|

市場調查報告書

商品編碼

1876571

非氣霧劑體香噴霧市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Non-Aerosol Body Mist Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

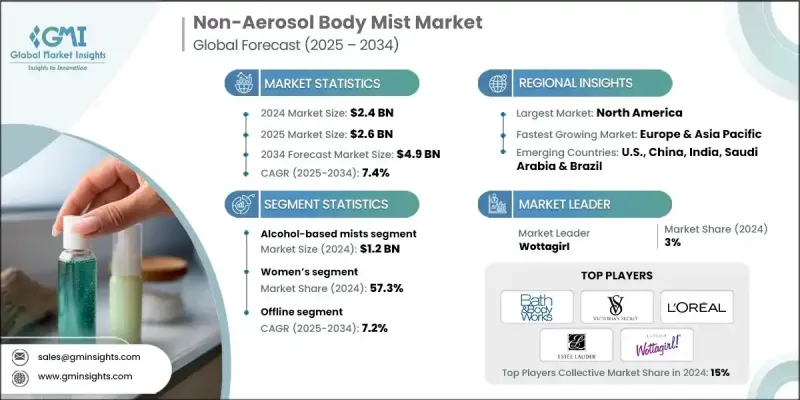

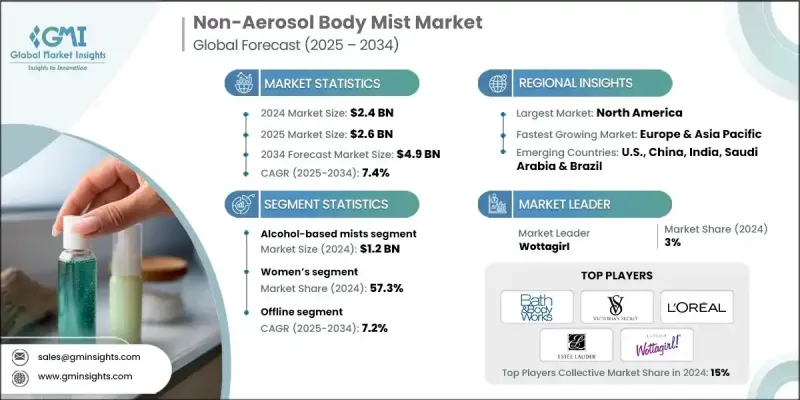

2024 年全球非氣霧劑身體噴霧市場價值為 24 億美元,預計到 2034 年將以 7.4% 的複合年成長率成長至 49 億美元。

隨著消費者越來越傾向於選擇親膚且注重健康的個人護理產品,而非通常含有酒精和合成推進劑的傳統氣霧劑,非氣霧劑香體噴霧市場正在不斷擴張。這類產品通常以水為基底,並富含植物萃取物、維生素和保濕成分,例如甘油或蘆薈。這些配方不僅帶來怡人的香氣,還能滋養和保濕肌膚,即使是敏感肌膚也適用。這一趨勢與「清潔美容」運動不謀而合,該運動強調安全、透明和無毒的成分。根據美國環境工作小組(EWG)的數據顯示,73%的美國消費者現在更傾向於選擇含有天然或無毒成分的個人護理產品。此外,健康和自我照護運動也提升了香體噴霧的功能,使其不再只是香氛,而是成為提升情緒健康和促進放鬆及自我表達的日常儀式的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 49億美元 |

| 複合年成長率 | 7.4% |

2024年,女性市場佔據57.3%的市場佔有率,預計到2034年將以7.3%的複合年成長率成長。女性對個人護理和香氛產品的需求持續成長,這主要得益於她們對美容護膚和健康生活方式的重視。非氣霧型身體噴霧配方溫和,具有護膚功效,能夠滿足女性消費者對保濕、舒緩、成分純淨且帶有香味的產品的需求。

2024年,線下分銷通路市佔率為60.1%,預計2025年至2034年將以7.2%的複合年成長率成長。實體零售店透過店內促銷、產品展示和季節性陳列,大幅提升品牌知名度,增強消費者互動,促進衝動消費。許多品牌也利用獨家零售合作關係和體驗式行銷活動來吸引客流,培養品牌忠誠度。

2024年美國非氣霧劑香體噴霧市場規模為6.752億美元,預計到2034年將以7.5%的複合年成長率成長。美國消費者擴大將香體噴霧融入日常護理程序中,他們欣賞其輕盈清爽的觸感和親膚的特性。這些產品為傳統香水提供了一種用途廣泛、輕鬆隨意的選擇,並迎合了香氛疊搭和自我表達等潮流。日益興起的健康和自我照護概念進一步鞏固了香體噴霧作為提升情緒健康的產品的市場地位。

全球非氣霧型身體噴霧市場的主要企業包括露華濃 (Revlon Inc.)、迪奧 (Dior)、維多利亞的秘密 (Victoria's Secret)、歐萊雅 (L'Oreal)、Sol de Janeiro、美體小鋪 (The Body Shop)、雅詩蘭黛 (Estee Lauder)、香奈兒 (Chanel)、Opakmhit. Provence)、Bath & Body Works、資生堂 (Shiseido Company, Limited)、寶潔 (Procter & Gamble) 與聯合利華 (Unilever)。這些企業正致力於產品創新、成分透明化和永續發展,以鞏固其市場地位。各大品牌紛紛推出採用天然、純素和無毒成分的配方,以吸引注重健康的消費者。許多公司正透過線上線下零售通路拓展業務,同時投資體驗式行銷活動和獨家合作,以提升品牌知名度和忠誠度。透過香型多樣性、保濕功效和多功能用途等產品差異化策略,有助於吸引不同的消費族群。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 健康親膚配方

- 健康與自我照護趨勢

- 高階化及多用途配方

- 產業陷阱與挑戰

- 市場飽和與差異化難題

- 消費者關注皮膚敏感性和酒精使用問題

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 關鍵成分分析

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 酒精噴霧

- 水性噴霧

- 油性噴霧

第6章:市場估計與預測:依香水類別分類,2021-2034年

- 主要趨勢

- 花的

- 果味

- 柑橘

- 其他(辣味、木香等)

第7章:市場估價與預測:依包裝規格分類,2021-2034年

- 主要趨勢

- 30-60毫升

- 100-150毫升

- 200-300毫升

第8章:市場估算與預測:依包裝類型分類,2021-2034年

- 主要趨勢

- 塑膠瓶

- 玻璃瓶

- 可重複灌裝瓶

第9章:市場估計與預測:依價格分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

第10章:市場估計與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 女性

- 男人

- 男女通用的

第11章:市場估價與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大型超市

- 專賣店/大型零售店

- 便利商店(百貨公司、獨立商店)

第12章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第13章:公司簡介

- Bath & Body Works

- Chanel

- Coty Inc.

- Dior

- Estee Lauder

- L'Occitane en Provence

- L'Oreal

- Pacifica Beauty

- Procter & Gamble

- Revlon Inc.

- Shiseido Company, Limited

- Sol de Janeiro

- The Body Shop

- Unilever

- Victoria's Secret

The Global Non-Aerosol Body Mist Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 4.9 billion by 2034.

The market is expanding as consumers increasingly prefer skin-friendly and health-conscious personal care products over traditional aerosol sprays, which often contain alcohol and synthetic propellants. Non-aerosol body mists are typically water-based and enriched with botanical extracts, vitamins, and moisturizing agents such as glycerin or aloe. These formulations not only provide a pleasant fragrance but also nourish and hydrate the skin, making them suitable even for sensitive skin types. This trend aligns with the clean beauty movement, which emphasizes safe, transparent, and non-toxic ingredients. According to the Environmental Working Group (EWG), 73% of U.S. consumers now prefer personal care products made with natural or non-toxic components. Additionally, the wellness and self-care movement has elevated body mists beyond simple fragrance, positioning them as tools for emotional well-being and daily rituals that promote relaxation and self-expression.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 7.4% |

The women's segment held a 57.3% share in 2024 and is expected to grow at a CAGR of 7.3% through 2034. Women continue to drive personal care and fragrance product demand due to their greater engagement in beauty routines and wellness-focused lifestyles. Non-aerosol body mists, with their gentle formulations and skin benefits, meet the needs of female consumers seeking products that offer hydration, soothing effects, and clean ingredients alongside fragrance.

The offline distribution channels segment held 60.1% share in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2034. Physical retail stores provide strong brand visibility through in-store promotions, product demonstrations, and seasonal displays, which enhance consumer engagement and encourage impulse purchases. Many brands also leverage exclusive retail partnerships and experiential marketing initiatives to attract foot traffic and cultivate brand loyalty.

U.S. Non-Aerosol Body Mist Market was valued at USD 675.2 million in 2024 and is expected to grow at a CAGR of 7.5% through 2034. U.S. consumers increasingly incorporate body mists into daily grooming routines, appreciating their lightweight, refreshing feel and skin-friendly properties. These products offer a versatile, casual alternative to traditional perfumes and support trends such as scent layering and self-expression. The growing wellness and self-care movement has further solidified its position as products that enhance emotional well-being.

Key companies operating in the Global Non-Aerosol Body Mist Market include Revlon Inc., Dior, Victoria's Secret, L'Oreal, Sol de Janeiro, The Body Shop, Estee Lauder, Chanel, Coty Inc., Pacifica Beauty, L'Occitane en Provence, Bath & Body Works, Shiseido Company, Limited, Procter & Gamble, and Unilever. Companies in the Non-Aerosol Body Mist Market are focusing on product innovation, ingredient transparency, and sustainability to strengthen their market position. Brands are introducing formulations with natural, vegan, and non-toxic ingredients to appeal to health-conscious consumers. Many firms are expanding their presence through offline and online retail channels while investing in experiential marketing campaigns and exclusive partnerships to enhance visibility and brand loyalty. Product differentiation through scent variety, moisturization benefits, and multifunctional uses helps attract diverse consumer segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fragrance

- 2.2.4 Pack size

- 2.2.5 Packaging

- 2.2.6 Price

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Health- & skin-friendly formulations

- 3.2.1.2 Wellness & self-care trend

- 3.2.1.3 Premiumization & multipurpose formulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Market saturation & differentiation difficulties

- 3.2.2.2 Consumer concerns over skin sensitivity & alcohol use

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Key ingredient analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Regulatory landscape

- 3.8.1 Standards and compliance requirements

- 3.8.2 Regional regulatory frameworks

- 3.8.3 Certification standards

- 3.9 Trade statistics

- 3.9.1 Major importing countries

- 3.9.2 Major exporting countries

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behavior

- 3.12.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Alcohol-based mists

- 5.3 Water-based mists

- 5.4 Oil-based mists

Chapter 6 Market Estimates & Forecast, By Fragrance, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Floral

- 6.3 Fruity

- 6.4 Citrus

- 6.5 Others (spicy, woody, etc.)

Chapter 7 Market Estimates & Forecast, By Pack Size, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 30-60 ml

- 7.3 100-150 ml

- 7.4 200-300 ml

Chapter 8 Market Estimates & Forecast, By Packaging, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Plastic bottles

- 8.3 Glass bottles

- 8.4 Refillable bottles

Chapter 9 Market Estimates & Forecast, By Price, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Women

- 10.3 Men

- 10.4 Unisex

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company websites

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarkets

- 11.3.2 Specialty stores/ mega retail stores

- 11.3.3 Convenience stores (departmental, independent)

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Indonesia

- 12.4.7 Malaysia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Bath & Body Works

- 13.2 Chanel

- 13.3 Coty Inc.

- 13.4 Dior

- 13.5 Estee Lauder

- 13.6 L’Occitane en Provence

- 13.7 L'Oreal

- 13.8 Pacifica Beauty

- 13.9 Procter & Gamble

- 13.10 Revlon Inc.

- 13.11 Shiseido Company, Limited

- 13.12 Sol de Janeiro

- 13.13 The Body Shop

- 13.14 Unilever

- 13.15 Victoria's Secret