|

市場調查報告書

商品編碼

1750441

非公路電動車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Off-highway Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

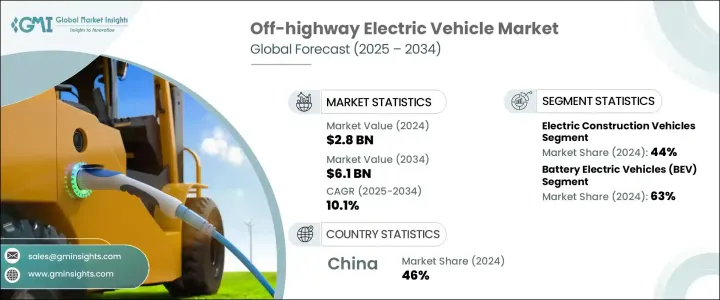

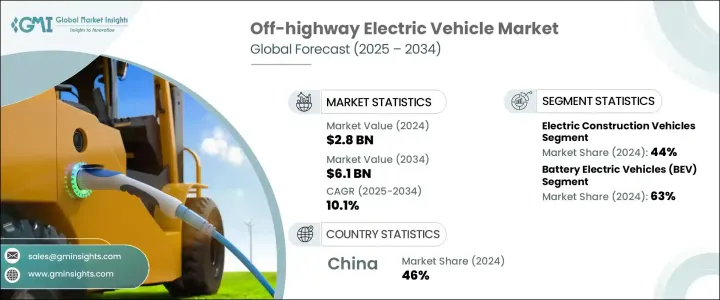

2024年,全球非公路用電動車市場規模達28億美元,預計2034年將以10.1%的複合年成長率成長,達到61億美元。這主要得益於嚴格的環境法規和減排目標,尤其是在建築、採礦和農業等傳統上依賴重型柴油機械的行業。世界各國政府正在實施更嚴格的排放標準,促使企業採用電動車作為更清潔的替代方案,以符合當地和國際環境標準。

由於不斷發展的城市對永續高效建築設備的需求不斷成長,城鎮化和基礎設施擴張成為全電動車輛市場的主要成長動力。隨著城市不斷發展和基礎設施需求的增加,降低建築工地噪音和空氣污染的壓力空前高漲。電動非公路車輛不僅滿足了這項需求,也符合市政當局和政府設定的永續發展目標。這些車輛尤其適合嚴格執行排放限制和噪音法規的城市環境。此外,由於運動部件減少和燃料成本降低,營運成本的降低使電動車型成為承包商越來越有吸引力的投資對象。隨著技術的不斷進步,電動車的動力和效率不斷提升,進一步增強了其處理高強度施工任務的能力,同時支持全球向環保發展轉型。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 61億美元 |

| 複合年成長率 | 10.1% |

電動工程車輛市場佔44%的市場佔有率,預計在2025-2034年期間的複合年成長率為10.5%。由於該行業的快速城鎮化、基礎設施建設以及日益成長的減排壓力,電動工程車輛在全封閉式電動車輛市場中佔據最高佔有率。建築活動通常發生在人口稠密的城市地區,噪音和空氣污染是主要問題,因此電動車非常適合。此外,各國政府正在對施工區域實施更嚴格的排放法規,尤其是在已開發地區和環境敏感地區。

純電動車細分市場佔63%的市場佔有率,預計2025年至2034年期間的複合年成長率為10.2%。鋰離子電池技術的進步顯著提高了能量密度、充電速度和使用壽命,使純電動車在建築和採礦等非公路應用中更加實用且經濟高效。純電動車在運行過程中實現零排放,符合全球監管壓力和永續發展目標,尤其是在減少空氣污染至關重要的城市化地區。此外,與內燃機汽車相比,純電動車的運作和維護成本更低,因為它們的運動部件更少,維護需求也更低。

由於政府的大力支持、完善的基礎設施以及對永續建築和採礦設備日益成長的需求,中國非公路用電動車市場在2024年佔據了46%的市場佔有率,市場規模達到5.572億美元。推動碳中和的政策和電動車補貼加速了電動車的普及。中國原始設備製造商正在大力投資研發,重點關注電池效率和智慧系統。該地區受益於完善的電池製造生態系統和日益加速的城鎮化進程,推動了對低排放設備的需求。

全球非公路用電動車輛產業的主要參與者包括徐工集團、日立建機、久保田、Caterpillar、三一重工、利勃海爾、小松、威克諾森、沃爾沃集團和迪爾公司。這些公司正致力於引進新技術,以鞏固其市場地位。車輛的研發旨在提高燃油效率,實現最佳作業性能和速度,並降低噪音水平。這些創新有望促進電動非公路用車輛在各行各業的普及。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 電池製造商和供應商

- 原始設備製造商 (OEM)

- 技術和軟體供應商

- 分銷、銷售和售後服務供應商

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 嚴格的環境法規與減排目標

- 人們對永續性和環境議題的認知不斷提高

- 電池和引擎的技術進步

- 政府激勵和補貼

- 都市化和基礎設施擴張

- 產業陷阱與挑戰

- 初始購買成本高

- 電池續航範圍和運行時間有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 電動工程車輛

- 挖土機

- 推土機

- 裝載機

- 電動農用車

- 聯結機

- 收割機

- 噴霧器

- 電動採礦車

- 運輸卡車

- 鑽頭

- 其他

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 純電動車(BEV)

- 插電式混合動力車(PHEV)

- 混合動力電動車(HEV)

- 燃料電池電動車(FCEV)

第7章:市場估計與預測:依電池容量,2021 - 2034 年

- 主要趨勢

- 少於50度

- 50–200 千瓦時

- 超過200度

第8章:市場估計與預測:依發電量,2021 - 2034

- 主要趨勢

- 低於50 HP

- 50–150 生命值

- 超過150馬力

第9章:市場估計與預測:按應用,2021 - 2034 年

- 建造

- 農業

- 礦業

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Bell Equipment

- Caterpillar

- CNH Industrial

- Deere & Company

- DEUTZ AG

- Doosan

- Hitachi Construction Machinery

- JCB

- Komatsu

- Kubota

- Liebherr

- Manitou Group

- Sany

- Solectrac

- Stihl Holding

- Sumitomo Heavy Industries

- Terex Corporation

- Volvo AB

- Wacker Neuson

- XCMG

The Global Off-highway Electric Vehicle Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 6.1 billion by 2034 driven by stringent environmental regulations and emissions reduction targets, particularly in industries like construction, mining, and agriculture, which traditionally rely on heavy diesel-powered machinery. Governments worldwide are enforcing tighter emissions standards, pushing companies to adopt electric vehicles as a cleaner alternative to comply with local and international environmental standards.

Urbanization and infrastructure expansion are key growth drivers for the OHEV market due to the increasing demand for sustainable and efficient construction equipment in growing cities. As cities continue to grow and infrastructure demands increase, the pressure to reduce noise and air pollution on construction sites has never been higher. Electric off-highway vehicles not only meet this demand but also align with sustainability goals set by municipalities and governments. These vehicles are especially well-suited for urban environments where emissions limits and noise ordinances are strictly enforced. Additionally, the operational cost savings-thanks to fewer moving parts and lower fuel expenses-make electric models an increasingly attractive investment for contractors. As technology continues to improve, electric vehicles are becoming more powerful and efficient, further enhancing their capability to handle intensive construction tasks while supporting the global shift toward environmentally responsible development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 10.1% |

The electric construction vehicles segment held a 44% share and is expected to grow at a CAGR of 10.5% during 2025-2034. Electric construction vehicles hold the highest market share in the OHEV market due to the sector's rapid urbanization, infrastructure development, and growing pressure to reduce emissions on job sites. Construction activities often occur in densely populated urban areas where noise and air pollution are major concerns, making electric vehicles highly suitable. Additionally, governments are enforcing stricter emissions regulations for construction zones, especially in developed and environmentally sensitive regions.

The Battery Electric Vehicles segment held 63% share and is expected to grow at a CAGR of 10.2% from 2025 - 2034. Advancements in lithium-ion battery technology have significantly improved energy density, charging speed, and lifespan, making BEVs more practical and cost-effective for off-highway applications like construction and mining. BEVs offer zero emissions during operation, aligning with global regulatory pressures and sustainability goals, especially in urbanized areas where reducing air pollution is critical. Moreover, BEVs have lower operational and maintenance costs compared to internal combustion engine vehicles, as they have fewer moving parts and require less upkeep.

China Off-highway Electric Vehicle Market held a 46% share and generated USD 557.2 million in 2024 due to strong government support, robust infrastructure, and a growing demand for sustainable construction and mining equipment. Policies promoting carbon neutrality and subsidies for electric vehicles have accelerated adoption. Chinese OEMs are investing heavily in R&D, focusing on battery efficiency and intelligent systems. The region benefits from a well-established battery manufacturing ecosystem and increasing urbanization, driving demand for low-emission equipment.

Major players operating in the Global Off-Highway Electric Vehicle Industry include XCMG, Hitachi Construction Machinery, Kubota, Caterpillar, Sany, Liebherr, Komatsu, Wacker Neuson, Volvo AB, and Deere & Company. These companies are focusing on introducing new technologies to strengthen their position in the market. The development in vehicles aims to improve fuel efficiency, delivering optimal job performance , speed, and reduce noise levels. Such innovations are expected to enhance the adoption of electric off-highway vehicles in various industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Battery manufacturers and suppliers

- 3.2.3 Original Equipment Manufacturers (OEMs)

- 3.2.4 Technology and software providers

- 3.2.5 Distribution, sales, and aftermarket service providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Stringent environmental regulations and emissions reduction targets

- 3.11.1.2 Growing awareness of sustainability and environmental concerns

- 3.11.1.3 Technological advancements in batteries and motors

- 3.11.1.4 Government incentives and subsidies

- 3.11.1.5 Urbanization and infrastructure expansion

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial purchase cost

- 3.11.2.2 Limited battery range and operating time

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electric construction vehicles

- 5.2.1 Excavators

- 5.2.2 Bulldozers

- 5.2.3 Loaders

- 5.3 Electric agricultural vehicles

- 5.3.1 Tractors

- 5.3.2 Harvesters

- 5.3.3 Sprayers

- 5.4 Electric mining vehicles

- 5.4.1 Haul trucks

- 5.4.2 Drills

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Plug-in hybrid electric vehicles (PHEV)

- 6.4 Hybrid electric vehicles (HEV)

- 6.5 Fuel cell electric vehicles (FCEVs)

Chapter 7 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Less than 50 kWh

- 7.3 50–200 kWh

- 7.4 More than 200 kWh

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Less than 50 HP

- 8.3 50–150 HP

- 8.4 More than 150 HP

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Construction

- 9.2 Agriculture

- 9.3 Mining

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bell Equipment

- 11.2 Caterpillar

- 11.3 CNH Industrial

- 11.4 Deere & Company

- 11.5 DEUTZ AG

- 11.6 Doosan

- 11.7 Hitachi Construction Machinery

- 11.8 JCB

- 11.9 Komatsu

- 11.10 Kubota

- 11.11 Liebherr

- 11.12 Manitou Group

- 11.13 Sany

- 11.14 Solectrac

- 11.15 Stihl Holding

- 11.16 Sumitomo Heavy Industries

- 11.17 Terex Corporation

- 11.18 Volvo AB

- 11.19 Wacker Neuson

- 11.20 XCMG