|

市場調查報告書

商品編碼

1740937

牲畜疫苗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Livestock Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

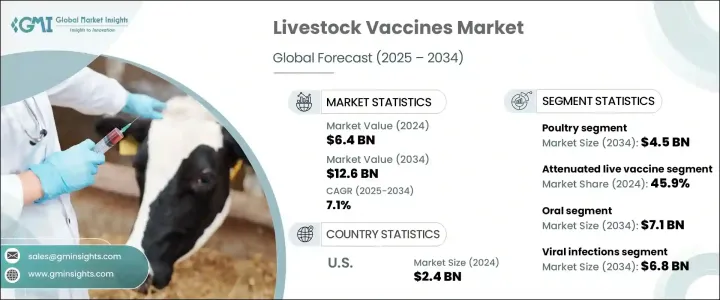

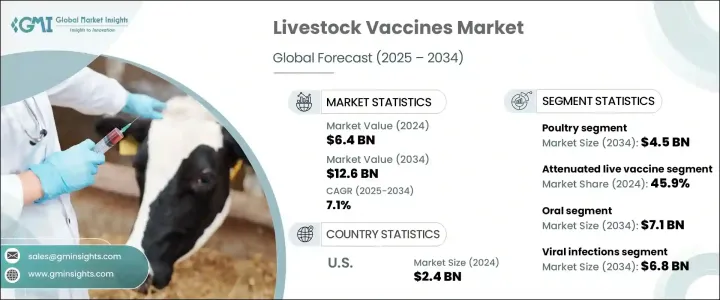

2024年,全球牲畜疫苗市場規模達64億美元,預計到2034年將以7.1%的複合年成長率成長,達到126億美元,這得益於動物健康意識的提升、工業化養殖的擴張以及疫苗技術的進步。這一成長趨勢主要歸因於農民對疾病預防的重視程度不斷提高,以及對免疫相關經濟效益的認知日益加深。隨著畜牧業的工業化程度不斷提高,對綜合疾病管理策略的需求也日益增強。科技創新進一步推動了高效疫苗的研發,增強了動物健康水平,並提高了農場的生產力。全球疾病疫情頻繁,預防措施的緊迫性日益增強,尤其對於仍高度脆弱的家禽。全球糧食安全越來越依賴畜牧業的生產力,這使得動物健康成為農業永續發展的關鍵因素。此外,疾病和死亡損失的減少直接支持了農業經營的經濟可行性,尤其是在高密度養殖環境下。市場繼續受益於有利的政府政策、產業合作以及對動物保健基礎設施的投資增加。

牛、豬、家禽、水產養殖物種以及綿羊和山羊等牲畜是農業經濟的核心,其用途廣泛,包括糧食生產、纖維生產和勞動力。疫苗接種被廣泛認為是保障動物健康和減少傳染病經濟影響的重要工具。 2024年,家禽業佔據了最大的市場佔有率,創造了24億美元的收入,預計到2034年將達到45億美元,複合年成長率為6.5%。家禽仍然是全球主要飲食來源,這主要是因為與其他牲畜相比,家禽的生產成本更低、週轉速度更快。家禽產品需求的成長,尤其是在快速發展地區,加速了大規模疫苗接種實踐的採用。該產業面臨病毒和細菌疫情的持續威脅,凸顯了強力的疫苗接種計畫的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 64億美元 |

| 預測值 | 126億美元 |

| 複合年成長率 | 7.1% |

在疫苗類型中,減毒活疫苗佔據市場主導地位,2024 年的市佔率為 45.9%。預計到 2034 年,該領域將保持領先地位,複合年成長率為 6.7%。這些疫苗非常有效,因為它們模擬自然感染,只需較少劑量即可提供強效持久的免疫力。它們常用於治療嚴重的牲畜疾病,使其成為大規模動物健康管理的首選解決方案。這些疫苗也以提供更快的免疫反應而聞名,這在疾病可能迅速傳播的密集養殖環境中至關重要。

在給藥途徑方面,口服疫苗因其便利性和在大規模生產中的有效性而備受青睞。預計到2034年,該領域的市值將達到71億美元,複合年成長率將達到6.8%。口服疫苗為動物免疫提供了一種輕鬆便捷的方式,尤其是在家禽、豬和牛養殖領域。口服疫苗可以透過飼料或飲水給藥,減少了操作,從而最大限度地降低了受傷風險,並確保了更高的畜群依從性。疫苗製劑技術的進步提高了口服疫苗的穩定性和有效性,使其越來越適合廣泛應用。

在應用方面,病毒感染疫苗佔據了相當大的市場佔有率,預計到2034年將達到68億美元,複合年成長率為7.2%。反覆爆發的病毒疫情持續對畜牧業構成重大挑戰,無論是在動物健康方面或經濟方面。這些疾病顯著降低了產量,迫使農民採取有效的預防措施。疫苗製造商持續的研發投入預計將推動該領域的創新,提高病毒疫苗的有效性和可近性。

在分銷方面,獸醫院藥局佔了最大的收入佔有率,2024 年達 33 億美元,預計到 2034 年將達到 64 億美元,複合年成長率為 6.9%。這些機構因其全面的護理服務而備受青睞,包括診斷、諮詢和即時疫苗接種。獸醫院護理網路的擴展,尤其是在新興市場,正在促進動物醫療保健的可近性。獸醫院結構化的配送系統可確保及時接種疫苗,減少錯失良機,並提高整體效果。

美國引領北美牲畜疫苗市場,2024年估值達24億美元。其領先地位得益於其先進的動物保健體系、高昂的獸醫支出以及政府對預防性牲畜保健的持續支持。疾病的流行持續推動疫苗接種需求,從而推動市場向前發展。

碩騰、默克動物保健、勃林格殷格翰、禮來和詩華等主要企業合計佔據全球約45%的市場。他們的主導地位得益於廣泛的產品線、強大的全球分銷網路以及對下一代疫苗開發的戰略投資。牲畜疫苗產業保持中等程度的整合,這些領導者引領動物保健解決方案的創新、效率和永續性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 牲畜疾病發生率上升

- 農民對疫苗接種益處的認知不斷提高。

- 政府支持動物健康和食品安全的措施和政策。

- 技術進步促進了更有效疫苗的開發

- 產業陷阱與挑戰

- 疫苗研發和分發成本高昂

- 監管障礙可能會延遲產品核准和市場進入。

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按動物類型,2021 - 2034 年

- 主要趨勢

- 家禽

- 牛

- 豬

- 水產養殖

- 綿羊和山羊

第6章:市場估計與預測:按疫苗類型,2021 - 2034 年

- 主要趨勢

- 減毒活疫苗

- 結合疫苗

- 去活化疫苗

- 重組疫苗

- 其他疫苗類型

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 父母

- 其他給藥途徑

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 細菌感染

- 病毒感染

- 寄生蟲感染

- 其他應用

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 獸醫院藥房

- 零售藥局

- 電子商務

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Biogenesis Bago

- Bioveta

- Boehringer Ingelheim

- Ceva

- Elanco

- HIPRA

- Indian Immunologicals

- Merck Animal Health

- Neogen

- Phibro Animal Health

- SAN VET

- Vaxxinova

- Venkys

- Virbac

- Zoetis

The Global Livestock Vaccines Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 12.6 billion by 2034, driven by increased awareness of animal health, the expansion of industrial farming, and advancements in vaccine technology. This rising trend is largely attributed to the heightened focus on disease prevention among farmers and a growing understanding of the economic advantages linked to immunization. As livestock farming becomes more industrialized, the need for comprehensive disease management strategies grows stronger. Technological innovation has further enabled the development of highly effective vaccines, strengthening animal health outcomes and improving productivity across farms. The emergence of frequent disease outbreaks globally has led to increased urgency around preventive measures, especially for poultry, which remains a highly vulnerable category. Global food security is increasingly reliant on livestock productivity, making animal health a critical aspect of agricultural sustainability. Moreover, the reduction in losses due to illness and mortality directly supports the economic viability of farming operations, especially in high-density production settings. The market continues to benefit from favorable government policies, industry collaborations, and increased investments in animal healthcare infrastructure.

Livestock animals such as cattle, swine, poultry, aquaculture species, and sheep and goats are central to the agricultural economy, serving various purposes including food production, fiber, and labor. Vaccination is widely recognized as an essential tool for safeguarding animal health and reducing the economic impact of infectious diseases. In 2024, the poultry segment held the largest market share, generating USD 2.4 billion in revenue, and is projected to reach USD 4.5 billion by 2034, growing at a CAGR of 6.5%. Poultry remains a global dietary staple, largely due to its lower production costs and faster turnover compared to other livestock. Increased demand for poultry products, particularly in rapidly developing regions, has accelerated the adoption of mass vaccination practices. The industry faces ongoing threats from viral and bacterial outbreaks, which have emphasized the importance of robust vaccination programs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $12.6 Billion |

| CAGR | 7.1% |

Among vaccine types, attenuated live vaccines dominate the market, holding a 45.9% share in 2024. This segment is expected to maintain its leading position through 2034 with a CAGR of 6.7%. These vaccines are highly effective because they mimic natural infections, providing strong and long-lasting immunity with fewer doses. Their use is common in addressing serious livestock diseases, making them a preferred solution for large-scale animal health management. These vaccines are also known for providing quicker immune responses, an essential factor in intensive farming setups where disease can spread rapidly.

Regarding administration routes, the oral segment is gaining significant traction due to its convenience and effectiveness in large-scale operations. Valued at USD 7.1 billion by 2034, this segment is projected to grow at a CAGR of 6.8%. Oral vaccines offer a stress-free way to immunize animals, especially in poultry, swine, and cattle sectors. Their ability to be administered through feed or water reduces handling, thereby minimizing injury risks and ensuring higher compliance across herds. Technological progress in vaccine formulation has improved the stability and efficiency of oral vaccines, making them increasingly suitable for widespread use.

In terms of applications, viral infection vaccines hold a substantial share of the market, anticipated to reach USD 6.8 billion by 2034, with a CAGR of 7.2%. Recurring viral outbreaks continue to pose major challenges to the livestock industry, both in terms of animal health and economic impact. These diseases significantly reduce production yields, compelling farmers to adopt effective preventive solutions. The ongoing investment in research and development by vaccine manufacturers is expected to drive innovation in this segment, improving the efficacy and accessibility of viral vaccines.

When it comes to distribution, veterinary hospital pharmacies accounted for the largest revenue share of USD 3.3 billion in 2024 and are forecasted to hit USD 6.4 billion by 2034, growing at a CAGR of 6.9%. These facilities are preferred for their comprehensive care offerings, including diagnostics, consultations, and immediate vaccine administration. The expansion of veterinary care networks, especially in emerging markets, is contributing to better access to animal healthcare. The structured delivery system in veterinary hospitals ensures timely vaccination, reducing missed opportunities and increasing overall effectiveness.

The United States leads the North American livestock vaccines market, achieving a valuation of USD 2.4 billion in 2024. This leadership is supported by an advanced animal healthcare framework, high veterinary expenditure, and consistent government support for preventive livestock care. Disease prevalence continues to drive demand for vaccination, pushing the market forward.

Key players such as Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, and Ceva collectively hold around 45% of the global market. Their dominance is attributed to broad product lines, strong global distribution networks, and strategic investments in next-generation vaccine development. The livestock vaccines industry remains moderately consolidated, with these leaders setting the pace for innovation, efficiency, and sustainability in animal health solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of livestock diseases

- 3.2.1.2 Growing awareness among farmers about the benefits of vaccination.

- 3.2.1.3 Government initiatives and policies supporting animal health and food security.

- 3.2.1.4 Technological advancements leading to the development of more effective vaccines

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs associated with vaccine development and distribution

- 3.2.2.2 Regulatory hurdles that can delay product approvals and market entry.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Poultry

- 5.3 Cattle

- 5.4 Swine

- 5.5 Aquaculture

- 5.6 Sheep and goats

Chapter 6 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Attenuated live vaccine

- 6.3 Conjugate vaccine

- 6.4 Inactivated vaccine

- 6.5 Recombinant vaccine

- 6.6 Other vaccine types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parentral

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Bacterial infections

- 8.3 Viral infections

- 8.4 Parasitic infections

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 E-commerce

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Biogenesis Bago

- 11.2 Bioveta

- 11.3 Boehringer Ingelheim

- 11.4 Ceva

- 11.5 Elanco

- 11.6 HIPRA

- 11.7 Indian Immunologicals

- 11.8 Merck Animal Health

- 11.9 Neogen

- 11.10 Phibro Animal Health

- 11.11 SAN VET

- 11.12 Vaxxinova

- 11.13 Venkys

- 11.14 Virbac

- 11.15 Zoetis