|

市場調查報告書

商品編碼

1740997

重型燃氣渦輪機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Heavy Duty Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

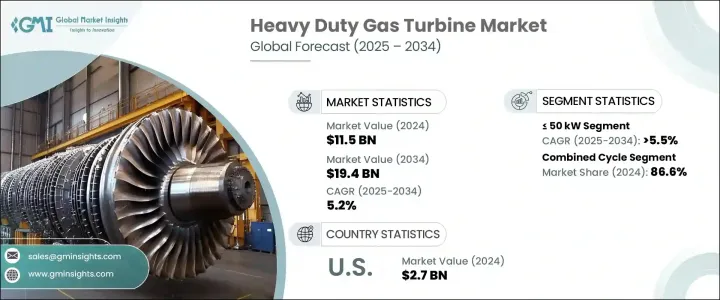

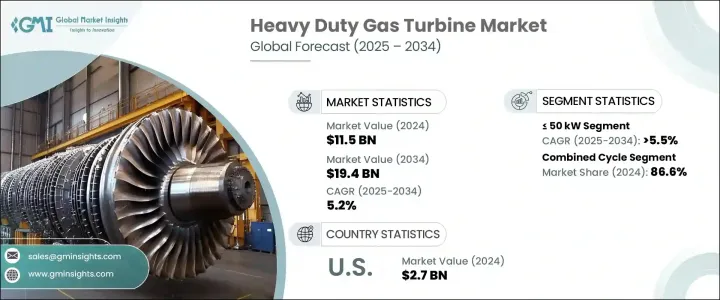

2024 年全球重型燃氣渦輪機市場價值為 115 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長至 194 億美元。這一成長是由環境永續性計劃、全球對清潔能源替代品的推動以及對可靠電力解決方案日益成長的需求共同推動的。隨著世界各國減少對煤炭的依賴並向再生能源轉型,燃氣渦輪機正成為這項轉變中不可或缺的中間技術。這些燃氣渦輪機提供了一種靈活、低排放的解決方案,可在不影響電力供應可靠性的情況下支援能源轉型。全球電力消耗的不斷成長,加上燃氣渦輪機設計的重大技術進步,進一步推動了市場需求。此外,燃氣渦輪機能夠與現有能源基礎設施無縫整合,同時保持穩定的電力輸出,使其成為國家和地區能源戰略的重要組成部分。

重型燃氣渦輪機市場也受益於對天然氣日益成長的依賴,這得益於天然氣探勘和相關基礎設施建設投資的增加。這一趨勢正在加速各行各業對燃氣渦輪機的需求,尤其是在微電網和遠端能源網路等分散式電力系統中。對於那些追求經濟高效、無需大規模熱電廠的地區來說,這些系統越來越受歡迎。燃氣渦輪機的工作原理是壓縮空氣並將其與燃料結合產生高壓氣體,從而以驚人的熱效率產生高效的能源輸出。燃氣渦輪機的多功能性以及在不同地理和經濟條件下運行的能力使其成為滿足全球能源需求的關鍵解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 115億美元 |

| 預測值 | 194億美元 |

| 複合年成長率 | 5.2% |

額定功率小於等於 50 千瓦的渦輪機預計將經歷顯著成長,到 2034 年的複合年成長率將達到 5.5%。這些小型渦輪機在小型工業設施和分散式能源系統中越來越受歡迎,因為這些系統對可靠性和效率至關重要。它們能夠提供穩定的本地化電力,同時最大限度地減少對電網的依賴,這使得它們在偏遠地區或離網地區尤其有價值。此外,它們還被廣泛用於關鍵基礎設施的備用解決方案,確保在高峰需求或停電期間提供可靠的電力。

開式循環燃氣渦輪機市場預計將對市場成長做出重大貢獻,預計到2034年其市場價值將達25億美元。設計和燃燒技術的進步提高了燃料效率並降低了排放,使得這類燃氣渦輪機對那些尋求減少碳足跡的公用事業和行業更具吸引力。開式循環燃氣渦輪機尤其適用於需要快速啟動和運作靈活性的應用,例如調峰電廠和有助於平衡電網波動的快速反應能源系統。

在美國,重型燃氣渦輪機市場預計到2024年將達到27億美元。這一成長主要得益於嚴格的監管框架,這些框架旨在促進清潔發電,並推動減少工業碳排放。因此,公用事業和工業領域擴大採用下一代燃氣渦輪機技術,這些技術不僅符合性能標準,還符合不斷變化的排放法規。

市場的主要參與者包括西門子能源、通用電氣 Vernova、Capstone Green Energy、索拉透平公司、勞斯萊斯、Vericor、Flex Energy Solutions、三菱重工、Destinus Energy、MAN Energy Solutions、安薩爾多能源、川崎重工、哈爾濱電氣、斗山、巴拉特重型電氣、南京汽輪電機和貝克休斯。為了保持競爭力,這些公司專注於提高透平效率、混合動力系統整合和低排放技術的創新。用於預測性維護的數位平台也日益受到關注,有助於減少停機時間並延長設備壽命。建立策略合作夥伴關係、拓展新興市場以及開發燃料靈活的透平機是促進這一不斷發展的產業成長的關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- ≤ 50 千瓦

- > 50 千瓦至 500 千瓦

- > 500 千瓦至 1 兆瓦

- > 1 兆瓦至 30 兆瓦

- > 30 兆瓦至 70 兆瓦

- > 70 MW 至 200 MW

- > 200 兆瓦

第6章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 開放式循環

- 複合循環

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 發電廠

- 石油和天然氣

- 加工廠

- 航空

- 海洋

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 荷蘭

- 芬蘭

- 希臘

- 波蘭

- 瑞典

- 亞太地區

- 中國

- 澳洲

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 約旦

- 南非

- 奈及利亞

- 阿爾及利亞

- 拉丁美洲

- 巴西

- 阿根廷

- 秘魯

- 智利

第9章:公司簡介

- Ansaldo Energia

- Baker Hughes

- Bharat Heavy Electricals

- Capstone Green Energy

- Doosan

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Nanjing Turbine and Electric Machinery

- Destinus Energy

- Rolls Royce

- Siemens Energy

- Solar Turbines

- Vericor

- Wartsila

The Global Heavy Duty Gas Turbine Market was valued at USD 11.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 19.4 billion by 2034. This growth is being driven by a combination of environmental sustainability initiatives, the global push for cleaner energy alternatives, and the increasing demand for reliable power solutions. As nations worldwide reduce their dependency on coal and transition toward renewable energy, gas-fired turbines are becoming an essential intermediate technology in this shift. These turbines offer a flexible, low-emission solution that supports the energy transition without compromising the reliability of the power supply. The growing global consumption of electricity, paired with significant technological advancements in turbine design, is further driving market demand. Additionally, the adaptability of gas turbines to integrate seamlessly with existing energy infrastructures while maintaining stable power output positions them as a key component in national and regional energy strategies.

The heavy-duty gas turbine market is also benefiting from the growing reliance on natural gas, spurred by increasing investments in gas exploration and the development of related infrastructure. This trend is accelerating demand for turbines across various sectors, particularly in decentralized power systems such as microgrids and remote energy networks. These systems are increasingly sought after in regions aiming for cost-effective and efficient energy delivery without the need for full-scale thermal plants. By operating on the principle of compressing air and combining it with fuel to create high-pressure gas, gas turbines generate efficient energy output with impressive thermal efficiency. Their versatility and ability to perform in diverse geographical and economic conditions make them a critical solution in meeting global energy needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.5 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 5.2% |

Turbines rated at <= 50 kW are set to experience significant growth, with a CAGR of 5.5% through 2034. These smaller turbines are becoming increasingly popular in small-scale industrial setups and decentralized energy systems, where reliability and efficiency are paramount. Their ability to provide stable, localized power while minimizing grid dependency makes them especially valuable in remote or off-grid regions. In addition, they are widely used in critical infrastructure as backup solutions, ensuring reliable power during peak demand or outages.

The open-cycle gas turbine segment is also expected to contribute significantly to market growth, with an estimated market value of USD 2.5 billion by 2034. Advances in design and combustion technology have led to increased fuel efficiency and lower emissions, making these turbines more attractive to utilities and industries seeking to reduce their carbon footprint. Open-cycle gas turbines are particularly beneficial in applications that require quick startup times and operational flexibility, such as peaker plants and fast-response energy systems that help balance grid variability.

In the United States, the heavy-duty gas turbine market is expected to reach USD 2.7 billion in 2024. This growth is largely driven by stringent regulatory frameworks that promote cleaner power generation and push for a reduction in industrial carbon emissions. As such, utilities and industries are increasingly adopting next-generation turbine technologies that not only meet performance standards but also comply with evolving emissions regulations.

Key players in the market include Siemens Energy, GE Vernova, Capstone Green Energy, Solar Turbines, Rolls Royce, Vericor, Flex Energy Solutions, Mitsubishi Heavy Industries, Destinus Energy, MAN Energy Solutions, Ansaldo Energia, Kawasaki Heavy Industries, Harbin Electric, Doosan, Bharat Heavy Electricals, Nanjing Turbine and Electric Machinery, and Baker Hughes. To stay competitive, these companies are focusing on innovations in turbine efficiency, hybrid system integration, and low-emission technologies. Digital platforms for predictive maintenance are also gaining traction, helping to reduce downtime and extend equipment life. Strategic partnerships, expansion into emerging markets, and the development of fuel-flexible turbines are key strategies for fostering growth in this evolving industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 50 kW

- 5.3 > 50 kW to 500 kW

- 5.4 > 500 kW to 1 MW

- 5.5 > 1 MW to 30 MW

- 5.6 > 30 MW to 70 MW

- 5.7 > 70 MW to 200 MW

- 5.8 > 200 MW

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Open cycle

- 6.3 Combined cycle

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Power plants

- 7.3 Oil & gas

- 7.4 Process plants

- 7.5 Aviation

- 7.6 Marine

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Poland

- 8.3.10 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 South Africa

- 8.5.12 Nigeria

- 8.5.13 Algeria

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Baker Hughes

- 9.3 Bharat Heavy Electricals

- 9.4 Capstone Green Energy

- 9.5 Doosan

- 9.6 Flex Energy Solutions

- 9.7 GE Vernova

- 9.8 Harbin Electric

- 9.9 Kawasaki Heavy Industries

- 9.10 MAN Energy Solutions

- 9.11 Mitsubishi Heavy Industries

- 9.12 Nanjing Turbine and Electric Machinery

- 9.13 Destinus Energy

- 9.14 Rolls Royce

- 9.15 Siemens Energy

- 9.16 Solar Turbines

- 9.17 Vericor

- 9.18 Wartsila