|

市場調查報告書

商品編碼

1740936

電動大眾運輸系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Public Transport System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

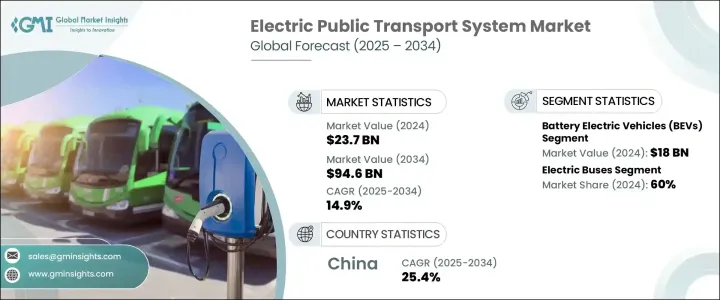

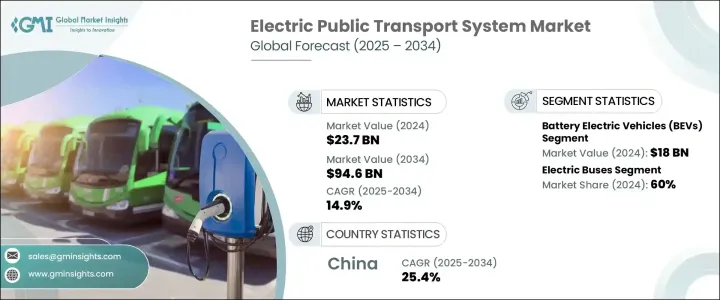

2024 年全球電動公共交通系統市場價值為 237 億美元,預計到 2034 年將以 14.9% 的複合年成長率成長,達到 946 億美元,這得益於城市密度增加、環境法規更加嚴格以及全球向清潔出行解決方案邁進的勢頭。世界各國政府和交通運輸機構都將向永續的智慧交通系統轉變為優先事項,以應對不斷上升的排放、交通堵塞和城市擴張。隨著城市密度增加和人口激增,對節能、低排放公共交通網路的需求正成為當務之急。電動公共交通系統結合了自動化、數位化和零排放技術,正在重新定義城市交通的未來。各個城市正在大力投資電動車隊、現代化基礎設施和智慧交通管理系統,為數百萬通勤者創造無縫的移動體驗。電池技術、遠端資訊處理和無線充電方面的創新進一步提高了電動車隊的營運效率和可靠性。隨著智慧城市計畫在全球擴展,電動大眾運輸正成為下一代城市交通生態系統的支柱,使大眾運輸更加環保、快速、智慧。

隨著城市致力於降低碳足跡和升級交通基礎設施,公共部門對電動大眾運輸(包括電車、公車和地鐵)的投資正在迅速增加。電氣化與數位連接和自動化相結合,正在改變城市交通,為日常交通營運帶來先進的功能和更高的效率。電動大眾運輸網路目前正在整合智慧路線規劃、零排放車輛和即時車隊追蹤系統。營運商正在採用電池管理系統、快速充電解決方案和再生煞車等節能技術,以降低營運成本並提高效能。同時,對以乘客為中心的創新的需求也在不斷成長,例如高級駕駛輔助系統、車載監控系統和整合數位票務。這些升級不僅提高了交通安全性和乘客舒適度,也增加了對乘客的吸引力。無線軟體更新、輕量複合材料和無線能量傳輸系統等技術突破正在加速市場的成長軌跡。隨著電動替代品逐漸取代基於化石燃料的交通方式,市場蓬勃發展,不斷創新,致力於提高永續性、自動化和通勤體驗。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 237億美元 |

| 預測值 | 946億美元 |

| 複合年成長率 | 14.9% |

2024年,純電動車 (BEV) 市場規模達到180億美元,在電動大眾運輸系統領域佔據推進系統類別的最大佔有率。 BEV持續的領先地位與城市交通向電動轉型的加速發展息息相關,低排放目標與日益成長的智慧化、以用戶為中心的車載技術需求完美契合。 BEV具備零廢氣排放、更低維護需求,並且易於與即時路線更新、互動式儀錶板和先進駕駛輔助系統等數位創新技術整合,使其成為市政當局車隊現代化改造的首選。

在各類車型中,電動公車佔據主導地位,2024 年的市佔率達 60%,成為最廣泛採用的電動大眾運輸方式。全球環保政策的不斷訂定、政府補貼的不斷增加以及公共充電網路的加速擴張,共同支撐了電動公車的領先地位。現代電動公車超越了永續出行的範疇,提供電容式觸控螢幕、直覺的駕駛顯示器、自適應照明和符合人體工學的內裝等智慧功能,提升了駕駛體驗和乘客舒適度。電動公車的可擴展性和成本效益使其成為人口密集城市的理想選擇,因為這些城市對清潔、高容量交通的需求正在飆升。

2024年,中國電動大眾運輸系統市場規模達30億美元,預計2034年將以25.4%的驚人複合年成長率成長。中國在該領域的主導地位得益於其大力推行的國家戰略,這些戰略有利於永續旅行和智慧城市發展。大量的政府資金投入、快速的城市化進程以及廣泛的公共交通電氣化規劃,使中國繼續處於創新的前沿。地方政府正在大力投資高容量電動公車車隊和智慧交通生態系統,這些生態系統整合了電池管理系統、人工智慧調度、雲端監控和自動駕駛功能,有助於減少車輛故障時間、最佳化路線並延長車輛生命週期。

全球電動公共運輸系統市場的主要參與者包括 VDL 巴士及客車、比亞迪、宇通客車、氦氧混合氣、EasyMile、塔塔汽車、日立鐵路、西門子交通、阿爾斯通和沃爾沃。領先公司正在透過投資模組化電動平台、開發可互通的充電系統以及與城市交通機構建立戰略合作夥伴關係來鞏固其市場地位。他們還透過能源最佳化的電動車擴展產品組合,並將研發重點放在高級駕駛輔助系統 (ADAS)、遠端資訊處理和車隊管理軟體上,以保持敏捷性並滿足全球市場不斷變化的監管、營運和環境要求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 配銷通路分析

- 最終用途

- 利潤率分析

- 供應商格局

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 貿易影響

- 技術與創新格局

- 專利分析

- 監管格局

- 成本細分分析

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 車載連線和使用者體驗的需求不斷成長

- 材料和製造技術的進步

- 電動車和自動駕駛汽車的成長

- OEM注重減輕重量和設計整合

- 產業陷阱與挑戰

- 生產成本高

- 耐久性和環境敏感性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依運輸方式,2021 - 2034 年

- 主要趨勢

- 電動公車

- 電動火車

- 電動渡輪

- 電動計程車/叫車

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 純電動車(BEV)

- 插電式混合動力電動車(PHEV)

- 燃料電池電動車(FCEV)

第7章:市場估計與預測:按充電方式,2021 - 2034 年

- 主要趨勢

- 車庫充電

- 機會充電

- 無線充電

- 電池更換

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 政府交通管理部門

- 私人車隊營運商

- 公私部門合作(PPP)

- 機場和工業運輸營運商

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- ABB

- Alexander Dennis

- Alstom

- Ashok Leyland

- BYD

- CAF

- CRRC

- EasyMile

- Heliox

- Hitachi Rail

- Keolis

- Navya

- Proterra

- Schneider Electric

- Siemens eMobility

- Soltaro

- Tata Motors

- VDL Bus & Coach

- Volvo

- Yutong Bus

The Global Electric Public Transport System Market was valued at USD 23.7 billion in 2024 and is estimated to grow at a CAGR of 14.9% to reach USD 94.6 billion by 2034, driven by increased urban density, stricter environmental regulations, and the global momentum toward clean mobility solutions. Governments and transit agencies worldwide are prioritizing the shift to sustainable, smart transportation systems to combat rising emissions, congestion, and urban sprawl. As cities grow denser and populations surge, the demand for energy-efficient, low-emission public transport networks is becoming a critical priority. Electric public transport systems, combining automation, digitalization, and zero-emission technology, are redefining the future of urban mobility. Cities are investing heavily in electrified fleets, modern infrastructure, and intelligent traffic management systems to create seamless, connected travel experiences for millions of commuters. Innovation in battery technologies, telematics, and wireless charging is further enhancing the operational efficiency and reliability of electric fleets. As smart city initiatives expand globally, electric public transportation is emerging as the backbone of next-generation urban transit ecosystems, making public commuting greener, faster, and smarter.

Public sector investments in electric mass transit-including trams, buses, and metros-are rapidly accelerating as cities aim to lower carbon footprints and upgrade transportation infrastructure. Electrification combined with digital connectivity and automation is transforming urban mobility, bringing advanced functionality and greater efficiency into daily transit operations. Electric public transport networks are now integrating intelligent route planning, zero-emission vehicles, and real-time fleet tracking systems. Operators are adopting energy-saving technologies such as battery management systems, fast-charging solutions, and regenerative braking to drive down operating costs and boost performance. Simultaneously, demand is rising for rider-focused innovations like advanced driver assistance, onboard surveillance systems, and integrated digital ticketing. These upgrades not only enhance transit safety and passenger comfort but also increase ridership appeal. Technological breakthroughs, including over-the-air software updates, lightweight composite materials, and wireless energy transfer systems, are accelerating the market growth trajectory. As electric alternatives steadily replace fossil-fuel-based transit modes, the market is thriving with continuous innovations focused on improving sustainability, automation, and commuter experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.7 Billion |

| Forecast Value | $94.6 Billion |

| CAGR | 14.9% |

The battery electric vehicles (BEVs) segment generated USD 18 billion in 2024, securing the largest share among propulsion categories within the electric public transport system sector. Their sustained leadership is tied to the accelerating shift toward electric urban mobility, where low-emission goals align perfectly with the rising demand for intelligent, user-centric onboard technology. BEVs offer zero tailpipe emissions, lower maintenance needs, and easy integration with digital innovations such as real-time route updates, interactive dashboards, and advanced driver assistance systems, making them the top choice for municipalities modernizing their fleets.

Among vehicle types, the electric buses segment dominated with a 60% market share in 2024, standing out as the most widely adopted mode of electric public transport. This leadership is backed by a global wave of environmental policies, increasing government subsidies, and accelerated expansion of public charging networks. Modern electric buses go beyond sustainable mobility, offering smart features like capacitive touchscreens, intuitive driver displays, adaptive lighting, and ergonomic interiors that enhance both driver experience and passenger comfort. Their scalability and cost-efficiency make them ideal for densely populated cities where demand for clean, high-capacity transit is soaring.

The China Electric Public Transport System Market generated USD 3 billion in 2024 and is forecasted to grow at a remarkable CAGR of 25.4% through 2034. China's dominance in the sector is reinforced by aggressive national strategies favoring sustainable mobility and smart city development. Massive government funding, rapid urbanization, and extensive mass transit electrification plans continue to place China at the forefront of innovation. Local authorities are investing heavily in high-capacity electric bus fleets and intelligent traffic ecosystems that integrate battery management systems, AI-powered scheduling, cloud-based monitoring, and autonomous driving capabilities, all helping to reduce downtime, optimize routes, and extend vehicle lifecycles.

Major players in the Global Electric Public Transport System Market include VDL Bus & Coach, BYD, Yutong Bus, Heliox, EasyMile, Tata Motors, Hitachi Rail, Siemens Mobility, Alstom, and Volvo. Leading companies are strengthening their market positions by investing in modular electric platforms, developing interoperable charging systems, and forming strategic partnerships with urban transit agencies. They are also expanding product portfolios with energy-optimized electric vehicles and focusing R&D efforts on ADAS, telematics, and fleet management software to stay agile and meet evolving regulatory, operational, and environmental requirements across global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Trade impact

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for in-vehicle connectivity and UX

- 3.8.1.2 Technological advancements in materials & manufacturing

- 3.8.1.3 Growth in electric and autonomous vehicles

- 3.8.1.4 OEM focus on weight reduction and design integration

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High Production Costs

- 3.8.2.2 Durability and Environmental Sensitivity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Mode of Transport, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Electric buses

- 5.3 Electric trains

- 5.4 Electric ferries

- 5.5 Electric taxis/ride-hailing

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicles (BEV)

- 6.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 6.4 Fuel Cell Electric Vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Charging, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Depot charging

- 7.3 Opportunity charging

- 7.4 Wireless charging

- 7.5 Battery swapping

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Government transit authorities

- 8.3 Private fleet operators

- 8.4 Public-Private Partnerships (PPPs)

- 8.5 Airport & industrial transit operators

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Alexander Dennis

- 10.3 Alstom

- 10.4 Ashok Leyland

- 10.5 BYD

- 10.6 CAF

- 10.7 CRRC

- 10.8 EasyMile

- 10.9 Heliox

- 10.10 Hitachi Rail

- 10.11 Keolis

- 10.12 Navya

- 10.13 Proterra

- 10.14 Schneider Electric

- 10.15 Siemens eMobility

- 10.16 Soltaro

- 10.17 Tata Motors

- 10.18 VDL Bus & Coach

- 10.19 Volvo

- 10.20 Yutong Bus