|

市場調查報告書

商品編碼

1750443

寵物鳥健康市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pet Bird Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

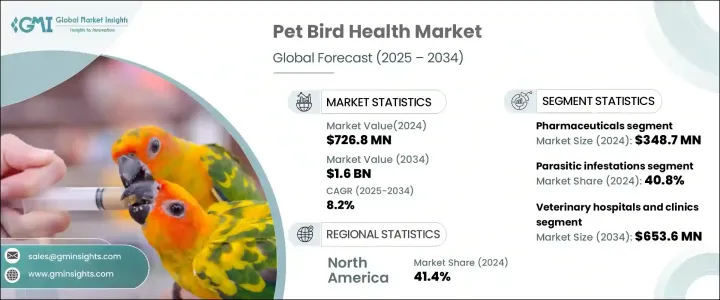

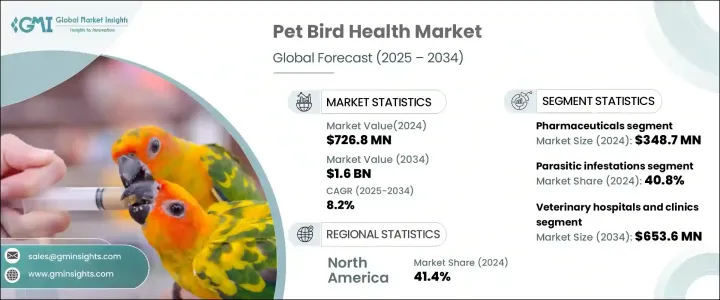

2024年,全球寵物鳥健康市場價值7.268億美元,預計到2034年將以8.2%的複合年成長率成長,達到16億美元。這得歸功於人們對鳥類健康狀況的日益重視,以及鳥類主人和獸醫紛紛採取預防性護理方法。隨著越來越多的人尋求鳥類疾病的早期診斷,影像技術、非侵入性診斷和行為評估的使用顯著增加。隨著預防性護理日益成為主流,診斷、營養科學和禽類醫學的進步正在持續改變全球鳥類健康的管理方式。

人們對全面健康照護日益成長的興趣,刺激了針對不同鳥類的專用補充劑、針對性治療和個人化獸醫策略的需求。如今,科技工具有助於早期發現疾病,延長鳥類壽命並提高整體生活品質。遠距醫療解決方案和行動獸醫服務彌補了醫療服務的差距,尤其是在偏遠地區。以寵物鳥飼養為重點的教育推廣有助於提高公眾意識,從而提高治療依從性,改善伴侶鳥的生活條件。所有這些因素共同支撐著市場的上升趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.268億美元 |

| 預測值 | 16億美元 |

| 複合年成長率 | 8.2% |

2024年,製藥領域以3.487億美元的市場規模領先市場,反映出對各種禽類細菌和真菌感染的管理需求日益成長。這個領域持續見證藥物劑型的創新—從口服藥物到外用製劑,這些創新正在帶來更好的治療效果。持證禽科獸醫數量的不斷成長也帶來了處方量的增加,促使製藥公司拓展其產品線。此外,專為鳥類設計的抗寄生蟲和營養療法也越來越受到市場的青睞。

2024年,寄生蟲感染佔寵物鳥感染總數的40.8%,凸顯了對寵物鳥健康的廣泛影響。體內和體外的寄生蟲持續威脅鳥類的健康。腸道蠕蟲和原生動物引起的疾病常常導致食慾不振、消化問題和免疫力下降。隨著人們對這些風險的認知不斷提高,抗寄生蟲解決方案的使用也日益增多,包括藥物飼料、外用藥物和預防性補充劑。

2024年,美國寵物鳥健康市場規模達2.729億美元,這得益於寵物鳥擁有量的增加、獸醫護理服務管道的改善以及消費者對預防性保健的日益關注。隨著越來越多的主人為寵物鳥購買保險,定期體檢和診斷逐漸成為常態。鳥類健康產品透過線上零售通路銷售,擴大了消費者覆蓋範圍。

Vetnil、IDEXX、Vetafarm、Virbac、默克公司、INDICAL BIOSCIENCE、AdvaCare Pharma、Wildlife Computers、VioVet、CJ Wildlife、賽默飛世爾科技、HomeoPet 和 Pranidhi Veterinary Diagnostics 等公司正在透過開發針對特定物種的解決方案、推出教育平台和拓展獸醫地位。許多公司投資禽類研發,以開發更有效的治療方法,同時與獸醫專業人士合作,改進產品交付並改善動物結果。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 提高對禽類健康與福利的認知

- 鳥類收養和外來寵物趨勢的增加

- 禽類診斷和治療的進展

- 產業陷阱與挑戰

- 針對特定物種的獸藥供應有限

- 鳥類治療費用高且保險普及率低

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品和服務,2021-2034 年

- 主要趨勢

- 製藥

- 藥物

- 疫苗

- 營養補充品

- 診斷和監控

- 診斷設備

- 監控設備

- 耗材

- 服務

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 寄生蟲感染

- 細菌感染

- 其他應用

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 獸醫醫院和診所

- 寵物鳥主人(家庭照顧)

- 鳥舍和鳥類保護區

- 其他最終用途

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AdvaCare Pharma

- Bimeda

- CJ Wildlife

- Hidrolab

- HomeoPet

- IDEXX

- INDICAL BIOSCIENCE

- Meadow's Animal Healthcare

- Merck & Co.

- Pranidhi Veterinary Diagnostics

- Thermo Fisher Scientific

- Vetafarm

- vetagenix

- Vetnil

- VioVet

- Virbac

- Wildlife Computers

- Zhejiang Pushkang Biotechnology

The Global Pet Bird Health Market was valued at USD 726.8 million in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 1.6 billion by 2034, propelled by the increasing recognition of avian health conditions and the adoption of preventative care approaches by bird owners and veterinarians alike. With more people seeking early diagnosis for avian ailments, there has been a noticeable uptick in the use of imaging technologies, non-invasive diagnostics, and behavioral assessments. As preventive care becomes more mainstream, advancements in diagnostics, nutritional science, and avian medicine continue to transform how bird health is managed globally.

Increased interest in comprehensive wellness care fuels demand for specialized supplements, targeted treatments, and personalized veterinary strategies tailored to various bird species. Technological tools now assist with early disease detection, improving bird longevity and overall quality of life. Telehealth solutions and mobile veterinary services bridge care gaps, especially in remote regions. Educational outreach focused on pet bird husbandry helps in driving awareness, leading to higher treatment adherence and better living conditions for companion birds. Collectively, these factors are sustaining the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $726.8 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 8.2% |

The pharmaceuticals segment led the market with USD 348.7 million in 2024, reflecting the growing need to manage a range of avian bacterial and fungal infections. This segment continues to see innovation in drug formats-from oral treatments to topical formulations, which are delivering better therapeutic results. The growing number of certified avian veterinarians is increasing prescriptions, prompting pharmaceutical firms to broaden their product offerings. Additionally, antiparasitic and nutritional therapies specifically designed for birds are gaining traction in the market.

Parasitic infestations held a 40.8% share in 2024, underscoring their widespread impact on pet bird health. Both internal and external parasites continue to pose threats to avian wellness. Conditions caused by intestinal worms and protozoa often result in appetite loss, digestive issues, and weakened immunity. Rising awareness about these risks has led to greater use of anti-parasitic solutions, including medicated feeds, topical agents, and preventative supplements.

U.S. Pet Bird Health Market generated USD 272.9 million in 2024, supported by rising pet bird ownership, improved access to veterinary care, and increasing consumer focus on preventative wellness. With more owners seeking insurance for pet birds, routine checkups and diagnostics are becoming standard. The availability of bird health products through online retail channels expands consumer reach.

Companies like Vetnil, IDEXX, Vetafarm, Virbac, Merck & Co., INDICAL BIOSCIENCE, AdvaCare Pharma, Wildlife Computers, VioVet, CJ Wildlife, Thermo Fisher Scientific, HomeoPet, and Pranidhi Veterinary Diagnostics are strengthening their foothold by developing species-specific solutions, launching e-commerce platforms, and expanding veterinary education programs. Many invest in avian R&D to produce more effective treatments while collaborating with veterinary professionals to refine product delivery and improve animal outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising awareness of avian health and welfare

- 3.2.1.2 Increase in bird adoption and exotic pet trends

- 3.2.1.3 Advances in avian diagnostics and therapeutics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited availability of species-specific veterinary drugs

- 3.2.2.2 High treatment costs and low insurance penetration for birds

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Products and Services, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Drugs

- 5.2.2 Vaccines

- 5.2.3 Nutritional supplements

- 5.3 Diagnostics and monitoring

- 5.3.1 Diagnostic equipment

- 5.3.2 Monitoring devices

- 5.3.3 Consumables

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parasitic infestations

- 6.3 Bacterial infections

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Veterinary hospitals and clinics

- 7.3 Pet bird owners (home care)

- 7.4 Aviaries and bird sanctuaries

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AdvaCare Pharma

- 9.2 Bimeda

- 9.3 CJ Wildlife

- 9.4 Hidrolab

- 9.5 HomeoPet

- 9.6 IDEXX

- 9.7 INDICAL BIOSCIENCE

- 9.8 Meadow's Animal Healthcare

- 9.9 Merck & Co.

- 9.10 Pranidhi Veterinary Diagnostics

- 9.11 Thermo Fisher Scientific

- 9.12 Vetafarm

- 9.13 vetagenix

- 9.14 Vetnil

- 9.15 VioVet

- 9.16 Virbac

- 9.17 Wildlife Computers

- 9.18 Zhejiang Pushkang Biotechnology