|

市場調查報告書

商品編碼

1750453

素食配料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vegan Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

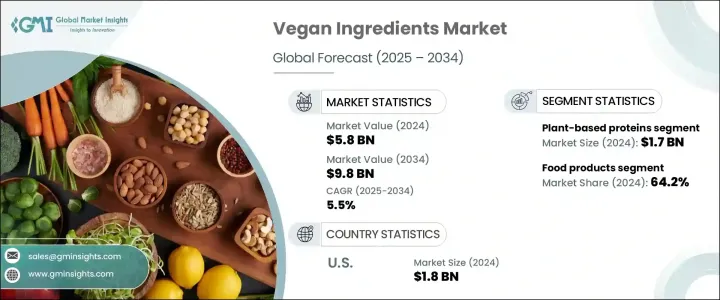

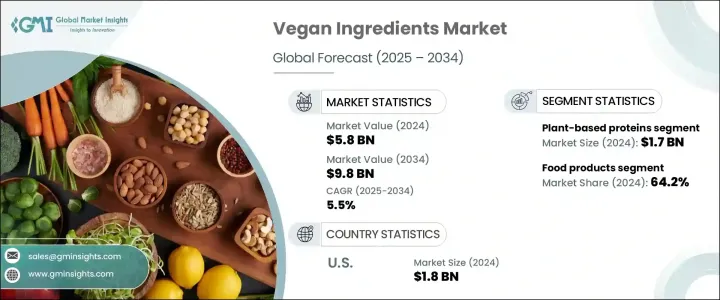

2024 年全球素食配料市場價值為 58 億美元,預計到 2034 年將以 5.5% 的複合年成長率成長,達到 98 億美元,這得益於向植物性食品的轉變、消費者偏好的變化、環保意識的增強,以及比傳統動物性食品更健康的替代品的普及。隨著人們越來越注重自己的食物選擇和對動物的道德對待,素食配料已成為食品創新的重點。人們對植物性營養日益成長的興趣導致對植物蛋白的需求增加,包括大豆、豌豆、米和扁豆,它們不僅更永續,而且還在各種食品應用中提供功能性益處。這引發了食品生產、分配和消費方式的改變。

這一趨勢背後的一個主要驅動力是植物性飲食的日益普及,這導致純素食品在即食食品、零食、飲料甚至膳食補充劑等多個類別中呈現爆炸性成長。植物性成分的環境效益——生產所需的資源比動物產品更少——也推動了這一轉變。政府支持永續農業和推廣替代蛋白質來源的舉措進一步推動了市場擴張。隨著對這些產品的需求不斷成長,創新繼續發揮重要作用,發酵菌蛋白等新成分不斷進入市場,以提升植物性食品的口感和營養成分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 58億美元 |

| 預測值 | 98億美元 |

| 複合年成長率 | 5.5% |

植物蛋白佔了30.2%的市場佔有率,2024年的市值為17億美元。這些來自大豆、豌豆和扁豆等作物的蛋白質,隨著消費者尋求肉類替代品,正變得越來越受歡迎。隨著各國政府大力推廣豆類作物作為永續農業的重要作物,人們對植物蛋白的日益關注也導致了蛋白質來源的多樣化。這些植物性蛋白質不僅被用於肉類替代品,還被用於其他食品,例如烘焙食品、零食和簡便食品,這些食品的蛋白質含量被宣傳為有益健康。

食品類產品在2024年價值37億美元,在純素食材市場佔據主導地位,預計2034年將佔64.2%的市場佔有率。此類別涵蓋範圍廣泛,包括植物性乳製品和肉類替代品、即食烘焙食品、零食和糖果。該行業對純素食材的巨大需求,主要源於消費者對健康益處、動物養殖倫理問題以及傳統動物性食品生產對環境影響的意識不斷增強。

2024年,美國純素食材市場規模達18億美元,預計2034年將持續維持6.3%的強勁複合年成長率。美國在消費和創新方面均處於領先地位,是全球市場的關鍵驅動力。推動這一成長的因素包括:個人健康意識的增強、對工廠化養殖倫理影響的日益擔憂,以及向植物性飲食的轉變。美國市場不僅滿足了人們對更健康、更永續食品選擇的需求,也推動了純素食品的創新。

全球純素原料市場的主要公司包括嘉吉、ADM、贏創、巴斯夫和Beyond Meat。這些公司一直致力於透過採用創新技術來擴展產品組合併改進產品供應。他們也透過投資環保生產流程和建立合作關係來推動植物性原料在各行各業的應用,從而加強永續發展。透過豐富產品系列並探索純素原料的新應用,這些公司旨在鞏固其在快速成長的市場中的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 供給側影響(原料)

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要進口國

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 全球監理框架概覽

- FDA法規

- 歐盟化妝品法規

- 中國化妝品監督管理條例

- 衝擊力

- 成長動力

- 健康意識不斷增強

- 環境永續性

- 植物性食品的技術進步

- 政府支持和政策舉措

- 產業陷阱與挑戰

- 生產成本高

- 消費者認知度和接受度有限

- 成長動力

- 市場機會

- 向發展中經濟體擴張

- 營養保健品和化妝品功能性素食成分的創新

- 為餐飲服務和自有品牌量身訂製的 B2B 解決方案

- 永續包裝和清潔標籤定位

- 市場進入和擴張策略

- 市場進入障礙與挑戰

- 監管障礙和合規成本

- 智慧財產權限制

- 確立了玩家主導地位

- 技術專長要求

- 市場進入策略

- 合資企業和策略聯盟

- 許可和技術轉讓

- 收購和棕地進入

- 綠地投資和有機成長

- 地理擴張機會

- 高成長區域市場

- 尚未開發的市場潛力評估

- 文化和監管考慮

- 在地化和適應策略

- 產品組合擴展策略

- 產品線延伸和產品變體

- 跨品類擴張

- 高階和價值細分市場定位

- 客製化和個人化方法

- 市場進入障礙與挑戰

- 風險評估和緩解策略

- 市場風險

- 需求波動性和週期性

- 競爭強度與價格壓力

- 替代產品和技術

- 消費者偏好轉變

- 營運風險

- 供應鏈中斷

- 品質控制和產品安全

- 製造和配方挑戰

- 勞動力和人才管理

- 監理與合規風險

- 不斷變化的監管格局

- 成分限制和禁令

- 標籤和行銷索賠風險

- 市場風險

- 未來展望與市場預測

- 短期市場展望(1-2年)

- 立即成長的機會

- 近期挑戰

- 競爭格局演變

- 中期市場展望(3-5年)

- 新興市場領域

- 技術採用曲線

- 供需平衡預測

- 長期市場展望(5-10年)

- 顛覆性技術與創新

- 永續發展驅動的市場轉型

- 消費者行為的演變

- 產業整合與重組情景

- 情境分析與應急計劃

- 最佳成長情景

- 基準市場演變

- 最糟糕的市場萎縮

- 顛覆性情境分析

- 短期市場展望(1-2年)

- 投資機會和策略建議

- 投資吸引力評估

- 高成長細分市場

- 技術投資機會

- 地理投資熱點

- 併購和合作機會

- 針對原料製造商的策略建議

- 產品開發與創新重點領域

- 市場定位和差異化策略

- 永續性和合規路線圖

- 夥伴關係和合作機會

- 針對最終產品製造商的策略建議

- 配方和產品開發重點

- 消費者參與和行銷策略

- 分銷和通路最佳化

- 永續性和品牌定位

- 為投資者和金融利益相關者提供策略建議

- 高潛力投資目標

- 風險評估和緩解方法

- 投資組合多元化策略

- 退出策略考慮

- 投資吸引力評估

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 植物蛋白

- 大豆蛋白

- 大豆分離蛋白

- 大豆濃縮蛋白

- 組織化大豆蛋白

- 大豆粉

- 其他

- 豌豆蛋白

- 豌豆分離蛋白

- 豌豆蛋白濃縮物

- 組織豌豆蛋白

- 小麥蛋白

- 活性小麥麩質

- 小麥分離蛋白

- 組織化小麥蛋白

- 米蛋白

- 米分離蛋白

- 米蛋白濃縮物

- 其他

- 馬鈴薯蛋白

- 藻類蛋白

- 螺旋藻

- 小球藻

- 其他

- 大豆蛋白

- 植物性乳製品替代品

- 植物奶

- 杏仁奶成分

- 豆漿原料

- 燕麥奶成分

- 椰奶成分

- 米漿成分

- 其他

- 植物性起司成分

- 蛋白質鹼基

- 油脂

- 調味劑

- 功能性成分

- 植物優格成分

- 蛋白質鹼基

- 培養物和發酵劑

- 質地改良劑

- 調味料

- 植物性奶油和塗抹醬原料

- 植物油脂

- 乳化劑

- 調味劑

- 著色劑

- 植物性冰淇淋原料

- 植物乳基

- 脂肪和油

- 甜味劑

- 穩定劑和乳化劑

- 植物奶

- 蛋替代品

- 澱粉類雞蛋替代品

- 蛋白質類雞蛋替代品

- 纖維類雞蛋替代品

- 豆類蛋替代品

- 水果蛋替代品

- 鷹嘴豆水

- 植物性脂肪和油

- 椰子油

- 棕櫚油

- 橄欖油

- 酪梨油

- 葵花籽油

- 菜籽油

- 特種植物油

- 結構化植物脂質

- 天然香料及增味劑

- 植物風味

- 植物甜味劑

- 鮮味增強劑

- 煙燻口味

- 香料萃取物

- 草本萃取物

- 自然色彩

- 花青素

- 類胡蘿蔔素

- 葉綠素

- 薑黃素

- 甜菜根

- 其他

- 水膠體和組織劑

- 瓊脂

- 角叉菜膠

- 瓜爾膠

- 刺槐豆膠

- 果膠

- 黃原膠

- 蒟蒻膠

- 改性澱粉

- 素食甜味劑

- 蔗糖

- 甜菜糖

- 椰子糖

- 楓糖漿

- 龍舌蘭蜜

- 棗糖漿

- 甜菊糖

- 羅漢果萃取物

- 素食乳化劑

- 卵磷脂(大豆、葵花籽)

- 單甘油酯和雙甘油酯(植物衍生)

- 柑橘纖維

- 其他

- 素食防腐劑

- 迷迭香萃取物

- 生育酚

- 抗壞血酸

- 其他

- 特色素食配料

- 營養酵母

- 海藻和藻類衍生物

- 發酵原料

- 其他

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 食品

- 植物性肉類替代品

- 漢堡和肉餅

- 香腸和熱狗

- 雞塊和雞條

- 碎肉替代品

- 熟食切片

- 植物性乳製品替代品

- 牛奶替代品

- 起司替代品

- 優格替代品

- 奶油和抹醬替代品

- 冰淇淋替代品

- 烘焙產品

- 麵包和捲餅

- 蛋糕和糕點

- 餅乾和餅乾

- 糖果

- 小吃

- 美味小吃

- 能量棒

- 湯和肉湯

- 醬汁和肉汁

- 調味品和蛋黃醬替代品

- 即食食品

- 冷凍食品

- 嬰兒配方奶粉和嬰兒食品

- 植物性肉類替代品

- 飲料

- 植物奶

- 植物性蛋白質飲料

- 冰沙和果汁

- 咖啡和茶添加劑

- 酒精飲料

- 個人護理和化妝品

- 保養產品

- 護髮產品

- 彩妝

- 口腔護理產品

- 膳食補充劑

- 動物飼料替代品

- 寵物食品

- 牲畜飼料

- 水產飼料

- 其他

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Aadhunik Ayurveda

- ADM

- BASF

- Beyond Meat

- Cargill

- Evonik

- Schouten

- Symega

- Tofurky

- Trader Joe's

The Global Vegan Ingredients Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 9.8 billion by 2034, driven by the shift toward plant-based foods and changes in consumer preferences, increasing environmental awareness, and greater access to healthier alternatives compared to traditional animal-based options. As people become more conscious of their food choices and ethical treatment of animals, vegan ingredients have become a key focus in food innovation. The growing interest in plant-based nutrition has led to increased demand for plant proteins, including soy, pea, rice, and lentils, which are not only more sustainable but also offer functional benefits in a variety of food applications. This has sparked a transformation in how food is produced, distributed, and consumed.

A major driving force behind this trend is the growing adoption of plant-based diets, which has led to an explosion of vegan food products across multiple categories, such as ready-to-eat meals, snacks, beverages, and even dietary supplements. The environmental benefits of plant-based ingredients-requiring fewer resources to produce than animal products-have also spurred the shift. Government initiatives supporting sustainable agriculture and the promotion of alternative protein sources are further boosting the market's expansion. As demand for these products rises, innovation continues to play a significant role, with new ingredients such as fermented mycoprotein entering the market to enhance the texture and nutritional profile of plant-based foods.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 5.5% |

The plant-based proteins segment held a 30.2% share and was valued at USD 1.7 billion in 2024. These proteins, sourced from crops like soy, peas, and lentils, are becoming increasingly popular as consumers seek alternatives to meat. The growing focus on plant proteins has led to a diversification of protein sources, as governments also promote legumes and pulses as vital crops in sustainable agriculture. These plant-based proteins are being used not only in meat substitutes but also in other food items, such as baked goods, snacks, and convenience meals, where their protein content is marketed as a health benefit.

The food products segment, valued at USD 3.7 billion in 2024, holds a dominant position in the vegan ingredients market, representing 64.2% share through 2034. This category encompasses a wide range of offerings, including plant-based dairy and meat alternatives, ready-to-bake items, snacks, and sweets. The significant demand for vegan ingredients within this sector is largely driven by increasing consumer awareness regarding health benefits, ethical concerns about animal farming, and the environmental impact of traditional animal-based food production.

United States Vegan Ingredients Market was valued at USD 1.8 billion in 2024 and is expected to continue growing at a robust CAGR of 6.3% through 2034. The U.S. leads both in terms of consumption and innovation, serving as a key driver of the global market. Factors contributing to this surge include rising awareness about personal health, a growing concern over the ethical implications of factory farming, and a shift towards plant-based diets. The American market is not only responding to the demand for healthier and more sustainable food options but also driving forward innovation in vegan food products.

Key companies in the Global Vegan Ingredients Market include Cargill, ADM, Evonik, BASF, and Beyond Meat. These companies have been focusing on expanding their portfolios and improving product offerings by adopting innovative technologies. They are also enhancing their sustainability efforts by investing in eco-friendly production processes and forging partnerships to promote the adoption of plant-based ingredients across various industries. By diversifying their product ranges and exploring new applications for vegan ingredients, these firms aim to solidify their positions in the rapidly growing market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.3.2 Major importing countries, 2021-2024 (kilo tons)

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 Global regulatory framework overview

- 3.7.2 FDA regulations

- 3.7.3 EU cosmetics regulation

- 3.7.4 China's CSAR (cosmetic supervision and administration regulation)

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising health consciousness

- 3.8.1.2 Environmental sustainability

- 3.8.1.3 Technological advancements in plant-based foods

- 3.8.1.4 Government support and policy initiatives

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High production costs

- 3.8.2.2 Limited consumer awareness and acceptance

- 3.8.1 Growth drivers

- 3.9 Market opportunities

- 3.9.1 Expansion into developing economies

- 3.9.2 Innovation in functional vegan ingredients for nutraceuticals and cosmetics

- 3.9.3 Customized B2B solutions for food service and private label

- 3.9.4 Sustainable packaging and clean label positioning

- 3.10 Market entry and expansion strategies

- 3.10.1 Market entry barriers and challenges

- 3.10.1.1 Regulatory hurdles and compliance costs

- 3.10.1.2 Intellectual property constraints

- 3.10.1.3 Established player dominance

- 3.10.1.4 Technical expertise requirements

- 3.10.2 Market entry strategies

- 3.10.2.1 Joint ventures and strategic alliances

- 3.10.2.2 Licensing and technology transfer

- 3.10.2.3 Acquisition and brownfield entry

- 3.10.2.4 Greenfield investment and organic growth

- 3.10.3 Geographic expansion opportunities

- 3.10.3.1 High-growth regional markets

- 3.10.3.2 Untapped market potential assessment

- 3.10.3.3 Cultural and regulatory considerations

- 3.10.3.4 Localization and adaptation strategies

- 3.10.4 Product portfolio expansion strategies

- 3.10.4.1 Line extensions and product variants

- 3.10.4.2 Cross-category expansion

- 3.10.4.3 Premium and value segment targeting

- 3.10.4.4 Customization and personalization approaches

- 3.10.1 Market entry barriers and challenges

- 3.11 Risk assessment and mitigation strategies

- 3.11.1 Market risks

- 3.11.1.1 Demand volatility and cyclicality

- 3.11.1.2 Competitive intensity and price pressure

- 3.11.1.3 Substitute products and technologies

- 3.11.1.4 Consumer preference shifts

- 3.11.2 Operational risks

- 3.11.2.1 Supply chain disruptions

- 3.11.2.2 Quality control and product safety

- 3.11.2.3 Manufacturing and formulation challenges

- 3.11.2.4 Workforce and talent management

- 3.11.3 Regulatory and compliance risks

- 3.11.3.1 Changing regulatory landscape

- 3.11.3.2 Ingredient restrictions and bans

- 3.11.3.3 Labeling and marketing claim risks

- 3.11.1 Market risks

- 3.12 Future outlook and market projections

- 3.12.1 Short-term market outlook (1-2 years)

- 3.12.1.1 Immediate growth opportunities

- 3.12.1.2 Near-term challenges

- 3.12.1.3 Competitive landscape evolution

- 3.12.2 Medium-term market outlook (3-5 years)

- 3.12.2.1 Emerging market segments

- 3.12.2.2 Technology adoption curves

- 3.12.2.3 Supply-demand balance projections

- 3.12.3 Long-term market outlook (5-10 years)

- 3.12.3.1 Disruptive technologies and innovations

- 3.12.3.2 Sustainability-driven market transformation

- 3.12.3.3 Consumer behavior evolution

- 3.12.3.4 Industry consolidation and restructuring scenarios

- 3.12.4 Scenario analysis and contingency planning

- 3.12.4.1 Best-case growth scenario

- 3.12.4.2 Base-case market evolution

- 3.12.4.3 Worst-case market contraction

- 3.12.4.4 Disruptive scenario analysis

- 3.12.1 Short-term market outlook (1-2 years)

- 3.13 Investment opportunities and strategic recommendations

- 3.13.1 Investment attractiveness assessment

- 3.13.1.1 High-growth market segments

- 3.13.1.2 Technology investment opportunities

- 3.13.1.3 Geographic investment hotspots

- 3.13.1.4 M&A and partnership opportunities

- 3.13.2 Strategic recommendations for ingredient manufacturers

- 3.13.2.1 Product development and innovation focus areas

- 3.13.2.2 Market positioning and differentiation strategies

- 3.13.2.3 Sustainability and compliance roadmap

- 3.13.2.4 Partnership and collaboration opportunities

- 3.13.2.5 Strategic recommendations for end-product manufacturers

- 3.13.2.6 Formulation and product development priorities

- 3.13.2.7 Consumer engagement and marketing strategies

- 3.13.2.8 Distribution and channel optimization

- 3.13.2.9 Sustainability and brand positioning

- 3.13.3 Strategic recommendations for investors and financial stakeholders

- 3.13.3.1 High-potential investment targets

- 3.13.3.2 Risk assessment and mitigation approaches

- 3.13.3.3 Portfolio diversification strategies

- 3.13.3.4 Exit strategy considerations

- 3.13.1 Investment attractiveness assessment

- 3.14 Growth potential analysis

- 3.15 Porter’s analysis

- 3.16 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-based proteins

- 5.2.1 Soy protein

- 5.2.1.1 Soy protein isolates

- 5.2.1.2 Soy protein concentrates

- 5.2.1.3 Textured soy protein

- 5.2.1.4 Soy flour

- 5.2.1.5 Others

- 5.2.2 Pea protein

- 5.2.2.1 Pea protein isolates

- 5.2.2.2 Pea protein concentrates

- 5.2.2.3 Textured pea protein

- 5.2.3 Wheat protein

- 5.2.3.1 Vital wheat gluten

- 5.2.3.2 Wheat protein isolates

- 5.2.3.3 Textured wheat protein

- 5.2.4 Rice protein

- 5.2.4.1 Rice protein isolates

- 5.2.4.2 Rice protein concentrates

- 5.2.4.3 Others

- 5.2.5 Potato protein

- 5.2.6 Algae protein

- 5.2.6.1 Spirulina

- 5.2.6.2 Chlorella

- 5.2.6.3 Others

- 5.2.1 Soy protein

- 5.3 Plant-based dairy alternatives

- 5.3.1 Plant milks

- 5.3.1.1 Almond milk ingredients

- 5.3.1.2 Soymilk ingredients

- 5.3.1.3 Oat milk ingredients

- 5.3.1.4 Coconut milk ingredients

- 5.3.1.5 Rice milk ingredients

- 5.3.1.6 Others

- 5.3.2 Plant-based cheese ingredients

- 5.3.2.1 Protein bases

- 5.3.2.2 Oils and fats

- 5.3.2.3 Flavoring agents

- 5.3.2.4 Functional ingredients

- 5.3.3 Plant-based yogurt ingredients

- 5.3.3.1 Protein bases

- 5.3.3.2 Cultures and fermentation agents

- 5.3.3.3 Texturizing agents

- 5.3.3.4 Flavoring ingredients

- 5.3.4 Plant-based butter and spreads ingredients

- 5.3.4.1 Plant oils and fats

- 5.3.4.2 Emulsifiers

- 5.3.4.3 Flavoring agents

- 5.3.4.4 Coloring agents

- 5.3.5 Plant-based ice cream ingredients

- 5.3.5.1 Plant milk bases

- 5.3.5.2 Fats and oils

- 5.3.5.3 Sweeteners

- 5.3.5.4 Stabilizers and emulsifiers

- 5.3.1 Plant milks

- 5.4 Egg replacers

- 5.4.1 Starch-based egg replacers

- 5.4.2 Protein-based egg replacers

- 5.4.3 Fiber-based egg replacers

- 5.4.4 Legume-based egg replacers

- 5.4.5 Fruit-based egg replacers

- 5.4.6 Aquafaba

- 5.5 Plant-based fats and oils

- 5.5.1 Coconut oil

- 5.5.2 Palm oil

- 5.5.3 Olive oil

- 5.5.4 Avocado oil

- 5.5.5 Sunflower oil

- 5.5.6 Canola oil

- 5.5.7 Specialty plant oils

- 5.5.8 Structured plant lipids

- 5.6 Natural flavors and enhancers

- 5.6.1 Plant-based savory flavors

- 5.6.2 Plant-based sweet flavors

- 5.6.3 Umami enhancers

- 5.6.4 Smoke flavors

- 5.6.5 Spice extracts

- 5.6.6 Herb extracts

- 5.7 Natural colors

- 5.7.1 Anthocyanins

- 5.7.2 Carotenoids

- 5.7.3 Chlorophyll

- 5.7.4 Curcumin

- 5.7.5 Beetroot

- 5.7.6 Others

- 5.8 Hydrocolloids and texturizers

- 5.8.1 Agar-agar

- 5.8.2 Carrageenan

- 5.8.3 Guar gum

- 5.8.4 Locust bean gum

- 5.8.5 Pectin

- 5.8.6 Xanthan gum

- 5.8.7 Konjac gum

- 5.8.8 Modified starches

- 5.9 Vegan sweeteners

- 5.9.1 Cane sugar

- 5.9.2 Beet sugar

- 5.9.3 Coconut sugar

- 5.9.4 Maple syrup

- 5.9.5 Agave nectar

- 5.9.6 Date syrup

- 5.9.7 Stevia

- 5.9.8 Monk fruit extract

- 5.10 Vegan emulsifiers

- 5.10.1 Lecithin (soy, sunflower)

- 5.10.2 Mono- and diglycerides (plant-derived)

- 5.10.3 Citrus fiber

- 5.10.4 Others

- 5.11 Vegan preservatives

- 5.11.1 Rosemary extract

- 5.11.2 Tocopherols

- 5.11.3 Ascorbic acid

- 5.11.4 Others

- 5.12 Specialty vegan ingredients

- 5.12.1 Nutritional yeast

- 5.12.2 Seaweed and algae derivatives

- 5.12.3 Fermented ingredients

- 5.12.4 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food products

- 6.2.1 Plant-based meat alternatives

- 6.2.1.1 Burgers and patties

- 6.2.1.2 Sausages and hot dogs

- 6.2.1.3 Nuggets and strips

- 6.2.1.4 Ground meat alternatives

- 6.2.1.5 Deli slices

- 6.2.2 Plant-based dairy alternatives

- 6.2.2.1 Milk alternatives

- 6.2.2.2 Cheese alternatives

- 6.2.2.3 Yogurt alternatives

- 6.2.2.4 Butter and spread alternatives

- 6.2.2.5 Ice cream alternatives

- 6.2.3 Bakery products

- 6.2.3.1 Breads and rolls

- 6.2.3.2 Cakes and pastries

- 6.2.3.3 Cookies and biscuits

- 6.2.4 Confectionery

- 6.2.5 Snacks

- 6.2.5.1 Savory snacks

- 6.2.5.2 Energy bars

- 6.2.6 Soups and broths

- 6.2.6.1 Sauces and gravies

- 6.2.6.2 Dressings and mayonnaise alternatives

- 6.2.7 Ready meals

- 6.2.8 Frozen meals

- 6.2.9 Infant formula and baby food

- 6.2.1 Plant-based meat alternatives

- 6.3 Beverages

- 6.3.1 Plant-based milk

- 6.3.2 Plant-based protein drinks

- 6.3.3 Smoothies and juices

- 6.3.4 Coffee and tea additives

- 6.3.5 Alcoholic beverages

- 6.4 Personal care and cosmetics

- 6.4.1 Skincare products

- 6.4.2 Haircare products

- 6.4.3 Color cosmetics

- 6.4.4 Oral care products

- 6.5 Dietary supplements

- 6.6 Animal feed alternatives

- 6.7 Pet food

- 6.7.1 Livestock feed

- 6.7.2 Aquaculture feed

- 6.7.3 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Aadhunik Ayurveda

- 8.2 ADM

- 8.3 BASF

- 8.4 Beyond Meat

- 8.5 Cargill

- 8.6 Evonik

- 8.7 Schouten

- 8.8 Symega

- 8.9 Tofurky

- 8.10 Trader Joe’s