|

市場調查報告書

商品編碼

1740743

胺基碳捕獲市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Amine-Based Carbon Capture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

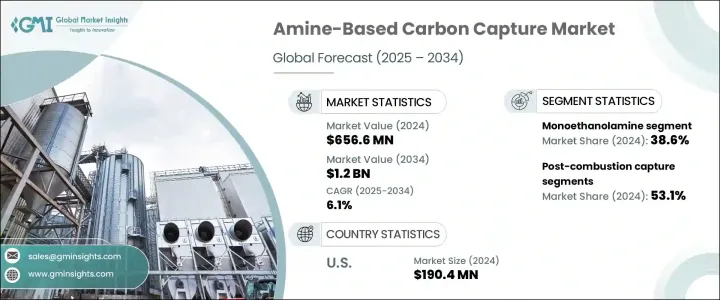

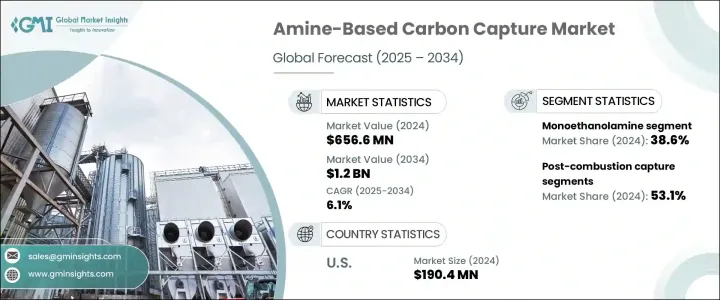

2024年,全球胺基碳捕集市場規模達6.566億美元,預計2034年將以6.1%的複合年成長率成長,達到12億美元。全球正加強應對溫室氣體排放,尤其是發電廠和重工業排放的二氧化碳。隨著各國制定雄心勃勃的碳中和目標,對高效、可擴展且經濟高效的碳捕集技術的需求持續成長。胺基碳捕集正成為最可靠的解決方案之一,它提供了一種無需改造現有基礎設施即可顯著減少排放的實用方法。企業、政府和研究機構正大力投資先進胺溶劑和系統的開發,並認知到其在能源和製造業轉型方面的潛力。

推動這一市場發展的不僅是監管壓力,還有投資者對永續技術日益成長的興趣。隨著碳定價機制的收緊以及脫碳成為企業策略的核心,企業正在尋求可靠的長期解決方案,以確保合規性並支持永續發展承諾。此外,循環碳經濟的日益成長推動了對捕獲、回收甚至永久去除二氧化碳的技術的需求。在此背景下,基於胺的碳捕獲技術擁有久經考驗的性能和靈活性。它目前既可以進行工業規模部署,也可以作為創新平台,包括與碳利用和儲存系統的整合。隨著材料科學、工藝工程和自動化的進步,預計這一市場將繼續快速擴張,為新進業者和老牌企業提供重大機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.566億美元 |

| 預測值 | 12億美元 |

| 複合年成長率 | 6.1% |

胺基捕集技術以其高效性而聞名,尤其是在燃燒後煙氣富含二氧化碳的應用中。此製程依賴胺水溶液以化學方式吸收二氧化碳,然後在再生階段釋放,使溶劑能夠連續循環使用。該技術尤其適用於改造現有的燃煤和燃氣發電廠以及其他工業設施,無需進行大規模改造。實現氣候目標和減少工業碳足跡的緊迫性日益增強,推動該領域的創新,重點是提高溶劑性能、提高二氧化碳負載能力並降低再生所需的能源。

該領域最具前瞻性的發展之一是使用胺類增強固體吸附劑直接捕獲空氣中的二氧化碳。雖然這項技術比從源頭捕獲排放物耗能更高,但它有可能透過直接從大氣中提取二氧化碳來逆轉排放。隨著人們的注意力轉向淨負排放策略,這種方法正受到氣候技術投資者和各國政府的青睞。

近期研發工作重點在於提升胺基溶劑的選擇性和反應性,旨在降低整體營運成本的同時提高捕集效率。這包括開發具有更高熱穩定性和更低分解率的新型溶劑配方。跨部門合作推動創新,化學工程師、環境科學家和清潔能源專家齊心協力,致力於使碳捕集系統更容易大規模部署。這些進步對於水泥、鋼鐵和煉油等難以減排的產業尤其重要,因為電氣化在這些產業中並非可行的脫碳途徑。

2024年,單乙醇胺 (MEA) 佔據了38.6%的市場佔有率,佔據主導地位。 MEA以其對二氧化碳的強親和力和形成穩定氨基甲酸酯化合物的能力而聞名,至今仍是化學吸收系統的基石。其可靠性、操作一致性和廣泛的可用性使其成為燃燒後碳捕集的首選,尤其是在傳統能源基礎設施中。

2024年,燃燒後捕集技術以53.1%的市佔率領先市場,這主要歸功於其與現有系統的無縫整合。各行各業都青睞這種方法,因為它能夠在最大程度上減少碳排放,同時最大程度地降低營運中斷。經過數十年的試點測試、商業項目和工程改進,燃燒後捕集仍然是最實用、最廣泛應用的解決方案。

2024年,美國胺基碳捕集市場規模達1.904億美元。稅收抵免等聯邦激勵措施,加上靈活的州級法規,使美國成為碳捕集創新領域的領先市場。美國環保署和各州政府部門對六級井的快速核准縮短了專案週期,增強了投資者信心,進一步加速了部署進程。

主要的產業參與者包括東芝能源系統與解決方案公司、林德集團、三菱重工、福陸公司、科赫-格力奇公司、殼牌CANSOLV公司、巴斯夫歐洲公司、濱特爾公司、Carbon Clean公司和基伊埃集團。這些公司致力於提高溶劑再生效率,推出模組化碳捕集裝置,並將試點計畫擴展到全面的商業營運。他們的努力有助於降低成本,並提高下一代胺系統在廣泛工業應用中的可擴展性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 主要製造商

- 經銷商

- 整個產業的利潤率

- 供應中斷

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業回應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 增加單乙醇胺在燃煤電廠燃燒後二氧化碳捕集中的應用

- 甲基二乙醇胺混合物用於天然氣脫硫的技術改進

- 使用胺基功能化固體吸附劑的直接空氣捕獲(DAC)投資不斷增加

- 產業陷阱與挑戰

- 溶劑再生帶來的高能量損失和營運成本

- 某些胺具有腐蝕性,需要昂貴的材料來建造工廠基礎設施

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按胺類型,2021-2034 年

- 主要趨勢

- 單乙醇胺

- 二乙醇胺

- 甲基二乙醇胺

- 三乙醇胺

- 其他

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 燃燒後捕獲

- 燃燒前捕集

- 直接空氣捕獲

- 其他

第7章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- BASF SE

- Carbon Clean

- Fluor Corporation

- GEA Group

- Koch-Glitsch

- Linde PLC

- Mitsubishi Heavy Industries

- Pentair

- Shell CANSOLV

- Toshiba Energy Systems & Solutions

The Global Amine-Based Carbon Capture Market was valued at USD 656.6 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 1.2 billion by 2034, as global efforts ramp up to combat greenhouse gas emissions, particularly carbon dioxide released from power plants and heavy industries. As countries set ambitious carbon neutrality goals, demand for efficient, scalable, and cost-effective carbon capture technologies continues to rise. Amine-based carbon capture is emerging as one of the most dependable solutions, offering a practical way to significantly reduce emissions without overhauling existing infrastructure. Companies, governments, and research institutions are heavily investing in the development of advanced amine solvents and systems, recognizing their potential to transform the energy and manufacturing sectors.

This market is driven not only by regulatory pressure but also by growing investor interest in sustainable technologies. As carbon pricing mechanisms tighten and decarbonization becomes central to corporate strategies, businesses are seeking reliable, long-term solutions that ensure compliance while supporting sustainability commitments. Moreover, the growing push for circular carbon economies is reinforcing the need for technologies that capture, recycle, and even permanently remove CO2 ,In this context, amine-based carbon capture offers a proven track record of performance and flexibility. It can be deployed at industrial scale today while also serving as a platform for innovation, including integration with carbon utilization and storage systems. With advancements in material science, process engineering, and automation, this market is expected to continue expanding rapidly, offering significant opportunities for new entrants and established players alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $656.6 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 6.1% |

Amine-based capture technology is known for its high efficiency, particularly in post-combustion applications where flue gases are rich in carbon dioxide. The process relies on aqueous amine solutions to chemically absorb CO2 which is then released during the regeneration phase, allowing the solvent to be reused in continuous cycles. This technology is especially well-suited for retrofitting existing coal and gas-fired power plants, as well as other industrial facilities, without the need for extensive modifications. The increasing urgency to meet climate targets and reduce industrial carbon footprints is pushing innovation in this field, with an emphasis on improving solvent performance, increasing CO2 loading capacity, and reducing the energy required for regeneration.

One of the most forward-looking developments in this space is direct air capture using solid sorbents enhanced with amines. Although more energy-intensive than capturing emissions at the source, this technology holds the potential to reverse emissions by extracting CO2 directly from the atmosphere. As attention shifts toward net-negative emission strategies, this approach is gaining traction among climate tech investors and governments alike.

Recent R&D efforts are focused on improving the selectivity and reactivity of amine-based solvents, aiming to reduce overall operational costs while enhancing capture efficiency. This includes the development of new solvent formulations with higher thermal stability and lower degradation rates. Innovations are being driven by cross-sector collaboration involving chemical engineers, environmental scientists, and clean energy specialists, all working toward making carbon capture systems more viable for large-scale deployment. These advancements are particularly important in hard-to-abate sectors like cement, steel, and refining, where electrification is not a feasible path to decarbonization.

The monoethanolamine (MEA) segment accounted for a dominant 38.6% market share in 2024. Known for its strong affinity to carbon dioxide and its ability to form stable carbamate compounds, MEA remains a cornerstone of chemical absorption systems. Its reliability, operational consistency, and widespread availability have made it a go-to choice for post-combustion capture, particularly in legacy energy infrastructure.

Post-combustion capture technologies led the market with a 53.1% share in 2024, largely because of their seamless integration into existing systems. Industries favor this method as it allows them to reduce carbon emissions with minimal disruption to operations. Supported by decades of pilot testing, commercial projects, and engineering improvements, post-combustion capture continues to be the most practical and widely adopted solution.

The United States Amine-Based Carbon Capture Market was valued at USD 190.4 million in 2024. Federal incentives like tax credits, coupled with flexible state-level regulations, have made the U.S. a leading market for carbon capture innovation. Fast-track permitting for Class VI wells by the Environmental Protection Agency and delegated state authorities has shortened project timelines and boosted investor confidence, further accelerating deployment.

Key industry players include Toshiba Energy Systems & Solutions, Linde PLC, Mitsubishi Heavy Industries, Fluor Corporation, Koch-Glitsch, Shell CANSOLV, BASF SE, Pentair, Carbon Clean, and GEA Group. These companies are focusing on enhancing solvent regeneration efficiency, launching modular carbon capture units, and scaling up pilot projects into full-scale commercial operations. Their efforts are helping to drive down costs and improve the scalability of next-generation amine systems across a wide range of industrial applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply disruptions

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major Exporting Countries

- 3.3.2 Major Importing Countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing deployment of monoethanolamine in post-combustion CO2 capture in coal-fired power plants

- 3.7.1.2 Technological improvements in methyldiethanolamine blends for natural gas sweetening

- 3.7.1.3 Rising investments in direct air capture (DAC) using amine-functionalized solid sorbents

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High energy penalty and operational costs associated with solvent regeneration

- 3.7.2.2 Corrosiveness of certain amines, requiring expensive materials for plant infrastructure

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type of Amines, 2021–2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Monoethanolamine

- 5.3 Diethanolamine

- 5.4 Methyldiethanolamine

- 5.5 Triethanol amine

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021–2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Post-combustion capture

- 6.3 Pre-combustion capture

- 6.4 Direct air capture

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021–2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BASF SE

- 8.2 Carbon Clean

- 8.3 Fluor Corporation

- 8.4 GEA Group

- 8.5 Koch-Glitsch

- 8.6 Linde PLC

- 8.7 Mitsubishi Heavy Industries

- 8.8 Pentair

- 8.9 Shell CANSOLV

- 8.10 Toshiba Energy Systems & Solutions