|

市場調查報告書

商品編碼

1750419

胸骨閉合系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Sternal Closure Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

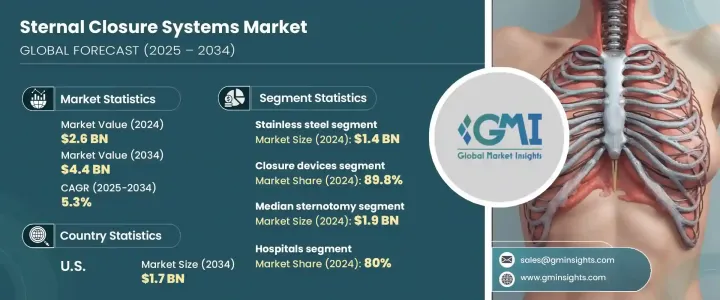

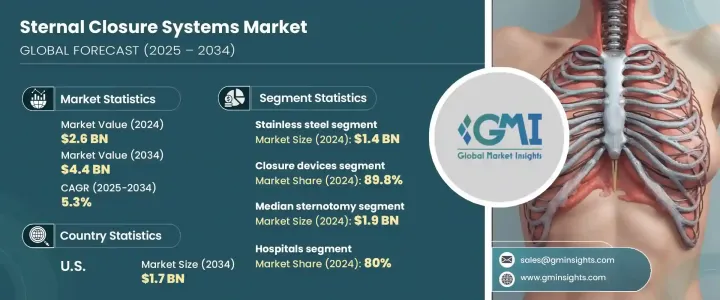

2024年,全球胸骨閉合系統市場規模達26億美元,預計2034年將以5.3%的複合年成長率成長,達到44億美元。這主要得益於冠狀動脈疾病等心血管疾病的日益流行,這使得開胸手術(尤其是正中胸骨切開術)變得更加普遍。隨著心臟手術數量的增加,對有效胸骨閉合裝置的需求也隨之激增。先進的胸骨閉合系統透過降低感染風險、改善癒合過程並最大程度縮短住院時間,改善了患者的預後。這些系統的成功應用降低了術後併發症的發生率,從而促進了其應用和整體市場的成長。

胸骨閉合系統是一種醫療器械,用於在心臟手術等術後穩定和閉合胸骨。這些裝置透過將胸骨的兩半固定在一起,防止傷口裂開和感染等併發症。這些系統中常用的器械包括導絲、鋼板、螺絲、夾子和骨水泥,這些器械對於確保術後良好癒合和預防機械問題至關重要。新型、更有效率的胸骨閉合裝置(例如採用抗菌塗層或可吸收技術的裝置)的開發,持續推動市場的發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 44億美元 |

| 複合年成長率 | 5.3% |

2024年,器械領域佔據了最大的市場佔有率,達到89.8%。開胸手術(尤其是冠狀動脈繞道手術和心臟瓣膜置換術)數量的不斷增加,持續推動了胸骨閉合裝置的需求。由於心血管疾病仍然是全球主要死亡原因,對可靠且高效的術後胸骨固定系統的需求日益成長。此外,先進的技術和固定方法,尤其是針對高風險或複雜病例的固定方法,正變得越來越普及,這進一步推動了市場的成長。

2024年,不鏽鋼胸骨閉合系統細分市場收入最高,達14億美元。不銹鋼因其成本效益和耐用性而備受青睞,是預算緊張的醫院的理想選擇。在高容量手術環境中,尤其是在公立醫院和中低收入地區,不銹鋼在保持機械完整性的同時也能耐受滅菌,這一點至關重要。經濟實惠且性能可靠的優勢使其成為廣受歡迎的選擇。

2024年,美國胸骨閉合系統市場規模達11億美元,預計2034年將達17億美元。美國人口老化和心臟病高發病率是推動這一成長的主要因素。此外,醫療機構擴大採用先進的胸骨閉合系統,以減少傷口感染等併發症,並改善復健效果。這些系統有助於醫院滿足醫療保險和醫療補助服務中心等機構的成本效益和優質照護標準。

全球胸骨閉合系統市場的一些主要參與者包括 Jeil Medical、Zimmer Biomet、Acumed、Stryker、KLS Martin、Orthofix、強生和 Praesidia。胸骨閉合系統市場的關鍵策略包括投資研發,透過抗菌塗層和可吸收技術等創新功能增強產品供應。他們也透過策略合作夥伴關係、收購和合作來加強市場佔有率。公司正在不斷擴展其產品組合,為各種患者需求提供更通用、更有效的解決方案。此外,加強銷售和分銷網路,尤其是在新興市場,有助於這些公司鞏固立足點並接觸更廣泛的客戶群。透過不斷改進產品的功能和性能,這些參與者確保了在競爭激烈的市場中的長期成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 胸骨切開技術的技術進步

- 心胸外科手術數量不斷增加

- 主要市場醫療報銷管道日益普及

- 人們對微創手術和更快恢復解決方案的偏好日益增加

- 產業陷阱與挑戰

- 胸骨閉合相關併發症

- 先進封閉系統成本高昂

- 成長動力

- 成長潛力分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮川普政府關稅

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 監管格局

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 封閉裝置

- 電線

- 鋼板和螺絲

- 夾子和帶子

- 骨水泥

第6章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 不銹鋼

- 鈦

- 聚醚醚酮(PEEK)

第7章:市場估計與預測:按程序,2021 年至 2034 年

- 主要趨勢

- 正中胸骨切開術

- 半胸骨切開術

- 雙側開胸手術

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 專科診所

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Able Medical

- Abyrx

- Acumed

- B. Braun

- IDEAR

- Jace Medical

- Jeil Medical

- Johnson & Johnson

- Kinamed

- KLS Martin

- Orthofix

- Praesidia

- Stryker

- Waston Medical

- Zimmer Biomet

The Global Sternal Closure Systems Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 4.4 billion by 2034, driven by the increasing prevalence of cardiovascular diseases, such as coronary artery disease, which has made open-heart surgeries, especially median sternotomies, more common. As the number of cardiac surgeries rises, the demand for effective sternal closure devices has surged. Advanced sternal closure systems have enhanced patient outcomes by reducing infection risks, improving healing, and minimizing hospital stay times. The success of these systems has led to lower post-surgical complications, boosting their use and the overall market growth.

Sternal closure systems are medical devices designed to stabilize and close the sternum after surgeries like heart surgery. These devices prevent complications such as wound dehiscence and infection by holding the two halves of the sternum together. Common devices used in these systems include wires, plates, screws, clips, and bone cement, which are essential for ensuring proper healing and preventing mechanical issues after surgery. The development of new, more efficient sternal closure devices, such as those using antimicrobial coatings or resorbable technology, continues to push the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 5.3% |

The devices segment held the largest market share of 89.8% in 2024. The increasing number of open-heart surgeries, particularly coronary artery bypass grafting and heart valve replacement, continues to drive the demand for sternal closure devices. As cardiovascular diseases remain a leading cause of death worldwide, the need for reliable and efficient systems to fixate the sternum post-surgery is growing. Furthermore, advanced techniques and fixation methods, especially for high-risk or complicated cases, are becoming more prevalent, further propelling market growth.

In 2024, the stainless steel sternal closure systems segment generated the largest revenue, valued at USD 1.4 billion. Stainless steel is favored due to its cost-effectiveness and durability, making it ideal for hospitals operating under tight budget constraints. Its ability to withstand sterilization while maintaining mechanical integrity is crucial in high-volume surgical environments, particularly in public hospitals and low-to-middle-income regions. This combination of affordability and reliability makes stainless steel a popular choice.

U.S. Sternal Closure Systems Market was valued at USD 1.1 billion in 2024 and is anticipated to reach USD 1.7 billion by 2034. The aging population and the high incidence of heart conditions in the U.S. are the main drivers behind this growth. Furthermore, healthcare institutions are increasingly adopting advanced sternal closure systems to reduce complications like wound infections and improve recovery outcomes. These systems help hospitals meet the cost-effectiveness and quality care standards of organizations like the Centers for Medicare & Medicaid Services.

Some key players in the Global Sternal Closure Systems Market include Jeil Medical, Zimmer Biomet, Acumed, Stryker, KLS Martin, Orthofix, Johnson & Johnson, and Praesidia. Key strategies in the sternal closure systems market include investing in research and development to enhance product offerings with innovative features, such as antimicrobial coatings and resorbable technologies. They also strengthen their market presence through strategic partnerships, acquisitions, and collaborations. Companies are increasingly expanding their product portfolios to offer more versatile and effective solutions for various patient needs. Additionally, enhancing their sales and distribution networks, particularly in emerging markets, helps these companies strengthen their foothold and reach a broader customer base. By continuously improving the functionality and performance of their products, these players ensure long-term growth in the competitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in sternotomy techniques

- 3.2.1.2 Increasing number of cardiothoracic surgical procedures

- 3.2.1.3 Growing availability of medical reimbursement across major markets

- 3.2.1.4 Rising preference for minimally invasive procedures and faster recovery solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications associated with sternal closure

- 3.2.2.2 High cost of advanced closure systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Closure devices

- 5.2.1 Wires

- 5.2.2 Plates and screws

- 5.2.3 Clips and straps

- 5.3 Bone cement

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Titanium

- 6.4 Polyether ether ketone (PEEK)

Chapter 7 Market Estimates and Forecast, By Procedure, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Median sternotomy

- 7.3 Hemistemotomy

- 7.4 Bilateral thoracotomy

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Specialty clinics

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Mexico

- 9.5.2 Brazil

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Able Medical

- 10.2 Abyrx

- 10.3 Acumed

- 10.4 B. Braun

- 10.5 IDEAR

- 10.6 Jace Medical

- 10.7 Jeil Medical

- 10.8 Johnson & Johnson

- 10.9 Kinamed

- 10.10 KLS Martin

- 10.11 Orthofix

- 10.12 Praesidia

- 10.13 Stryker

- 10.14 Waston Medical

- 10.15 Zimmer Biomet