|

市場調查報告書

商品編碼

1750446

車載太陽能板市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vehicle-Integrated Solar Panels Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

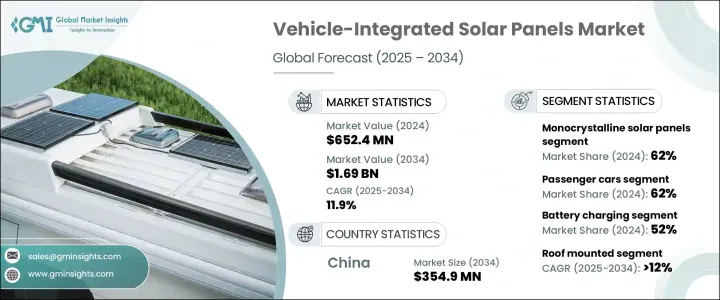

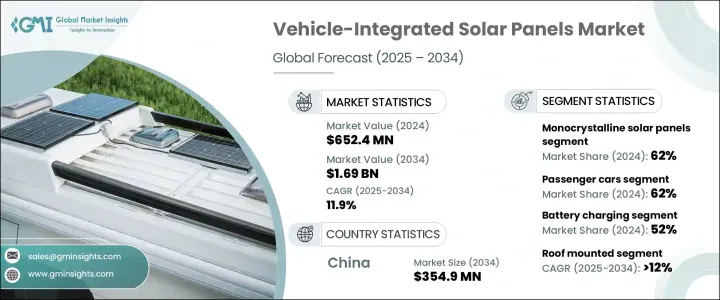

2024年,全球車載太陽能板市場規模達6.524億美元,預計到2034年將以11.9%的複合年成長率成長,達到16.9億美元。這主要得益於電動車的廣泛普及以及全球對再生能源日益成長的需求,推動了車載太陽能板市場的需求。隨著交通運輸系統的現代化,汽車製造商越來越希望將太陽能直接整合到車輛中,以減少對外部充電系統的依賴。車載太陽能光電系統 (VISP) 能夠實現清潔、自給自足的能源生產,有助於延長電動車的續航里程,同時減輕車載電池的壓力。

環保意識的增強、燃油價格的波動以及政府對低碳交通解決方案日益成長的支持,共同推動了市場的成長。汽車製造商正透過創新更有效率的太陽能材料、增強其與車輛設計的融合度以及最佳化能量轉換率來應對這項挑戰。消費者的興趣正在不斷成長,尤其是在陽光充足的地區,太陽能汽車可以實現更高的能源獨立性。買家更重視車輛的先進功能,例如耐熱太陽能材料、無縫設計整合以及即時能量追蹤。直銷數位銷售管道的不斷發展提升了太陽能汽車及相關售後套件的曝光度,使製造商能夠覆蓋更廣泛的人群。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.524億美元 |

| 預測值 | 16.9億美元 |

| 複合年成長率 | 11.9% |

2024年,乘用車佔62%的市場佔有率,引領市場,預計到2034年將以12.3%的複合年成長率成長。這些車輛憑藉其平坦的空氣動力學表面,為VISP技術提供了理想的平台。這種設計使太陽能系統能夠在有限的空間內產生更高的電力輸出。在日照充足的地區,自充電能力對於城市和城際旅行尤其重要。由於對注重環保的駕駛者俱有強烈的吸引力,太陽能整合系統正迅速成為電動車領域的差異化因素。

單晶太陽能板市場佔據62%的市場佔有率,預計到2034年將以12.2%的複合年成長率成長。這些電池板因其卓越的能量轉換效率和視覺均勻性而備受青睞。單晶電池板以其在陰涼和高溫環境下的良好運作而聞名,是汽車車頂和引擎蓋的理想選擇。其光滑的外觀和一致的紋理使其在注重性能和美觀的高階電動車中廣受歡迎。

2024年,亞太地區車載太陽能板市場佔48%的市場。強大的國內生產能力、經濟高效的製造流程以及政府主導的可再生能源出行政策,推動了中國在車載太陽能板應用領域的領先地位。此外,中國強勁的基礎建設、智慧物流網路的擴展以及快速的都市化進程,也刺激了對車載折臂起重機等多功能起重解決方案的需求。本土製造商受益於規模經濟和精簡的供應鏈,從而實現了更快的生產速度和更具競爭力的價格。

Sono Motors、大眾汽車、豐田汽車、比亞迪、日產汽車、Lightyear、Planet Solar、Aptera Motors、通用汽車和福特汽車等主要行業參與者正在尋求戰略合作和技術升級,以保持競爭力。許多公司投資研發,以提高太陽能電池的耐用性、能源效率以及與電動車平台的整合度。與太陽能科技公司建立策略合作夥伴關係並在目標市場推出試點車輛也很常見。有些公司最佳化了直接面對消費者的線上銷售模式,而有些公司則專注於模組化VISP解決方案,以滿足車隊採用和最後一哩物流應用的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件供應商

- 製造商

- 服務提供者

- 經銷商

- 最終用途

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(客戶成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 貿易影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 定價趨勢

- 產品

- 地區

- 成本細分分析

- 對部隊的影響

- 成長動力

- 電動車普及率不斷上升

- 太陽能板效率的技術進步

- 降低太陽能技術成本

- 消費者對再生能源的認知不斷提高

- 環境法規與減碳目標

- 產業陷阱與挑戰

- 整合的初始成本高

- 耐用性和安全性問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車

- 中型商用車

- 重型商用車

- 電動車(EV)

- 特種車輛

- 休閒車(RV)

- 高爾夫球車

- 軍用或緊急車輛

第6章:市場估計與預測:按太陽能板,2021 - 2034 年

- 主要趨勢

- 單晶太陽能板

- 多晶太陽能板

- 薄膜太陽能板

- 軟性太陽能板

第7章:市場估計與預測:依安裝方式,2021 - 2034 年

- 主要趨勢

- 車頂安裝

- 引擎蓋安裝

- 一體式車身面板

- 可拆卸面板

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 發電

- 電池充電

- 輔助電源

- 暖氣系統

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Aptera Motors

- BYD

- Cruise Car

- Ford Motor

- General Motors

- Hanergy Thin Film

- Honda Motor

- Hyundai Motor

- Lightyear

- LOMOcean

- Mahindra & Mahindra

- Nissan Motor

- Planet Solar

- Sono Motors

- Surat Exim

- Tesla

- Toyota Motor

- Venturi Automobiles

- Volkswagen

- Weifang Guangsheng New Energy

The Global Vehicle-Integrated Solar Panels Market was valued at USD 652.4 million in 2024 and is estimated to grow at a CAGR of 11.9% to reach USD 1.69 billion by 2034, driven by the demand for vehicle-integrated solar systems with the widespread shift toward electric mobility and the growing global push for renewable energy. As transportation systems modernize, vehicle manufacturers are increasingly looking to integrate solar power directly into vehicles to reduce reliance on external charging systems. VISPs enable clean, self-sustaining energy generation, helping extend the operational range of electric vehicles while alleviating pressure on onboard batteries.

Environmental awareness, volatile fuel prices, and growing government support for decarbonized transportation solutions contribute to market growth. Automakers are responding by innovating more efficient solar materials, enhancing their integration with vehicle designs, and optimizing energy conversion rates. Consumer interest is expanding, especially in sunny regions, where solar-powered cars can deliver greater energy independence. Buyers prioritize advanced vehicle features such as thermal-resistant solar materials, seamless design integration, and real-time energy tracking. The evolution of direct-to-consumer digital sales channels boosts visibility for solar-enabled vehicles and related aftermarket kits, allowing manufacturers to reach a broader demographic base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $652.4 Million |

| Forecast Value | $1.69 Billion |

| CAGR | 11.9% |

Passenger vehicles led the market in 2024, making up 62% share, and are expected to grow at 12.3% CAGR through 2034. These vehicles provide ideal platforms for VISP technology due to their flat, aerodynamic surfaces. This design allows solar systems to generate higher electricity outputs from limited space. In regions with high solar exposure, the ability to self-charge becomes especially valuable for urban and intercity mobility. With a strong appeal among environmentally conscious drivers, solar-integrated systems are rapidly becoming a differentiator in the EV space.

The monocrystalline solar panels segment held 62% share and is expected to grow at a CAGR of 12.2% through 2034. These panels are favored for their superior energy conversion efficiency and visual uniformity. Known for operating well in shaded and high-temperature environments, monocrystalline panels are ideal for vehicle rooftops and hoods. Their sleek appearance and consistent texture make them popular for premium EVs where performance and aesthetics matter.

Asia Pacific Vehicle- Integrated Solar Panels Market held a 48% share in 2024. Strong domestic production capabilities, cost-effective manufacturing, and government-led renewable mobility policies have propelled China's leadership in VISP adoption. Additionally, the country's robust infrastructure development, expansion of smart logistics networks, and rapid urbanization have fueled the need for versatile lifting solutions like truck-mounted knuckle boom cranes. Local manufacturers benefit from economies of scale and streamlined supply chains, enabling faster production and competitive pricing.

Key industry participants such as Sono Motors, Volkswagen, Toyota Motor, BYD, Nissan Motor, Lightyear, Planet Solar, Aptera Motors, General Motors, and Ford Motor are pursuing strategic collaborations and technology upgrades to stay competitive. Many invest in R&D to enhance solar cell durability, energy efficiency, and integration with EV platforms. Strategic partnerships with solar tech firms and the rollout of pilot vehicles in target markets are also common. Some players optimize direct-to-consumer online sales models, while others focus on modular VISP solutions for fleet adoption and last-mile logistics applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Component supplier

- 3.2.3 Manufacturer

- 3.2.4 Service provider

- 3.2.5 Distributor

- 3.2.6 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing trend

- 3.9.1 Product

- 3.9.2 Region

- 3.10 Cost breakdown analysis

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising adoption of electric vehicles

- 3.11.1.2 Technological advancements in solar panel efficiency

- 3.11.1.3 Decreasing cost of solar technology

- 3.11.1.4 Growing consumer awareness of renewable energy

- 3.11.1.5 Environmental regulations and carbon reduction goals

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial cost of integration

- 3.11.2.2 Durability and safety concerns

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles

- 5.3.2 Medium commercial vehicles

- 5.3.3 Heavy commercial vehicles

- 5.4 Electric vehicles (EVs)

- 5.5 Specialty Vehicles

- 5.5.1 Recreational vehicles (RVs)

- 5.5.2 Golf carts

- 5.5.3 Military or emergency vehicles

Chapter 6 Market Estimates & Forecast, By Solar Panel, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Monocrystalline solar panels

- 6.3 Polycrystalline solar panels

- 6.4 Thin-film solar panels

- 6.5 Flexible solar panels

Chapter 7 Market Estimates & Forecast, By Installation Method, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Roof mounted

- 7.3 Hood mounted

- 7.4 Integrated body panels

- 7.5 Removable panels

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Power generation

- 8.3 Battery charging

- 8.4 Auxiliary power supply

- 8.5 Heating systems

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Aptera Motors

- 10.2 BYD

- 10.3 Cruise Car

- 10.4 Ford Motor

- 10.5 General Motors

- 10.6 Hanergy Thin Film

- 10.7 Honda Motor

- 10.8 Hyundai Motor

- 10.9 Lightyear

- 10.10 LOMOcean

- 10.11 Mahindra & Mahindra

- 10.12 Nissan Motor

- 10.13 Planet Solar

- 10.14 Sono Motors

- 10.15 Surat Exim

- 10.16 Tesla

- 10.17 Toyota Motor

- 10.18 Venturi Automobiles

- 10.19 Volkswagen

- 10.20 Weifang Guangsheng New Energy