|

市場調查報告書

商品編碼

1740750

軟包裝機械市場機會、成長動力、產業趨勢分析及2025-2034年預測Flexible Packaging Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

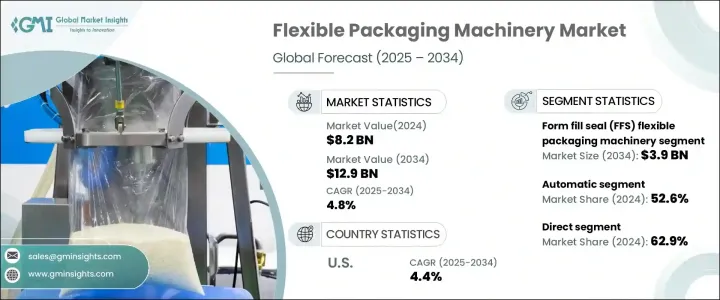

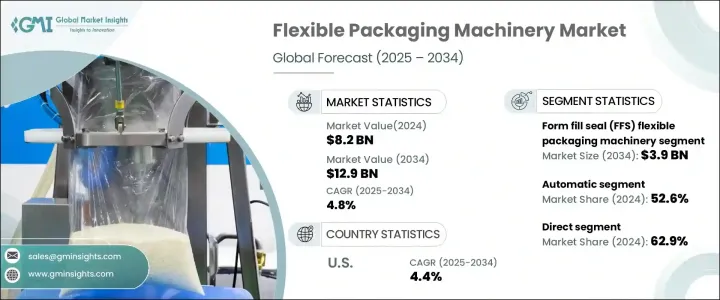

2024年,全球軟包裝機械市場規模達82億美元,預計2034年將以4.8%的複合年成長率成長,達到129億美元。這主要得益於生活方式的轉變、快速的城市化以及消費者對包裝食品日益成長的偏好。新興經濟體的中等收入群體對加工和即食產品的需求,推動了現代包裝技術的普及。小袋、小包裝袋和袋子等輕巧且經濟高效的包裝形式因其易於使用和運輸而備受青睞。隨著產量的持續攀升,製造商正在轉向能夠有效處理各種材料和包裝類型的高速自動化系統。這些趨勢反映出人們對生產線靈活性和速度日益成長的需求,促使製造商採用能夠滿足不斷變化的消費者期望和監管要求的先進機械。

目前的設備預計將支援無縫格式轉換,處理可生物分解和複合材料,並在極少人工干預的情況下運作。客製化包裝需求的不斷成長、產品週期的縮短以及產品種類的豐富,推動著產業朝向更智慧和模組化的機械方向發展。自動化不僅能提高產量,還能確保更高的準確性、減少浪費,並更符合永續性基準。這種轉變使生產商能夠更快地響應市場變化,同時保持較高的營運效率和產品品質。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 82億美元 |

| 預測值 | 129億美元 |

| 複合年成長率 | 4.8% |

2024年,自動包裝機市場佔有52.6%的佔有率。它們能夠簡化工作流程,提高產出一致性,並降低人力成本,使其成為食品、製藥和個人護理等行業不可或缺的利器。這些系統整合了智慧控制功能、遠端診斷和即時效能監控,從而提高了效率並減少了停機時間。這種轉變正在推動產業標準轉向自動化、智慧化的包裝環境。

市場依分銷方式細分為直接通路及間接通路。 2024年,直銷通路佔了62.9%的市佔率。將設備直接銷售給最終用戶有助於製造商提供客製化解決方案、更快速的支援和更強大的售後服務。透過減少中間商環節,供應商可以與客戶保持直接溝通,改善服務交付,並根據特定的生產需求客製化系統。這也使得技術升級和流程最佳化的部署更加便利。

預計到2034年,美國軟包裝機械市場將維持4.4%的複合年成長率,這得益於食品飲料、製藥和個人護理等多個行業的強勁需求,這些行業對精度、衛生和速度至關重要。大量的研發投入,加上完善的製造基礎設施,使美國在創新和產出能力方面都具有競爭優勢。憑藉先進的自動化技術、智慧系統整合以及滿足全球合規標準的能力,美國將繼續成為包裝機械的主要出口國。

MULTIVAC、Coesia 集團、Optima 包裝集團、Ishida 株式會社和 Hayssen 軟性系統等主要參與者採用多項核心策略來確保長期成長。這些策略包括增加對人工智慧驅動自動化的投資,擴展產品線以處理多種規格的包裝,以及建立策略聯盟以擴大市場覆蓋範圍。許多公司正在透過合併和設施擴建來擴大其全球影響力,同時最佳化機器設計以實現永續性、能源效率和最大程度地減少廢物產生。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 包裝和加工食品的需求不斷成長

- 技術進步

- 越來越重視永續包裝

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 處理各種包裝材料的複雜性

- 成長動力

- 成長潛力分析

- 交易分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按機器類型,2021 - 2034 年

- 主要趨勢

- 成型灌裝封口機(FFS)

- 裝袋機

- 袋裝包裝機

- 裝盒機

- 包裝機

- 貼標機

- 其他

第6章:市場估計與預測:按自動化,2021 - 2034 年

- 主要趨勢

- 半自動

- 全自動

- 手動的

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 個人護理和化妝品

- 居家護理產品

- 工業產品

- 其他

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Barry-Wehmiller Companies

- Coesia Group

- GEA Group

- Hayssen Flexible Systems

- IMA Group

- Ishida Co., Ltd.

- KHS GmbH

- Mespack

- MULTIVAC

- Optima Packaging Group

- PFM Packaging Machinery

- ProMach

- Syntegon

- TNA Solutions

- W&H (Windmoller & Holscher)

The Global Flexible Packaging Machinery Market was valued at USD 8.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 12.9 billion by 2034, fueled by shifting lifestyles, rapid urbanization, and rising consumer preferences for packaged food. Middle-income groups in emerging economies demand processed and ready-to-eat products, which drives the adoption of modern packaging technologies. Lightweight and cost-effective formats such as sachets, pouches, and bags are favored for their ease of use and transport. As production volumes continue to climb, manufacturers are turning to high-speed, automated systems that can handle a wide range of materials and packaging types efficiently. These trends reflect a growing need for flexibility and speed in production lines, encouraging the adoption of advanced machinery that meets evolving consumer expectations and regulatory demands.

Current equipment is expected to support seamless format changes, handle biodegradable and composite materials, and operate with minimal human intervention. Increased demand for customized packaging, shorter product cycles, and greater product variation have pushed the industry toward more intelligent and modular machinery. Automation not only enhances output but also ensures greater accuracy, reduced waste, and improved compliance with sustainability benchmarks. This shift enables producers to respond faster to market changes while maintaining high operational efficiency and product quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.2 billion |

| Forecast Value | $12.9 Billion |

| CAGR | 4.8% |

In 2024, the automatic packaging machines segment held a 52.6% share. Their ability to streamline workflows, improve output consistency, and reduce labor costs has made them essential for industries such as food, pharmaceuticals, and personal care. These systems integrate intelligent control features, remote diagnostics, and real-time performance monitoring, which enhances efficiency and reduces downtime. This transformation is shifting industry standards toward automated, smart packaging environments.

The market is segmented by distribution into direct and indirect channels. In 2024, the direct sales segment held 62.9% share. Selling equipment directly to end-users helps manufacturers offer customized solutions, faster support, and stronger post-sale service. By cutting out intermediaries, suppliers can maintain direct communication with clients, improving service delivery and tailoring systems to specific production needs. This also allows for easier deployment of technical upgrades and process optimization over time.

United States Flexible Packaging Machinery Market is expected to maintain a CAGR of 4.4% through 2034 backed by strong demand across multiple sectors, including food and beverage, pharmaceuticals, and personal care, where precision, hygiene, and speed are critical. Extensive R&D investments, combined with a well-established manufacturing infrastructure, give the U.S. a competitive edge in both innovation and output capacity. The country continues to be a major exporter of packaging machinery, supported by advanced automation technologies, integration of smart systems, and the ability to meet global compliance standards.

Key players such as MULTIVAC, Coesia Group, Optima Packaging Group, Ishida Co., Ltd., and Hayssen Flexible Systems use several core strategies to secure long-term growth. These include ramping up investment in AI-driven automation, expanding product lines to handle multi-format packaging, and entering strategic alliances to boost market reach. Many are enhancing their global footprints through mergers and facility expansions while optimizing machine design for sustainability, energy efficiency, and minimal waste production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.3.4 Demand-side impact (selling price)

- 3.2.3.5 Price transmission to end markets

- 3.2.3.6 Market share dynamics

- 3.2.3.7 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for packaged and processed foods

- 3.7.1.2 Technological advancements

- 3.7.1.3 Increasing focus on sustainable packaging

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial investment and maintenance costs

- 3.7.2.2 Complexity in handling diverse packaging materials

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Trade analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Form fill seal (FFS) machines

- 5.3 Bagging machines

- 5.4 Pouch packaging machines

- 5.5 Cartoning machines

- 5.6 Wrapping machines

- 5.7 Labeling machines

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Automation, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

- 6.4 Manual

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Personal care & cosmetics

- 7.5 Homecare products

- 7.6 Industrial products

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Barry-Wehmiller Companies

- 10.2 Coesia Group

- 10.3 GEA Group

- 10.4 Hayssen Flexible Systems

- 10.5 IMA Group

- 10.6 Ishida Co., Ltd.

- 10.7 KHS GmbH

- 10.8 Mespack

- 10.9 MULTIVAC

- 10.10 Optima Packaging Group

- 10.11 PFM Packaging Machinery

- 10.12 ProMach

- 10.13 Syntegon

- 10.14 TNA Solutions

- 10.15 W&H (Windmoller & Holscher)