|

市場調查報告書

商品編碼

1740926

聚乙烯 (PE) 透明阻隔包裝薄膜市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Polyethylene (PE) Transparent Barrier Packaging Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

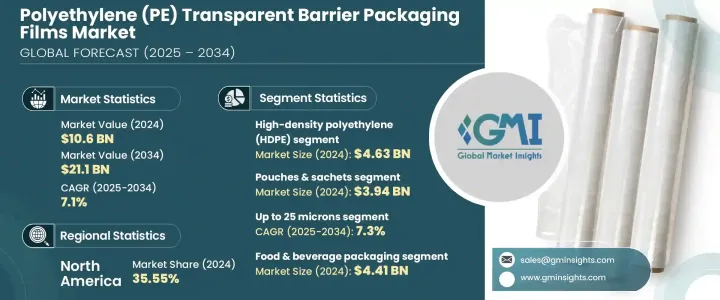

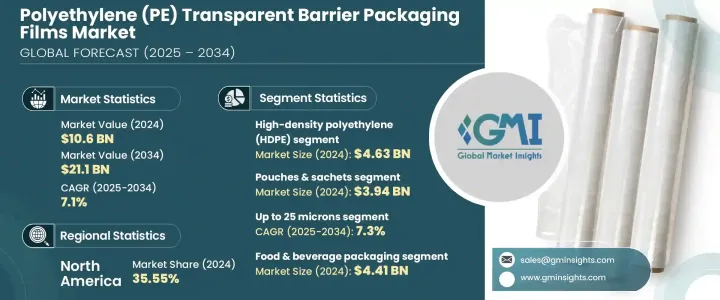

2024年,全球聚乙烯透明阻隔包裝薄膜市場規模達106億美元,預計到2034年將以7.1%的複合年成長率成長,達到211億美元。這主要得益於對便利耐用包裝商品日益成長的需求,這些商品需要高性能的包裝解決方案。消費者對永續、輕盈且經濟高效的包裝日益成長的偏好,正在加速各行各業向聚乙烯 (PE) 透明阻隔薄膜的轉型。隨著食品、化妝品和藥品行業越來越重視延長保存期限和產品完整性,對先進包裝解決方案的需求也迅速成長。 PE透明阻隔薄膜能夠出色地抵禦潮濕、氧氣和污染物,同時保持產品的可視性和柔韌性。

與金屬和玻璃等傳統材料不同,這些薄膜具有顯著優勢,例如運輸成本更低、環境足跡更小、可回收性更高,使其成為前瞻性品牌的首選。此外,全球法規日益嚴格,提倡使用環保和可回收材料,這正推動各行各業根據循環經濟目標創新包裝設計。隨著永續性繼續成為企業議程的主導,製造商越來越注重提供高性能且易於回收的單一材料解決方案。消費者對環境議題的意識日益增強也是一個重要的催化劑,推動市場在預測期內保持強勁的成長軌跡。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 106億美元 |

| 預測值 | 211億美元 |

| 複合年成長率 | 7.1% |

市場按類型細分為茂金屬聚乙烯 (mPE)、線性低密度聚乙烯 (LLDPE)、低密度聚乙烯 (LDPE) 和高密度聚乙烯 (HDPE)。 2024 年,HDPE 以 46.3 億美元的市值領先該細分市場。 HDPE 以其卓越的耐用性和卓越的阻隔性而聞名,是包裝敏感產品的首選材料,尤其是在食品和製藥行業。其優異的化學和氧氣阻隔性能使其對於提高食品安全和貨架穩定性至關重要。隨著市場日益重視永續性,採用共擠 HDPE 薄膜的趨勢日益強勁,這種薄膜具有更高的可回收性,並有助於簡化材料。

就厚度而言,市場涵蓋100微米以上、50-100微米、25-50微米以及高達25微米的薄膜。預計2025年至2034年間,高達25微米的薄膜市場複合年成長率將達7.3%。這些超薄薄膜因其卓越的防潮和防氣性能,越來越受到零食、烘焙食品和藥品包裝的青睞。企業正迅速轉向採用這種厚度範圍內的單一材料薄膜,以符合嚴格的環保標準,同時確保成本效益和產品新鮮度。

預計到2034年,德國聚乙烯透明阻隔包裝薄膜市場將以驚人的32.77%的複合年成長率擴張,成為成長最快的區域市場之一。這項令人印象深刻的成長得益於德國《包裝法》下不斷完善的回收法規,該法規推動了單一材料聚乙烯薄膜的廣泛應用,從而簡化了分類和回收流程。德國在永續工業實踐方面的領導地位以及強力的監管推動力,正在為市場的未來發展奠定基礎。

全球聚乙烯透明阻隔包裝膜市場的領導企業包括Berry Global Inc.、Jindal Poly Films Ltd.、Sealed Air Corporation和Amcor Plc。這些公司正在大力投資先進製造技術,拓展可回收和可生物分解薄膜產品組合,並建立策略合作夥伴關係以推動創新。他們高度重視開發高性能單材料薄膜,並透過共擠技術最佳化生產流程,這有助於他們鞏固全球市場地位,同時滿足不斷變化的監管要求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 永續包裝需求不斷成長

- 嚴格的環境法規

- 技術進步提高了阻隔性和可回收性

- 食品飲料、化妝品和製藥業的採用率不斷提高

- 提高對塑膠污染的認知。

- 產業陷阱與挑戰

- 與傳統塑膠相比,生產成本高且可擴展性有限

- 多層薄膜結構導致回收複雜性

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 低密度聚乙烯(LDPE)

- 高密度聚乙烯(HDPE)

- 線性低密度聚乙烯(LLDPE)

- 茂金屬聚乙烯(mPE)

第6章:市場估計與預測:依包裝形式,2021 - 2034 年

- 主要趨勢

- 小袋和小袋

- 包裝膜和蓋膜

- 袋子和內襯

- 收縮膜和伸展膜

- 蛤蜊殼包裝和泡殼包裝

- 真空和氣調包裝(MAP)薄膜

第7章:市場估計與預測:按厚度,2021 - 2034 年

- 高達 25 微米

- 25–50微米

- 50–100微米

- 100微米以上

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料包裝

- 醫藥和醫療包裝

- 個人護理和化妝品包裝

- 工業包裝

- 電子產品包裝

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Amcor Plc

- Arena Products, Inc.

- Berry Global Inc.

- BIO Packaging Films

- Celplast Metallized Products Ltd.

- Cosmo Films Ltd.

- Dai Nippon Printing Co., Ltd.

- DuPont Teijin Films USA

- Glenroy, Inc.

- Innovia Films

- Jindal Poly Films Ltd.

- Mondi Plc

- Plastissimo Film Co.

- ProAmpac

- Schur Flexibles Group

- Sealed Air Corporation

- SUDPACK Verpackungen GmbH & Co. KG

- Toray Plastics (America), Inc.

- UFlex Limited

- Winpak Ltd.

The Global Polyethylene Transparent Barrier Packaging Films Market was valued at USD 10.6 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 21.1 billion by 2034, driven by the rising demand for convenient, durable packaged goods that require high-performance packaging solutions. Growing consumer preference for sustainable, lightweight, and cost-effective packaging is accelerating the transition toward polyethylene (PE) transparent barrier films across industries. With businesses across food, cosmetics, and pharmaceuticals placing a stronger emphasis on shelf life extension and product integrity, the demand for advanced packaging solutions is rapidly escalating. PE transparent barrier films deliver excellent protection against moisture, oxygen, and contaminants while maintaining product visibility and flexibility.

Unlike traditional materials like metal and glass, these films offer significant advantages such as lower transportation costs, reduced environmental footprint, and better recyclability, making them a top choice for forward-looking brands. In addition, stricter global regulations promoting the use of eco-friendly and recyclable materials are pushing industries to innovate packaging designs in line with circular economy goals. As sustainability continues to dominate corporate agendas, manufacturers are increasingly focused on delivering mono-material solutions that are both high-performing and easily recyclable. The growing awareness among consumers about environmental issues is also a major catalyst, propelling the market's robust growth trajectory through the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 7.1% |

The market is segmented by type into metallocene polyethylene (mPE), linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), and high-density polyethylene (HDPE). HDPE led the segment in 2024 with a market value of USD 4.63 billion. Known for its excellent durability and superior barrier resistance, HDPE is a preferred material for packaging sensitive products, especially in the food and pharmaceutical sectors. Its chemical and oxygen barrier capabilities make it vital for enhancing food safety and shelf stability. As the market leans heavily toward sustainability, the trend of adopting co-extruded HDPE films is gaining momentum, offering better recyclability and supporting material simplification efforts.

In terms of thickness, the market includes above 100 microns, 50-100 microns, 25-50 microns, and up to 25 microns. The up to 25 microns category is projected to grow at a CAGR of 7.3% from 2025 to 2034. These ultra-thin films are increasingly favored for packaging snacks, baked goods, and pharmaceuticals due to their exceptional moisture and gas barrier properties. Companies are rapidly moving toward adopting mono-material films in this thickness range to align with strict environmental standards while ensuring cost-effectiveness and product freshness.

Germany's Polyethylene Transparent Barrier Packaging Films Market is projected to expand at a staggering CAGR of 32.77% by 2034, emerging as one of the fastest-growing regional markets. This impressive growth is fueled by the country's progressive recycling laws under the German Packaging Act, driving widespread adoption of mono-material polyethylene films that simplify sorting and recycling. Germany's leadership in sustainable industrial practices and strong regulatory push is setting the pace for the market's future.

Leading players in the Global Polyethylene Transparent Barrier Packaging Films Market include Berry Global Inc., Jindal Poly Films Ltd., Sealed Air Corporation, and Amcor Plc. These companies are investing heavily in advanced manufacturing technologies, expanding their portfolios with recyclable and biodegradable films, and forming strategic partnerships to drive innovation. A sharp focus on developing high-performance mono-material films and optimizing production processes through co-extrusion techniques is helping them strengthen global market positions while meeting evolving regulatory demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable packaging

- 3.2.1.2 Stringent environmental regulations

- 3.2.1.3 Technological advancements improving barrier properties and recyclability

- 3.2.1.4 Increasing adoption of food & beverage, cosmetics, and pharmaceutical industries

- 3.2.1.5 Increasing awareness of plastic pollution.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & limited scalability compared to traditional plastics

- 3.2.2.2 Recycling complexities due to multilayer film structures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Low-density polyethylene (LDPE)

- 5.3 High-density polyethylene (HDPE)

- 5.4 Linear low-density polyethylene (LLDPE)

- 5.5 Metallocene polyethylene (mPE)

Chapter 6 Market Estimates and Forecast, By Packaging Format, 2021 - 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Pouches & sachets

- 6.3 Wraps & lidding films

- 6.4 Bags & liners

- 6.5 Shrink & stretch films

- 6.6 Clamshells & blister packs

- 6.7 Vacuum & modified atmosphere packaging (MAP) films

Chapter 7 Market Estimates and Forecast, By Thickness, 2021 - 2034 ($ Mn & Kilo Tons)

- 7.1 Up to 25 microns

- 7.2 25–50 microns

- 7.3 50–100 microns

- 7.4 Above 100 microns

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage packaging

- 8.3 Pharmaceutical & medical packaging

- 8.4 Personal care & cosmetics packaging

- 8.5 Industrial packaging

- 8.6 Electronics packaging

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Amcor Plc

- 10.2 Arena Products, Inc.

- 10.3 Berry Global Inc.

- 10.4 BIO Packaging Films

- 10.5 Celplast Metallized Products Ltd.

- 10.6 Cosmo Films Ltd.

- 10.7 Dai Nippon Printing Co., Ltd.

- 10.8 DuPont Teijin Films USA

- 10.9 Glenroy, Inc.

- 10.10 Innovia Films

- 10.11 Jindal Poly Films Ltd.

- 10.12 Mondi Plc

- 10.13 Plastissimo Film Co.

- 10.14 ProAmpac

- 10.15 Schur Flexibles Group

- 10.16 Sealed Air Corporation

- 10.17 SUDPACK Verpackungen GmbH & Co. KG

- 10.18 Toray Plastics (America), Inc.

- 10.19 UFlex Limited

- 10.20 Winpak Ltd.