|

市場調查報告書

商品編碼

1750355

器官晶片市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Organ-on-chips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

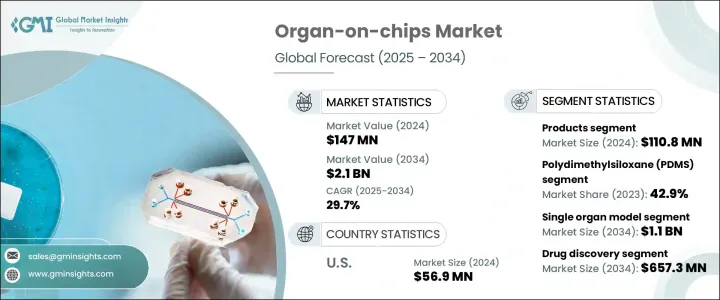

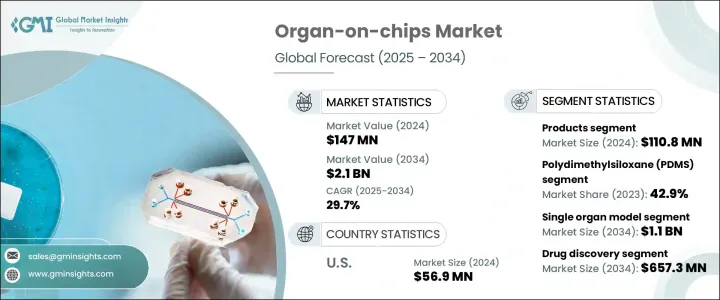

2024年,全球器官晶片市場規模達1.47億美元,預計年複合成長率將達29.7%,到2034年將達21億美元。需求激增的促進因素包括:迫切需要減少動物試驗;組織工程和微流體技術不斷取得突破;以及向精準醫療和簡化藥物開發的轉變。此外,人們越來越傾向於更快、更具成本效益的臨床前測試解決方案,以便提供對人體生理學的精準洞察。

全球慢性病發病率持續上升,這對醫療保健和研究系統造成越來越大的壓力,迫使它們採用創新技術,以更深入地了解疾病的發展路徑和治療反應。這些疾病需要客製化的研究模型,這促使器官晶片 (OoC) 設備得到更廣泛的應用。這些微型系統能夠在體外模擬人體器官的功能,為以更貼近人體的方式研究疾病行為和藥物效應提供了一種新方法。由於傳統測試方法在準確性、時間和成本方面的限制,其實用性逐漸下降,OoC 平台正被視為醫學研究和藥物開發的變革性工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.47億美元 |

| 預測值 | 21億美元 |

| 複合年成長率 | 29.7% |

就類型而言,市場分為產品和服務。包括各種器官模擬晶片在內的產品細分市場在2024年佔據最大佔有率,創造了1.108億美元的收入。這些晶片複製了器官的生理和功能,為研究人員提供了更好的藥物篩選和疾病建模工具。它們能夠模擬真實的人體器官反應,這使得它們比傳統的測試模型更具競爭優勢。

依材料分析,聚二甲基矽氧烷 (PDMS) 在 2023 年佔據市場主導地位,市佔率為 42.9%。該材料因其優異的生物相容性、透明性和易於製造而脫穎而出。其靈活性使研究人員能夠創建與人體組織高度相似的複雜器官晶片結構。基於 PDMS 的製造方法的技術改進提高了準確性、可擴展性和可重複性,這是推動器官晶片技術發展的關鍵因素。這反過來又推動了實驗室和商業研究機構的採用,旨在開發支援複雜測試環境的模型。

根據模型類型,市場細分為單一器官模型和多器官模型。單器官晶片在2024年佔據主導地位,預計2034年將達到11億美元。這些模型因其簡單、成本低且專注於特定的生理功能而備受青睞。它們能夠針對性地評估藥物毒性、藥效學和疾病特異性反應,使其成為早期研究的首選。簡單的維護和製造流程使其在學術和商業研究機構中廣泛應用。

根據應用,器官晶片市場可分為藥物研發、疾病建模、毒性測試、個人化醫療和其他用途。藥物研發領域在2024年佔據主導地位,預計2034年將成長至6.573億美元。器官晶片系統的高準確度和預測能力使製藥公司能夠最大限度地減少藥物開發過程中的反覆試驗。這些系統減少了對動物試驗的依賴,並提供了與人體相關的資料,有助於更早發現藥物失敗,並減少後期臨床試驗的損失。

就最終用戶而言,市場細分為製藥和生物技術公司、學術和研究機構以及其他領域。製藥和生物技術領域在2024年的收入最高,預計2034年將達到14億美元。該領域受益於降低開發成本、提高臨床前測試精度以及降低人體試驗相關風險的需求。各公司正在轉向OoC技術,以便更精確地模擬人體組織,並更有效地測試對新候選藥物的反應。

2024年,美國佔據了5,690萬美元的市場佔有率,從2022年的3,080萬美元成長到2023年的4,260萬美元,並維持了主導地位。預計2025年至2034年期間,美國市場的複合年成長率將達到28.6%。雄厚的科研資金、先進的醫療基礎設施以及支持性的監管舉措等因素推動了該地區市場的成長。美國致力於探索動物試驗的替代方案,並投入了大量的私人和公共資金,這些舉措將繼續支持動物實驗技術的推廣。

領先的公司佔據了約60%的整體市場佔有率,透過持續創新和推出新的、更先進的晶片模型來塑造行業格局。隨著人們對針對個體生物學客製化解決方案的興趣日益濃厚,器官晶片市場正迅速成為藥物開發、安全測試和個人化醫療策略的重要組成部分。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率不斷上升

- 個人化醫療需求日益成長

- 器官晶片技術不斷進步

- 擴大器官晶片模型在生物醫學應用的使用

- 產業陷阱與挑戰

- 實施器官晶片技術的挑戰與複雜性

- 監管障礙阻礙市場成長

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 產品

- 肝臟晶片

- 肺晶片

- 心臟晶片

- 腎臟晶片

- 其他產品

- 服務

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 聚二甲基矽氧烷(PDMS)

- 聚合物

- 玻璃

- 其他材料

第7章:市場估計與預測:按車型,2021 - 2034

- 主要趨勢

- 單一器官模型

- 多重器官模型

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 藥物研發

- 疾病模型

- 毒性測試

- 個人化醫療

- 其他應用

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥和生物技術公司

- 學術和研究機構

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Altis Biosystems

- AlveoliX

- Axosim

- Beonchip

- Bi/ond Solutions

- Cherry Biotech

- CN Bio Innovations

- Emulate

- Hesperos

- InSphero

- MesoBioTech

- Mimetas

- NETRI

- React4Life

- TissUse

The Global Organ-On-Chips Market was valued at USD 147 million in 2024 and is estimated to grow at a CAGR of 29.7% to reach USD 2.1 billion by 2034. The surge in demand is driven by the urgent need to reduce animal testing, ongoing breakthroughs in tissue engineering and microfluidics, and the growing shift toward precision medicine and streamlined drug development. There is also a rising preference for faster, more cost-effective preclinical testing solutions that can provide accurate insights into human physiology.

Chronic diseases continue to rise globally, placing increasing pressure on healthcare and research systems to adopt innovative technologies that allow a deeper understanding of disease pathways and therapeutic responses. These conditions, which require tailored research models, have led to wider adoption of organ-on-chip (OoC) devices. These miniature systems mimic the functions of human organs in vitro, offering a new approach to studying disease behavior and drug effects in a more realistic and human-relevant manner. As traditional testing methods become less practical due to limitations in accuracy, time, and cost, OoC platforms are being recognized as transformative tools in medical research and pharmaceutical development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $147 Million |

| Forecast Value | $2.1 Billion |

| CAGR | 29.7% |

In terms of type, the market is divided into products and services. The products segment, which includes various organ-mimicking chips, accounted for the largest share in 2024, generating USD 110.8 million in revenue. These chips replicate the physiological and functional aspects of organs, offering researchers better tools for drug screening and disease modeling. Their ability to imitate real-life human organ responses gives them a competitive edge over older testing models.

When analyzed by material, polydimethylsiloxane (PDMS) led the market in 2023, with a share of 42.9%. This material stands out due to its excellent biocompatibility, transparency, and ease of use in manufacturing. Its flexibility allows researchers to create intricate organ-on-chip structures that closely replicate human tissues. Technological improvements in PDMS-based fabrication methods have allowed for greater accuracy, scalability, and reproducibility, which are key factors in advancing organ-on-chip technologies. This, in turn, has fueled adoption across laboratories and commercial research facilities aiming to develop models that support complex testing environments.

Based on model type, the market is segmented into single organ models and multi-organ models. Single organ chips dominated in 2024 and are expected to reach USD 1.1 billion by 2034. These models are favored for their simplicity, lower cost, and focus on specific physiological functions. They enable targeted evaluation of drug toxicity, pharmacodynamics, and disease-specific responses, making them a preferred choice for early-phase studies. The straightforward maintenance and manufacturing processes make these chips practical for widespread use across academic and commercial research setups.

By application, the organ-on-chips market is categorized into drug discovery, disease modeling, toxicity testing, personalized medicine, and other uses. The drug discovery segment took the lead in 2024 and is projected to grow to USD 657.3 million by 2034. The high accuracy and predictive capabilities of OoC systems allow pharmaceutical companies to minimize trial and error during drug development. These systems reduce reliance on animal testing and provide human-relevant data, helping to identify drug failures earlier and reduce late-stage clinical trial losses.

Regarding end users, the market is segmented into pharmaceutical and biotechnology companies, academic and research institutes, and others. The pharmaceutical and biotechnology segment held the highest revenue in 2024 and is anticipated to reach USD 1.4 billion by 2034. This segment benefits from the need to cut down on development costs, improve the precision of preclinical testing, and reduce the risks associated with human trials. Companies are turning to OoC technology to produce more accurate simulations of human tissues and test reactions to new drug candidates more effectively.

The United States accounted for USD 56.9 million of the market in 2024, maintaining its dominance after growing from USD 30.8 million in 2022 to USD 42.6 million in 2023. Between 2025 and 2034, the U.S. market is forecast to grow at a CAGR of 28.6%. Factors such as strong research funding, advanced healthcare infrastructure, and supportive regulatory initiatives have fueled market growth in the region. The country's commitment to exploring alternatives to animal testing, along with robust private and public investments, continues to support the expansion of OoC technologies.

Leading companies account for around 60% of the overall market share, shaping the industry landscape through continuous innovation and the launch of new, more advanced chip models. With growing interest in customized solutions tailored to individual biology, the organ-on-chips market is rapidly becoming an integral part of drug development, safety testing, and personalized medicine strategies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic disease

- 3.2.1.2 Increasing demand for personalized medicine

- 3.2.1.3 Growing advancement in organ-on-chip technology

- 3.2.1.4 Expanding use of organ-on-chip models in biomedical applications

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Challenges and intricacies in implementing organ-on-chip techniques

- 3.2.2.2 Regulatory obstacles hinder the market growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Products

- 5.2.1 Liver-on-chip

- 5.2.2 Lung-on-chip

- 5.2.3 Heart-on-chip

- 5.2.4 Kidney-on-chip

- 5.2.5 Other products

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polydimethylsiloxane (PDMS)

- 6.3 Polymer

- 6.4 Glass

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By Model Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Single organ model

- 7.3 Multi-organ model

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drug discovery

- 8.3 Disease modeling

- 8.4 Toxicity testing

- 8.5 Personalized medicine

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Pharmaceutical and biotechnology companies

- 9.3 Academic and research institutes

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Altis Biosystems

- 11.2 AlveoliX

- 11.3 Axosim

- 11.4 Beonchip

- 11.5 Bi/ond Solutions

- 11.6 Cherry Biotech

- 11.7 CN Bio Innovations

- 11.8 Emulate

- 11.9 Hesperos

- 11.10 InSphero

- 11.11 MesoBioTech

- 11.12 Mimetas

- 11.13 NETRI

- 11.14 React4Life

- 11.15 TissUse