|

市場調查報告書

商品編碼

1690201

歐洲暖通空調:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Europe HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

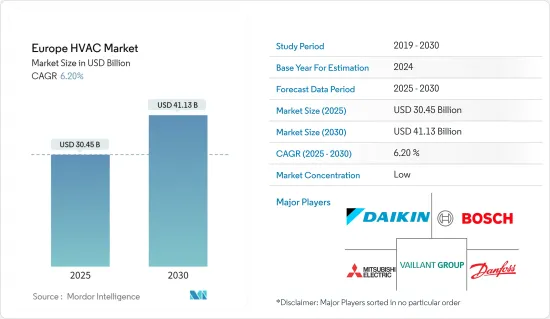

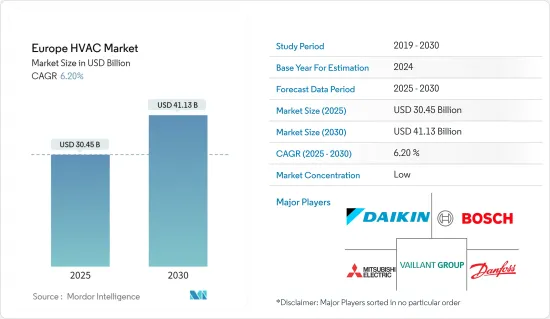

預計 2025 年歐洲 HVAC 市場規模為 304.5 億美元,到 2030 年將達到 411.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.2%。

關鍵亮點

- 世界各地的許多建築物,包括學校、辦公室、住宅和工廠,仍然依賴石化燃料,尤其是天然氣來供暖,導致大量溫室氣體排放。此外,當前的全球能源危機表明,迫切需要轉向更便宜、更可靠、更清潔的供暖方式。在此背景下,能夠高效為建築和工業提供供暖的熱泵是實現供暖更安全、更永續的關鍵技術之一。

- 根據國際能源總署的數據,到 2030 年,熱泵預計將減少全球二氧化碳排放至少 5 億噸,相當於所有歐洲汽車的年二氧化碳排放。

- 因此,世界各國政府都渴望推出更嚴格的法規,例如強制安裝熱泵。預計這將對所研究的市場產生正面影響。歐盟也宣佈2030年將安裝超過6,000萬台熱泵,這與歐盟的目標一致。與 2022 年相比,到 2030 年,這可能使歐盟建築天然氣需求減少 40%,能源進口減少 600 億歐元(642.8 億美元)。

- 2023 年 3 月,歐盟委員會宣布對其國家援助指南進行重要修改,這將促進熱泵產業的發展。歐盟希望放寬某些歐洲領域的補貼規定,以避免輸給美國的綠色技術計畫《通膨削減法案》。其中包括熱泵以及風力發電機和電池製造等其他領域。歐盟計畫在2023年至2027年間安裝1,000萬台熱泵。

- 該行業主要由各個地區的經銷商和零件供應商控制。製造 HVAC 設備所需的原料是電子產品、塑膠和壓縮機。霍尼韋爾是一家提供空調壓縮機的公司。依靠供應公司的議價能力來為 HVAC 系統提供動力正在增加他們的議價能力和製造產品的成本。這也增加了這些供應商的轉換成本。這加劇了市場競爭並對市場成長提出了挑戰。

- 新冠疫情凸顯了適當通風系統的重要性,一些地方政府推廣使用暖通空調系統來遏制病毒的傳播。這促進了市場的發展。

歐洲暖通空調市場趨勢

商業領域是成長最快的終端用戶領域

- 商業部門在商業建築和基礎設施(如餐廳、住宅、小型到大型購物中心和辦公室)中使用應用 HVAC 設備。在商業建築中,當建築物不統一且需要特定客製化時,就會安裝半客製化 HVAC 設備,而不是安裝市場上現有的標準設備。

- 與傳統的加熱和冷卻系統相比,熱泵具有許多優勢,使其成為商業房地產的理想選擇。熱泵非常適合提高能源效率、降低營運成本以及促進環境永續性和脫碳。透過安裝熱泵,商業設施可以有效減少碳排放並為永續發展做出積極貢獻。安裝熱泵系統是一項明智的投資,不僅可以提高效率、節省成本,還可以使您的商業設施成為向更清潔、更永續的能源未來轉變的先驅。

- 商用熱泵在不同類型的設施中有廣泛的應用,並可用於多種用途。預計政府措施將進一步推動商業建築中熱泵的成長。例如,英國政府正在積極推動採用熱泵技術來取代商業建築中的石化燃料鍋爐。還有許多計劃可幫助英國企業過渡到熱泵系統。

- 一些公司不斷投資推出各種產品,以滿足商業領域對此類暖氣系統的需求。例如,大金於2023年11月發布了有關兩款VRV 5熱泵系統的資訊,計劃於2024年上半年發布。這些新系統,即Mini-VRV和Top-Blow系列,旨在滿足商業建築日益成長的脫碳需求。 Mini-VRV 的最大容量為 33.5kW,Top-Blow 的最大容量為 56kW。透過這些新增功能,大金進一步增強了產品系列,支持向更永續和更節能的解決方案過渡。此類供應商活動可望增強市場潛力。

- 根據歐洲公共房地產協會預測,2023年歐洲商用房地產市場規模將超過9兆美元,其中德國、英國和法國三國合計佔據歐洲商業房地產市場的50%以上。 2023 年,德國商用房地產市場價值為 1.9 兆美元。同時,2023 年歐洲商用房地產投資與 2022 年相比有所減弱。預計 2022 年商用房地產總投資為 2,530 億歐元(2,704.3 億美元),到 2023 年將下降至約 1,330 億歐元。商用房地產領域的如此高額投資應該會推動暖通空調設備市場商業領域的成長。

預計法國將實現強勁成長

- 由於法國希望用熱泵取代住宅燃料和燃氣加熱器,以減少溫室排放,並發展熱泵製造業,預計該市場將快速成長。作為多年環境計畫的一部分,政府計劃推廣使用熱泵作為住宅供暖的一種方式。

- 全國約有 27 家熱泵工廠,政府正致力於增加熱泵產量以滿足日益成長的需求,從而進一步促進市場成長。例如,2024年4月,法國政府宣布,2027年底必須生產100萬台熱泵。政府宣布的計劃有兩個關鍵要素。首先,政府將繼續推出各種計劃來支持消費者購買熱泵,例如「MaPrimeRenov」和能源效率證書。

- 其次,政府將直接支持製造商,並在新的歐洲開放基礎上支持戰略性綠色產業。法國計劃將為每家工廠提供高達 2 億歐元(2.1341 億美元)的稅收優惠,以支持投資。

- 根據歐盟統計局的數據,2022 年 12 月住宅建築佔法國 GDP 的比重為 6.80%。根據環境部長的報告,到2023年,法國將擁有約3,800萬個註冊住宅,而其人口將超過6,700萬。 2008年,這一數字約為3,300萬戶。此外,過去20年來,法國每年新建住宅超過30萬套,有些年份甚至達到50萬套。隨著住宅的不斷成長,對高效冷卻解決方案的需求也將持續成長。

- 隨著全球氣溫上升,法國的冷凍需求也增加。根據歐盟統計局的數據,預計到 2025 年,法國非家用冷凍通風設備製造的收益將達到約 85.84 億美元。這一成長應會支持暖通空調市場的成長。

- 許多參與企業正在擴大在該國的業務,以增加市場佔有率,從而支持市場成長。例如,2024年4月,三菱電機水力與IT冷卻系統公司(Mitsubishi Electric Hydronics & IT Cooling Systems SpA)和三菱電機歐洲公司(Mitsubishi Electric Europe BV)宣布將收購AIRCALO。透過此次收購,該公司希望利用 AIRCALO 廣泛的產品線和強大的客製化能力,在多元化的歐洲市場擴展和升級其水暖 HVAC 系統業務。

歐洲暖通空調產業概況

歐洲 HVAC 市場高度分散,主要參與者包括大金工業株式會社、羅伯特博世有限公司、三菱電機歐洲有限公司、威能集團和丹佛斯公司。市場參與企業正在採取聯盟和收購等策略來擴大其產品供應並獲得永續的競爭優勢。

- 2024年4月,大金工業株式會社宣布啟動「Stand by Me認證合作夥伴」計劃,將以大金學院現有的大金培訓為基礎。除了透過大金學院提供的現有大金培訓外,我們還將提供建築安全和品質的培訓,並將建築公司認證為認證合作夥伴。

- 2024 年 1 月三菱電機歐洲有限公司宣布推出住宅空氣源熱泵。該公司的 Hydrolution EZY 一體式熱水器即使外界溫度降至 -25°C 也能產生高達 60°C 的熱水。有兩種輸出功率可供選擇:10 kW 和 14 kW。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 政府稅額扣抵

- 節能電器的需求不斷增加

- 市場問題

- 競爭加劇導致利潤率下降

第6章市場區隔

- 按設備

- 透過空調/通風設備

- 單分體/多分體

- 可變冷媒流量 (VRF)

- 空氣調節機

- 冷卻器

- 風機盤管

- 包裝和屋頂

- 其他空調/通風設備

- 透過加熱設備

- 鍋爐/散熱器/火爐

- 熱泵

- 透過空調/通風設備

- 按最終用戶產業

- 住宅

- 商用

- 工業的

- 按國家

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 丹麥

- 芬蘭

- 冰島

- 挪威

- 瑞典

第7章 全球市場概況

- 北美洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第8章競爭格局

- 公司簡介

- Daikin Industries Ltd

- Robert Bosch GmbH

- Mitsubishi Electric Europe BV

- Vaillant Group

- Danfoss A/S

- Lennox International Inc.

- Carrier Corporation

- Hitachi Ltd

- Ariston Thermo SpA

- BDR Thermea Group

- Panasonic Corporation

第9章 市場展望

簡介目錄

Product Code: 70778

The Europe HVAC Market size is estimated at USD 30.45 billion in 2025, and is expected to reach USD 41.13 billion by 2030, at a CAGR of 6.2% during the forecast period (2025-2030).

Key Highlights

- Many buildings worldwide, including schools, offices, homes, and factories, still rely on fossil fuels, particularly natural gas, for heating, leading to large amounts of greenhouse gas emissions. Moreover, the current global energy crisis implies that there is an urgent need to move to more affordable, reliable, and cleaner ways of heating buildings. In this context, heat pumps, which can efficiently provide heating to buildings and industries, are one the key technologies to make heating more secure and sustainable.

- According to the IEA, heat pumps have the ability to minimize global CO2 emissions by a minimum of 500 million ton by 2030, equating to the yearly CO2 emissions of all cars in Europe.

- As a result, governments are looking forward to introducing stringent regulations, including mandating the incorporation of heat pumps. This is expected to positively impact the market studied. The European Union also announced the installation of 60 million more heat pumps by 2030, which is in line with the EU targets. This could cut the European Union's gas demand for buildings by 40% by 2030 compared to the 2022 levels and decrease its energy import bill by EUR 60 billion (USD 64.28 billion).

- In March 2023, the European Commission announced key changes to state aid guidelines, which should boost the heat pump sector. The EU wants more relaxed rules on subsidies for specific European sectors to avoid losing out to the Inflation Reduction Act, the US's green technology plan. The sectors include heat pumps and others like wind turbine and battery manufacturing. The European Union has planned to install 10 million heat pumps between 2023 and 2027.

- The industry is heavily controlled by distributors and component suppliers operating in different regions. The raw materials required to manufacture HVAC equipment are electronics, plastics, and compressors. Honeywell is a company that provides AC compressors. The dependence on suppliers for enhanced HVAC systems increases their bargaining power and the production cost of the product. Therefore, the switching cost of these suppliers to other companies is also high. This adds up to the competition in the market, challenging the market's growth.

- The importance of a proper ventilation system was highlighted by the COVID-19 pandemic, and several regional governments have promoted HVAC systems to reduce the spread of the virus. This has boosted the market.

Europe HVAC Market Trends

The Commercial Segment is to be the Fastest-growing End-user Verticals

- The commercial segment involves the use of applied HVAC equipment in commercial buildings and infrastructures, such as restaurants, residential lodges, and small to large shopping complexes and offices. In commercial buildings, semi-custom HVAC equipment is installed wherever the buildings are not uniform and require certain customizations instead of the standard equipment available in the market.

- Heat pumps are an ideal choice for commercial properties as they provide numerous advantages that go beyond conventional heating and cooling systems. Heat pumps excel in enhancing energy efficiency, minimizing operational expenses, and promoting environmental sustainability and decarbonization. By implementing heat pumps, commercial properties can effectively reduce their carbon footprint and actively contribute to sustainability efforts. Embracing these systems is a wise investment that not only improves efficiency and saves costs but also positions commercial properties as pioneers in the shift toward a cleaner and more sustainable energy future.

- Commercial heat pumps have a broad range of applications across different property types and serve various purposes. The growth of heat pumps in commercial settings is anticipated to be further boosted by government efforts. For example, the UK government is actively promoting the adoption of heat pump technology as an alternative to fossil fuel boilers in commercial settings. There are numerous programs accessible to assist UK companies in transitioning to heat pump systems.

- Several companies are constantly investing in introducing various products catering to the demand for these heating systems in the commercial segment. For instance, in November 2023, Daikin disclosed information regarding two upcoming VRV 5 heat pump systems that are scheduled to be released in the first half of 2024. These new systems, namely the Mini-VRV and the Top-Blow series, are designed to cater to the growing demand for decarbonization in commercial buildings. The Mini-VRV system will now offer expanded capacities of up to 33.5 kW, while the new Top-Blow series will reach an impressive 56 kW. With these additions, Daikin is further enhancing its product portfolio to support the transition toward more sustainable and energy-efficient solutions. Such vendor activities are expected to increase the market's potential.

- The European commercial real estate market was valued at over USD 9 trillion in 2023, according to the European Public Real Estate Association, with Germany, the United Kingdom, and France together accounting for more than 50% of the total market. The commercial real estate market in Germany was valued at USD 1.9 trillion in 2023. Meanwhile, commercial real estate investments in Europe weakened in 2023 compared to 2022. The total commercial real estate investment volume was EUR 253 billion (USD 270.43 billion) in 2022, which dropped to about 133 billion in 2023. Such high investments in the commercial real estate sector should drive the commercial segment's growth in the HVAC equipment market.

France is Expected to Witness Significant Growth

- The market is expected to witness high growth as France wants to replace residential fuel and gas heaters with heat pumps and create an industry to make the device in a bid to reduce greenhouse gas emissions. The government plans to promote heat pumps as a way to heat houses as part of a multi-year environmental plan.

- The country has approximately 27 heat pump factories, and the government is focusing on increasing the production of heat pumps to meet the growing demand, further driving the market's growth. For instance, in April 2024, the French government announced that the country must produce one million heat pumps before the end of 2027. The plan unveiled by the government has two key elements. Firstly, the government will continue various schemes that help consumers purchase heat pumps, such as 'MaPrimeRenov' and energy-saving certificates.

- Secondly, the government will directly support manufacturers, building on Europe's new openness to support strategic green industries. The French program will support the construction of factories through tax incentives that can amount to up to EUR 200 million (USD 213.41 million) per factory in investment aid.

- According to EUROSTAT, residential construction accounted for 6.80% of France's GDP in December 2022. The Ministere de l'environnementne reports that in 2023, France had approximately 38 million registered dwelling units to accommodate a population of over 67 million. This figure was nearly 33 million in 2008. Additionally, France has consistently built no less than 300,000 new homes per year over the past two decades, with some years reaching approximately 500,000 new homes. As residential construction activities continue to increase, there will be a significant demand for efficient cooling solutions.

- As temperatures are rising worldwide, the demand for air conditioning in France is also increasing. According to EUROSTAT, the revenue from the manufacturing of non-domestic cooling and ventilation equipment in France is expected to be approximately USD 8.584 billion in 2025. Such an increase should support the HVAC market's growth.

- Several players in the market are expanding their presence in the country to increase their market share, supporting market growth. For instance, in April 2024, Mitsubishi Electric Hydronics & IT Cooling Systems SpA and Mitsubishi Electric Europe BV announced that they would acquire AIRCALO. Through this acquisition, the company expects to leverage AIRCALO's broad product line and strong customization capabilities to expand and upgrade its hydronic HVAC systems business in the diversifying European market.

Europe HVAC Industry Overview

The European HVAC market is highly fragmented, with the presence of major players like Daikin Industries Ltd, Robert Bosch GmbH, Mitsubishi Electric Europe BV, Vaillant Group, and Danfoss A/S. The market players are adopting strategies like partnerships and acquisitions to improve their product offerings and gain sustainable competitive advantage.

- April 2024: Daikin Industries Ltd announced the launch of the Stand by Me Certified Partner program, which builds on existing Daikin training through the Daikin Academy. The program provides training on installation safety and quality and allows installers to become certified partners.

- January 2024: Mitsubishi Electric Europe BV announced the release of its residential air-to-water heat pumps. The company's Hydrolution EZY monoblock is able to produce hot water at temperatures of up to 60°C even when outdoor temperatures are down to -25°C. It is available in two power variants: 10 kW and 14 kW.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations Like Incentives for Saving Energy Through Tax Credit Programs

- 5.1.2 Increasing Demand for Energy-efficient Devices

- 5.2 Market Challenges

- 5.2.1 Growing Competition Could Limit Margins

6 MARKET SEGMENTATION

- 6.1 By Equipment

- 6.1.1 By Air Conditioning/Ventilation Equipment

- 6.1.1.1 Single Split/Multi-Splits

- 6.1.1.2 Variable Refrigerant Flow (VRF)

- 6.1.1.3 Air Handling Units

- 6.1.1.4 Chillers

- 6.1.1.5 Fans Coils

- 6.1.1.6 Packaged and Rooftops

- 6.1.1.7 Other Air Conditioning/Ventilation Equipment

- 6.1.2 By Heating Equipment

- 6.1.2.1 Boilers/Radiators/Furnace

- 6.1.2.2 Heat Pumps

- 6.1.1 By Air Conditioning/Ventilation Equipment

- 6.2 By End User Industry

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Russia

- 6.3.7 Denmark

- 6.3.8 Finland

- 6.3.9 Iceland

- 6.3.10 Norway

- 6.3.11 Sweden

7 GLOBAL MARKET SCENARIO

- 7.1 North America

- 7.2 Asia

- 7.3 Australia and New Zealand

- 7.4 Latin America

- 7.5 Middle East & Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Daikin Industries Ltd

- 8.1.2 Robert Bosch GmbH

- 8.1.3 Mitsubishi Electric Europe BV

- 8.1.4 Vaillant Group

- 8.1.5 Danfoss A/S

- 8.1.6 Lennox International Inc.

- 8.1.7 Carrier Corporation

- 8.1.8 Hitachi Ltd

- 8.1.9 Ariston Thermo SpA

- 8.1.10 BDR Thermea Group

- 8.1.11 Panasonic Corporation

9 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219