|

市場調查報告書

商品編碼

1750474

電動車聲音產生器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Vehicle Sound Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

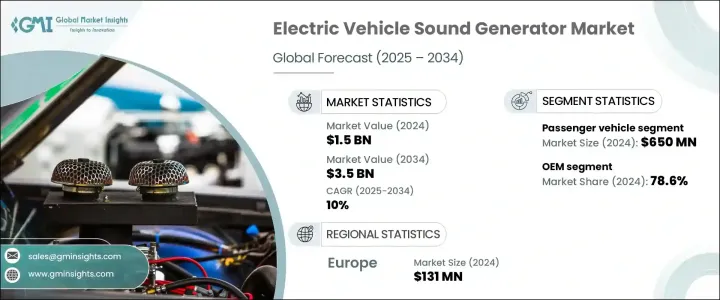

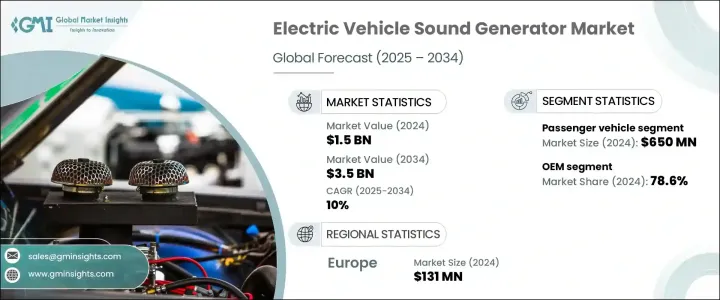

2024 年全球電動車聲音產生器市場規模達 15 億美元,預計到 2034 年將以 10% 的複合年成長率成長,達到 35 億美元。隨著電動車 (EV) 的普及,對聲音產生器的需求也將持續成長。電動車低速行駛時幾乎無聲,這在城市和行人密集的地區構成安全隱患。為此,世界各地的監管機構要求電動車必須發出合成聲音,以提醒行人,尤其是視障人士。日益成長的監管壓力促使汽車製造商將電動車聲音產生器 (EVSG) 作為標準配備。電動車產量的不斷成長和安全隱患的日益加劇,共同推動了這一需求,尤其是在人口稠密的城市。

隨著電動車在多個領域(從個人乘用車到商用車隊和公共交通)的不斷擴展,電動車聲音產生器 (EVSG) 正在從可選功能演變為強制性安全組件。隨著城市交通堵塞加劇和步行區不斷擴大,電動車低速行駛時近乎無聲的運作對公共安全構成了切實的威脅。聲音產生器透過發出聲音提示,提醒行人、騎乘者和其他道路使用者註意駛近的車輛,從而彌合這一差距。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 35億美元 |

| 複合年成長率 | 10% |

乘用車領域在電動車聲音產生器市場中佔了40%的佔有率,2024年的估值達到6.5億美元,因為這些車輛最常用於行人頻繁互動的城市地區。隨著駕駛員行駛距離的增加,確保合規性和增強安全性的需求促使汽車製造商在這些車輛中整合聲音產生器。製造商也開始轉向客製化設計的電動車聲音,不僅是為了滿足法律要求,也是為了打造獨特的品牌形象。安全與品牌行銷的融合正在加速先進的電動車聲音產生器系統在乘用電動車中的應用。

2024年,原始設備製造商 (OEM) 佔據了最大的市場佔有率,達到 78.6%。在車輛生產過程中安裝電動車音響系統,可與車載電子設備和系統(包括動力總成和資訊娛樂單元)無縫整合。這種方法從一開始就確保了合規性,有助於維護保固並簡化認證流程。 OEM 可以透過大規模採購和組裝來降低成本,在保持生產效率的同時,為消費者提供符合法規要求的內建音響解決方案。監管機構青睞OEM安裝,因為它可以在車輛上路前保證合規性。

2024年,德國電動車聲音產生器市場產值達1.31億美元。該國的主導地位得益於其強大的汽車製造基礎和積極的電氣化。德國製造商是最早採用電動車聲音產生器系統的國家之一,他們利用監管要求和創新技術在競爭中保持領先。他們的方法將嚴格遵守歐盟聲音法規與注重聲學品牌建立相結合,使汽車製造商能夠創建與品牌形象相符的標誌性聲音配置文件。電動車的高產量,加上大規模生產設施和先進的研發能力,進一步刺激了對無縫整合電動車聲音產生器解決方案的需求。

電動車聲音系統 (EVSG) 市場的領導者包括現代、ECCO、意法半導體、大陸集團、哈曼國際、安波福、電裝、Forvia Hella、Brigade Electronics 和 Ansys。為了保持競爭力,這些公司正在採取關鍵策略,例如改進數位聲音架構、擴大與原始設備製造商的合作夥伴關係以及投資基於人工智慧的聲音生成技術。許多公司專注於為不同類型的電動車提供可擴展的解決方案,同時增強車載整合度和使用者體驗。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 軟體開發人員和聲學工程師

- 系統整合商

- 最終用途

- 利潤率分析

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 價格趨勢

- 地區

- 產品

- 成本細分分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 行人安全監理規定

- 電動車的普及率不斷提高

- 聲音設計和技術的進步

- OEM整合與品牌差異化

- 產業陷阱與挑戰

- 先進系統成本高昂

- 技術和標準化障礙

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品,2021 - 2034 年

- 主要趨勢

- 外部聲音產生器

- 內部聲音產生器

- 可客製化的音響系統

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 純電動車(BEV)

- 混合動力電動車(HEV)

- 插電式混合動力車(PHEV)

- 燃料電池電動車(FCEV)

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 越野車

- 掀背車

- 商用車

- 輕型商用車

- 平均血紅素 (MCV)

- 丙型肝炎病毒

- 二輪車和三輪車

- 非公路車輛

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:依組件,2021 - 2034

- 主要趨勢

- 硬體

- 演講嘉賓

- 擴大機

- 控制器

- 執行器

- 線束

- 軟體

- 聲音設計應用

- 控制系統

- 使用者介面系統

第10章:市場估計與預測:按速度範圍,2021 - 2034 年

- 主要趨勢

- 低速聲音產生器(0-30 公里/小時)

- 全速範圍聲音產生器(超過 30 公里/小時)

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Ansys

- Aptiv

- Brigade Electronics

- Continental

- Denso

- ECCO

- ESI Group (Keysights)

- Forvia Hella

- General Motors

- Harman International

- Hyundai

- Mercedes-Benz

- Softeq

- Soundracer

- STMicroelectronics

- Thor

- TVS

- Volkswagen

- Volvo

The Global Electric Vehicle Sound Generator Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 10% to reach USD 3.5 billion by 2034, as electric vehicles (EVs) become more widespread, the demand for sound generators continues to rise. EVs are almost silent at low speeds, which poses safety risks in urban and pedestrian-heavy areas. Regulatory bodies worldwide have responded by requiring EVs to produce synthetic sounds to alert pedestrians, especially those who are visually impaired. This growing regulatory pressure pushes automakers to adopt EVSGs as a standard feature. The convergence of rising EV production and increasing safety concerns fuels this demand, particularly in densely populated cities.

As electric mobility continues to expand across multiple segments-from individual passenger cars to commercial fleets and public transit-electric vehicle sound generators (EVSGs) are evolving from optional features to mandatory safety components. With cities growing more congested and pedestrian zones increasing, the near-silent operation of EVs at low speeds poses a real risk to public safety. Sound generators help bridge this gap by producing audible cues that alert pedestrians, cyclists, and other road users to an approaching vehicle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 10% |

The passenger vehicles segment in the electric vehicle sound generator market held a 40% share, reaching a valuation of USD 650 million in 2024, as these vehicles are most often used in urban areas where pedestrian interaction is frequent. As drivers travel longer distances, the need to ensure regulatory compliance and enhance safety prompts automakers to integrate sound generators in these vehicles. Manufacturers are also turning to custom-designed EV sounds not only to meet legal mandates but also to build distinctive brand identities. The fusion of safety and brand marketing is accelerating the adoption of advanced EVSG systems in passenger electric vehicles.

Original equipment manufacturers (OEMs) held the largest market share of 78.6% in 2024. Installing EV sound systems during vehicle production allows for seamless integration with onboard electronics and systems, including powertrains and infotainment units. This approach ensures legal compliance from the outset, which helps preserve warranties and streamline certification processes. OEMs benefit by reducing costs through large-scale purchasing and assembly, offering consumers built-in, regulation-ready sound solutions while maintaining manufacturing efficiency. Regulatory bodies favor OEM installation since it guarantees adherence before the vehicle hits the road.

Germany Electric Vehicle Sound Generator Market generated USD 131 million in 2024. The country's dominance is attributed to its strong automotive manufacturing base and aggressive push toward electrification. German manufacturers are among the earliest adopters of EVSG systems, leveraging regulatory requirements and innovation to stay ahead in the competitive landscape. Their approach blends strict adherence to EU sound regulations with a focus on acoustic branding, allowing automakers to create signature sound profiles that align with brand identity. The high output of electric vehicles, supported by large-scale production facilities and advanced R&D capabilities, further fuels demand for seamlessly integrated EVSG solutions.

Leading players in the EVSG market include Hyundai, ECCO, STMicroelectronics, Continental, Harman International, Aptiv, Denso, Forvia Hella, Brigade Electronics, and Ansys. To stay competitive, these companies are adopting key strategies such as advancing digital sound architecture, expanding partnerships with OEMs, and investing in AI-based sound generation. Many focus on scalable solutions for different EV types while enhancing in-vehicle integration and user experience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Component manufacturers

- 3.2.3 Software developers and acoustic engineers

- 3.2.4 System integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price trend

- 3.7.1 Region

- 3.7.2 Product

- 3.8 Cost breakdown analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Regulatory mandates for pedestrian safety

- 3.11.1.2 Increasing adoption of EVs

- 3.11.1.3 Advancements in sound design and technology

- 3.11.1.4 OEM integration and brand differentiation

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High cost of advanced systems

- 3.11.2.2 Technical and standardization barriers

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 External sound generators

- 5.3 Internal sound generators

- 5.4 Customizable sound systems

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Hybrid electric vehicles (HEV)

- 6.4 Plug-in hybrid electric vehicles (PHEV)

- 6.5 Fuel cell electric vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two and three wheelers

- 7.5 Off-highway vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Hardware

- 9.2.1 Speakers

- 9.2.2 Amplifiers

- 9.2.3 Controllers

- 9.2.4 Actuators

- 9.2.5 Wiring harnesses

- 9.3 Software

- 9.3.1 Sound design applications

- 9.3.2 Control systems

- 9.3.3 User interface systems

Chapter 10 Market Estimates & Forecast, By Speed Range, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Low-speed sound generators (0-30 km/h)

- 10.3 Full-speed range sound generators (more than 30 km/h)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Ansys

- 12.2 Aptiv

- 12.3 Brigade Electronics

- 12.4 Continental

- 12.5 Denso

- 12.6 ECCO

- 12.7 ESI Group (Keysights)

- 12.8 Forvia Hella

- 12.9 General Motors

- 12.10 Harman International

- 12.11 Hyundai

- 12.12 Mercedes-Benz

- 12.13 Softeq

- 12.14 Soundracer

- 12.15 STMicroelectronics

- 12.16 Thor

- 12.17 TVS

- 12.18 Volkswagen

- 12.19 Volvo