|

市場調查報告書

商品編碼

1750279

傳染病治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Infectious Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

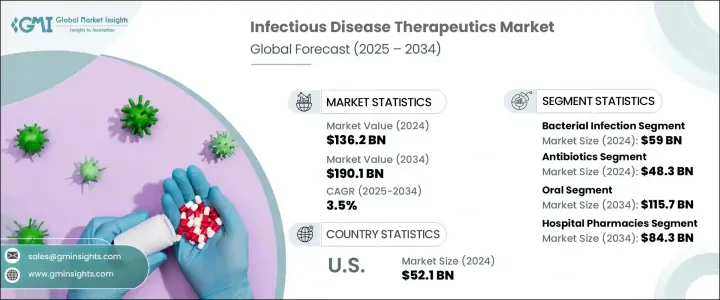

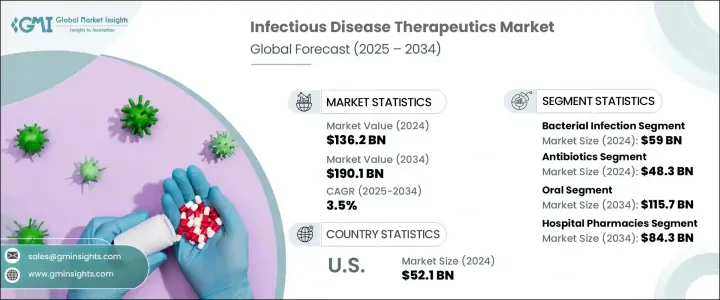

2024年,全球傳染病治療市場規模達1,362億美元,預計到2034年將以3.5%的複合年成長率成長,達到1,901億美元,這得益於全球傳染病發病率的不斷上升。針對細菌、病毒感染、真菌和寄生蟲病等感染性疾病的治療手段正得到更廣泛的應用,尤其是在人口成長和醫療保健涵蓋範圍不斷擴大的情況下。這些療法包括抗菌藥物和疫苗,它們透過針對病因或增強免疫力來治療或預防疾病。

此外,人畜共通傳染病由動物傳播給人類日益普遍,導致全球醫療體系的治療需求激增。都市化、森林砍伐和密集畜牧業等因素導致這些感染的發生率上升。值得注意的是,愛滋病毒等逆轉錄病毒疾病的全球持續負擔,持續催生了對先進抗病毒療法的強勁需求,從而鞏固了市場的上升勢頭。隨著宣傳活動的有效性和診斷技術的進步,早期檢測率正在不斷攀升。這一趨勢,加上成熟經濟體和發展中經濟體醫療基礎設施和保險覆蓋範圍的擴大,正在加速人們獲得治療的途徑,並推動市場穩步成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1362億美元 |

| 預測值 | 1901億美元 |

| 複合年成長率 | 3.5% |

2024年,細菌感染領域產值達590億美元。細菌性疾病易感性增加,很大程度上與營養不良、久坐不動的生活方式、人口老化以及糖尿病和癌症等慢性疾病的流行導致的免疫系統受損有關。在世界許多地區,尤其是在中低收入國家,衛生設施不足、水源污染以及食品衛生標準低下,持續加劇了細菌病原體的傳播。這些因素構成了持續的醫療保健挑戰,刺激了對有效抗生素、聯合療法和下一代治療方案的持續需求。

2024年,抗生素市場規模達483億美元。這些藥物仍是治療常見及嚴重細菌性疾病的基石。然而,傳統抗生素抗藥性的日益加劇,促使人們尋求新的治療方案和下一代抗生素的開發。抗藥性菌株的治療難度越來越大,這使得藥物創新和更廣泛的抗菌藥物研發管道更加緊迫。

2024年,美國傳染病治療市場規模達521億美元。多種因素鞏固了這一領先地位,包括老齡人口成長、抗菌素抗藥性病原體的傳播以及強勁的創新生態系統。醫療保健產業對先進生物製劑和標靶病原體免疫療法開發的持續投資,進一步提升了美國的市場地位。治療平台(尤其是疫苗研發和交付)的科學突破,塑造了疾病的預防和治療策略。

全球傳染病治療市場的主要公司正優先考慮研發創新、策略合作夥伴關係和法規核准,以擴大其產品供應和全球影響力。輝瑞和吉利德科學正在推進mRNA和抗病毒療法,而默克和葛蘭素史克則正在加強疫苗研究。羅氏製藥和強生公司繼續投資標靶生物製劑和下一代抗病毒藥物。賽諾菲和阿斯特捷利康正在與研究機構合作,以加速藥物開發。諾華和拜耳正致力於透過收購和授權協議來實現產品組合多元化。同時,山德士國際和勃林格殷格翰則利用生物相似藥途徑來增強其競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 傳染病發生率上升

- 創新療法的不斷發展

- 診斷技術的進步

- 產業陷阱與挑戰

- 抗生素抗藥性導致治療費用高昂

- 嚴格的法規核准

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按感染類型,2021 - 2034 年

- 主要趨勢

- 細菌感染

- 病毒感染

- 逆轉錄病毒感染(HIV/AIDS)

- 流感

- 肝炎

- 其他病毒感染

- 黴菌感染

- 寄生蟲感染

第6章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 抗生素

- 抗病毒藥物

- 抗真菌藥物

- 抗寄生蟲藥

- 疫苗

- 免疫療法

第7章:市場估計與預測:按管理模式,2021 - 2034 年

- 主要趨勢

- 口服

- 腸外

- 鼻內

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott Laboratories

- AstraZeneca

- Bayer

- Boehringer Ingelheim International

- Bristol-Myers Squibb

- F. Hoffmann-La Roche

- Gilead Sciences

- GlaxoSmithKline (GSK)

- Johnson & Johnson (Janssen Pharmaceuticals)

- Merck

- Novartis

- Pfizer

- Sandoz International

- Sanofi

The Global Infectious Disease Therapeutics Market was valued at USD 136.2 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 190.1 billion by 2034, driven by the increasing occurrence of infectious diseases globally. Treatments targeting infectious conditions from bacterial and viral infections to fungal and parasitic diseases are seeing wider adoption, particularly as populations grow and healthcare access expands. These therapies include antimicrobial drugs and vaccines that treat or prevent illnesses by targeting the root cause or strengthening immunity.

Additionally, zoonotic infections transmitted from animals to humans are becoming increasingly common, driving a surge in treatment requirements across global healthcare systems. Factors such as urbanization, deforestation, and intensified livestock farming contribute to the rising incidence of these infections. Notably, the persistent global burden of retroviral diseases like HIV continues to create a strong demand for advanced antiviral therapies, reinforcing the market's upward trajectory. As awareness campaigns grow more effective and diagnostic technologies improve, early detection rates are climbing. This trend, coupled with the expansion of healthcare infrastructure and insurance coverage in both mature and developing economies, is accelerating access to treatment and fueling steady market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $136.2 Billion |

| Forecast Value | $190.1 Billion |

| CAGR | 3.5% |

In 2024, the bacterial infections segment generated USD 59 billion. The increased vulnerability to bacterial illnesses is largely tied to compromised immune systems resulting from poor nutrition, sedentary lifestyles, aging populations, and the prevalence of chronic diseases such as diabetes and cancer. In many parts of the world, particularly in low- and middle-income countries, inadequate sanitation facilities, contaminated water sources, and insufficient food hygiene standards continue to amplify the spread of bacterial pathogens. These conditions create persistent healthcare challenges, spurring consistent demand for effective antibiotics, combination therapies, and next-generation treatment solutions.

The antibiotics segment generated USD 48.3 billion in 2024. These medications remain the cornerstone in managing common and serious bacterial conditions. However, the increasing resistance to traditional antibiotics has triggered a push for novel therapeutic solutions and next-generation antibiotic development. Drug-resistant strains are becoming more difficult to treat, which places greater urgency on pharmaceutical innovation and broader antimicrobial pipelines.

United States Infectious Disease Therapeutics Market generated USD 52.1 billion in 2024. Several factors have reinforced this leadership, including a growing elderly population, the spread of antimicrobial-resistant pathogens, and robust innovation ecosystems. The healthcare sector's continued investment in the development of advanced biologics and pathogen-targeted immunotherapies further enhances the country's market standing. Scientific breakthroughs in treatment platforms, especially in vaccine development and delivery, shape disease prevention and treatment strategies.

Key companies in the Global Infectious Disease Therapeutics Market are prioritizing R&D innovation, strategic partnerships, and regulatory approvals to expand their product offerings and global reach. Pfizer and Gilead Sciences are advancing mRNA and antiviral therapies, while Merck and GlaxoSmithKline are enhancing vaccine research. F. Hoffmann-La Roche and Johnson & Johnson continue to invest in targeted biologics and next-gen antivirals. Sanofi and AstraZeneca are collaborating with research institutions to accelerate drug development. Novartis and Bayer are focusing on portfolio diversification through acquisitions and licensing agreements. Meanwhile, Sandoz International and Boehringer Ingelheim leverage biosimilar pathways to strengthen their competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidences of infectious diseases

- 3.2.1.2 Increasing development of innovative therapeutics

- 3.2.1.3 Advancement in diagnostic technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs due to antimicrobial resistance

- 3.2.2.2 Stringent regulatory approvals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Infection Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bacterial infection

- 5.3 Viral infection

- 5.3.1 Retroviral infection(HIV/AIDS)

- 5.3.2 Influenza

- 5.3.3 Hepatitis

- 5.3.4 Other viral infections

- 5.4 Fungal infection

- 5.5 Parasitic infection

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antibiotics

- 6.3 Antivirals

- 6.4 Antifungals

- 6.5 Antiparasitic

- 6.6 Vaccines

- 6.7 Immunotherapies

Chapter 7 Market Estimates and Forecast, By Mode of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Intranasal

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 AstraZeneca

- 10.3 Bayer

- 10.4 Boehringer Ingelheim International

- 10.5 Bristol-Myers Squibb

- 10.6 F. Hoffmann-La Roche

- 10.7 Gilead Sciences

- 10.8 GlaxoSmithKline (GSK)

- 10.9 Johnson & Johnson (Janssen Pharmaceuticals)

- 10.10 Merck

- 10.11 Novartis

- 10.12 Pfizer

- 10.13 Sandoz International

- 10.14 Sanofi