|

市場調查報告書

商品編碼

1740773

時間溫度指示標籤市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Time Temperature Indicator Labels Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

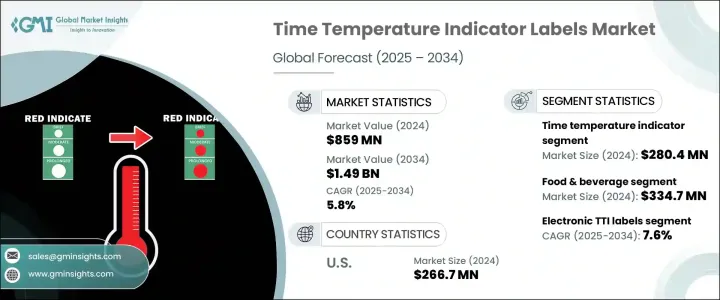

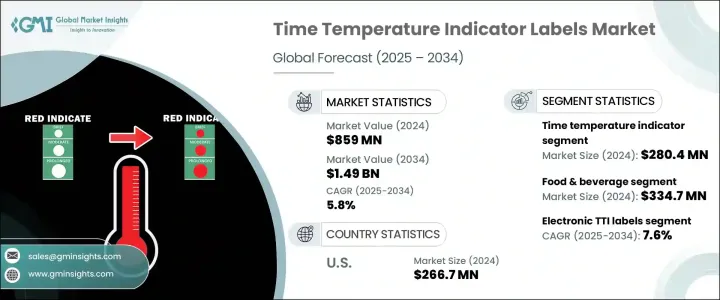

2024 年全球時間溫度指示標籤市場價值為 8.59 億美元,預計到 2034 年將以 5.8% 的複合年成長率成長,達到 14.9 億美元,這得益於即食食品、簡便食品需求的激增以及醫藥和醫療保健應用的不斷擴大。隨著全球供應鏈變得更加複雜和監管標準更加嚴格,對可靠的溫度監控解決方案的需求變得比以往任何時候都更加重要。食品、飲料和製藥行業的公司擴大將時間溫度指示標籤整合到他們的物流和分銷系統中,以確保產品安全、最大限度地減少浪費並維護品牌完整性。包括餐包配送和線上雜貨平台在內的直接面對消費者管道的興起,進一步推動了時間溫度指示標籤的採用。同時,永續發展趨勢正在重塑市場,製造商正在創新環保、智慧和數據驅動的解決方案,以滿足環境標準和消費者期望。隨著越來越多的消費者重視食品安全和品質保證,TTI 正在迅速從可選工具發展成為整個供應鏈中必不可少的組成部分,為未來十年的市場參與者創造重大機會。

儘管成長前景強勁,但某些挑戰仍在拖累市場格局。川普政府時期徵收的關稅持續構成障礙,尤其是對特種化學品、黏合劑和TTI製造必需的電子元件等原料徵收更高的進口關稅。這些關稅正在擠壓製造商的利潤率,除非增加的成本能夠被吸收或轉移給消費者。在全球舞台上,主要貿易夥伴的報復性關稅使美國TTI供應商在國際上競爭更加艱難,尤其是在易腐爛商品監管更加嚴格、需求不斷成長的情況下。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.59億美元 |

| 預測值 | 14.9億美元 |

| 複合年成長率 | 5.8% |

時間溫度指示標籤市場按標籤類型分類,包括關鍵時間溫度指示劑 (CTTI)、時間溫度指示劑等。僅時間溫度指示劑細分市場在 2024 年就創造了 2.804 億美元的市場規模,這主要得益於食品和飲料行業對其應用的不斷成長。監測乳製品、肉類、海鮮和即食食品的新鮮度和安全性從未如此重要。製藥業也在推動成長,因為生物製劑、特種藥物和疫苗需要精確的儲存和運輸監控。直銷模式和最後一哩配送服務的激增,加劇了對能夠確保即時新鮮度追蹤的 TTI 的需求。

2024年,食品和飲料產業的市場規模達到3.347億美元,主要得益於人們對食源性疾病、污染和腐敗問題的日益擔憂。城鎮化進程的加速和現代消費者忙碌的生活方式顯著推動了簡便食品的消費,從而導致了TTI在整個供應鏈中的廣泛整合。

2024年,德國時間溫度指示標籤市場規模達4,850萬美元,主要得益於藥品出口成長和歐盟法規趨嚴。隨著冷鏈物流的發展以及以永續發展為重點的溫度控制技術創新,對時間溫度指示標籤的需求激增。

時間溫度指示標籤市場的主要參與者包括美國熱工儀器公司 (American Thermal Instruments)、艾利丹尼森公司 (Avery Dennison)、柏林格公司 (Berlinger)、CCL Industries、Delta Trak、Freshliance Electronics、Insignia Technologies、Neogen、NiGK、Omex、Freshliance Electronics、Insignia Technologies、Neogen、NiGK、Ome Technologies Engineering、Sensi、St.Samt、Skbrame Technologies Engineering、Sensi)各公司正在推動智慧即時追蹤解決方案,並拓展新興市場,以滿足食品安全和醫藥物流創新領域日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 新鮮易腐商品需求不斷成長

- 冷鏈物流擴張

- 電子商務和線上雜貨配送的成長

- 製藥和醫療保健領域採用率不斷提高

- 即食食品和簡便食品的成長

- 產業陷阱與挑戰

- 先進TTL技術成本高

- 溫度靈敏度和可靠性不一致

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按標籤訊息,2021 年至 2034 年

- 主要趨勢

- 關鍵時間溫度指標 (CTTI)

- 臨界溫度指標

- 時間溫度指示器

- 其他

第6章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 電子TTI標籤

- 化學基TTI標籤

- 酶促TTI標籤

第7章:市場估計與預測:依最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 製藥和醫療保健

- 化學品

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- American Thermal Instruments

- Avery Dennison

- Berlinger

- CCL Industries

- Delta Trak

- Freshliance Electronics

- Insignia Technologies

- Neogen

- NiGK

- Omega Engineering

- Sensitech

- SpotSee

- Timestrip

- Zebra Technologies

The Global Time Temperature Indicator Labels Market was valued at USD 859 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 1.49 billion by 2034, fueled by surging demand for ready-to-eat meals, convenience foods, and expanding pharmaceutical and healthcare applications. As global supply chains become more sophisticated and regulatory standards tighten, the need for reliable temperature monitoring solutions is becoming more critical than ever. Companies across the food, beverage, and pharmaceutical industries are increasingly integrating TTIs into their logistics and distribution systems to guarantee product safety, minimize waste, and maintain brand integrity. The rise of direct-to-consumer channels, including meal kit deliveries and online grocery platforms, is further pushing the adoption of TTIs. Meanwhile, sustainability trends are reshaping the market, with manufacturers innovating eco-friendly, smart, and data-driven solutions to meet environmental standards and consumer expectations. As more consumers prioritize food safety and quality assurance, TTIs are rapidly evolving from optional tools to essential components across supply chains, creating significant opportunities for market players over the next decade.

Despite the strong growth outlook, certain challenges are weighing on the market landscape. Tariffs imposed during the Trump administration continue to present hurdles, particularly through higher import duties on raw materials like specialty chemicals, adhesives, and electronic components essential for TTI manufacturing. These tariffs are pressuring manufacturers' profit margins unless the increased costs can be absorbed or passed on to consumers. On the global stage, retaliatory tariffs from key trading partners are making it harder for U.S.-based TTI suppliers to compete internationally, especially as demand intensifies under stricter perishable goods regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $859 Million |

| Forecast Value | $1.49 Billion |

| CAGR | 5.8% |

The Time Temperature Indicator Labels Market is categorized by label types, including critical time-temperature indicators (CTTI), time temperature indicators, and others. The time temperature indicator segment alone generated USD 280.4 million in 2024, driven largely by heightened adoption in the food and beverage sector. Monitoring the freshness and safety of dairy, meat, seafood, and ready-to-eat meals has never been more important. The pharmaceutical sector is also fueling growth as biologics, specialty drugs, and vaccines demand precise storage and transportation monitoring. The explosion of direct-to-consumer models and last-mile delivery services is amplifying the need for TTIs that ensure real-time freshness tracking.

The food and beverage segment accounted for USD 334.7 million in 2024, powered by growing concerns over foodborne illnesses, contamination, and spoilage. Rising urbanization and the busy lifestyles of modern consumers are significantly boosting convenience food consumption, leading to widespread TTI integration across supply chains.

Germany Time Temperature Indicator Labels Market generated USD 48.5 million in 2024, led by increased pharmaceutical exports and tighter EU regulations. Demand for TTIs is surging with the development of cold chain logistics and sustainability-focused innovations in temperature control technologies.

Key players in the Time Temperature Indicator Labels Market are American Thermal Instruments, Avery Dennison, Berlinger, CCL Industries, Delta Trak, Freshliance Electronics, Insignia Technologies, Neogen, NiGK, Omega Engineering, Sensitech, SpotSee, Timestrip, and Zebra Technologies. Companies are advancing smart, real-time tracking solutions and expanding into emerging markets to capture the rising demand for food safety and pharmaceutical logistics innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for fresh & perishable goods

- 3.3.1.2 Expansion of cold chain logistics

- 3.3.1.3 Growth in e-commerce & online grocery delivery

- 3.3.1.4 Increasing adoption in pharmaceuticals & healthcare

- 3.3.1.5 Growth of ready-to-eat & convenience foods

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of advanced TTL technologies

- 3.3.2.2 Inconsistent temperature sensitivity & reliability

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Label Information, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Critical Time Temperature Indicators (CTTI)

- 5.3 Critical temperature indicator

- 5.4 Time temperature indicator

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Electronic TTI labels

- 6.3 Chemical-Based TTI labels

- 6.4 Enzymatic TTI labels

Chapter 7 Market Estimates and Forecast, By End-use Industry, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals & healthcare

- 7.4 Chemicals

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 American Thermal Instruments

- 9.2 Avery Dennison

- 9.3 Berlinger

- 9.4 CCL Industries

- 9.5 Delta Trak

- 9.6 Freshliance Electronics

- 9.7 Insignia Technologies

- 9.8 Neogen

- 9.9 NiGK

- 9.10 Omega Engineering

- 9.11 Sensitech

- 9.12 SpotSee

- 9.13 Timestrip

- 9.14 Zebra Technologies