|

市場調查報告書

商品編碼

1740963

暖通空調市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測HVAC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

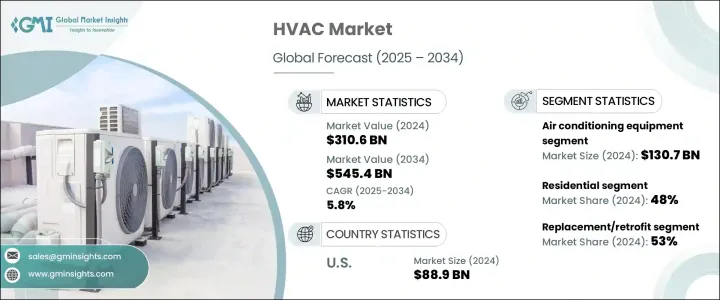

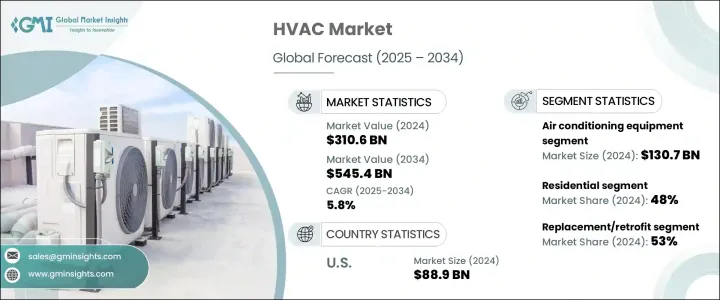

2024年,全球暖通空調市場規模達3,106億美元,預計到2034年將以5.8%的複合年成長率成長,達到5,454億美元。推動這一成長的主要因素之一是已開發國家和發展中國家對節能環保冷凍技術的需求不斷成長。隨著全球對永續發展和環境保護的日益關注,製造商被鼓勵創新和開發先進的暖通空調系統,以降低能耗和排放。監管機構正在實施各種節能項目,以推廣此類系統的使用,這促使企業和消費者都選擇節能型暖通空調解決方案。這種偏好的轉變正在加速智慧變速空調系統的普及,這些系統性能更佳,營運成本更低。人們對降低能耗的需求日益成長,尤其是在氣候控制系統方面,這使得節能暖通空調技術在住宅、商業和工業應用中越來越具有吸引力。此外,氣候變遷和全球氣溫上升正在推動更多地區持續使用冷凍系統,這進一步加劇了對高性能暖通空調設備的需求。

新興市場的快速城市化,加上住宅區、商業空間和工業基礎建設的增加,也推動了市場的發展。現代建築正在採用符合最新能源標準的智慧系統和整合式暖通空調 (HVAC) 技術。世界各國政府都在強制執行建築規範,要求在新開發案中使用節能的氣候控制解決方案。對更智慧、更互聯建築的追求,大大促進了配備自動溫控、智慧感測器和物聯網連接等功能的暖通空調系統的需求。此外,改造安裝也越來越受到關注,尤其是在需要升級以滿足最新監管標準和永續發展目標的老舊建築中。到2024年,改造/更換部分將佔暖通空調市場總量的53%,在仍在使用傳統系統的市場中顯示出強勁的發展勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3106億美元 |

| 預測值 | 5454億美元 |

| 複合年成長率 | 5.8% |

按產品類型細分,暖通空調 (HVAC) 市場包括空調設備、暖氣設備、通風系統、冷水機組和冷卻水塔。 2024 年,空調設備佔據主導地位,創造了 1,307 億美元的收入。其持續成長主要得益於人們對節能製冷解決方案的認知不斷提高,尤其是在空氣品質和氣溫上升日益令人擔憂的城市地區。另一方面,受對經濟高效、低排放供暖系統日益成長的需求推動,供暖設備市場預計在 2025 年至 2034 年期間以約 5.7% 的複合年成長率成長。

市場終端用途細分包括住宅、商業和工業領域。 2024年,住宅領域佔據了48%的市場佔有率,這得益於快速的城市擴張和不斷成長的中產階級人口,他們擴大投資於空調和氣候控制系統,以提高個人舒適度。辦公大樓、零售店和飯店等商業場所對先進暖通空調系統的需求也日益成長。這些設施優先考慮空氣品質、舒適度和營運效率,推動了智慧互聯暖通空調技術的安裝。商業領域也受益於基礎設施升級和更嚴格的環境標準的遵守,這些因素促使建築業主使用現代化的節能解決方案來改造舊系統。

從地理分佈來看,美國仍然是暖通空調 (HVAC) 市場的主要貢獻者,約佔北美市場佔有率的 79%,2024 年市場收入達 889 億美元。美國市場的成長得益於聯邦政府為提高暖氣和冷氣系統能源效率而訂定的各項法規和激勵措施。為使用現代化節能設備取代老舊暖通空調 (HVAC) 提供稅收抵免的計劃,正在加速住宅和商業建築的系統升級。因此,對具有先進連接性、更佳能源管理且環境影響更低的暖通空調 (HVAC) 系統的需求強勁成長。

一些知名公司正透過產品創新和策略合作積極塑造暖通空調 (HVAC) 市場格局。主要的行業參與者包括開利 (Carrier)、博世 (Bosch)、大金工業 (Daikin Industries)、格力電器 (GREE Electric Appliances)、丹佛斯 (Danfoss)、海爾 (Haier)、江森自控 (Johnson Controls)、海信諾克斯、金融暖通設備 (Hisense HVAC ELGpment)、海信諾克斯和國際暖通空調設備 (Hisense HVAC ELGpment)、海信克斯Electronics)、三菱電機 (Mitsubishi Electric)、Rheem Manufacturing Company、松下 (Panasonic) 和特靈科技 (Trane Technologies)。這些公司持續投入研發,以滿足不斷變化的消費者期望和監管要求,推動市場邁向更智慧、更環保、更有效率的暖通空調 (HVAC) 解決方案邁進。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製成品

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 加強基礎建設

- 在各行各業的用途日益廣泛

- 技術進步

- 產業陷阱與挑戰

- 投資成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 加熱設備

- 熔爐

- 鍋爐

- 熱泵

- 通風設備

- 空氣處理器

- 管道系統

- 風扇

- 空調設備

- 冷水機組

- 冷卻水塔

第6章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 住宅

- 商業的

- 工業

第7章:市場估計與預測:按安裝量,2021-2034

- 主要趨勢

- 新建築

- 更換/改造

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Bosch

- Carrier

- Daikin Industries

- Danfoss

- GREE Electric Appliances

- Haier

- Hisense HVAC equipment

- Johnson Controls

- Lennox International

- LG Electronics

- Midea

- Mitsubishi Electric

- Panasonic

- Rheem Manufacturing Company

- Trane Technologies

The Global HVAC Market was valued at USD 310.6 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 545.4 billion by 2034. One of the major factors supporting this growth is the rising demand for energy-efficient and eco-friendly cooling technologies across both developed and developing countries. As global focus intensifies on sustainability and environmental protection, manufacturers are being encouraged to innovate and develop advanced HVAC systems that consume less energy and produce fewer emissions. Regulatory bodies are implementing various energy efficiency programs that promote the use of such systems, which is prompting both businesses and consumers to opt for energy-conscious HVAC solutions. This shift in preference is accelerating the adoption of smart and variable-speed air conditioning systems, which offer better performance and lower operational costs. The growing need to reduce power consumption, particularly in climate control systems, has made energy-efficient HVAC technologies increasingly attractive across residential, commercial, and industrial applications. Additionally, climate change and rising global temperatures are pushing more regions toward consistent use of cooling systems, further amplifying the need for high-performance HVAC units.

Rapid urbanization in emerging markets, combined with increased construction of residential complexes, commercial spaces, and industrial infrastructure, is also fueling the market. Modern buildings are being designed with smart systems and integrated HVAC technologies that comply with the latest energy standards. Governments around the world are enforcing building codes that mandate the use of energy-efficient climate control solutions in new developments. The push for smarter, more connected buildings has significantly contributed to the demand for HVAC systems equipped with features like automated temperature control, smart sensors, and IoT connectivity. In addition, retrofit installations are gaining traction, especially in older buildings that require upgrades to meet updated regulatory standards and sustainability goals. The retrofit/replacement segment accounted for 53% of the total HVAC market in 2024, showing strong momentum in markets where legacy systems are still in use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $310.6 Billion |

| Forecast Value | $545.4 Billion |

| CAGR | 5.8% |

When broken down by product type, the HVAC market includes air conditioning equipment, heating equipment, ventilation systems, chillers, and cooling towers. In 2024, air conditioning equipment was the dominant category, generating revenue of USD 130.7 billion. Its continued growth is largely driven by increased awareness of energy-efficient cooling solutions, particularly in urban areas where air quality and rising temperatures are a growing concern. On the other hand, the heating equipment segment is poised to grow at a CAGR of approximately 5.7% from 2025 to 2034, supported by growing demand for cost-effective and low-emission heating systems.

End-use segmentation of the market includes residential, commercial, and industrial sectors. The residential segment comprised 48% of the market in 2024, backed by rapid urban expansion and a growing middle-class population that is increasingly investing in air conditioning and climate control systems for personal comfort. Commercial spaces, such as office buildings, retail outlets, and hospitality venues, are also witnessing heightened demand for advanced HVAC systems. These facilities prioritize air quality, comfort, and operational efficiency, driving the installation of smart and connected HVAC technologies. The commercial segment is further benefitting from infrastructure upgrades and compliance with stricter environmental standards, which are pushing building owners to retrofit older systems with modern, energy-efficient solutions.

Geographically, the United States remained a leading contributor to the HVAC market, accounting for approximately 79% of the North American share and generating revenue of USD 88.9 billion in 2024. The market growth in the US is being fueled by federal mandates and incentives that promote energy efficiency in heating and cooling systems. Programs offering tax credits for replacing older HVAC units with modern, energy-efficient alternatives are supporting the acceleration of system upgrades in both residential and commercial buildings. As a result, there has been a strong uptick in demand for HVAC systems that feature advanced connectivity, improved energy management, and reduced environmental impact.

Several prominent companies are actively shaping the HVAC landscape through product innovation and strategic partnerships. Key industry players include Carrier, Bosch, Daikin Industries, GREE Electric Appliances, Danfoss, Haier, Johnson Controls, Hisense HVAC Equipment, Lennox International, Midea, LG Electronics, Mitsubishi Electric, Rheem Manufacturing Company, Panasonic, and Trane Technologies. These companies are continually investing in R&D to meet evolving consumer expectations and regulatory requirements, helping to drive the market toward smarter, greener, and more efficient HVAC solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing infrastructure development

- 3.6.1.2 Growing uses in various industries

- 3.6.1.3 Technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of investments

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Heating equipment

- 5.2.1 Furnaces

- 5.2.2 Boiler

- 5.2.3 Heat pumps

- 5.3 Ventilation equipment

- 5.3.1 Air handlers

- 5.3.2 Ductwork

- 5.3.3 Fans

- 5.4 Air conditioning equipment

- 5.5 Chillers

- 5.6 Cooling towers

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrials

Chapter 7 Market Estimates & Forecast, By Installation, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 New construction

- 7.3 Replacement/Retrofit

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bosch

- 10.2 Carrier

- 10.3 Daikin Industries

- 10.4 Danfoss

- 10.5 GREE Electric Appliances

- 10.6 Haier

- 10.7 Hisense HVAC equipment

- 10.8 Johnson Controls

- 10.9 Lennox International

- 10.10 LG Electronics

- 10.11 Midea

- 10.12 Mitsubishi Electric

- 10.13 Panasonic

- 10.14 Rheem Manufacturing Company

- 10.15 Trane Technologies