|

市場調查報告書

商品編碼

1800741

全球 ITS(智慧型運輸系統)市場:公路、鐵路、航空、海運、先進交通管理系統、收費和停車管理系統、安全和監控系統以及智慧票務系統 - 預測至 2030 年Intelligent Transportation System Market by Roadways, Railways, Aviation, Maritime, Advanced Traffic Management Systems, Tolling & Parking Management Systems, Security & Surveillance Systems, Smart Ticketing Systems - Global Forecast to 2030 |

||||||

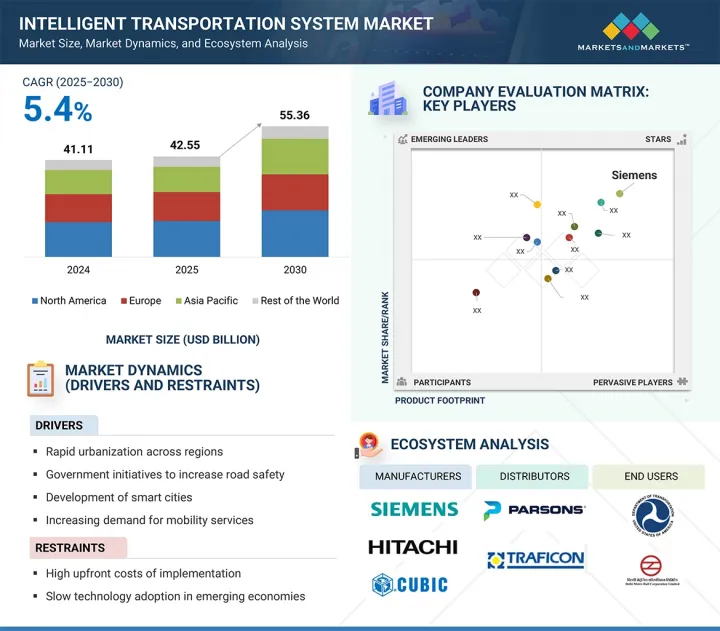

預計 2025 年全球 ITS(智慧型運輸系統)市場規模將達到 425.5 億美元,到 2030 年將達到 553.6 億美元,預測期內複合年成長率為 5.4%。

由於都市區交通堵塞加劇、汽車保有量激增以及對智慧和永續移動解決方案的需求不斷成長,各地區市場均呈現強勁成長。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 方法、用途、區域 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

政府大力發展智慧城市和改善公共交通基礎設施,進一步加速了智慧交通系統 (ITS) 技術的部署。 ITS 解決方案在提昇道路安全、縮短旅行時間、最佳化交通流量和最大程度減少環境影響方面發揮關鍵作用。先進的交通管理系統 (ATMS)、智慧停車、電子收費系統和即時乘客資訊系統等應用正在道路和公共交通網路中廣泛應用。

“按模式計算,預計鐵路領域將在預測期內佔據第二大市場佔有率。”

預計在預測期內,鐵路領域將成為智慧型運輸系統(ITS) 市場中第二大市場規模,這得益於鐵路基礎設施的現代化、高速鐵路和城市交通系統投資的增加,以及對提高安全性和營運效率日益成長的需求。鐵路基礎設施的現代化正在推動先進 ITS 技術的應用,例如自動訊號、即時監控和預測性維護,這些技術有助於提高營運效率並減少停機時間。此外,已開發經濟體和新興經濟體對高速鐵路和城市交通計劃的投資不斷增加,正在推動 ITS 解決方案的大規模部署,例如智慧票務系統、集中交通控制中心和動態乘客資訊顯示器。這些系統可確保無縫整合、最佳化調度並改善通勤體驗。此外,對提高安全性和系統可靠性日益成長的需求正在加速障礙物偵測、智慧監控和自動煞車等技術的應用,所有這些技術都有助於提高鐵路營運的安全性和效率。

“根據應用情況,票務部門預計在預測期內的複合年成長率將位居第二。”

智慧型運輸系統(ITS) 市場中的票務部分預計將在預測期內實現第二高的複合年成長率,這得益於對非接觸式數位支付解決方案日益成長的需求、自動售檢票 (AFC) 系統日益廣泛的部署,以及對提升乘客便利性和降低營運成本日益成長的關注。對非接觸式數位支付解決方案日益成長的需求推動了智慧卡、行動票務應用程式和基於QR碼的系統的採用,這些系統提供了更快、更安全、更衛生的支付方式,在提升通勤體驗的同時減少了肢體接觸的需求。 AFC 系統在公車、火車和地鐵服務中日益廣泛的部署,實現了高效、無錯誤的即時票價處理。這不僅提高了交通運輸業者的收益保障,也支持了這些系統在大型多式聯運運輸網路中的可擴展性。此外,對提升乘客便利性和降低營運成本日益成長的關注,促使交通運輸機構從手動票務解決方案過渡到數位票務解決方案,從而簡化了登車流程,降低了人事費用,並提高了整體服務的可靠性,從而推動了該部分的強勁成長。

“預測期內,北美將實現第二高的複合年成長率。”

預計在預測期內,北美地區智慧型運輸系統的複合年成長率將位居第二,這得益於其擁有強大的先進交通基礎設施、對智慧運輸和自動駕駛汽車技術的投資不斷成長,以及政府對永續高效交通系統的支持力度不斷加大。該地區完善的交通網路為智慧交通管理、即時事件偵測和自適應號誌控制等先進 ITS 解決方案的整合奠定了堅實的基礎。

本報告對全球 ITS(智慧型運輸系統)市場進行了分析,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- ITS(智慧型運輸系統)市場為企業帶來誘人機會

- ITS(智慧型運輸系統)市場:依方法

- ITS(智慧型運輸系統)市場:按應用

- ITS(智慧型運輸系統)市場(按地區)

- 各國智慧型運輸系統(ITS) 市場

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 影響客戶業務的趨勢/中斷

- 定價分析

- 熱感儀各地區平均售價趨勢(2021-2024)

- 各地區車輛偵測感測器平均售價趨勢(2021-2024)

- 主要企業熱感像儀平均銷售價格(2024年)

- 2024年主要企業平均銷售價格

- 價值鏈分析

- 生態系分析

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 專利分析

- 貿易分析

- 進口資料(HS編碼8530)

- 出口資料(HS編碼8530)

- 大型會議和活動(2025-2026年)

- 案例研究

- 德拉敦公共交通採用即時監控和數位票務來最佳化出行模式

- 深圳交通樞紐利用類比和數位系統加強監控

- MERIDA 利用 CUBIC 的智慧交通平台部署智慧城市解決方案,以減少延誤並提高出行效率

- 埃及引入智慧型運輸系統(ITS)以提高安全性和機動性並緩解交通堵塞

- 投資金籌措場景

- 關稅和監管格局

- 海關分析(HS編碼8530)

- 監管機構、政府機構和其他組織

- 標準

- 波特五力分析

- 主要相關利益者和採購標準

- 人工智慧/產生人工智慧對ITS(智慧型運輸系統)市場的影響

- 2025年美國關稅對智慧型運輸系統市場的影響

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對使用的影響

第6章 ITS(智慧型運輸系統)通訊協定

- 介紹

- 短距離

- WAVE(IEEE 802.11)

- WPAN(IEEE 802.15)

- 遠距

- WIMAX(IEEE 802.11)

- OFDM

- IEEE 1512

- TMDD(TRAFFIC MANAGEMENT DATA DICTIONARY)

- 其他通訊協定

第7章 ITS(智慧型運輸系統)市場:依方法

- 介紹

- 路

- 鐵路

- 航空

- 海

第 8 章:道路 ITS(智慧型運輸系統)市場(按系統類型和產品)

- 介紹

- 道路 ITS(智慧型運輸系統)市場(依系統類型)

- 先進的交通管理系統

- 高級乘客資訊系統

- 停車收費管理系統

- 安全和監控系統

- 道路 ITS(智慧型運輸系統)市場(按產品)

- 硬體

- 軟體

- 服務

9. 鐵路智慧型運輸系統市場(依系統類型和產品分類)

- 介紹

- 鐵路 ITS(智慧型運輸系統)市場(依系統類型)

- 鐵路營運系統

- 乘客資訊系統

- 智慧票務系統

- 其他鐵路系統類型

- 鐵路 ITS(智慧型運輸系統)市場(按產品)

- 硬體

- 軟體

- 服務

第 10 章。航空 ITS(智慧型運輸系統)市場按系統類型和產品分類

- 介紹

- 航空 ITS(智慧型運輸系統)市場(依系統類型)

- 飛機管理系統

- 安全和監控系統

- 智慧票務系統

- 資訊管理系統

- 航空智慧型運輸系統(ITS) 市場(按產品)

- 硬體

- 軟體

- 服務

第 11 章海上智慧型運輸系統(ITS) 市場(依系統類型和產品)

- 介紹

- 海上智慧型運輸系統(ITS) 市場(依系統類型)

- 自動辨識系統

- 船舶交通管理系統

- 資訊系統

- 其他類型的海事系統

- 海上智慧型運輸系統(ITS) 市場(按產品)

- 硬體

- 軟體

- 服務

第 12 章 ITS(智慧型運輸系統)市場:按應用

- 介紹

- 安全與監控

- 交通管理

- 資訊管理

- 售票處

- 其他用途

第13章 ITS(智慧型運輸系統)市場(按地區)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 比利時

- 丹麥

- 奧地利

- 瑞典

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 其他地區

- 其他地區的宏觀經濟展望

- 中東

- 非洲

- 南美洲

第14章競爭格局

- 概述

- 主要參與企業的策略/優勢(2020-2025)

- 市場佔有率分析(2024年)

- 收益分析(2020-2024)

- 公司估值及財務指標

- 品牌/產品比較

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第15章 公司簡介

- 介紹

- 主要企業

- SIEMENS

- HITACHI, LTD.

- CUBIC CORPORATION

- CONDUENT INCORPORATED

- KAPSCH TRAFFICCOM AG

- THALES

- TELEDYNE TECHNOLOGIES INCORPORATED

- INDRA SISTEMAS, SA

- MUNDYS

- VERRA MOBILITY

- TOMTOM INTERNATIONAL BV

- 其他公司

- SWARCO

- ST ENGINEERING

- ITERIS, INC.

- Q-FREE

- SERCO GROUP PLC

- EFKON GMBH

- LANNER ELECTRONICS

- SENSYS GATSO GROUP AB

- TAGMASTER

- RICARDO

- TRANSMAX PTY LTD.

- DAKTRONICS, INC.

- GEOTOLL

- CELLINT

- ALSTOM SA

- CLEVER DEVICES LTD

- ETA TRANSIT

- FURUNO ELECTRIC CO., LTD

- TRANSCORE

- ADAPTIVE RECOGNITION INC

- ECONOLITE

- MIOVISION TECHNOLOGIES INCORPORATED

- ELOVATE

第16章 附錄

The global intelligent transportation system market was valued at USD 42.55 billion in 2025 and is projected to reach USD 55.36 billion by 2030, at a CAGR of 5.4% during the forecast period. The market is experiencing robust growth across regions, driven by increasing urban traffic congestion, a surge in vehicle ownership, and the rising demand for smart and sustainable mobility solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Mode, Intelligent Transportation System Market for Roadways, Intelligent Transportation System Market for Railways, Intelligent Transportation System Market for Aviation, Intelligent Transportation System Market for Maritime, By Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Government initiatives aimed at developing smart cities and improving public transport infrastructure further accelerate ITS technology deployment. ITS solutions play a crucial role in enhancing road safety, reducing travel time, optimizing traffic flow, and minimizing environmental impact. Applications such as advanced traffic management systems, smart parking, electronic toll collection, and real-time traveler information systems are being widely adopted across roadways and public transit networks.

"Based on mode, the railways segment is expected to account for the second-largest market share during the forecast period."

The railways segment is expected to hold the second-largest market size in the intelligent transportation system market during the forecast period due to the modernization of rail infrastructure, increasing investments in high-speed rail and urban transit systems, and rising demand for enhanced safety and operational efficiency. Modernization of rail infrastructure drives the adoption of advanced ITS technologies such as automated signaling, real-time monitoring, and predictive maintenance, which help enhance operational efficiency and reduce service downtime. Additionally, increasing investments in high-speed rail and urban transit projects across both developed and developing economies are leading to the large-scale deployment of ITS solutions like smart ticketing systems, centralized traffic control centers, and dynamic passenger information displays. These systems ensure seamless integration, optimized scheduling, and improved commuter experiences. Moreover, the rising demand for improved safety and system reliability is accelerating the implementation of technologies such as obstacle detection, intelligent surveillance, and automated braking, all of which contribute to safer and more efficient rail operations.

"Based on application, the ticketing segment is projected to register the second-highest CAGR during the forecast period."

The ticketing segment is projected to register the second-highest CAGR in the intelligent transportation system market during the forecast period due to the growing demand for contactless and digital payment solutions, increasing deployment of automated fare collection (AFC) systems, and rising focus on improving passenger convenience and reducing operational costs. Growing demand for contactless and digital payment solutions is driving the adoption of smart cards, mobile ticketing apps, and QR-code-based systems, offering faster, more secure, and hygienic payment options that enhance the commuter experience while reducing the need for physical interactions. The increasing deployment of AFC systems across buses, trains, and metro services enables efficient, error-free, and real-time fare processing. This not only improves revenue assurance for transit operators but also supports the scalability of these systems across large, multimodal transport networks. Additionally, the rising focus on enhancing passenger convenience and reducing operational costs encourages transport agencies to transition from manual to digital ticketing solutions, which streamline boarding processes, cut down on labor expenses, and improve overall service reliability, fueling the segment's robust growth.

"North America to register second-highest CAGR during forecast period"

North America is projected to register the second-highest CAGR in the intelligent transportation system market during the forecast period due to the strong presence of advanced transport infrastructure, growing investments in smart mobility and autonomous vehicle technologies, and increasing government support for sustainable and efficient transportation systems. The region's well-established transportation network provides a strong foundation for the integration of advanced ITS solutions, such as intelligent traffic management, real-time incident detection, and adaptive signal control. Additionally, government initiatives supporting eco-friendly and efficient urban transportation, including congestion pricing, electric vehicle (EV) integration, and data-driven traffic optimization, further drive the adoption of ITS. These factors combined are fostering an environment conducive to the rapid implementation and expansion of intelligent transportation systems, positioning North America as a key growth region in the global market.

Extensive primary interviews were conducted with key industry experts in the intelligent transportation system market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - North America - 45%, Europe - 30%, Asia Pacific - 20%, and RoW - 5%

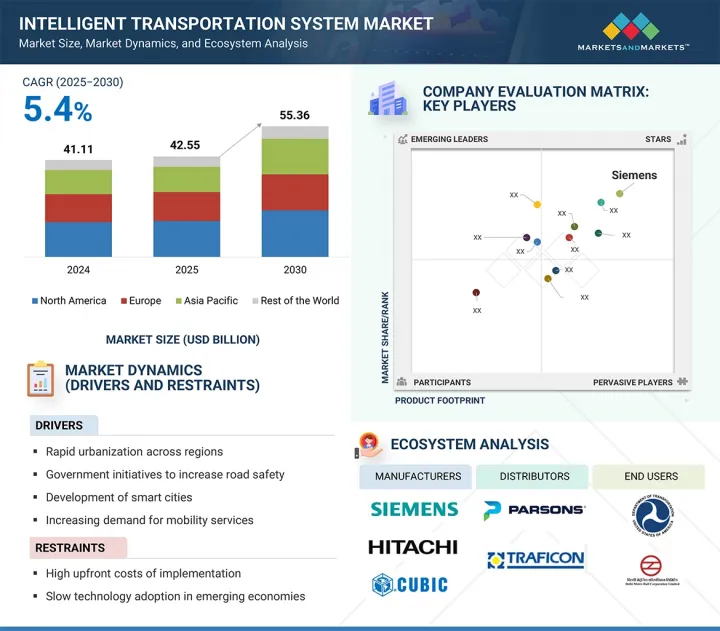

The intelligent transportation system market is dominated by a few globally established players, such as Siemens (Germany), Hitachi Ltd. (Japan), Mundys (Italy), Indra Sistemas S.A. (Spain), Verra Mobility (US), Cubic Corporation (US), Conduent, Inc. (US), Kapsch Trafficcom AG (Austria), Thales (France), Teledyne Technologies Incorporated (US), Swarco (Austria), ST Engineering (Singapore), Iteris, Inc (US), Q-Free (Norway), SERCO GROUP PLC (UK).

The study includes an in-depth competitive analysis of these key players in the intelligent transportation system market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the intelligent transportation system market and forecasts its size by mode (roadways, railways, aviation, maritime), intelligent transportation system market for roadways (advanced traffic management systems, advanced traveler information systems, tolling & parking management systems, security & surveillance systems), intelligent transportation system market for railways (rail operation systems, passenger information systems, smart ticketing systems, others), intelligent transportation system market for aviation (aircraft management systems, security & surveillance systems, smart ticketing systems, information management systems), intelligent transportation system market for maritime (automatic identification systems, vessel traffic management systems, information systems, others), application (security & surveillance, traffic management, information management, ticketing, others). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the intelligent transportation system ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Rapid urbanization across regions, Government initiatives to increase road safety, Rising development of smart cities globally, Increasing demand for mobility services), restraints (High upfront costs of implementation, Slow technology adoption in emerging economies), opportunities (Growing public-private partnerships, Growing demand for emerging economies), challenges (Complexity of data management and privacy)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the intelligent transportation system market

- Market Development: Comprehensive information about lucrative markets - the report analyses the intelligent transportation system market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the intelligent transportation system market

- Competitive Assessment: In-depth assessment of market shares and growth strategies of leading players, such as Siemens (Germany), Hitachi Ltd. (Japan), Mundys (Italy), Indra Sistemas S.A. (Spain), Verra Mobility (US), Cubic Corporation (US), Conduent, Inc. (US), Kapsch Trafficcom AG (Austria), Thales (France), Teledyne Technologies Incorporated (US), Swarco (Austria), ST Engineering (Singapore), Iteris, Inc (US), Q-Free (Norway), SERCO GROUP PLC (UK).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INTELLIGENT TRANSPORTATION SYSTEM MARKET

- 4.2 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE

- 4.3 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY APPLICATION

- 4.4 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY REGION

- 4.5 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing migration from rural to urban areas

- 5.2.1.2 Government-led initiatives to increase road safety

- 5.2.1.3 Rapid development of smart cities

- 5.2.1.4 Increasing demand for mobility services

- 5.2.2 RESTRAINT

- 5.2.2.1 Substantial investments in deploying advanced technologies

- 5.2.2.2 Infrastructure limitations and budgetary constraints in developing countries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing public-private partnerships

- 5.2.3.2 Pressing need for smart mobility solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with data management and privacy

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF THERMAL CAMERAS, BY REGION, 2021-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF VEHICLE DETECTION SENSORS, BY REGION, 2021-2024

- 5.4.3 AVERAGE SELLING PRICE OF THERMAL CAMERAS, BY KEY PLAYER, 2024

- 5.4.4 AVERAGE SELLING PRICE OF VEHICLE DETECTION SENSORS, BY KEY PLAYER, 2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Global navigation satellite systems

- 5.7.1.2 Automatic number plate recognition

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Digital twin

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 RFID

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA (HS CODE 8530)

- 5.9.2 EXPORT DATA (HS CODE 8530)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDIES

- 5.11.1 PUBLIC TRANSPORTATION IN DEHRADUN ADOPT REAL-TIME MONITORING AND DIGITAL TICKETING TO OPTIMIZE TRAVEL PATTERNS

- 5.11.2 SHENZHEN TRANSPORTATION HUBS ENHANCE SURVEILLANCE WITH ANALOG AND DIGITAL SYSTEMS

- 5.11.3 MERIDA DEPLOYS SMART CITY SOLUTIONS TO REDUCE DELAY AND IMPROVE MOBILITY WITH CUBIC'S INTELLIGENT TRAFFIC PLATFORM

- 5.11.4 EGYPT IMPLEMENTS INTELLIGENT TRANSPORT SYSTEM TO IMPROVE SAFETY, ENHANCE MOBILITY, AND REDUCE CONGESTION

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 8530)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDER IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON INTELLIGENT TRANSPORTATION SYSTEM MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF ON INTELLIGENT TRANSPORTATION SYSTEM MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 PROTOCOLS FOR INTELLIGENT TRANSPORTATION SYSTEMS

- 6.1 INTRODUCTION

- 6.2 SHORT RANGE

- 6.2.1 WAVE (IEEE 802.11)

- 6.2.2 WPAN (IEEE 802.15)

- 6.3 LONG RANGE

- 6.3.1 WIMAX (IEEE 802.11)

- 6.3.2 OFDM

- 6.4 IEEE 1512

- 6.5 TRAFFIC MANAGEMENT DATA DICTIONARY

- 6.6 OTHER PROTOCOLS

7 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE

- 7.1 INTRODUCTION

- 7.2 ROADWAYS

- 7.2.1 RISING NEED FOR REAL-TIME VEHICLE TRACKING TO FOSTER MARKET GROWTH

- 7.3 RAILWAYS

- 7.3.1 INTEGRATION WITH ONBOARD DIAGNOSTICS AND CLOUD COMMUNICATION TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 7.4 AIRWAYS

- 7.4.1 DRONE INTEGRATION INTO COMMERCIAL AIRSPACE TO FUEL MARKET GROWTH

- 7.5 MARITIME

- 7.5.1 EVOLUTION OF SMART LOGISTICS HUBS TO DRIVE MARKET

8 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE AND OFFERING

- 8.1 INTRODUCTION

- 8.2 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE

- 8.2.1 ADVANCED TRAFFIC MANAGEMENT SYSTEMS

- 8.2.1.1 Adaptive traffic signal control systems

- 8.2.1.1.1 Shift toward smart and responsive traffic ecosystems to drive market

- 8.2.1.2 Ramp metering systems

- 8.2.1.2.1 Rising emphasis on smart mobility and congestion mitigation to boost demand

- 8.2.1.3 Variable speed limit systems

- 8.2.1.3.1 Transition toward intelligent and connected infrastructure to support segmental growth

- 8.2.1.4 Incident detection systems

- 8.2.1.4.1 Increasing demand for scalable, automated, and reliable detection solutions to foster market growth

- 8.2.1.1 Adaptive traffic signal control systems

- 8.2.2 ADVANCED TRAVELER INFORMATION SYSTEMS

- 8.2.2.1 Dynamic signboards

- 8.2.2.1.1 Growing emphasis on connectivity, automation, and energy efficiency to drive market

- 8.2.2.2 Transit information systems

- 8.2.2.2.1 Global push for sustainable and integrated mobility to support market growth

- 8.2.2.3 Weather information systems

- 8.2.2.3.1 Shift toward AI-powered forecasting and edge computing capabilities to drive market

- 8.2.2.1 Dynamic signboards

- 8.2.3 TOLLING & PARKING MANAGEMENT SYSTEMS

- 8.2.3.1 Rising digital infrastructure investments to boost demand

- 8.2.4 SECURITY & SURVEILLANCE SYSTEMS

- 8.2.4.1 Growing emphasis on smart city infrastructure to drive market

- 8.2.1 ADVANCED TRAFFIC MANAGEMENT SYSTEMS

- 8.3 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY OFFERING

- 8.3.1 HARDWARE

- 8.3.1.1 Increasing focus on developing energy-efficient, ruggedized, and low-maintenance equipment to boost demand

- 8.3.2 SOFTWARE

- 8.3.2.1 Improved roadway efficiency and safety to fuel market growth

- 8.3.3 SERVICES

- 8.3.3.1 Shift toward cloud-based traffic management platforms and AI-powered analytics to offer lucrative growth opportunities

- 8.3.1 HARDWARE

9 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE AND OFFERING

- 9.1 INTRODUCTION

- 9.2 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE

- 9.2.1 RAIL OPERATION SYSTEMS

- 9.2.1.1 Signaling solutions

- 9.2.1.1.1 Growing emphasis on high-speed rail and urban metro networks to foster market growth

- 9.2.1.2 Control & supervision systems

- 9.2.1.2.1 Increasing demand for high-capacity and low-latency control solutions to drive market

- 9.2.1.3 Rail traffic management systems

- 9.2.1.3.1 Growing sophistication of rail traffic management platforms to boost demand

- 9.2.1.1 Signaling solutions

- 9.2.2 PASSENGER INFORMATION SYSTEMS

- 9.2.2.1 Shift toward cloud-based architectures and AI-driven analytics to support market growth

- 9.2.3 SMART TICKETING SYSTEMS

- 9.2.3.1 Increasing investments in smart city infrastructure to fuel market growth

- 9.2.4 OTHER RAILWAYS SYSTEM TYPES

- 9.2.1 RAIL OPERATION SYSTEMS

- 9.3 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY OFFERING

- 9.3.1 HARDWARE

- 9.3.1.1 Growing demand for high-speed rail and smart rail infrastructure to drive market

- 9.3.2 SOFTWARE

- 9.3.2.1 Reduced operational delays with data-driven and AI-enhanced software platforms to foster market growth

- 9.3.3 SERVICES

- 9.3.3.1 Growing complexity of rail networks and increasing emphasis on digital transformation to support market growth

- 9.3.1 HARDWARE

10 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE AND OFFERING

- 10.1 INTRODUCTION

- 10.2 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE

- 10.2.1 AIRCRAFT MANAGEMENT SYSTEMS

- 10.2.1.1 Air traffic control systems

- 10.2.1.1.1 Increasing complexity of manned and unmanned aircraft operations to drive market

- 10.2.1.1.2 Other aircraft management systems

- 10.2.1.1 Air traffic control systems

- 10.2.2 SECURITY & SURVEILLANCE SYSTEMS

- 10.2.2.1 Seamless integration with centralized command and control systems to drive market

- 10.2.3 SMART TICKETING SYSTEMS

- 10.2.3.1 Emphasis on modernizing global air travel systems to boost demand

- 10.2.4 INFORMATION MANAGEMENT SYSTEMS

- 10.2.4.1 Expanding ecosystem of eVTOL aircraft to support market growth

- 10.2.1 AIRCRAFT MANAGEMENT SYSTEMS

- 10.3 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY OFFERING

- 10.3.1 HARDWARE

- 10.3.1.1 Advancements in sensor miniaturization and edge computing to offer lucrative growth opportunities

- 10.3.2 SOFTWARE

- 10.3.2.1 Shift toward interoperable, scalable, and secure software systems to foster market growth

- 10.3.3 SERVICES

- 10.3.3.1 Increasing investments in smart airport infrastructure to boost demand

- 10.3.1 HARDWARE

11 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE AND OFFERING

- 11.1 INTRODUCTION

- 11.2 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE

- 11.2.1 AUTOMATIC IDENTIFICATION SYSTEMS

- 11.2.1.1 Shift toward autonomous navigation and digital port infrastructure to boost demand

- 11.2.2 VESSEL TRAFFIC MANAGEMENT SYSTEMS

- 11.2.2.1 Need to optimize vessel turnaround times and reduce fuel consumption to foster market growth

- 11.2.3 INFORMATION SYSTEMS

- 11.2.3.1 Rising need to implement sustainable shipping practices to foster market growth

- 11.2.4 OTHER MARITIME SYSTEM TYPES

- 11.2.1 AUTOMATIC IDENTIFICATION SYSTEMS

- 11.3 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY OFFERING

- 11.3.1 HARDWARE

- 11.3.1.1 Growing adoption of digital and automated maritime operations to drive market

- 11.3.2 SOFTWARE

- 11.3.2.1 Need to optimize maritime logistics and enhance safety to fuel market growth

- 11.3.3 SERVICES

- 11.3.3.1 Reduced operational downtime and improved safety to drive market

- 11.3.1 HARDWARE

12 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 SECURITY & SURVEILLANCE

- 12.2.1 RISING DEMAND FOR AI-POWERED SECURITY & SURVEILLANCE TO DRIVE MARKET

- 12.3 TRAFFIC MANAGEMENT

- 12.3.1 NEED TO OPTIMIZE TRAFFIC FLOW AND REDUCE CONGESTION TO FUEL MARKET GROWTH

- 12.4 INFORMATION MANAGEMENT

- 12.4.1 GROWING COMPLEXITY OF URBAN MOBILITY TO DRIVE MARKET

- 12.5 TICKETING

- 12.5.1 SHIFT TOWARD INTEGRATED MOBILITY-AS-A-SERVICE MODELS TO FUEL MARKET GROWTH

- 12.6 OTHER APPLICATIONS

13 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Need to control traffic congestion and reduce pollution to boost demand

- 13.2.3 CANADA

- 13.2.3.1 Favorable government initiatives to drive market

- 13.2.4 MEXICO

- 13.2.4.1 Expanding transportation networks to offer lucrative growth opportunities

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Growing emphasis on creating sustainable and future-proof transportation systems to fuel market growth

- 13.3.3 FRANCE

- 13.3.3.1 Implementation of Mobility 3.0 program to offer lucrative growth opportunities

- 13.3.4 UK

- 13.3.4.1 Growing investments to develop and deploy ITS to drive market

- 13.3.5 ITALY

- 13.3.5.1 Improved fleet management and passenger information to support market growth

- 13.3.6 SPAIN

- 13.3.6.1 Increasing emphasis on improving safety in road operations and maintenance to boost demand

- 13.3.7 BELGIUM

- 13.3.7.1 Growing demand for emission-free public transportation systems to fuel market growth

- 13.3.8 DENMARK

- 13.3.8.1 Rising adoption of EVs to offer lucrative growth opportunities

- 13.3.9 AUSTRIA

- 13.3.9.1 Increasing decarbonization efforts to drive market

- 13.3.10 SWEDEN

- 13.3.10.1 Promotion of sustainable and smart transportation initiatives to support market growth

- 13.3.11 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Rising need to tackle traffic congestion and pollution to fuel market growth

- 13.4.3 JAPAN

- 13.4.3.1 Growing demand for connected and autonomous vehicles to foster market growth

- 13.4.4 INDIA

- 13.4.4.1 Increasing need to boost efficiency of urban transportation networks to support market growth

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Emphasis on developing smart mobility infrastructure and reducing urban congestion to support market growth

- 13.4.6 AUSTRALIA

- 13.4.6.1 Public-private collaborations to boost demand

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 GCC

- 13.5.2.1.1 Rising initiatives to promote sustainable mobility to drive market

- 13.5.2.2 Rest of Middle East

- 13.5.2.1 GCC

- 13.5.3 AFRICA

- 13.5.3.1 Shift toward intelligent urban mobility and sustainable transport development to boost demand

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Increasing emphasis on developing smart cities to offer lucrative growth opportunities

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Mode footprint

- 14.7.5.4 Offering footprint

- 14.7.5.5 Application footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 SIEMENS

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Developments

- 15.2.1.4 MnM view

- 15.2.1.4.1 Key strengths/Right to win

- 15.2.1.4.2 Strategic choices

- 15.2.1.4.3 Weaknesses/Competitive threats

- 15.2.2 HITACHI, LTD.

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Product launches

- 15.2.2.3.2 Deals

- 15.2.2.3.3 Other developments

- 15.2.2.4 MnM view

- 15.2.2.4.1 Key strengths/Right to win

- 15.2.2.4.2 Strategic choices

- 15.2.2.4.3 Weaknesses/Competitive threats

- 15.2.3 CUBIC CORPORATION

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.3.1 Product launches

- 15.2.3.3.2 Deals

- 15.2.3.3.3 Expansions

- 15.2.3.4 MnM view

- 15.2.3.4.1 Key strengths/Right to win

- 15.2.3.4.2 Strategic choices

- 15.2.3.4.3 Weaknesses/Competitive threats

- 15.2.4 CONDUENT INCORPORATED

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.3.1 Product launches

- 15.2.4.3.2 Other developments

- 15.2.4.4 MnM view

- 15.2.4.4.1 Key strengths/Right to win

- 15.2.4.4.2 Strategic choices

- 15.2.4.4.3 Weaknesses/Competitive threats

- 15.2.5 KAPSCH TRAFFICCOM AG

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 Recent developments

- 15.2.5.3.1 Product launches

- 15.2.5.3.2 Other developments

- 15.2.5.4 MnM view

- 15.2.5.4.1 Key strengths/Right to win

- 15.2.5.4.2 Strategic choices

- 15.2.5.4.3 Weaknesses/Competitive threats

- 15.2.6 THALES

- 15.2.6.1 Business overview

- 15.2.6.2 Products/Solutions/Services offered

- 15.2.6.3 Recent developments

- 15.2.6.3.1 Product launches

- 15.2.7 TELEDYNE TECHNOLOGIES INCORPORATED

- 15.2.7.1 Business overview

- 15.2.7.2 Products/Solutions/Services offered

- 15.2.7.3 Recent developments

- 15.2.7.3.1 Product launches

- 15.2.7.3.2 Deals

- 15.2.8 INDRA SISTEMAS, S.A.

- 15.2.8.1 Business overview

- 15.2.8.2 Products/Solutions/Services offered

- 15.2.8.2.1 Deals

- 15.2.9 MUNDYS

- 15.2.9.1 Business overview

- 15.2.9.2 Products/Solutions/Services offered

- 15.2.9.3 Recent developments

- 15.2.9.3.1 Product launches

- 15.2.10 VERRA MOBILITY

- 15.2.10.1 Business overview

- 15.2.10.2 Products/Solutions/Services offered

- 15.2.11 TOMTOM INTERNATIONAL BV

- 15.2.11.1 Business overview

- 15.2.11.2 Products/Solutions/Services offered

- 15.2.11.3 Recent developments

- 15.2.11.3.1 Product launches

- 15.2.1 SIEMENS

- 15.3 OTHER PLAYERS

- 15.3.1 SWARCO

- 15.3.2 ST ENGINEERING

- 15.3.3 ITERIS, INC.

- 15.3.4 Q-FREE

- 15.3.5 SERCO GROUP PLC

- 15.3.6 EFKON GMBH

- 15.3.7 LANNER ELECTRONICS

- 15.3.8 SENSYS GATSO GROUP AB

- 15.3.9 TAGMASTER

- 15.3.10 RICARDO

- 15.3.11 TRANSMAX PTY LTD.

- 15.3.12 DAKTRONICS, INC.

- 15.3.13 GEOTOLL

- 15.3.14 CELLINT

- 15.3.15 ALSTOM SA

- 15.3.16 CLEVER DEVICES LTD

- 15.3.17 ETA TRANSIT

- 15.3.18 FURUNO ELECTRIC CO., LTD

- 15.3.19 TRANSCORE

- 15.3.20 ADAPTIVE RECOGNITION INC

- 15.3.21 ECONOLITE

- 15.3.22 MIOVISION TECHNOLOGIES INCORPORATED

- 15.3.23 ELOVATE

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

List of Tables

- TABLE 1 INTELLIGENT TRANSPORTATION SYSTEM MARKET: RISK ASSESSMENT

- TABLE 2 AVERAGE SELLING PRICE TREND OF THERMAL CAMERAS, BY REGION, 2021-2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF VEHICLE DETECTION SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE OF THERMAL CAMERAS, BY KEY PLAYER, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE OF VEHICLE DETECTION SENSORS, BY KEY PLAYER, 2024 (USD)

- TABLE 6 ROLE OF COMPANIES IN INFORMATION TRANSPORTATION SYSTEM ECOSYSTEM

- TABLE 7 LIST OF MAJOR PATENTS, 2022-2023

- TABLE 8 IMPORT DATA FOR HS CODE 8530-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 8530-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 MFN IMPORT TARIFFS FOR HS CODE 8530-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INTELLIGENT TRANSPORTATION SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 EXPECTED CHANGE IN PRICES AND IMPACT ON MODES DUE TO TARIFF

- TABLE 21 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2021-2024 (USD MILLION)

- TABLE 22 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2025-2030 (USD MILLION)

- TABLE 23 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 24 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 25 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 ADVANCED TRAFFIC MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 28 ADVANCED TRAFFIC MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 29 ADVANCED TRAFFIC MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 ADVANCED TRAFFIC MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 ADVANCED TRAVELER INFORMATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 32 ADVANCED TRAVELER INFORMATION SYSTEMS: INTELLIGENT TRANSPORTATION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 33 ADVANCED TRAVELER INFORMATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 ADVANCED TRAVELER INFORMATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 TOLLING & PARKING MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 TOLLING & PARKING MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 SECURITY & SURVEILLANCE SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 SECURITY & SURVEILLANCE SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 40 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 41 HARDWARE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 HARDWARE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 INTERFACE BOARDS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 INTERFACE BOARDS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 SENSORS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 SENSORS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 SURVEILLANCE CAMERAS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 48 SURVEILLANCE CAMERAS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 TELECOMMUNICATION NETWORKS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 50 TELECOMMUNICATION NETWORKS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 51 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 52 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 53 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 RAIL OPERATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 56 RAIL OPERATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 57 RAIL OPERATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 RAIL OPERATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 PASSENGER INFORMATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 PASSENGER INFORMATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 SMART TICKETING SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 SMART TICKETING SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 OTHER RAILWAYS SYSTEM TYPES: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 OTHER RAILWAYS SYSTEM TYPES: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 66 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 67 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 68 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 69 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 AIRCRAFT MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 AIRCRAFT MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 SECURITY & SURVEILLANCE SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 SECURITY & SURVEILLANCE SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 SMART TICKETING SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 SMART TICKETING SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 INFORMATION MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 INFORMATION MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 80 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 81 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 82 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 83 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION 2025-2030 (USD MILLION)

- TABLE 85 AUTOMATIC IDENTIFICATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 AUTOMATIC IDENTIFICATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 VESSEL TRAFFIC MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 VESSEL TRAFFIC MANAGEMENT SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION 2025-2030 (USD MILLION)

- TABLE 89 INFORMATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 INFORMATION SYSTEMS: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION 2025-2030 (USD MILLION)

- TABLE 91 OTHER MARITIME SYSTEM TYPES: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 OTHER MARITIME SYSTEM TYPES: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY REGION 2025-2030 (USD MILLION)

- TABLE 93 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 94 INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 95 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 96 INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 INTELLIGENT TRANSPORT SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 INTELLIGENT TRANSPORT SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2021-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2021-2024 (USD MILLION)

- TABLE 136 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY MODE, 2025-2030 (USD MILLION)

- TABLE 137 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 138 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR ROADWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 139 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 140 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR RAILWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 141 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 142 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR AIRWAYS, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 143 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 144 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET FOR MARITIME, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 145 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 ROW: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST: INTELLIGENT TRANSPORTATION SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 149 INTELLIGENT TRANSPORTATION SYSTEM MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 150 INTELLIGENT TRANSPORTATION SYSTEM MARKET: MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 151 INTELLIGENT TRANSPORTATION SYSTEM MARKET: REGION FOOTPRINT

- TABLE 152 INTELLIGENT TRANSPORTATION SYSTEM MARKET: MODE FOOTPRINT

- TABLE 153 INTELLIGENT TRANSPORTATION SYSTEM MARKET: OFFERING FOOTPRINT

- TABLE 154 INTELLIGENT TRANSPORTATION SYSTEM MARKET: APPLICATION FOOTPRINT

- TABLE 155 INTELLIGENT TRANSPORTATION SYSTEM MARKET: DETAILED LIST KEY OF STARTUPS/SMES

- TABLE 156 INTELLIGENT TRANSPORTATION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 157 INTELLIGENT TRANSPORTATION SYSTEM MARKET: PRODUCT LAUNCHES, JUNE 2021-JULY 2025

- TABLE 158 INTELLIGENT TRANSPORTATION SYSTEM MARKET: DEALS, JUNE 2021-JULY 2025

- TABLE 159 SIEMENS: COMPANY OVERVIEW

- TABLE 160 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 SIEMENS: DEVELOPMENTS

- TABLE 162 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 163 HITACHI, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 HITACHI, LTD.: PRODUCT LAUNCHES

- TABLE 165 HITACHI, LTD.: DEALS

- TABLE 166 HITACHI, LTD.: OTHER DEVELOPMENTS

- TABLE 167 CUBIC CORPORATION: COMPANY OVERVIEW

- TABLE 168 CUBIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 CUBIC CORPORATION: PRODUCT LAUNCHES

- TABLE 170 CUBIC CORPORATION: DEALS

- TABLE 171 CUBIC CORPORATION: EXPANSIONS

- TABLE 172 CONDUENT INCORPORATED: COMPANY OVERVIEW

- TABLE 173 CONDUENT INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 CONDUENT INCORPORATED: PRODUCT LAUNCHES

- TABLE 175 CONDUENT INCORPORATED: OTHER DEVELOPMENTS

- TABLE 176 KAPSCH TRAFFICCOM AG: COMPANY OVERVIEW

- TABLE 177 KAPSCH TRAFFICCOM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 KAPSCH TRAFFICCOM AG: PRODUCT LAUNCHES

- TABLE 179 KAPSCH TRAFFICCOM AG: OTHER DEVELOPMENTS

- TABLE 180 THALES: COMPANY OVERVIEW

- TABLE 181 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 THALES: PRODUCT LAUNCHES

- TABLE 183 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 184 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 186 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 187 INDRA SISTEMAS, S.A.: COMPANY OVERVIEW

- TABLE 188 INDRA SISTEMAS, S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 INDRA SISTEMAS, S.A.: DEALS

- TABLE 190 MUNDYS: COMPANY OVERVIEW

- TABLE 191 MUNDYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 MUNDYS: PRODUCT LAUNCHES

- TABLE 193 VERRA MOBILITY: COMPANY OVERVIEW

- TABLE 194 VERRA MOBILITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 TOMTOM INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 196 TOMTOM INTERNATIONAL BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 TOMTOM INTERNATIONAL BV: PRODUCT LAUNCHES

List of Figures

- FIGURE 1 INTELLIGENT TRANSPORTATION SYSTEM MARKET AND REGIONAL SEGMENTATION

- FIGURE 2 INTELLIGENT TRANSPORTATION SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 INTELLIGENT TRANSPORTATION SYSTEM MARKET: BOTTOM-UP APPROACH

- FIGURE 4 INTELLIGENT TRANSPORTATION SYSTEM MARKET: TOP-DOWN APPROACH

- FIGURE 5 INTELLIGENT TRANSPORTATION SYSTEM MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 6 INTELLIGENT TRANSPORTATION SYSTEM MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 INTELLIGENT TRANSPORTATION SYSTEM MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 INTELLIGENT TRANSPORTATION SYSTEM MARKET, 2021-2030

- FIGURE 10 ROADWAYS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 11 TRAFFIC MANAGEMENT SEGMENT TO LEAD MARKET IN 2025

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING DEMAND FOR SMART INFRASTRUCTURE AND ENHANCED SAFETY SOLUTIONS TO DRIVE MARKET GROWTH

- FIGURE 14 ROADWAYS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 15 INFORMATION MANAGEMENT SYSTEM TO DOMINATE MARKET IN 2030

- FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 INTELLIGENT TRANSPORTATION SYSTEM MARKET DYNAMICS

- FIGURE 19 IMPACT ANALYSIS OF DRIVERS ON INTELLIGENT TRANSPORTATION SYSTEM MARKET

- FIGURE 20 IMPACT ANALYSIS OF RESTRAINTS ON INTELLIGENT TRANSPORTATION SYSTEM MARKET

- FIGURE 21 IMPACT ANALYSIS OF OPPORTUNITIES ON INTELLIGENT TRANSPORTATION SYSTEM MARKET

- FIGURE 22 IMPACT ANALYSIS OF CHALLENGES ON INTELLIGENT TRANSPORTATION SYSTEM MARKET

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF THERMAL CAMERAS, BY REGION, 2021-2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF VEHICLE DETECTION SENSORS, BY REGION, 2021-2024

- FIGURE 26 AVERAGE SELLING PRICE OF THERMAL CAMERAS, BY KEY PLAYER, 2024

- FIGURE 27 AVERAGE SELLING PRICE OF VEHICLE DETECTION SENSORS, BY KEY PLAYER, 2024

- FIGURE 28 INFORMATION TRANSPORTATION SYSTEM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 ECOSYSTEM ANALYSIS

- FIGURE 30 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 31 IMPORT DATA FOR HS CODE 8530 -COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 32 EXPORT DATA FOR HS CODE 8530-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 34 INTELLIGENT TRANSPORTATION SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 37 IMPACT OF AI/GEN AI ON INTELLIGENT TRANSPORTATION SYSTEM MARKET

- FIGURE 38 AIRWAYS SEGMENT TO EXPAND AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 TOLLING & PARKING MANAGEMENT SYSTEMS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 PASSENGER INFORMATION SYSTEMS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 INFORMATION MANAGEMENT SYSTEMS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 AUTOMATIC IDENTIFICATION SYSTEMS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 INFORMATION MANAGEMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: INTELLIGENT TRANSPORTATION SYSTEM MARKET SNAPSHOT

- FIGURE 46 EUROPE: INTELLIGENT TRANSPORTATION SYSTEM MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: INTELLIGENT TRANSPORTATION SYSTEM MARKET SNAPSHOT

- FIGURE 48 INTELLIGENT TRANSPORTATION SYSTEM MARKET SHARE ANALYSIS, 2024

- FIGURE 49 INTELLIGENT TRANSPORTATION SYSTEM MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 50 COMPANY VALUATION (USD BILLION)

- FIGURE 51 FINANCIAL METRICS

- FIGURE 52 INTELLIGENT TRANSPORTATION SYSTEM MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 53 INTELLIGENT TRANSPORTATION SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 INTELLIGENT TRANSPORTATION SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 55 INTELLIGENT TRANSPORTATION SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 56 SIEMENS: COMPANY SNAPSHOT

- FIGURE 57 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 58 CONDUENT INCORPORATED: COMPANY SNAPSHOT

- FIGURE 59 KAPSCH TRAFFICCOM AG: COMPANY SNAPSHOT

- FIGURE 60 THALES: COMPANY SNAPSHOT

- FIGURE 61 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 62 INDRA SISTEMAS, S.A.: COMPANY SNAPSHOT

- FIGURE 63 MUNDYS: COMPANY SNAPSHOT

- FIGURE 64 VERRA MOBILITY: COMPANY SNAPSHOT

- FIGURE 65 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT