|

市場調查報告書

商品編碼

1741008

痤瘡敏感肌膚保養產品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Acne Prone Sensitive Skin Care Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球易痘敏感肌膚保養產品市場規模達55億美元,預計到2034年將以6%的複合年成長率成長,達到98億美元。這主要得益於消費者偏好的轉變以及對安全護膚方案的日益重視。隨著越來越多的人報告皮膚刺激和泛紅等問題,對有效治療痤瘡且不會加劇皮膚敏感的產品的需求也日益成長。青少年和成年人都越來越意識到保持均衡護膚方案的重要性,這推動了市場需求的成長。消費者對保養品成分的了解也更加深入,更傾向於選擇溫和有效的配方。隨著這種意識的增強,人們越來越願意為滿足自身特定皮膚需求的產品支付更高的價格。

人工智慧驅動的皮膚診斷和個人化護膚工具的進步進一步促進了這個市場的發展。這些工具,例如線上測驗和皮膚分析系統,使品牌能夠提供符合個人獨特膚質和狀況的客製化產品。這一趨勢引起了消費者的共鳴,他們厭倦了千篇一律的解決方案,並熱衷於投資針對自身特定問題(例如痤瘡和皮膚敏感)的產品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 55億美元 |

| 預測值 | 98億美元 |

| 複合年成長率 | 6% |

市場分為多種產品類型,包括潔面乳、爽膚水、保濕霜、面膜和精華液。保濕霜在2024年佔據最大佔有率,貢獻了14億美元,預計到2034年將達到26億美元,這得益於保濕霜的多功能作用,它不僅能保濕,還能修復和舒緩敏感肌膚。含有菸鹼醯胺和透明質酸等成分的產品尤其受歡迎,因為它們能夠舒緩刺激,並帶來持久的護膚功效。

就產品類別而言,藥用產品佔據市場主導地位,2024 年市場規模達 29 億美元,預計到 2034 年將達到 52 億美元。藥用產品因其在治療痤瘡和解決潛在皮膚問題方面經證實的功效而備受青睞。這些產品通常含有皮膚科醫生推薦的活性成分,例如水楊酸、過氧化苯甲醯和抗生素。消費者更青睞藥用產品,因為它們見效更快,而他們對成分保養品的認知度不斷提升,也進一步推動了這個細分市場的成長。

2024年,中國易長痘敏感肌膚保養產品市場佔據31.5%的市場佔有率,這主要得益於人們對荷爾蒙失衡和整體皮膚健康的日益關注,尤其是在年輕一代。隨著越來越多的人意識到荷爾蒙對痤瘡等皮膚問題的影響,對針對性解決方案的需求激增。社群媒體和美妝達人的廣泛影響力在塑造消費者行為方面發揮了重要作用,許多人轉向線上平台尋求護膚推薦。這導致易長痘痘護膚產品的供應和可近性增加,進一步影響了消費者的偏好。

全球易長痘痘敏感肌膚保養產品市場的主要參與者包括科顏氏 (Kiehl's)、理膚泉 (La Roche-Posay)、Burt's Bees、CeraVe、Paula's Choice、Tata Harper、The Ordinary、聯合利華、Drunk Elephant、Coxnis、靈吟風吟 (Inxnis)、太平洋風吟 (Johnsrson &)。為了鞏固市場地位,各大公司專注於創新,利用人工智慧 (AI) 和皮膚分析工具,開發更先進、個人化的護膚解決方案。他們也注重成分採購和行銷的透明度,旨在與消費者建立信任。與皮膚科醫生和美妝達人的合作有助於打造有針對性、高效的產品線。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 對部隊的影響

- 成長動力

- 皮膚敏感和過敏症的盛行率不斷上升

- 提高消費者意識

- 需要有效且舒緩的解決方案

- 個人化產品日益流行

- 增加可支配收入

- 產業陷阱與挑戰

- 成本更高

- 找到成分之間的正確平衡

- 成長動力

- 成長潛力分析

- 消費者購買行為

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 清潔劑

- 保濕霜

- 爽膚水

- 面罩

- 精華液

- 其他

第6章:市場估計與預測:按類別,2021 - 2034 年

- 主要趨勢

- 藥

- 非藥物

第7章:市場估計與預測:按配方,2021 - 2034 年

- 主要趨勢

- 凝膠基

- 乳霜類

- 液體基

- 其他(粉末、棒狀等)

第8章:市場估計與預測:依成分,2021 - 2034 年

- 主要趨勢

- 自然的

- 合成的

- 混合

第9章:市場估計與預測:依包裝尺寸,2021 - 2034

- 主要趨勢

- 10-15毫升

- 15-30毫升

- 30-50毫升

- 100毫升以上

第10章:市場估計與預測:依價格區間,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 11 章:市場估計與預測:按年齡段,2021 年至 2034 年

- 主要趨勢

- 19歲以下

- 19歲 - 25歲

- 26歲 - 45歲

- 45歲以上

第 12 章:市場估計與預測:按消費者群體分類,2021 年至 2034 年

- 主要趨勢

- 男性

- 女性

第 13 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 個人使用

- 商業的

- 水療中心

- 美容院和沙龍

- 皮膚科和美容診所

- 其他(流動美容服務等)

第 14 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司擁有的網站

- 離線

- 專賣店

- 大型零售商店

- 製藥中心

- 其他(個人、百貨等)

第 15 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- MEA 其餘地區

第 16 章:公司簡介

- Amorepacific Corporation

- Johnson & Johnson

- Burt's Bees

- CeraVe

- Cetaphil

- Cosrx

- Drunk Elephant

- Innisfree

- Kiehl's

- Paula's Choice

- Purito

- La Roche-Posay

- Tata Harper

- The Ordinary

- Unilever

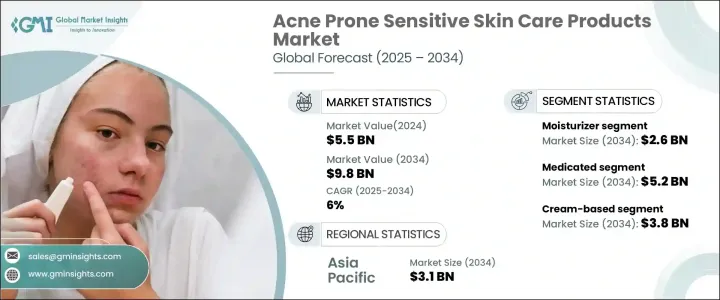

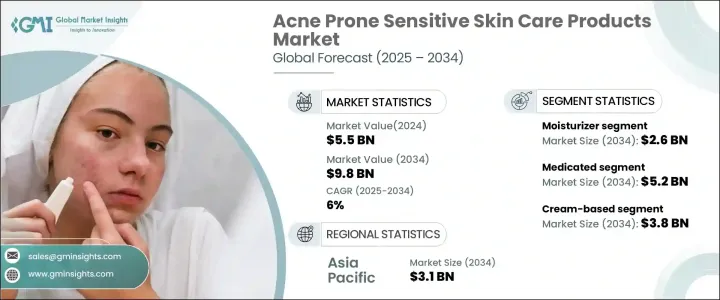

The Global Acne Prone Sensitive Skin care Products Market was valued at USD 5.5 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 9.8 billion by 2034, driven by shifting consumer preferences and an increasing focus on dermatologically safe skincare solutions. As more individuals report issues like skin irritation and redness, there is a growing demand for products that treat acne effectively without aggravating skin sensitivity. Both teens and adults are becoming more aware of the importance of maintaining a balanced skincare regimen, leading to an uptick in market demand. Consumers are also more knowledgeable about skincare ingredients, prioritizing formulations that are gentle yet effective. As this awareness rises, people are increasingly willing to pay a premium for products tailored to their specific skin needs.

The advancements in AI-driven skin diagnostics and personalized skincare tools have further bolstered this market. These tools, such as online quizzes and skin analysis systems, enable brands to offer customized products that cater to an individual's unique skin type and condition. This trend has resonated with consumers who are frustrated by generic solutions and are keen to invest in products designed to address their specific concerns, such as acne and sensitivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 6% |

The market is divided into various product types, including cleansers, toners, moisturizers, face masks, and serums. The moisturizer segment held the largest share in 2024, contributing USD 1.4 billion, and is expected to reach USD 2.6 billion by 2034 due to the multifunctional role moisturizers play, not only hydrating but also repairing and soothing sensitive skin. Products containing ingredients like niacinamide and hyaluronic acid are particularly popular for their ability to calm irritation and provide lasting skin benefits.

Regarding product categories, the medicated segment dominates the market, accounting for USD 2.9 billion in 2024 and is expected to reach USD 5.2 billion by 2034. Medicated products are favored due to their proven efficacy in treating acne and addressing underlying skin concerns. These products often feature dermatologist-recommended active ingredients like salicylic acid, benzoyl peroxide, and antibiotics. Consumers prefer medicated products for faster results, and their growing awareness of ingredient-based skincare has further fueled this segment's growth.

China Acne-Prone Sensitive Skin care Products Market held 31.5% share in 2024, driven by growing concerns over hormone imbalances and the overall health of the skin, especially among younger generations. As more people become aware of the impact hormones can have on skin conditions like acne, the demand for targeted solutions has surged. Social media and the widespread influence of beauty influencers have played a major role in shaping consumer behavior, with many turning to online platforms for skincare recommendations. This has led to an increase in the availability and accessibility of acne-prone skincare products, further influencing consumer preferences.

Major players in the Global Acne-Prone Sensitive Skin Care Products Market include Kiehl's, La Roche-Posay, Burt's Bees, CeraVe, Paula's Choice, Tata Harper, The Ordinary, Unilever, Drunk Elephant, Cosrx, Innisfree, Johnson & Johnson, and Amorepacific Corporation. To strengthen their presence, companies focus on innovation by developing more advanced, personalized skincare solutions, leveraging AI and skin analysis tools. They are also prioritizing transparency in ingredient sourcing and marketing, aiming to build trust with consumers. Collaborations with dermatologists and beauty influencers help create targeted, effective product lines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact on forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising prevalence of skin sensitivities and allergies

- 3.3.1.2 Heightened consumer awareness

- 3.3.1.3 Demand for effective yet soothing solutions

- 3.3.1.4 Growing popularity of personalized products

- 3.3.1.5 Increasing disposable income

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Higher cost

- 3.3.2.2 Finding the right balance between ingredients

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Consumer buying behavior

- 3.5.1 Demographic trends

- 3.5.2 Factors affecting buying decisions

- 3.5.3 Consumer product adoption

- 3.5.4 Preferred distribution channel

- 3.5.5 Preferred price range

- 3.6 Profit margin analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Cleansers

- 5.3 Moisturizers

- 5.4 Toners

- 5.5 Face masks

- 5.6 Serums

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Category, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Medicated

- 6.3 Non-medicated

Chapter 7 Market Estimates & Forecast, By Formulation, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Gel-based

- 7.3 Cream-based

- 7.4 Liquid-based

- 7.5 Others (powder, stick, etc.)

Chapter 8 Market Estimates & Forecast, By Ingredients, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Natural

- 8.3 Synthetic

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Pack Size, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 10-15 ml

- 9.3 15-30 ml

- 9.4 30-50 ml

- 9.5 Above 100 ml

Chapter 10 Market Estimates & Forecast, By Price Range, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates & Forecast, By Age Group, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Below 19 years

- 11.3 19 Years - 25 years

- 11.4 26 Years - 45 years

- 11.5 Above 45 years

Chapter 12 Market Estimates & Forecast, By Consumer Group, 2021 - 2034, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Male

- 12.3 Female

Chapter 13 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 13.1 Key trends

- 13.2 Individual use

- 13.3 Commercial

- 13.3.1 Spas

- 13.3.2 Beauty parlors and salons

- 13.3.3 Dermatological and cosmetology clinics

- 13.3.4 Others (mobile beauty services, etc.)

Chapter 14 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 14.1 Key trends

- 14.2 Online

- 14.2.1 E-commerce

- 14.2.2 Company owned website

- 14.3 Offline

- 14.3.1 Specialty stores

- 14.3.2 Mega retail stores

- 14.3.3 Pharma centers

- 14.3.4 Others (individuals and department stores, etc.)

Chapter 15 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 15.1 Key trends

- 15.2 North America

- 15.2.1 U.S.

- 15.2.2 Canada

- 15.3 Europe

- 15.3.1 Germany

- 15.3.2 UK

- 15.3.3 France

- 15.3.4 Italy

- 15.3.5 Spain

- 15.3.6 Rest of Europe

- 15.4 Asia Pacific

- 15.4.1 China

- 15.4.2 India

- 15.4.3 Japan

- 15.4.4 South Korea

- 15.4.5 Australia

- 15.5 Latin America

- 15.5.1 Brazil

- 15.5.2 Mexico

- 15.6 MEA

- 15.6.1 Saudi Arabia

- 15.6.2 UAE

- 15.6.3 South Africa

- 15.6.4 Rest of MEA

Chapter 16 Company Profiles

- 16.1 Amorepacific Corporation

- 16.2 Johnson & Johnson

- 16.3 Burt's Bees

- 16.4 CeraVe

- 16.5 Cetaphil

- 16.6 Cosrx

- 16.7 Drunk Elephant

- 16.8 Innisfree

- 16.9 Kiehl's

- 16.10 Paula's Choice

- 16.11 Purito

- 16.12 La Roche-Posay

- 16.13 Tata Harper

- 16.14 The Ordinary

- 16.15 Unilever