|

市場調查報告書

商品編碼

1750447

直接數位控制系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Direct Digital Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

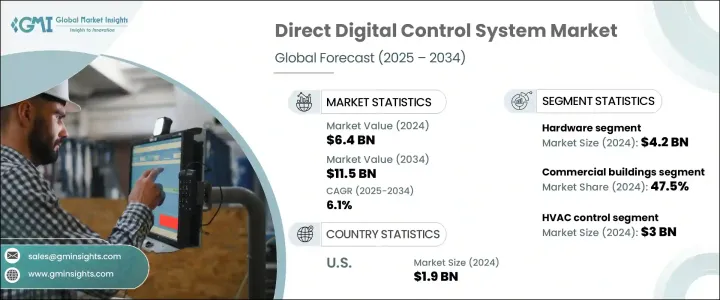

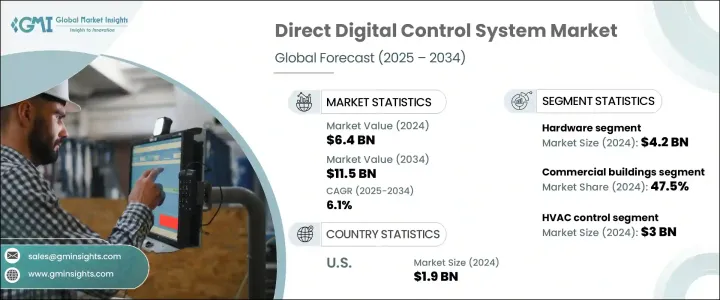

2024年,全球直接數位控制系統市場規模達64億美元,預計2034年將以6.1%的複合年成長率成長,達到115億美元。這得益於快速城鎮化和工業化帶來的智慧基礎設施需求的不斷成長。這些系統有助於管理建築內的暖通空調、照明和能源營運,從而提高效率、舒適度和永續性。隨著城市擴張的持續,尤其是在印度、非洲和拉丁美洲等發展中地區,對智慧自動化建築管理系統的需求正在激增。 DDC系統有助於最佳化能源、實現自動化並減少人工,使其成為大型基礎設施專案不可或缺的一部分。

這些系統能夠無縫控制暖氣、通風、空調 (HVAC)、照明和其他關鍵建築功能,從而提高整體效率和永續性。它們能夠在確保舒適度的同時最佳化能耗,這是其在商業、住宅和工業領域廣泛採用的關鍵因素。然而,市場也面臨許多挑戰,例如關稅政策造成的干擾,阻礙了從中國、歐盟和加拿大等主要製造地區進口關鍵電子元件、感測器和控制器。這些地緣政治因素可能會延遲專案進度,並增加 DDC 系統製造商的成本。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 64億美元 |

| 預測值 | 115億美元 |

| 複合年成長率 | 6.1% |

DDC 系統市場主要分為硬體、軟體和服務,其中硬體佔據主導地位。 2024 年,硬體市場價值達 42 億美元。控制器、感測器和執行器等核心組件對於 DDC 系統的有效運作至關重要。隨著全球(尤其是新興市場)對智慧基礎設施的需求不斷成長,對能夠實現即時監控、精確自動化和高效能源管理的先進硬體解決方案的需求也日益成長。這些硬體有助於對各種建築功能進行高級控制,從而確保能源效率和居住舒適度。

商業建築能耗高,基礎建設複雜,2024 年佔 47.5%。 DDC 系統廣泛應用於辦公大樓、購物中心、機場和飯店,這些場所對高效的能源管理和舒適的居住環境有著迫切的需求。這些建築的複雜性使得 DDC 系統成為自動化營運的理想選擇,從而降低營運成本並提升整體建築性能。隨著人們對永續性和能源效率的認知不斷提高,DDC 系統也成為商業設施能源管理的極具吸引力的解決方案。

2024年,美國直接數位控制系統(DDC)市場規模達19億美元,這得益於此類系統在商業、機構和工業建築中的廣泛應用。嚴格的能源效率法規以及使用先進自動化解決方案改造舊建築的日益成長的趨勢,極大地促進了美國DDC市場的擴張。此外,DDC行業主要參與者的存在進一步支持了市場的成長和創新,確保為各個行業穩定供應高品質、高效的系統。

全球直接數位控制系統 (DDC) 產業的主要參與者包括施耐德電氣、阿自倍爾株式會社、霍尼韋爾國際公司和江森自控公司。為了鞏固其在 DDC 系統市場的地位,各公司正在大力投資研發,以提高產品的性能和成本效益。透過專注於提高能源效率和可擴展性,他們旨在滿足日益成長的智慧建築解決方案需求。許多參與者也正在擴展其服務範圍,包括全面的安裝、維護和系統整合服務,以確保客戶能夠最大限度地發揮 DDC 系統的價值。與商業和工業參與者建立策略合作夥伴關係有助於公司擴大市場覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 衝擊力

- 成長動力

- 智慧建築技術的採用率不斷提高

- 快速城鎮化和工業化

- 能源效率需求不斷成長

- 基礎建設老化與改造需求

- 自動化和控制系統的技術進步

- 產業陷阱與挑戰

- 初始安裝成本高

- 整合的複雜性

- 成長動力

- 成長潛力分析

- 科技與創新格局

- 重要新聞和舉措

- 未來市場趨勢

- 波特的分析

- PESTEL分析

- 監管格局

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依組成部分,2021-2034

- 主要趨勢

- 硬體

- 控制器

- 感應器

- 執行器

- 輸入/輸出模組

- 其他

- 軟體

- 控制演算法

- 介面和視覺化工具

- 數據分析軟體

- 其他

- 服務

- 安裝和整合

- 維護與支援

- 諮詢和培訓

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- HVAC控制

- 照明控制

- 工業自動化

- 能源管理系統(EMS)

- 其他

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 住宅建築

- 商業建築

- 辦公室空間

- 零售店

- 熱情好客

- 工業設施

- 製造工廠

- 倉庫

- 機構建築

- 醫院

- 學校

- 政府大樓

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Allison Mechanical, Inc.

- Arvin Air Systems

- Azbil Corporation

- Computrols, Inc.

- DEOS AG

- Honeywell International Inc.

- Innotech

- Johnson Controls Inc.

- KMC Controls

- Lennox International Inc.

- Mason & Barry

- Matrix HG, Inc.

- Mitsubishi Electric Corporation

- Schneider Electric

- Siemens

- Winona Heating & Ventilating

- WODFA Company

The Global Direct Digital Control System Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 11.5 billion by 2034, driven by the increasing demand for smart infrastructure, fueled by rapid urbanization and industrialization. These systems help manage HVAC, lighting, and energy operations within buildings, enhancing efficiency, comfort, and sustainability. As urban expansion continues, particularly in developing regions such as India, Africa, and Latin America, the demand for intelligent, automated building management systems is surging. DDC systems help in energy optimization, automation, and reducing manual labor, making them indispensable for large-scale infrastructure projects.

These systems allow for seamless control of heating, ventilation, air conditioning (HVAC), lighting, and other critical building functions, improving overall efficiency and sustainability. Their ability to optimize energy consumption while ensuring comfort is a key factor behind their widespread adoption in the commercial, residential, and industrial sectors. However, the market faces challenges, such as the disruptions caused by tariff policies, which have hindered the import of critical electronic components, sensors, and controllers from major manufacturing regions like China, the EU, and Canada. These geopolitical factors can delay project timelines and increase costs for DDC system manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 6.1% |

The DDC system market is primarily segmented into hardware, software, and services, with hardware being the dominant segment. In 2024, the hardware segment was valued at USD 4.2 billion. The core components, including controllers, sensors, and actuators, are essential for the effective functioning of DDC systems. As the demand for smart infrastructure grows globally, especially in emerging markets, there is an increasing need for advanced hardware solutions that enable real-time monitoring, precise automation, and efficient energy management. This hardware facilitates high-level control across various building functions, ensuring energy efficiency and occupant comfort.

Commercial buildings, with their high energy usage and complex infrastructure, represented a 47.5% share in 2024. DDC systems are extensively used in office buildings, shopping malls, airports, and hotels, where there is a strong need for efficient energy management and occupant comfort. The complex nature of these buildings makes DDC systems an ideal choice for automating operations, thereby reducing operational costs and enhancing overall building performance. The increasing awareness of sustainability and energy efficiency also makes DDC systems an attractive solution for managing energy resources in commercial facilities.

U.S. Direct Digital Control System Market was valued at USD 1.9 billion in 2024, driven by the widespread adoption of these systems across commercial, institutional, and industrial buildings. Strict energy efficiency regulations and the growing trend of retrofitting older buildings with advanced automation solutions have significantly contributed to the market's expansion in the U.S. Additionally, the presence of major players in the DDC industry further supports the growth and innovation in the market, ensuring a steady supply of high-quality and efficient systems for various sectors.

Key players in the Global Direct Digital Control System Industry include Schneider Electric, Azbil Corporation, Honeywell International Inc., and Johnson Controls Inc. To strengthen their presence in the DDC system market, companies are heavily investing in research and development to enhance the performance and cost-effectiveness of their products. By focusing on improving energy efficiency and scalability, they aim to cater to the growing demand for smart building solutions. Many players are also expanding their service offerings to include comprehensive installation, maintenance, and system integration services, ensuring clients can maximize the value of DDC systems. Strategic partnerships with commercial and industrial players help companies expand their market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increased adoption of smart building technologies

- 3.3.1.2 Rapid urbanization and industrialization

- 3.3.1.3 Rising demand for energy efficiency

- 3.3.1.4 Aging infrastructure and retrofitting demand

- 3.3.1.5 Technological advancements in automation and control systems

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High initial installation costs

- 3.3.2.2 Complexity of integration

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Key news and initiatives

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Controllers

- 5.2.2 Sensors

- 5.2.3 Actuators

- 5.2.4 Input/output modules

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Control algorithms

- 5.3.2 Interface & visualization tools

- 5.3.3 Data analytics software

- 5.3.4 Others

- 5.4 Services

- 5.4.1 Installation & integration

- 5.4.2 Maintenance & support

- 5.4.3 consulting & training

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 HVAC control

- 6.3 Lighting control

- 6.4 Industrial automation

- 6.5 Energy management systems (EMS)

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Residential buildings

- 7.3 Commercial buildings

- 7.3.1 office spaces

- 7.3.2 retail stores

- 7.3.3 hospitality

- 7.4 Industrial facilities

- 7.4.1 manufacturing plants

- 7.4.2 warehouses

- 7.5 Institutional buildings

- 7.5.1 hospitals

- 7.5.2 schools

- 7.5.3 government buildings

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allison Mechanical, Inc.

- 9.2 Arvin Air Systems

- 9.3 Azbil Corporation

- 9.4 Computrols, Inc.

- 9.5 DEOS AG

- 9.6 Honeywell International Inc.

- 9.7 Innotech

- 9.8 Johnson Controls Inc.

- 9.9 KMC Controls

- 9.10 Lennox International Inc.

- 9.11 Mason & Barry

- 9.12 Matrix HG, Inc.

- 9.13 Mitsubishi Electric Corporation

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Winona Heating & Ventilating

- 9.17 WODFA Company