|

市場調查報告書

商品編碼

1740994

PVC 電工導管市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測PVC Electrical Conduit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

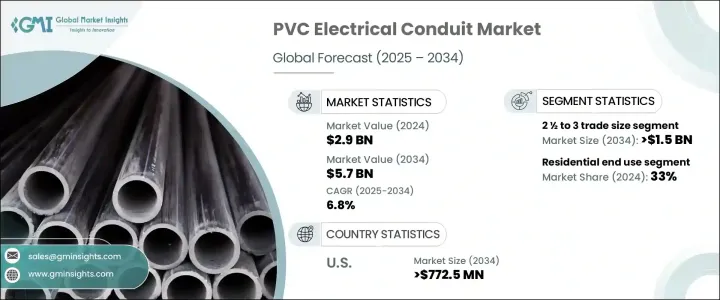

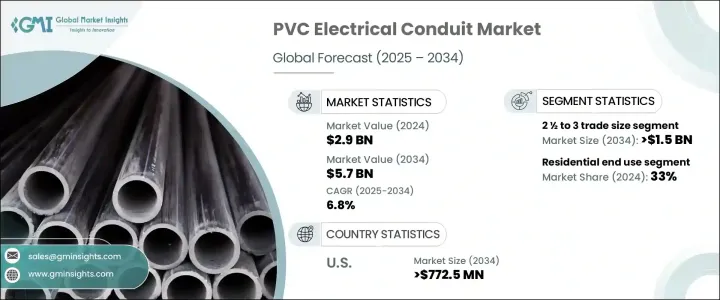

2024年,全球PVC電線管市場規模達29億美元,預計到2034年將以6.8%的複合年成長率成長,達到57億美元。隨著對更安全、更耐用、更具成本效益的電線保護解決方案的需求不斷成長,PVC電線管在住宅、商業和工業領域持續廣泛應用。 PVC電線管結構輕巧、耐腐蝕性能卓越且易於安裝,使其成為全球承包商和建築商的首選。現代建築實踐越來越重視能源效率、智慧建築整合和永續性,這推動了對能夠滿足不斷變化的安全標準和性能期望的可靠電線管解決方案的需求。

新興經濟體快速的城市化進程、不斷成長的基礎設施投資以及不斷擴張的住宅項目正在重塑市場格局。各主要地區的政府正大力投資升級電力基礎設施並擴大電力供應,這直接推動了導管的使用。此外,隨著各行各業向自動化和智慧技術邁進,對高效能、易於維護的佈線系統的需求也變得至關重要。導管材料、製造自動化和環保產品創新的技術進步,使 PVC 導管成為面向未來的建築項目中不可或缺的一部分。然而,該行業仍面臨原料價格波動以及對 PVC 產品環境影響日益嚴格的審查等挑戰。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29億美元 |

| 預測值 | 57億美元 |

| 複合年成長率 | 6.8% |

持續的城市發展和人口成長,推動了對智慧家庭和升級電氣系統的需求,尤其是在新興地區。市場也受益於不斷發展的製造技術和更強大的分銷網路,這些網路提高了可及性和覆蓋範圍。儘管原料成本波動和環境問題令人擔憂,但政府積極推動的基礎設施建設和電氣化項目預計將成為強勁的成長催化劑。

2.5吋至3吋之間的貿易尺寸類別正成為主導市場,預計到2034年將達到15億美元。這些尺寸的導管非常適合商業和工業安裝,為高容量線路的佈線提供充足的空間,同時保持了易於操作和安裝效率。在需要大量電路系統和先進電網的專案中,它們被擴大採用,這凸顯了其日益成長的重要性。

從最終用途來看,住宅領域在2024年佔33%,預計到2034年將以7%的複合年成長率成長。智慧住宅需求的不斷成長、快速的城市化以及多單元住宅項目的激增是推動這一成長的主要因素。建築商青睞PVC導管,因為其價格實惠、靈活性強,並且符合綠建築標準。商業領域也仍然是主要的消費者,依賴該產品的安全性、可靠性和低維護特性。

2024年,美國PVC電氣導管市場規模為4.356億美元,預計2034年將達到7.725億美元。再生能源裝置的不斷增加以及商業和住宅建築中智慧系統的整合持續推動著需求。儘管環境問題會影響市場動態,但PVC導管的持久性能以及與現代能源系統的兼容性確保了其主導地位。

ABB、Anamet Electrical、CANTEX、施耐德電機、羅格朗、Atkore、HellermannTyton、Astral、Bahra Electric、Vinidex、Electri-Flex、Wienerberger、Sundeep Electricals、Hubbell、Toyo Industry Lao Factory、Iplex Pipelines、Guangdong Ctberg、Guyo Industry Lao Factory、Iplex Pipelines、Guangdong Ctberg,公司正在推出其積極設計。他們正在加強重點地區的分銷管道,投資製造自動化,並與建築公司建立策略合作夥伴關係。不斷進行技術升級以適應不斷發展的建築規範,仍然是維持市場競爭優勢的關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依貿易規模,2021 - 2034 年

- 主要趨勢

- ½ 比 1

- 1.25 至 2

- 2.5 到 3

- 3到4

- 5到6

- 其他

第6章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

- 公用事業

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 德國

- 義大利

- 英國

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- Anamet Electrical

- ASTRAL

- Atkore

- Bahra Electric

- CANTEX

- Champion Fiberglass

- Electri-Flex

- Guangdong Ctube Industry

- HellermannTyton

- Hubbell

- Iplex Pipelines

- Legrand

- Schneider Electric

- Sundeep Electricals

- Toyo Industry Lao Factory

- Vinidex

- Wienerberger

The Global PVC Electrical Conduit Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 5.7 billion by 2034. As the demand for safer, more durable, and cost-effective solutions for electrical wiring protection accelerates, PVC electrical conduits continue to gain widespread adoption across residential, commercial, and industrial sectors. Their lightweight construction, superior corrosion resistance, and ease of installation make them a preferred choice among contractors and builders worldwide. Modern construction practices increasingly prioritize energy efficiency, smart building integration, and sustainability, driving the demand for reliable conduit solutions that can meet evolving safety standards and performance expectations.

Rapid urbanization, rising infrastructure investments, and expanding residential projects in emerging economies are reshaping the market landscape. Governments across major regions are heavily investing in upgrading power infrastructure and expanding access to electricity, which directly propels conduit usage. Moreover, with industries moving toward automation and smart technologies, the need for high-performance, easily maintainable wiring systems is becoming critical. Technological advancements in conduit materials, manufacturing automation, and eco-friendly product innovations are positioning PVC conduits as an indispensable element in future-ready building projects. However, the industry continues to navigate challenges such as raw material price volatility and increasing scrutiny over the environmental impact of PVC-based products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 6.8% |

Continued urban development and population growth are fueling higher demand for smart homes and upgraded electrical systems, especially in emerging regions. The market also benefits from evolving manufacturing technologies and stronger distribution networks that enhance accessibility and reach. Despite concerns surrounding fluctuating raw material costs and environmental issues, proactive governmental initiatives focused on infrastructure development and electrification projects are expected to be strong growth catalysts.

The trade size category between 21/2 and 3 inches is emerging as a dominant segment, forecasted to reach USD 1.5 billion by 2034. These conduit sizes are ideal for commercial and industrial installations, offering ample space for high-capacity wire runs while maintaining ease of handling and installation efficiency. Their rising adoption across projects requiring extensive circuit systems and advanced electrical networks highlights their growing importance.

Based on end use, the residential sector accounted for a 33% share in 2024 and is projected to grow at a CAGR of 7% through 2034. Increasing demand for smart housing, rapid urbanization, and a surge in multi-unit residential projects are major factors driving this growth. Builders are favoring PVC conduits for their affordability, flexibility, and compliance with green building standards. The commercial sector also remains a major consumer, relying on the product's safety, reliability, and low-maintenance characteristics.

The United States PVC Electrical Conduit Market was valued at USD 435.6 million in 2024 and is expected to reach USD 772.5 million by 2034. Rising renewable energy installations and the integration of smart systems in both commercial and residential buildings continue to drive demand. Although environmental concerns influence market dynamics, the long-lasting performance and compatibility of PVC conduits with modern energy systems secure their dominant position.

Companies like ABB, Anamet Electrical, CANTEX, Schneider Electric, Legrand, Atkore, HellermannTyton, Astral, Bahra Electric, Vinidex, Electri-Flex, Wienerberger, Sundeep Electricals, Hubbell, Toyo Industry Lao Factory, Iplex Pipelines, Guangdong Ctube Industry, and Champion Fiberglass are actively expanding their product portfolios with flexible and eco-conscious designs. They are strengthening distribution channels across key regions, investing in manufacturing automation, and forging strategic partnerships with construction firms. Embracing technology upgrades to align with evolving building codes continues to be a critical strategy for maintaining a competitive edge in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Trade Size, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 ½ to 1

- 5.3 1 ¼ to 2

- 5.4 2 ½ to 3

- 5.5 3 to 4

- 5.6 5 to 6

- 5.7 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

- 6.5 Utility

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 France

- 7.3.2 Germany

- 7.3.3 Italy

- 7.3.4 UK

- 7.3.5 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Anamet Electrical

- 8.3 ASTRAL

- 8.4 Atkore

- 8.5 Bahra Electric

- 8.6 CANTEX

- 8.7 Champion Fiberglass

- 8.8 Electri-Flex

- 8.9 Guangdong Ctube Industry

- 8.10 HellermannTyton

- 8.11 Hubbell

- 8.12 Iplex Pipelines

- 8.13 Legrand

- 8.14 Schneider Electric

- 8.15 Sundeep Electricals

- 8.16 Toyo Industry Lao Factory

- 8.17 Vinidex

- 8.18 Wienerberger