|

市場調查報告書

商品編碼

1716644

烘焙包裝機市場機會、成長動力、產業趨勢分析及2025-2034年預測Bakery Packaging Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

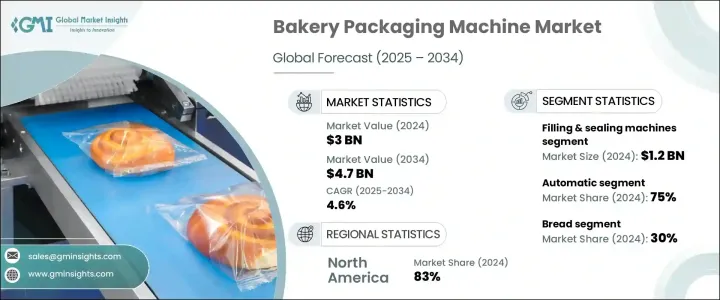

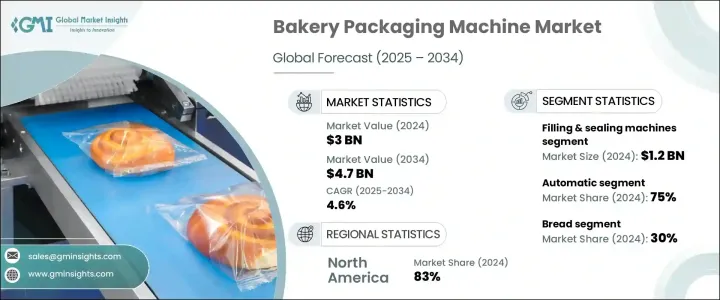

2024 年全球烘焙包裝機市場價值為 30 億美元,預計 2025 年至 2034 年的複合年成長率為 4.6%。這一成長得益於全球對包裝烘焙產品的需求不斷成長以及零售店和烘焙連鎖店的不斷增加。隨著消費者的生活方式變得越來越忙碌,他們越來越傾向於購買即食烘焙食品,例如麵包、蛋糕、餅乾和糕點。這種轉變對創新、高效、外觀吸引人的包裝解決方案產生了強烈的需求,這些解決方案不僅可以保護這些產品的質量,還可以延長其保存期限。此外,隨著電子商務和直接面對消費者的送貨服務的興起,烘焙品牌正在投資高品質的包裝機械,以滿足消費者不斷變化的需求。隨著越來越多的烘焙品牌尋求在競爭日益激烈的市場中脫穎而出,他們越來越重視能夠增強品牌形象並確保產品在運輸過程中完整性的包裝解決方案。

烘焙包裝機市場分為多種類型,包括填充和封口機、貼標機、捆紮機、膠帶機等。其中,灌裝封口機領域2024年創收12億美元,預計將維持強勁成長軌跡。這種成長歸因於對能夠處理不同形狀和尺寸的烘焙產品的機器的需求不斷成長,以滿足大量生產的需求。製造商正專注於能夠適應獨特形狀、尺寸和定製品牌的靈活包裝解決方案,確保他們的產品在擁擠的貨架上脫穎而出。此外,能夠處理多種包裝形式的填充和封口機對於旨在有效滿足不斷變化的消費者偏好的麵包店來說已經變得至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 30億美元 |

| 預測值 | 47億美元 |

| 複合年成長率 | 4.6% |

就自動化程度而言,市場分為全自動機器和半自動機器。 2024 年,自動機器佔據市場主導地位,佔有 75% 的佔有率。自動化需求的不斷成長是由於需要提高營運效率、降低勞動成本並確保包裝的一致性。自動包裝機對於大批量麵包店來說尤其重要,因為速度和一致性對於維持產品品質至關重要。這些系統簡化了生產流程,使製造商能夠擴大其營運規模,同時最大限度地減少錯誤和營運停機時間。隨著烘焙業的不斷發展,自動化機器對於維持高效率和高品質的標準變得越來越不可或缺。

北美烘焙包裝機市場佔全球市場的 83%,2024 年產值達 8.8 億美元。該地區的主導地位源於人們對烘焙產品(尤其是麵包)的需求不斷成長,以及美國和加拿大各地烘焙店數量的不斷增加。隨著消費者在選擇食品時不斷追求便利性,先進包裝技術的需求激增。智慧包裝創新和自動化在滿足這些需求方面發揮關鍵作用,使麵包店能夠改進其包裝流程,同時保持產品的新鮮度和吸引力。隨著烘焙業的不斷擴張,採用尖端包裝技術有望推動北美市場的持續成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 包裝烘焙產品需求不斷成長

- 擴大烘焙連鎖店和零售店

- 產業陷阱與挑戰

- 初期投資成本高

- 嚴格遵守食品安全規定

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 灌裝和封口機

- 貼標機

- 捆紮機

- 磁帶機

- 其他(漫畫等)

第6章:市場估計與預測:依自動化等級,2021 年至 2034 年

- 主要趨勢

- 自動的

- 半自動

第7章:市場估計與預測:依產量,2021 - 2034

- 主要趨勢

- 高達50/分鐘

- 50至100次/分鐘

- 100至200次/分鐘

- 200次/分鐘以上

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 麵包

- 蛋糕

- 餅乾

- 糕點

- 貝果

- 其他(可頌等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Arpac

- Bosch Packaging Technology

- Buhler

- Filpack

- Hopak Machinery

- Ishida

- Joiepack Industrial

- Multivac

- PAC Machinery

- Rademaker

- Rianta

- SOMIC Packaging

- Syntegon Technology

- Middleby

- Viking Masek

The Global Bakery Packaging Machine Market was valued at USD 3 billion in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2034. This growth is fueled by the increasing demand for packaged bakery products and the rising presence of retail outlets and bakery chains worldwide. As consumer lifestyles become more hectic, there is a growing inclination toward ready-to-eat bakery items such as bread, cakes, cookies, and pastries. This shift has created a strong demand for innovative, efficient, and visually appealing packaging solutions that not only protect the quality of these products but also extend their shelf life. Moreover, with the rise in e-commerce and direct-to-consumer delivery services, bakery brands are investing in high-quality packaging machinery to meet the changing needs of consumers. As more bakery brands look to differentiate themselves in an increasingly competitive market, there is a growing emphasis on packaging solutions that enhance brand identity and ensure product integrity during transit.

The market for bakery packaging machines is categorized into various types, including filling and sealing machines, labeling machines, strapping machines, tape machines, and others. Among these, the filling and sealing machines segment generated USD 1.2 billion in 2024 and is expected to maintain a strong growth trajectory. This growth is attributed to the increasing need for machines that can handle diverse bakery products in different forms and sizes, catering to bulk production requirements. Manufacturers are focusing on flexible packaging solutions that can accommodate unique shapes, sizes, and custom branding, ensuring that their products stand out on crowded shelves. Additionally, filling and sealing machines that can handle multiple packaging formats have become essential for bakeries aiming to meet changing consumer preferences efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.6% |

In terms of automation, the market is divided into automatic and semi-automatic machines. Automatic machines dominated the market in 2024, holding a 75% share. The rising demand for automation is driven by the need to improve operational efficiency, reduce labor costs, and ensure consistency in packaging. Automatic packaging machines are particularly crucial for high-volume bakeries, where speed and uniformity are essential for maintaining product quality. These systems streamline production processes, enabling manufacturers to scale their operations while minimizing errors and operational downtime. As the bakery industry continues to grow, automatic machines are becoming indispensable in maintaining high standards of efficiency and quality.

The North America bakery packaging machine market accounted for 83% of the global market and generated USD 880 million in 2024. The region's dominance is driven by a growing appetite for bakery products, especially bread, and an increasing number of bakery outlets across the United States and Canada. As consumers continue to seek convenience in their food choices, the demand for advanced packaging technologies has surged. Smart packaging innovations and automation play a pivotal role in meeting these demands, allowing bakeries to enhance their packaging processes while maintaining product freshness and appeal. With the continuous expansion of the bakery sector, the adoption of cutting-edge packaging technologies is expected to drive sustained growth in the North American market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for packaged bakery products

- 3.6.1.2 Expansion of bakery chains and retail outlets

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment costs

- 3.6.2.2 Strict food safety compliance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling & sealing machines

- 5.3 Labelling machines

- 5.4 Strapping machines

- 5.5 Tape machines

- 5.6 Others (cartooning etc.)

Chapter 6 Market Estimates & Forecast, By Automation Grade, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

Chapter 7 Market Estimates & Forecast, By Output Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 50/min

- 7.3 50 to 100/min

- 7.4 100 to 200/min

- 7.5 Above 200/min

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Bread

- 8.3 Cakes

- 8.4 Cookies

- 8.5 Pastry

- 8.6 Bagels

- 8.7 Others (croissants etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Arpac

- 11.2 Bosch Packaging Technology

- 11.3 Buhler

- 11.4 Filpack

- 11.5 Hopak Machinery

- 11.6 Ishida

- 11.7 Joiepack Industrial

- 11.8 Multivac

- 11.9 PAC Machinery

- 11.10 Rademaker

- 11.11 Rianta

- 11.12 SOMIC Packaging

- 11.13 Syntegon Technology

- 11.14 Middleby

- 11.15 Viking Masek