|

市場調查報告書

商品編碼

1740847

汽車後行李箱釋放電纜市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Boot Release Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

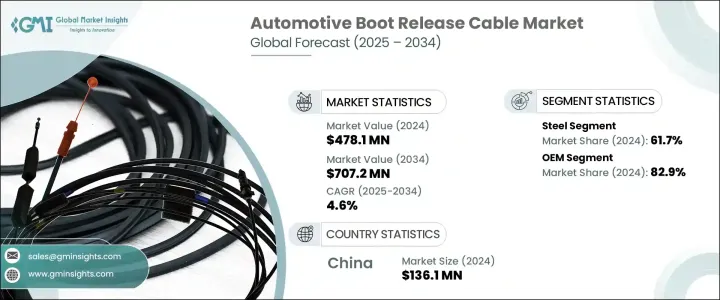

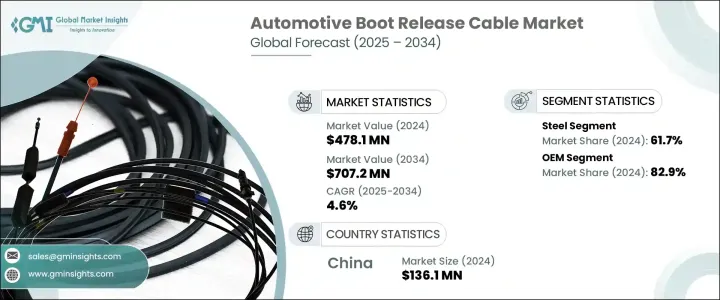

2024 年全球汽車後備箱釋放拉線市場價值為 4.781 億美元,預計到 2034 年將以 4.6% 的複合年成長率成長,達到 7.072 億美元,這得益於全球汽車產量的成長和對先進車輛出入解決方案日益成長的需求。隨著汽車設計的發展和消費者對與汽車更無縫互動的要求,後行李箱出入系統發生了顯著變化。後行李箱釋放拉線曾經是簡單的機械部件,現在卻在為各種車型提供更聰明、更安全、更有效率的後行李箱出入方面發揮著至關重要的作用。隨著汽車製造商繼續擁抱智慧出行和電動車技術,智慧後行李箱系統的整合正成為汽車設計的關鍵特徵。消費者期望方便和快捷,而汽車製造商則透過部署將機械可靠性與尖端電子設備相結合的高性能拉線系統來應對這一需求。

人們對連網科技汽車的日益青睞,也影響汽車製造商設計諸如後行李箱開啟等存取功能的方式。從基於手勢的觸發器到基於行動應用程式的功能,如今的消費者渴望的不僅僅是手動控制桿,他們更希望系統能夠與他們的數位生活方式和諧地協同工作。這種需求推動著汽車後行李箱釋放線纜系統的創新,以增強安全性、舒適性和使用者體驗。這些發展在電動車和混合動力車中尤其明顯,在這些汽車中,效率、輕量化設計和智慧整合是創新的前沿。汽車製造商如今正在利用即使在頻繁使用和嚴苛環境條件下也能保持高耐用性和高性能的技術。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.781億美元 |

| 預測值 | 7.072億美元 |

| 複合年成長率 | 4.6% |

為了滿足不斷發展的標準,製造商正轉向使用先進材料和更聰明的工程實踐。輕質、耐腐蝕和高強度材料正成為行李箱釋放拉索生產的標準。這些材料不僅延長了產品的使用壽命,還能透過減輕整體重量來提高車輛效率。鋼材仍然是首選材料,2024 年其市場佔有率接近 61.7%,預計到 2034 年將以 5% 的複合年成長率成長。鋼材的強度、經濟性和抗疲勞性使其成為承受重複性機械應力部件的理想選擇,尤其是在需要頻繁打開後行李箱的商用和乘用電動車中。

從分銷角度來看, OEM細分市場在 2024 年佔據全球主導地位,佔據 82.9% 的市場佔有率,預計在整個預測期內仍將保持領先地位。如今,汽車製造商已將先進的後備箱開啟系統視為標準組件,並在生產過程中整合,以增強安全性和便利性。 OEM 正增加對混合機電解決方案的投資,這些解決方案與車輛門禁的未來發展相契合,旨在為最終用戶提供更聰明、更安全、更直覺的功能。這種轉變在致力於透過從首次互動開始就提升用戶體驗來保持競爭力的全球汽車品牌中尤為明顯。

中國正逐漸成為最具影響力的區域市場,2024年佔全球汽車線束市場收入的57.6%,預計到2034年將達到1.361億美元。中國龐大的汽車產量,加上其強大的汽車零件生態系統,使其在全球市場中佔據戰略優勢。中國領先的供應商正專注於製造高精度、耐腐蝕且安全性更高的線束系統,以滿足國際標準和需求。持續的研發投入和智慧製造實踐,進一步鞏固了中國作為全球先進汽車線束技術中心的地位。

為了在這個競爭激烈的領域保持領先地位,THB集團、Universal Cable、Leoni AG、Nexans Auto Electric、Birla Cable、Kei Industry、TE Connectivity、Polycab、住友電工和Sterlite Technologies等主要參與者正專注於設計輕量化、多功能的纜線釋放系統。這些公司正在透過策略聯盟擴大其全球影響力,並利用自動化和新一代材料提升製造能力。他們共同關注性能、耐用性以及與智慧汽車平台的兼容性,確保他們始終與汽車行業不斷變化的需求保持一致。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 製造商

- 原物料供應商

- 汽車OEM

- 配銷通路

- 最終用途

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(客戶成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 貿易影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 定價分析

- 推進系統

- 地區

- 對部隊的影響

- 成長動力

- 越來越重視車輛安全與門禁系統

- 安裝簡便,維護成本低

- OEM偏好模組化組件

- 全球汽車產量成長

- 產業陷阱與挑戰

- 轉向電子和智慧行李箱系統

- 更換頻率低

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 鋼

- 鋁

- 塑膠

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- SUV

- 商用車

- 輕型

- 中型

- 重負

第7章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 汽油

- 柴油引擎

- 電的

- 插電式混合動力

- 油電混合車

- 燃料電池電動車

第8章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- 原始設備製造商

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Auto7

- Birla Cable

- Chuhatsu

- CMA

- Dorman Products

- Dura Automotive Systems

- GEMO

- HI-LEX

- Infac Corporation

- Kei Industries

- Kongsberg Automotive

- L&P Automotive Group

- Leoni AG

- Nexans Auto Electric

- Polycab

- Sterlite Technology

- Sumitomo Electric Industries

- TE connectivity

- THB Group

- Universal Cable

The Global Automotive Boot Release Cable Market was valued at USD 478.1 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 707.2 million by 2034, fueled by rising global vehicle production and the growing demand for advanced vehicle access solutions. As vehicle designs evolve and consumers demand more seamless interactions with their automobiles, trunk access systems have seen a notable transformation. Boot release cables, once simple mechanical components, are now playing a vital role in enabling smarter, more secure, and more efficient trunk access across a wide range of vehicle categories. As automakers continue to embrace smart mobility and electric vehicle technologies, the integration of intelligent trunk systems is becoming a critical feature in vehicle design. Consumers expect convenience and speed, and vehicle manufacturers are responding by deploying high-performance cable systems that blend mechanical reliability with cutting-edge electronics.

The increasing preference for connected, tech-savvy vehicles is shaping how automakers design access features like trunk openings. From gesture-based triggers to mobile app-based functionalities, today's consumers want more than manual levers-they want systems that work in harmony with their digital lifestyles. This demand is driving innovation in automotive boot release cable systems that offer enhanced security, comfort, and user experience. These developments are especially visible in electric and hybrid vehicles, where efficiency, lightweight design, and smart integration are at the forefront of innovation. Automakers are now leveraging technologies that can support high durability and performance even under frequent usage and challenging environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $478.1 Million |

| Forecast Value | $707.2 Million |

| CAGR | 4.6% |

To meet the evolving standards, manufacturers are shifting toward the use of advanced materials and smarter engineering practices. Lightweight, corrosion-resistant, and high-tensile materials are becoming standard in boot release cable production. These materials not only improve product longevity but also enhance vehicle efficiency by reducing overall weight. Steel remains the top choice among materials, capturing nearly 61.7% share of the market in 2024 and projected to grow at a CAGR of 5% through 2034. Its strength, affordability, and resistance to fatigue make it ideal for parts subject to repetitive mechanical stress, especially in commercial and passenger electric vehicles that require frequent trunk access.

In terms of distribution, the OEM segment dominated the global landscape in 2024, accounting for an 82.9% market share, and is expected to maintain its lead through the forecast period. Vehicle manufacturers now treat advanced boot release systems as standard components, integrating them during production to enhance both security and convenience. OEMs are increasingly investing in hybrid mechanical-electronic solutions that align with the future of vehicle access-offering smarter, safer, and more intuitive features for the end user. This shift is particularly prominent among global automotive brands that aim to stay competitive by improving user experience from the first point of interaction.

China is emerging as the most influential regional market, representing 57.6% of global revenue in 2024, with projections hitting USD 136.1 million by 2034. The country's high volume of vehicle production, combined with its robust automotive components ecosystem, gives it a strategic edge in the global market. Leading suppliers in China are focusing on manufacturing high-precision, corrosion-resistant, and safety-enhanced cable systems to meet international standards and demand. Continuous investments in R&D and smart manufacturing practices further strengthen China's position as a global hub for advanced automotive cable technologies.

To stay ahead in this competitive space, major players like THB Group, Universal Cable, Leoni AG, Nexans Auto Electric, Birla Cable, Kei Industry, TE Connectivity, Polycab, Sumitomo Electric Industries, and Sterlite Technologies are focusing on designing lightweight, multi-functional boot release cable systems. These companies are expanding their global presence through strategic alliances and improving their manufacturing capabilities with automation and next-gen materials. Their collective focus on performance, durability, and compatibility with smart vehicle platforms ensures they remain aligned with the evolving needs of the automotive industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End-use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing emphasis on vehicle security & access systems

- 3.10.1.2 Easy installation and low maintenance

- 3.10.1.3 OEM preference for modular components

- 3.10.1.4 Global vehicle production growth

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Shift towards electronic & smart trunk systems

- 3.10.2.2 Low replacement frequency

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Steel

- 5.3 Aluminium

- 5.4 Plastic

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchbacks

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light duty

- 6.3.2 Medium duty

- 6.3.3 Heavy duty

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric

- 7.5 PHEV

- 7.6 HEV

- 7.7 FCEV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Auto7

- 10.2 Birla Cable

- 10.3 Chuhatsu

- 10.4 CMA

- 10.5 Dorman Products

- 10.6 Dura Automotive Systems

- 10.7 GEMO

- 10.8 HI-LEX

- 10.9 Infac Corporation

- 10.10 Kei Industries

- 10.11 Kongsberg Automotive

- 10.12 L&P Automotive Group

- 10.13 Leoni AG

- 10.14 Nexans Auto Electric

- 10.15 Polycab

- 10.16 Sterlite Technology

- 10.17 Sumitomo Electric Industries

- 10.18 TE connectivity

- 10.19 THB Group

- 10.20 Universal Cable