|

市場調查報告書

商品編碼

1740881

鋁板及鋁捲市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Aluminum Sheets and Coils Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

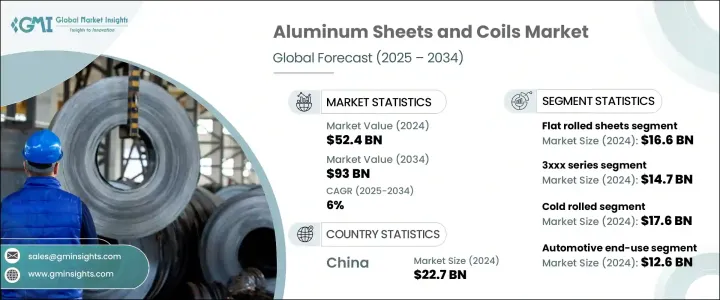

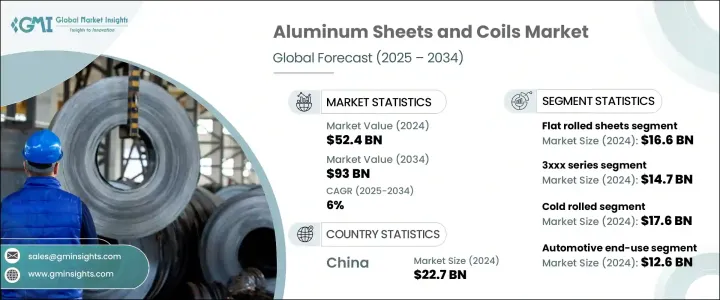

2024 年全球鋁板帶捲市場規模為 524 億美元,預計到 2034 年將以 6% 的複合年成長率成長至 930 億美元。這一成長主要源於工業生產率的持續提高和對永續材料的日益青睞。鋁的輕量化特性使其成為旨在提高能源效率和減少排放的行業的理想選擇。隨著各行各業擁抱電氣化和先進技術,鋁因其能夠在不影響強度的情況下減輕產品重量而變得越來越不可或缺。向清潔能源和交通運輸的加速轉變,尤其是對電動車日益成長的需求,也在推動市場擴張。此外,自動化和數位化等不斷發展的製造技術正在實現更快、更精確的生產,以滿足日益成長的全球需求。這些效率至關重要,因為生產商競相滿足優先考慮輕質、耐用和可回收材料的行業需求。市場也受到激烈競爭和各地區對低排放生產解決方案日益成長的需求的影響,這加強了對符合全球永續發展目標的經濟高效、高性能鋁解決方案的需求。

2024年,扁平軋製鋁板和鋁捲的市場規模達166億美元,預計2025年至2034年的複合年成長率將達到5.7%。其適應性和經濟可行性使其成為核心產業的首選,尤其是在注重耐用性、柔韌性和輕量化特性以實現大規模生產的產業。這些材料因其易於處理且與多種製造程序相容而廣受青睞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 524億美元 |

| 預測值 | 930億美元 |

| 複合年成長率 | 6% |

複合板和陽極氧化板在要求耐腐蝕、美觀和表面耐用性的應用領域中持續受到青睞。這些鋁材在精密度要求高的行業中備受青睞,並推動了塗層技術和合金成分的創新,以提高表面完整性。複合板和陽極氧化板的日益普及也加劇了專業產品類別的競爭。

諸如圖案、波紋和穿孔鋁板等紋理變體在美學和工業應用中都具有重要意義,體現了功能性設計的趨勢,同時也增強了性能和結構。這些類型因其在結構加固和建築細節方面的多功能性而備受關注。

在合金類型中,3xxx系列在2024年的估值達到147億美元,預計到2034年將以6.1%的複合年成長率成長。該系列與1xxx系列一樣,憑藉其耐腐蝕性、導電性和成本效益佔據了主導市場佔有率。這些牌號在功能性能和價格承受能力至關重要的行業中尤其受歡迎,生產商注重保持高產出效率和穩定的質量,同時保持成本競爭力。

同時,5xxx 和 6xxx 系列在需要高強度、可焊接鋁材的領域,尤其是在基礎設施和重型應用領域,持續保持穩定的需求。 2xxx、7xxx 和 8xxx 系列等更高等級的鋁材則滿足了技術先進市場對性能的需求,因為這些市場對耐用性和精度的要求至關重要。

就加工方法而言,冷軋鋁市場在2024年的市場價值為176億美元,預計到2034年將以6.4%的複合年成長率成長。冷軋鋁憑藉著卓越的表面光潔度、嚴格的公差和增強的機械性能,廣泛應用於關鍵應用領域。雖然熱軋鋁的精度較低,但因其在嚴苛環境下的強度和可靠性,通常被廣泛採用。

2024年,汽車業使用的鋁板和鋁捲市場規模達126億美元,佔市場佔有率的24%,預計在預測期內將以6.1%的複合年成長率成長。這些材料是現代汽車設計中不可或缺的一部分,尤其有助於減輕車重並提高燃油效率。隨著製造商繼續在主流汽車架構中採用更多鋁材,它們的應用範圍涵蓋結構部件和儲能系統。

建築業也對鋁的需求貢獻巨大,利用鋁的韌性、輕盈和美觀特性,滿足結構、屋頂和隔熱需求。在包裝和電子產品領域,鋁因其安全性、可回收性和抗污染性仍然是可靠的選擇。全球對回收的重視進一步提升了鋁在消費包裝應用的價值。

從區域來看,中國以2024年227億美元的估值引領市場,預計2034年將以5.9%的複合年成長率成長。憑藉強勁的國內需求和全球最廣泛的鋁產能,中國仍是主導力量。同時,在支持基礎建設和能源轉型的政策轉變的推動下,美國的消費模式持續保持穩定。然而,兩國都在應對複雜的全球貿易動態,這些動態正在塑造採購策略並鼓勵本地化供應鏈。

主要市場參與者包括美國鋁業公司、中國宏橋集團、俄羅斯鋁業公司、力拓集團和挪威海德魯公司。這些公司正透過低排放技術和對永續鋁生產的策略性投資來提升生產能力。行業領導者正專注於數位創新、高級合金和擴大回收業務,以在快速發展的市場中保持競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 汽車產業對輕量化材料的需求不斷成長

- 政府推動永續基礎建設的舉措

- 航太和國防領域的成長

- 消費性電子產品需求不斷擴大

- 產業陷阱與挑戰

- 原物料價格波動

- 鋁生產對環境的影響

- 成長動力

- 成長潛力分析

- 波特的分析

- Pestel 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 平軋鋼板

- 卷材

- 複合板材

- 陽極處理板

- 圖案床單

- 瓦楞板

- 穿孔板

第6章:市場估計與預測:依等級/合金類型,2021-2034

- 主要趨勢

- 1xxx系列

- 2xxx系列

- 3xxx系列

- 5xxx系列

- 6xxx系列

- 7xxx系列

- 8xxx系列

第7章:市場估計與預測:依加工方法,2021-2034 年

- 主要趨勢

- 冷軋

- 熱軋

- 連續鑄造

- 直接冷鑄(DC)

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 汽車

- 建築與施工

- 航太

- 電氣和電子產品

- 食品和飲料

- 機械設備

- 耐久性消費品

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Alcoa Corporation

- Novelis Inc.

- Arconic Corporation

- Kaiser Aluminum

- Hindalco Industries

- Constellium SE

- UACJ Corporation

- Norsk Hydro ASA

- JW Aluminum

- Aleris Corporation

- Hindalco Industries Ltd.

- BALCO (Bharat Aluminium)

- China Hongqiao Group

The Global Aluminum Sheets And Coils Market was valued at USD 52.4 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 93 billion by 2034. This growth stems largely from the ongoing rise in industrial productivity and the increasing preference for sustainable materials. Aluminum's lightweight properties make it ideal for sectors aiming to improve energy efficiency and reduce emissions. As industries embrace electrification and advanced technologies, aluminum is becoming more integral due to its ability to contribute to lower product weight without compromising strength. The accelerating shift toward cleaner energy and transportation, especially the rising demand for electric mobility, is also fueling market expansion. Alongside this, evolving manufacturing techniques, such as automation and digitalization, are enabling faster, more precise production to match growing global demand. These efficiencies are critical as producers race to meet the needs of industries prioritizing lightweight, durable, and recyclable materials. The market is also shaped by fierce competition and the increasing push for low-emission production solutions across regions, reinforcing the need for cost-effective, high-performance aluminum solutions that align with global sustainability goals.

Flat rolled aluminum sheets and coils commanded a market size of USD 16.6 billion in 2024 and are expected to grow at a CAGR of 5.7% from 2025 to 2034. Their adaptability and economic feasibility make them a top choice across core industries, especially where durability, flexibility, and lightweight characteristics are valued for mass production. These materials are commonly favored due to their ease of handling and compatibility with multiple manufacturing processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.4 Billion |

| Forecast Value | $93 Billion |

| CAGR | 6% |

Clad and anodized sheets continue to attract interest for applications requiring corrosion resistance, visual appeal, and surface durability. These aluminum variants are preferred in precision-demanding sectors and are prompting innovation in coating technologies and alloy compositions to improve surface integrity. Their increased adoption is intensifying competition in specialized product categories.

Textured variants like patterned, corrugated, and perforated aluminum sheets find relevance in aesthetic and industrial applications, reflecting a trend towards functional design that also enhances performance and structure. These types are gaining attention for their versatility in structural reinforcement and architectural detailing.

Among alloy types, the 3xxx series reached a valuation of USD 14.7 billion in 2024 and is forecasted to grow at a CAGR of 6.1% through 2034. This series, along with the 1xxx group, dominates market share due to its corrosion resistance, electrical conductivity, and cost-effectiveness. These grades are especially popular in sectors where functional performance and affordability are key factors, and producers are focused on maintaining high output efficiency and consistent quality while keeping costs competitive.

Meanwhile, the 5xxx and 6xxx series continue to find steady demand in sectors requiring high-strength, weldable aluminum, notably in infrastructure and heavy-duty applications. Higher-grade aluminum from the 2xxx, 7xxx, and 8xxx series fulfills the need for performance in technologically advanced markets, where durability and precision are crucial.

In terms of processing methods, the cold rolled aluminum segment held a market value of USD 17.6 billion in 2024 and is anticipated to grow at a CAGR of 6.4% through 2034. This category benefits from superior surface finish, tight tolerances, and enhanced mechanical properties, contributing to its extensive use across critical applications. While hot rolled variants are less precise, they are often chosen for their strength and reliability in demanding environments.

Aluminum sheets and coils used in the automotive sector accounted for USD 12.6 billion in 2024, representing a 24% market share and are poised to grow at 6.1% CAGR through the forecast period. These materials are integral in modern vehicle design, particularly for reducing vehicle weight and achieving better fuel efficiency. Their application spans structural components and energy storage systems, as manufacturers continue to incorporate more aluminum into mainstream vehicle architecture.

The building and construction industry also contributes significantly to demand, leveraging aluminum's resilience, light weight, and aesthetic properties for structural, roofing, and insulation needs. In packaging and electronics, aluminum remains a reliable choice due to its safety, recyclability, and resistance to contamination. The global emphasis on recycling further enhances its value in consumer packaging applications.

In regional terms, China led the market with a valuation of USD 22.7 billion in 2024, and it is expected to expand at a CAGR of 5.9% through 2034. With high domestic demand and the world's most extensive aluminum production capacity, China remains a dominant force. Meanwhile, the United States continues to register stable consumption patterns, bolstered by policy shifts supporting infrastructure development and energy transformation. However, both nations navigate complex global trade dynamics, which are shaping sourcing strategies and encouraging localized supply chains.

Major market participants include Alcoa Corporation, China Hongqiao Group, Rusal, Rio Tinto, and Norsk Hydro ASA. These companies are advancing production capabilities through low-emission technologies and strategic investments in sustainable aluminum manufacturing. Industry leaders are focusing on digital innovation, high-grade alloys, and expanding recycling operations to remain competitive in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for lightweight materials in automotive industry

- 3.7.1.2 Government initiatives for sustainable infrastructure

- 3.7.1.3 Growth in aerospace and defense sector

- 3.7.1.4 Expanding demand in consumer electronics

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Environmental impact of aluminum production

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Flat rolled sheets

- 5.3 Coiled sheets

- 5.4 Clad sheets

- 5.5 Anodized sheets

- 5.6 Patterned sheets

- 5.7 Corrugated sheets

- 5.8 Perforated sheets

Chapter 6 Market Estimates & Forecast, By Grade/Alloy Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 1xxx series

- 6.3 2xxx series

- 6.4 3xxx series

- 6.5 5xxx series

- 6.6 6xxx series

- 6.7 7xxx series

- 6.8 8xxx series

Chapter 7 Market Estimates & Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cold rolled

- 7.3 Hot rolled

- 7.4 Continuous casting

- 7.5 Direct chill (DC) casting

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Building & construction

- 8.4 Aerospace

- 8.5 Electrical & electronics

- 8.6 Food & beverage

- 8.7 Machinery & equipment

- 8.8 Consumer durables

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alcoa Corporation

- 10.2 Novelis Inc.

- 10.3 Arconic Corporation

- 10.4 Kaiser Aluminum

- 10.5 Hindalco Industries

- 10.6 Constellium SE

- 10.7 UACJ Corporation

- 10.8 Norsk Hydro ASA

- 10.9 JW Aluminum

- 10.10 Aleris Corporation

- 10.11 Hindalco Industries Ltd.

- 10.12 BALCO (Bharat Aluminium)

- 10.13 China Hongqiao Group