|

市場調查報告書

商品編碼

1858854

車載整合太陽能電池半導體市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Vehicle-Integrated Solar Cell Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

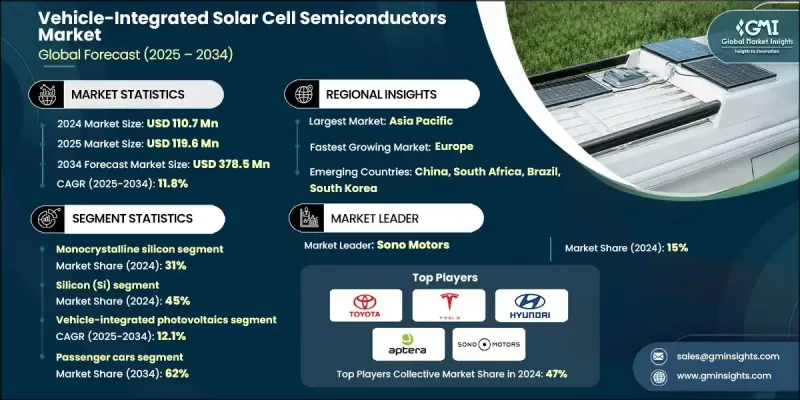

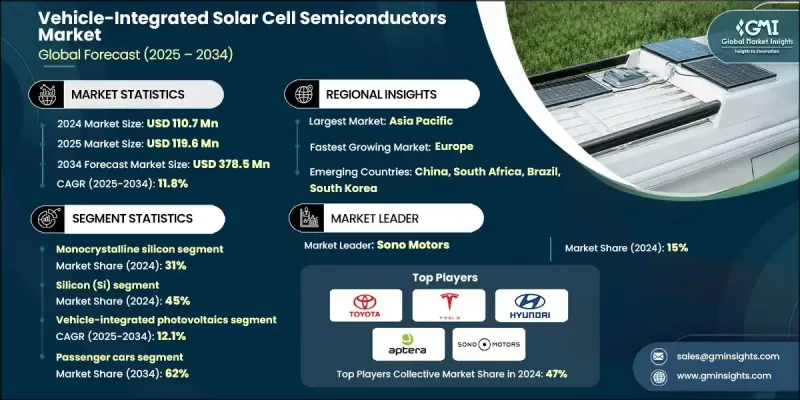

2024 年全球汽車整合太陽能電池半導體市場價值為 1.107 億美元,預計到 2034 年將以 11.8% 的複合年成長率成長至 3.785 億美元。

市場成長的驅動力來自於電動車的加速普及、半導體技術的持續進步以及對節能安全電源解決方案日益成長的需求。這一成長動能主要受到智慧出行創新、汽車電子設備升級以及汽車半導體生態系統競爭格局變化的影響。疫情後對晶片本地化和供應鏈韌性的重視也促進了這一成長,尤其是在亞洲和歐洲。在對電動交通和數位基礎設施投資不斷增加的推動下,這些地區正成為先進半導體製造的熱點。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.107億美元 |

| 預測值 | 3.785億美元 |

| 複合年成長率 | 11.8% |

全球汽車電氣化進程以及對車載能源效率的需求正推動汽車製造商和一級供應商加大對晶片級整合技術的投資,使太陽能電池能夠與智慧逆變器、區域控制器和先進的電源管理整合電路無縫協作。這些組件目前正被開發為可直接與光伏組件配合使用,從而實現更高的能源效率和更緊湊的系統設計。隨著汽車向智慧互聯系統演進,半導體網路和架構的創新對於支持這項轉型至關重要。

就材料而言,矽材料在2024年佔據了45%的市場佔有率,預計到2034年將以12%的複合年成長率成長。矽材料的主導地位得益於其高可靠性、成熟的供應鏈以及在各種光照條件下的優異性能。同時,銅銦鎵硒(CIGS)由於其柔韌性和適用於曲面車輛表面的特性,正日益受到青睞。

2024年,單晶矽市佔率為31%,預計2025-2034年將以12.6%的複合年成長率成長。其穩定的功率輸出和耐用性使其成為電動車和混合動力汽車車身整合式和車頂太陽能板的理想選擇。

亞太地區車載整合式太陽能電池半導體市場預計到2024年將佔據42.3%的市場佔有率,這主要得益於汽車和電子製造業的強勁發展。同時,歐洲正崛起為成長最快的地區,這主要歸功於嚴格的安全法規、電動車的快速普及以及太陽能技術與半導體邏輯的日益融合,從而打造出高效、適用於車輛的能源解決方案。

推動全球車載整合太陽能電池半導體市場發展的關鍵企業包括特斯拉、比亞迪、Aptera、豐田、福特、Lightyear、PlanetSolar、現代和Sono Motors。這些公司正積極致力於將新一代半導體與太陽能技術結合,從而推動智慧能源汽車的發展。車載整合太陽能電池半導體市場的領導者正透過創新、合作和垂直整合等方式拓展市場佔有率。許多企業正大力投資研發,以開發能夠實現高效能轉換並與太陽能電池無縫整合的半導體。與汽車製造商和一級供應商的策略合作,正促進著能夠最佳化電動車太陽能利用的能量管理系統的共同開發。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電動車和混合動力車的普及率不斷提高

- 太陽能半導體效率的進步

- 政府對綠色出行和節能車輛的激勵措施

- 轉型

- 消費者對永續和高階汽車設計的需求日益成長

- 產業陷阱與挑戰

- 在嚴苛的汽車條件下仍能保持耐久性和可靠性

- 高昂的製造和整合成本

- 市場機遇

- 鈣鈦礦和串聯半導體研發領域的投資不斷增加

- 與電動車和混合動力平台整合,以延長續航里程

- 拓展至兩輪及三輪車市場

- 透明和玻璃整合光伏系統的出現

- 成長潛力分析

- 監管環境

- 區域太陽能併網法規

- 國際標準協調

- 環境法規的影響

- 進出口限制

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利分析

- 成本細分分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 未來展望與路線圖

- 永續能源解決方案

- 跨產業融合趨勢

- 監管演變和標準制定

- 市場整合與合作策略

- 汽車級太陽能半導體供應鏈

- 汽車業資格要求

- 長期供應保障策略

- 品質管理系統要求

- 供應鏈風險緩解

- 地緣政治對太陽能供應的影響

- 成本效益與能源生產最佳化

- 太陽能電池每瓦成本分析

- 安裝和整合成本因素

- 能源回收期計算

- 總擁有成本模型

- 性能與價格權衡分析

- 汽車安全標準與太陽能整合

- 電氣安全要求(ISO 6469)

- 消防安全與熱失控預防

- 碰撞安全性和太陽能板性能

- 高壓系統整合安全

- 緊急應變程序

- 下一代太陽能技術演進

- 鈣鈦礦太陽能電池的研發

- 有機光伏技術進步

- 透明太陽能電池創新

- 軟性太陽能薄膜的演變

- 多結電池整合

- 聚光光電應用

- 能源管理與車輛系統整合

- 太陽能收集最佳化

- 電池管理系統整合

- 電力電子與轉換效率

- 儲能策略最佳化

- 負載管理和優先權

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依半導體產業分類,2021-2034年

- 主要趨勢

- 單晶矽

- 多晶矽

- 薄膜

- 鈣鈦礦太陽能電池

- 多節點

- 有機光伏(OPV)

第6章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 矽(Si)

- 銅銦鎵硒化物

- 碲化鎘(CdTe)

- 鈣鈦礦化合物

- 透明導電氧化物

- 聚合物基材

第7章:市場估算與預測:依整合類型分類,2021-2034年

- 主要趨勢

- 車輛整合光伏技術

- 車輛應用光伏技術

- 玻璃整合光伏

- 車身面板嵌入式光電系統

第8章:市場估算與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 商用車輛

- 電動車

- 兩輪/三輪車

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 牽引力補充

- 電池充電

- 暖通空調

- 車載資訊系統

- 能量收集

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 葡萄牙

- 克羅埃西亞

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第11章:公司簡介

- 全球參與者

- Toyota

- Hyundai

- Lightyear

- BMW Group

- Mercedes-Benz

- Audi AG

- Nissan Motor

- BYD Company

- Tesla

- Suno

- Aptera

- Goford

- 區域玩家

- Panasonic

- Sharp

- SunPower

- Hanwha Q CELLS

- First Solar

- Canadian Solar

- JinkoSolar Holding

- LONGi Solar

- 新興參與者

- Ubiquitous Energy

- Heliatek

- Oxford Photovoltaics

- Saule Technologies

- Solarmer Energy

- Armor

- Infinite Power Solutions

The Global Vehicle-Integrated Solar Cell Semiconductors Market was valued at USD 110.7 million in 2024 and is estimated to grow at a CAGR of 11.8% to reach USD 378.5 million by 2034.

Market growth is fueled by the acceleration of electric vehicle adoption, ongoing advances in semiconductor technology, and increasing demand for energy-efficient and secure power solutions. This momentum is largely influenced by the convergence of smart mobility innovations, enhanced vehicle electronics, and shifting competitive dynamics within the automotive semiconductor ecosystem. Post-pandemic emphasis on chip localization and supply chain resilience has also contributed to this growth, particularly across Asia and Europe. These regions are becoming hotspots for advanced semiconductor manufacturing, supported by rising investments in electrified transportation and digital infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110.7 Million |

| Forecast Value | $378.5 Million |

| CAGR | 11.8% |

Global vehicle electrification and the demand for in-vehicle energy efficiency are pushing automakers and Tier-1 suppliers to invest in chip-level integration, where solar cells work seamlessly with smart inverters, zonal controllers, and advanced power management ICs. These components are now being developed to operate directly with photovoltaic modules, enabling greater energy efficiency and more compact system designs. As vehicles evolve into intelligent, connected systems, innovations in semiconductor networking and architecture are becoming crucial in supporting this transformation.

In terms of materials, the silicon segment held a 45% share in 2024 and is forecasted to grow at a 12% CAGR through 2034. Silicon's dominance is backed by its high reliability, mature supply chains, and performance in diverse lighting conditions. At the same time, copper indium gallium selenide (CIGS) is seeing rising adoption due to its flexibility and suitability for curved vehicle surfaces.

The monocrystalline silicon segment accounted for a 31% share in 2024 and is expected to grow at a CAGR of 12.6% during 2025-2034. Its consistent power delivery and durability make it ideal for body-integrated and rooftop solar panels in EVs and hybrid models.

Asia-Pacific Vehicle-Integrated Solar Cell Semiconductors Market held 42.3% share in 2024, driven by strong progress in automotive and electronics manufacturing. Meanwhile, Europe is emerging as the fastest-growing region due to stringent safety regulations, rapid EV integration, and increasing fusion of solar technology with semiconductor logic to create efficient, vehicle-ready energy solutions.

Key players shaping the Global Vehicle-Integrated Solar Cell Semiconductors Market include Tesla, BYD, Aptera, Toyota, Go Ford, Lightyear, PlanetSolar, Hyundai, and Sono Motors. These companies are actively contributing to the evolution of smart, energy-producing vehicles by integrating next-gen semiconductors with solar technologies. Leading companies in the Vehicle-Integrated Solar Cell Semiconductors Market are leveraging a mix of innovation, collaboration, and vertical integration to expand their market presence. Many are investing heavily in R&D to develop semiconductors that enable high-efficiency energy conversion and seamless integration with solar cells. Strategic partnerships with automakers and Tier-1 suppliers are facilitating the co-development of energy management systems that optimize solar energy usage in EVs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Semiconductor

- 2.2.3 Material Type

- 2.2.4 Integration Type

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising adoption of electric and hybrid vehicles

- 3.2.1.3 Advancements in solar semiconductor efficiency

- 3.2.1.4 Government incentives for green mobility and energy-efficient vehicles

- 3.2.1.5 Shift toward energy-autonomous and smart vehicles

- 3.2.1.6 Growing consumer demand for sustainable and premium vehicle designs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Durability and reliability under harsh automotive conditions

- 3.2.2.2 High manufacturing and integration costs

- 3.2.3 Market opportunities

- 3.2.3.1 Rising investments in perovskite and tandem semiconductor R&D

- 3.2.3.2 Integration with EV and hybrid platforms for range extension

- 3.2.3.3 Expansion into two- and three-wheeler markets

- 3.2.3.4 Emergence of transparent and glass-integrated PV systems

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Regional solar integration regulations

- 3.4.2 International standards harmonization

- 3.4.3 Environmental Regulation Impact

- 3.4.4 Import/Export Restrictions

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Carbon footprint considerations

- 3.12 Future outlook and roadmap

- 3.12.1 Sustainable energy solutions

- 3.12.2 Cross-industry convergence trends

- 3.12.3 Regulatory evolution and standards development

- 3.12.4 Market consolidation and partnership strategies

- 3.13 Automotive-Grade Solar Semiconductor Supply Chain

- 3.13.1 Automotive qualification requirements

- 3.13.2 Long-term supply assurance strategies

- 3.13.3 Quality management system requirements

- 3.13.4 Supply chain risk mitigation

- 3.13.5 Geopolitical impact on solar supply

- 3.14 Cost-Effectiveness vs Energy Generation Optimization

- 3.1.1 Solar cell cost per watt analysis

- 3.14.2 Installation & integration cost factors

- 3.14.3 Energy payback time calculations

- 3.14.4 Total cost of ownership models

- 3.14.5 Performance vs price trade-off analysis

- 3.15 Automotive Safety Standards & Solar Integration

- 3.15.1 Electrical safety requirements (iso 6469)

- 3.15.2 Fire safety & thermal runaway prevention

- 3.15.3 Crash safety & solar panel behavior

- 3.15.4 High voltage system integration safety

- 3.15.5 Emergency response procedures

- 3.16 Next-Generation Solar Technology Evolution

- 3.16.1 Perovskite solar cell development

- 3.16.2 Organic photovoltaic advancement

- 3.16.3 Transparent solar cell innovation

- 3.16.4 Flexible solar film evolution

- 3.16.5 Multi-junction cell integration

- 3.16.6 Concentrated photovoltaic applications

- 3.17 Energy Management & Vehicle System Integration

- 3.17.1 Solar energy harvesting optimization

- 3.17.2 Battery management system integration

- 3.17.3 Power electronics & conversion efficiency

- 3.17.4 Energy storage strategy optimization

- 3.17.5 Load management & prioritization

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Semiconductor, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Monocrystalline Silicon

- 5.3 Polycrystalline Silicon

- 5.4 Thin-Film

- 5.5 Perovskite Solar Cells

- 5.6 Multi-Junction

- 5.7 Organic Photovoltaics (OPV)

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Silicon (Si)

- 6.3 Copper Indium Gallium Selenide

- 6.4 Cadmium Telluride (CdTe)

- 6.5 Perovskite compounds

- 6.6 Transparent conductive oxides

- 6.7 Polymer substrates

Chapter 7 Market Estimates & Forecast, By Integration Type, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Vehicle-Integrated Photovoltaics

- 7.3 Vehicle-Applied Photovoltaics

- 7.4 Glass-Integrated PV

- 7.5 Body Panel-Embedded PV

Chapter 8 Market Estimates & Forecast, By Vehicle Type, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Passenger Cars

- 8.3 Commercial Vehicles

- 8.4 Electric Vehicles

- 8.5 Two/Three-Wheelers

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Traction Power Supplement

- 9.3 Battery Charging

- 9.4 HVAC

- 9.5 Telematics

- 9.6 Energy Harvesting

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Toyota

- 11.1.2 Hyundai

- 11.1.3 Lightyear

- 11.1.4 BMW Group

- 11.1.5 Mercedes-Benz

- 11.1.6 Audi AG

- 11.1.7 Nissan Motor

- 11.1.8 BYD Company

- 11.1.9 Tesla

- 11.1.10 Suno

- 11.1.11 Aptera

- 11.1.12 Goford

- 11.2 Regional Players

- 11.2.1 Panasonic

- 11.2.2 Sharp

- 11.2.3 SunPower

- 11.2.4 Hanwha Q CELLS

- 11.2.5 First Solar

- 11.2.6 Canadian Solar

- 11.2.7 JinkoSolar Holding

- 11.2.8 LONGi Solar

- 11.3 Emerging Players

- 11.3.1 Ubiquitous Energy

- 11.3.2 Heliatek

- 11.3.3 Oxford Photovoltaics

- 11.3.4 Saule Technologies

- 11.3.5 Solarmer Energy

- 11.3.6 Armor

- 11.3.7 Infinite Power Solutions