|

市場調查報告書

商品編碼

1740914

再生能源變壓器市場機會、成長動力、產業趨勢分析及2025-2034年預測Renewable Energy Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球再生能源變壓器市場規模達99億美元,預計2034年將以9%的複合年成長率成長,達到239億美元。在全球積極向清潔能源轉型的推動下,該市場正呈現強勁成長動能。世界各國都在大力投資太陽能、風能和水力發電項目,這導致對能夠高效應對再生能源輸入動態變化的變壓器的需求激增。隨著公用事業供應商對老化基礎設施進行現代化改造,以及各國政府實施更嚴格的再生能源目標,對能夠確保電網穩定的先進技術變壓器的需求也空前高漲。

分散式能源 (DER) 和微電網的興起,加上儲能技術的進步,進一步提升了專用變壓器的重要性。越來越多的企業將人工智慧驅動的監控系統和物聯網感測器整合到變壓器設計中,旨在最佳化電網性能、最大限度地減少能源損耗並實現預測性維護。電動車的穩定成長、分散式發電的不斷擴張以及對智慧城市的投資,都強化了高性能再生能源變壓器的需求,為全球市場創造了廣闊的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 99億美元 |

| 預測值 | 239億美元 |

| 複合年成長率 | 9% |

太陽能和風能的日益普及,以及全球對清潔能源的大力推廣,正在推動這一市場的擴張。隨著儲能系統獲得更多投資以及電網的現代化升級,對能夠有效管理再生能源流量波動的變壓器的需求日益成長。數位監控系統和智慧電網技術的發展正在推動變壓器設計的創新,進一步促進市場成長。政府強制規定和公用事業公司設定的再生能源使用目標繼續在刺激需求方面發揮重要作用。

儘管前景樂觀,但複雜的監管環境、持續的供應鏈中斷以及原料價格波動等挑戰仍然是關鍵問題。該行業正致力於開發先進的、可客製化的變壓器設計,以滿足不斷變化的能源和環境標準。貿易政策,包括川普政府時期對進口鋼鐵、鋁和電氣元件徵收的關稅,已顯著影響生產成本,迫使製造商調整策略。許多公司正在將生產設施遷移或擴大至台灣、墨西哥和越南等成本效益較高的地區,以更好地管理成本並最大限度地降低風險。

就產品類型而言,配電變壓器佔據市場主導地位,預計2034年將創造91億美元的市場價值。這些變壓器在將太陽能和風能等再生能源整合到現有電網中發揮著至關重要的作用。物聯網感測器和即時效能監控等創新技術正在提升其可靠性和運作效率。電力變壓器對於將大容量電力從大型再生能源裝置輸送到城市中心至關重要,在絕緣和冷卻技術的進步推動下,電力變壓器也正在強勁成長。

2024年,水力發電領域再生能源變壓器市場佔比達到42%,預計2034年將以8%的複合年成長率成長。水力發電項目的擴張以及海上和陸上風電裝置容量的增加是市場成長的關鍵驅動力。用於應對太陽能光電系統波動輸出的變壓器的需求也在大幅成長。

2024 年,美國再生能源變壓器市場產值將達 19 億美元。隨著太陽能和風能技術的日益普及,再加上基礎設施現代化建設和智慧電網整合,美國市場可望持續擴張。

全球再生能源變壓器市場的主要公司包括 Aditya Energy、ABC Transformers、GE Vernova、ACTOM、Acutran、AEP Group、Celme、Hammond Power Solutions、CG Power、Daelim、Deltron Electricals、Eaton、Elsewedy Electric、HD Hyundai Energy Electric、Hitachi Energy、Hyosung Heaton、Elsewedy Electric、HD Hyundai Energy Electric、Hitachi Energy、Hyosung Hebacers、MMGidak、MMGcakak、Siyosung Hekakers、MMGidak、MMGcyekiak、Hyosung Heakem. Energy、Virginia Transformer 和 WEG。這些公司優先考慮能源效率和永續性方面的產品創新,採用先進的監控系統,並策略性地向新興市場擴張,以滿足日益成長的再生能源基礎設施需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 配電變壓器

- 電源變壓器

- 逆變變壓器

- 其他

第6章:市場規模及預測:依冷氣方式,2021 - 2034

- 主要趨勢

- 乾式

- 油浸式

第7章:市場規模及預測:依評級,2021 - 2034

- 主要趨勢

- ≤10兆伏安

- > 10 MVA 至 ≤ 100 MVA

- > 100 MVA 至 ≤ 600 MVA

- > 600 兆伏安

第 8 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 水能

- 風力發電場

- 太陽能光電

- 其他

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- ABC Transformers

- ACTOM

- Acutran

- Aditya Energy

- AEP Group

- Celme

- CG Power

- Daelim

- Deltron Electricals

- Eaton

- Elsewedy Electric

- GE Vernova

- Hammond Power Solutions

- HD Hyundai Electric

- Hitachi Energy

- Hyosung Heavy Industries

- MGM Transformers

- Mitsubishi Electric

- Ormazabal

- Prolec Energy

- Siemens Energy

- Virginia Transformer

- WEG

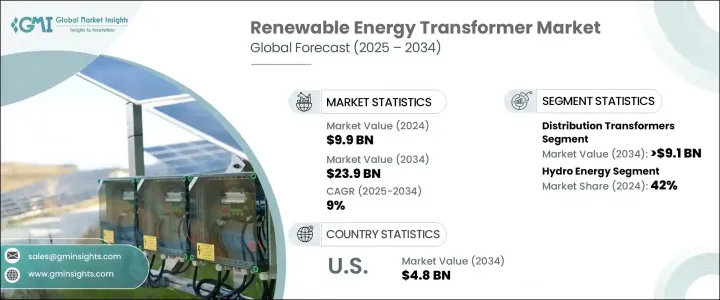

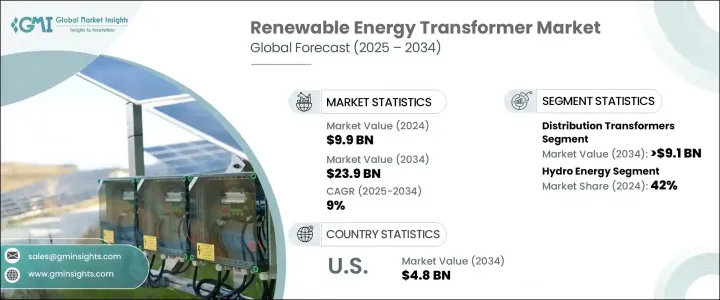

The Global Renewable Energy Transformer Market was valued at USD 9.9 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 23.9 billion by 2034. Driven by an aggressive global transition toward clean energy sources, the market is witnessing substantial momentum. Countries across the world are investing heavily in solar, wind, and hydroelectric power projects, leading to a massive demand for transformers capable of efficiently handling the dynamic nature of renewable energy inputs. As utility providers modernize aging infrastructure and governments enforce stricter renewable energy targets, the need for technologically advanced transformers that can ensure grid stability has never been higher.

The rise of distributed energy resources (DERs) and microgrids, combined with advancements in energy storage technologies, are further boosting the importance of specialized transformers. Companies are increasingly integrating AI-driven monitoring systems and IoT-enabled sensors into transformer designs, aiming to optimize grid performance, minimize energy loss, and enable predictive maintenance. The steady growth of electric vehicles, expanding decentralized power generation, and investments in smart cities are reinforcing the necessity for high-performance renewable energy transformers, creating promising opportunities across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $23.9 Billion |

| CAGR | 9% |

The increasing shift toward solar and wind power, along with a worldwide push for cleaner energy adoption, is fueling this market expansion. As energy storage systems receive more investments and power grids are modernized, there is a growing need for transformers that can efficiently manage the variability of renewable energy flows. The development of digital monitoring systems and smart grid technologies is driving innovations in transformer designs, further contributing to market growth. Government mandates and renewable energy usage targets set by utility companies continue to play a major role in boosting demand.

Despite the positive outlook, challenges such as complex regulatory environments, ongoing supply chain disruptions, and fluctuating raw material prices remain critical concerns. The industry is responding by focusing on advanced, customizable transformer designs that meet evolving energy and environmental standards. Trade policies, including tariffs on imported steel, aluminum, and electrical components enacted during the Trump administration, have significantly impacted production costs, pushing manufacturers to adjust strategies. Many companies are relocating or expanding production facilities to cost-effective regions like Taiwan, Mexico, and Vietnam to better manage expenses and minimize risks.

In terms of product types, distribution transformers dominate the market and are projected to generate USD 9.1 billion by 2034. These transformers play a vital role in integrating renewable energy sources like solar and wind into the existing grid. Innovations such as IoT sensors and real-time performance monitoring are enhancing their reliability and operational efficiency. Power transformers, which are critical for transmitting high-capacity electricity from large-scale renewable installations to urban centers, are also seeing robust growth, supported by advancements in insulation and cooling technologies.

The renewable energy transformers market from the hydro energy segment accounted for a 42% share in 2024 and is anticipated to grow at a CAGR of 8% by 2034. Expanding hydropower projects, along with increasing offshore and onshore wind installations, are key drivers for market growth. The demand for transformers designed to handle the fluctuating outputs of solar photovoltaic systems is also rising significantly.

The U.S. Renewable Energy Transformer Market generated USD 1.9 billion in 2024. With a growing adoption of solar and wind technologies, coupled with infrastructure modernization efforts and smart grid integration, the U.S. market is poised for sustained expansion.

Key companies operating in the Global Renewable Energy Transformer Market include Aditya Energy, ABC Transformers, GE Vernova, ACTOM, Acutran, AEP Group, Celme, Hammond Power Solutions, CG Power, Daelim, Deltron Electricals, Eaton, Elsewedy Electric, HD Hyundai Electric, Hitachi Energy, Hyosung Heavy Industries, MGM Transformers, Mitsubishi Electric, Ormazabal, Prolec Energy, Siemens Energy, Virginia Transformer, and WEG. These companies are prioritizing product innovation in energy efficiency and sustainability, incorporating advanced monitoring systems, and strategically expanding into emerging markets to meet the rising demand for renewable energy infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's Analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Distribution transformer

- 5.3 Power transformer

- 5.4 Inverter duty transformer

- 5.5 Others

Chapter 6 Market Size and Forecast, By Cooling, 2021 - 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Dry type

- 6.3 Oil immersed

Chapter 7 Market Size and Forecast, By Rating, 2021 - 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 ≤ 10 MVA

- 7.3 > 10 MVA to ≤ 100 MVA

- 7.4 > 100 MVA to ≤ 600 MVA

- 7.5 > 600 MVA

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Hydro energy

- 8.3 Wind farm

- 8.4 Solar PV

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABC Transformers

- 10.2 ACTOM

- 10.3 Acutran

- 10.4 Aditya Energy

- 10.5 AEP Group

- 10.6 Celme

- 10.7 CG Power

- 10.8 Daelim

- 10.9 Deltron Electricals

- 10.10 Eaton

- 10.11 Elsewedy Electric

- 10.12 GE Vernova

- 10.13 Hammond Power Solutions

- 10.14 HD Hyundai Electric

- 10.15 Hitachi Energy

- 10.16 Hyosung Heavy Industries

- 10.17 MGM Transformers

- 10.18 Mitsubishi Electric

- 10.19 Ormazabal

- 10.20 Prolec Energy

- 10.21 Siemens Energy

- 10.22 Virginia Transformer

- 10.23 WEG