|

市場調查報告書

商品編碼

1721568

動物疫苗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Animal Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

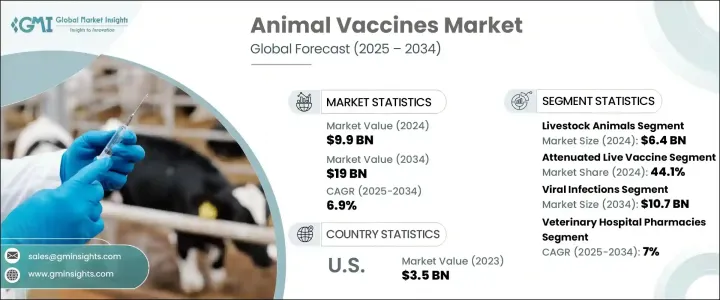

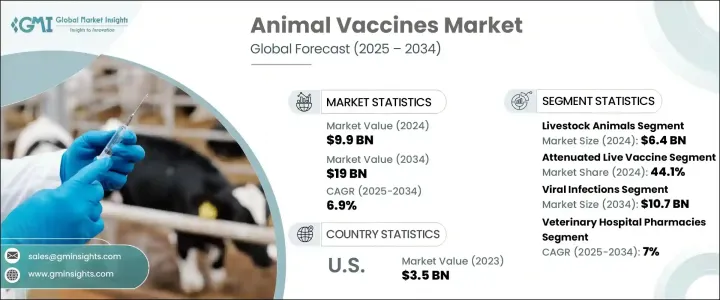

2024 年全球動物疫苗市場價值為 99 億美元,預計到 2034 年將以 6.9% 的複合年成長率成長,達到 190 億美元。隨著人們對動物健康和食品安全的擔憂日益加劇,全球對動物疫苗的需求也上升。隨著人們越來越重視預防人畜共通傳染病和減少動物疾病爆發造成的經濟損失,疫苗接種計畫的重要性也倍增。全球動物數量的穩定成長,以及寵物收養和擁有趨勢的不斷成長,正在重塑人們對獸醫護理的看法和優先考慮方式。如今,寵物主人更傾向於投資預防性醫療保健,包括接種疫苗,以確保他們的伴侶動物壽命更長、更健康。同時,畜牧農民正在採取積極的免疫策略,保護他們的牲畜免受可能破壞供應鏈並影響國際貿易的高度傳染性疾病的侵害。世界各國政府都在加強與動物健康相關的法規,實施強制疫苗接種計劃,以保護動物福利,確保食品供應鏈安全,並最大限度地降低跨物種疾病傳播的風險。人們越來越認知到動物健康是公共衛生不可或缺的一部分,這對市場成長做出了巨大貢獻。

動物疫苗市場大致分為兩大類:牲畜和伴侶動物。 2024 年,牲畜類別佔據市場主導地位,估值達 64 億美元。家禽、牛、豬和水產養殖等牲畜對全球糧食安全和農業經濟至關重要。預防這些動物的疾病爆發對於維持生產力和減少經濟損失至關重要。口蹄疫、豬瘟和禽流感的發生率仍然是該領域的嚴重問題,因此需要強而有力的疫苗接種策略。雖然隨著寵物擁有量的增加和對寵物健康的關注度增加,伴侶動物細分市場也不斷擴大,但牲畜細分市場仍創造最高收入。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 99億美元 |

| 預測值 | 190億美元 |

| 複合年成長率 | 6.9% |

動物保健領域的疫苗包括幾種類型,例如減毒活疫苗、結合疫苗、去活化疫苗、DNA疫苗、重組疫苗等。其中,減毒活疫苗在2024年市佔率最高,佔44.1%。這些疫苗因其能夠產生強大的免疫反應並提供長期保護而受到廣泛青睞。它們能夠刺激體液和細胞介導的免疫,從而減少重複劑量的需要,使其成為牲畜和伴侶動物疫苗接種計劃的首選。

2024 年,北美佔全球動物疫苗市場的 40.6%。這一主導佔有率是由於該地區擁有大量的家畜和牲畜。美國是寵物擁有量最高的國家,擁有成熟的農業部門,包括牛、家禽和豬。對維護畜群健康和最大限度降低傳染病風險的持續關注繼續推動該地區疫苗的採用。

影響全球動物疫苗模式的主要參與者包括 Zoetis、默克動物保健、維克、勃林格殷格翰國際、Bioveta、Brilliant Bio Pharma、Dechra Pharmaceuticals、Vetoquinol、Neogen Corporation、Elanco Animal Health、Hipra Animal Health Limited 和 Henry Schein Animal Health(Covetrus, Inc.)。這些公司正在透過廣泛的研究和開發積極擴大其疫苗組合。與獸醫組織和政府機構的策略夥伴關係有助於提高疫苗的可及性。此外,採用基因工程和重組 DNA 等先進技術,可以研發出針對不斷演變的疾病威脅的更有效、更持久的疫苗。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 人畜共通傳染病發生率上升

- 畜牧業擴張與食品安全問題

- 增加寵物收養和動物健康支出

- 疫苗技術的進步

- 動物疾病爆發增多

- 產業陷阱與挑戰

- 開發成本高

- 嚴格的監管要求

- 成長動力

- 成長潛力分析

- 監管格局

- 產品線分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按動物類型,2021 - 2034 年

- 主要趨勢

- 牲畜

- 家禽

- 牛

- 豬

- 水產養殖

- 綿羊和山羊

- 伴侶動物

- 犬科動物

- 貓科動物

- 馬

- 禽類

第6章:市場估計與預測:按疫苗類型,2021 - 2034 年

- 主要趨勢

- 減毒活疫苗

- 結合疫苗

- 去活化疫苗

- DNA疫苗

- 重組疫苗

- 其他疫苗類型

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 細菌感染

- 病毒感染

- 寄生蟲感染

- 黴菌感染

- 其他應用

第8章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 注射疫苗

- 口服疫苗

- 浸入式/噴霧式疫苗

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 獸醫院藥房

- 零售藥局

- 電子商務

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Boehringer Ingelheim International

- Brilliant Bio Pharma

- Bioveta

- Ceva Sante Animale

- Durvet

- Dechra Pharmaceuticals

- Elanco Animal Health

- Henry Schein Animal Health (Covetrus, Inc.)

- Hipra Animal Health Limited

- Indian Immunologicals

- Merck Animal Health

- Neogen Corporation

- Vetoquinol

- Virbac

- Zoetis

The Global Animal Vaccines Market was valued at USD 9.9 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 19 billion by 2034. The global demand for animal vaccines is on the rise as concerns over animal health and food safety gain increasing prominence. With the growing emphasis on preventing zoonotic diseases and reducing economic losses from animal disease outbreaks, the importance of vaccination programs has grown multifold. A steady rise in the global animal population, along with the increasing trend of pet adoption and ownership, is reshaping how veterinary care is perceived and prioritized. Pet owners today are more inclined to invest in preventive healthcare, including vaccinations, to ensure longer and healthier lives for their companion animals. At the same time, livestock farmers are adopting proactive immunization strategies to safeguard their herds against highly contagious diseases that can cripple supply chains and impact international trade. Governments across the globe are tightening regulations related to animal health, implementing compulsory vaccination programs to protect animal welfare, secure the food supply chain, and minimize the risk of cross-species disease transmission. This broader awareness of animal health as an integral part of public health is significantly contributing to market growth.

The animal vaccines market is broadly segmented into two key categories: livestock and companion animals. In 2024, the livestock category dominated the market with a valuation of USD 6.4 billion. Livestock species such as poultry, cattle, swine, and aquaculture are critical to global food security and agricultural economies. Preventing disease outbreaks in these animals is crucial to maintaining productivity and minimizing financial losses. Incidences of foot-and-mouth disease, swine fever, and avian influenza remain serious concerns in this sector, reinforcing the need for robust vaccination strategies. While the companion animal segment is also expanding due to rising pet ownership and increased attention to pet wellness, the livestock segment continues to generate the highest revenue.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $19 Billion |

| CAGR | 6.9% |

Vaccines in the animal health sector include several types, such as attenuated live, conjugate, inactivated, DNA, recombinant, and others. Among these, attenuated live vaccines held the highest market share in 2024, accounting for 44.1% of the total. These vaccines are widely favored for their ability to produce strong immune responses and deliver long-term protection. Their capability to stimulate both humoral and cell-mediated immunity often reduces the need for repeated doses, making them a preferred option in both livestock and companion animal vaccination programs.

North America accounted for 40.6% of the global animal vaccines market in 2024. This dominant share is driven by a large population of domesticated animals and livestock in the region. The United States leads in pet ownership and has a well-established agricultural sector comprising cattle, poultry, and swine. The ongoing focus on maintaining herd health and minimizing infectious disease risks continues to drive vaccine adoption in the region.

Key players shaping the global animal vaccine landscape include Zoetis, Merck Animal Health, Virbac, Boehringer Ingelheim International, Bioveta, Brilliant Bio Pharma, Dechra Pharmaceuticals, Vetoquinol, Neogen Corporation, Elanco Animal Health, Hipra Animal Health Limited, and Henry Schein Animal Health (Covetrus, Inc.). These companies are actively expanding their vaccine portfolios through extensive research and development. Strategic partnerships with veterinary organizations and government agencies are helping improve vaccine accessibility. Additionally, the adoption of advanced technologies like genetic engineering and recombinant DNA is enabling the creation of more effective, long-lasting vaccines tailored to evolving disease threats.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of zoonotic diseases

- 3.2.1.2 Expanding livestock industry and food security concerns

- 3.2.1.3 Increasing pet adoption and expenditure on animal health

- 3.2.1.4 Advancements in vaccine technology

- 3.2.1.5 Increasing outbreaks of animal diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development costs

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Product pipeline analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Livestock animals

- 5.2.1 Poultry

- 5.2.2 Cattle

- 5.2.3 Swine

- 5.2.4 Aquaculture

- 5.2.5 Sheep and goats

- 5.3 Companion animals

- 5.3.1 Canine

- 5.3.2 Feline

- 5.3.3 Equine

- 5.3.4 Avian

Chapter 6 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Attenuated live vaccine

- 6.3 Conjugate vaccine

- 6.4 Inactivated vaccine

- 6.5 DNA vaccine

- 6.6 Recombinant vaccine

- 6.7 Other vaccine types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacterial infections

- 7.3 Viral infections

- 7.4 Parasitic infections

- 7.5 Fungal infections

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Injection vaccines

- 8.3 Oral vaccines

- 8.4 Immersion/spray vaccines

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 E-commerce

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Boehringer Ingelheim International

- 11.2 Brilliant Bio Pharma

- 11.3 Bioveta

- 11.4 Ceva Sante Animale

- 11.5 Durvet

- 11.6 Dechra Pharmaceuticals

- 11.7 Elanco Animal Health

- 11.8 Henry Schein Animal Health (Covetrus, Inc.)

- 11.9 Hipra Animal Health Limited

- 11.10 Indian Immunologicals

- 11.11 Merck Animal Health

- 11.12 Neogen Corporation

- 11.13 Vetoquinol

- 11.14 Virbac

- 11.15 Zoetis