Unsweetened green tea

- 5.3.3 Flavored green tea

- 5.4 Herbal tea

- 5.4.1 Chamomile

- 5.4.2 Mint

- 5.4.3 Rooibos

- 5.4.4 Other herbal teas

- 5.5 Fruit tea

- 5.5.1 Citrus

- 5.5.2 Berry

- 5.5.3 Tropical

- 5.5.4 Mixed fruit

- 5.6 Oolong Tea

- 5.7 White Tea

- 5.8 Matcha Tea

- 5.9 Kombucha

- 5.10 Other

Chapter 6 Market Size and Forecast, By Packaging, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Bottles

- 6.2.1 PET bottles

- 6.2.2 Glass bottles

- 6.2.3 Other bottle types

- 6.3 Cans

- 6.3.1 Aluminum cans

- 6.3.2 Steel cans

- 6.4 Cartons

- 6.4.1 Aseptic cartons

- 6.4.2 Gable top cartons

- 6.5 Pouches

- 6.6 Other

Chapter 7 Market Size and Forecast, By Sweetness Level, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trend

- 7.2 Sweetened

- 7.2.1 Regular sugar

- 7.2.2 High fructose corn syrup

- 7.2.3 Honey & natural sweeteners

- 7.3 Reduced sugar

- 7.4 Unsweetened

- 7.5 Artificially sweetened

- 7.5.1 Aspartame

- 7.5.2 Sucralose

- 7.5.3 Stevia

- 7.5.4 Other

Chapter 8 Market Size and Forecast, By Functional Benefits, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trend

- 8.2 Regular RTD tea

- 8.3 Fortified RTD tea

- 8.3.1 Vitamin-enriched

- 8.3.2 Mineral-enriched

- 8.3.3 Antioxidant-enhanced

- 8.4 Functional RTD tea

- 8.4.1 Energy-boosting

- 8.4.2 Immunity-supporting

- 8.4.3 Digestive health

- 8.4.4 Relaxation & stress relief

- 8.5 Organic RTD tea

- 8.6 Clean Label RTD tea

Chapter 9 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trend

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Specialty stores

- 9.5 Online retail

- 9.6 Foodservice

- 9.6.1 Cafes & restaurants

- 9.6.2 Fast food chains

- 9.6.3 Institutional catering

- 9.7 Vending machines

- 9.8 Other

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rets of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 The Coca-Cola Company

- 11.2 PepsiCo, Inc

- 11.3 Unilever PLC

- 11.4 Nestle S.A.

- 11.5 Suntory Holdings Limited

- 11.6 ITO EN, Ltd.

- 11.7 Danone S.A.

- 11.8 Arizona Beverages USA

- 11.9 Keurig Dr Pepper Inc.

- 11.10 Tata Consumer Products Limited

- 11.11 Starbucks Corporation

- 11.12 Honest Tea (Coca-Cola)

- 11.13 Lipton (Unilever/PepsiCo)

- 11.14 Tejava (Crystal Geyser Water Company)

- 11.15 Harney & Sons

- 11.16 The Republic of Tea

- 11.17 Numi Organic Tea

- 11.18 Pokka Corporation

- 11.19 Oi Ocha (ITO EN)

- 11.20 Vita Coco

- 11.21 GT's Living Foods (Kombucha)

- 11.22 Health-Ade Kombucha

- 11.23 Steaz

- 11.24 Pure Leaf (Unilever/PepsiCo)

- 11.25 Gold Peak (Coca-Cola)

- 11.26 Snapple (Keurig Dr Pepper)

- 11.27 Tazo (Unilever)

- 11.28 Fuze Tea (Coca-Cola)