|

市場調查報告書

商品編碼

1721526

伴侶動物疫苗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Companion Animal Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

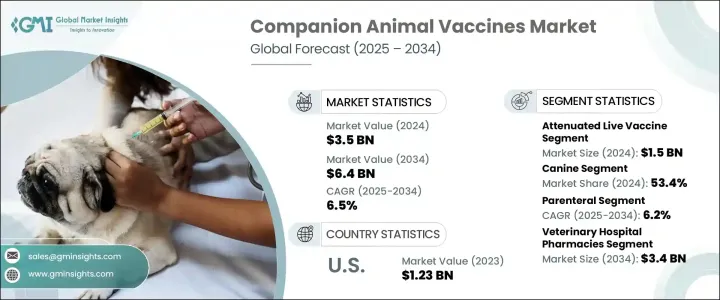

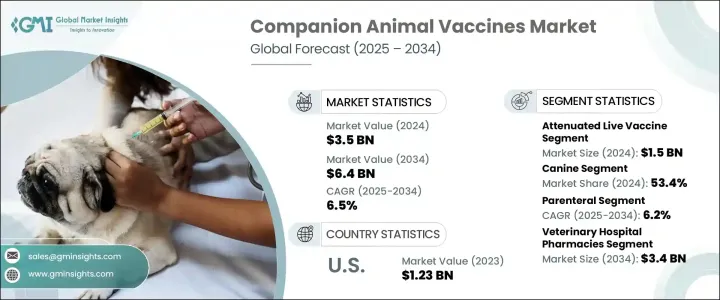

2024 年全球伴侶動物疫苗市場價值為 35 億美元,預計到 2034 年將以 6.5% 的複合年成長率成長,達到 64 億美元。這一良好的成長軌跡源於多種因素,例如寵物擁有量的增加、人們對動物健康意識的提高以及寵物人性化的不斷擴大。隨著全球各地的家庭繼續穩步飼養寵物,對疫苗接種等預防性醫療保健解決方案的需求正在迅速成長。寵物主人非常重視伴侶動物的整體健康和福祉,通常將對寵物的照顧與對人類家庭成員的照顧等同起來。這種態度的轉變推動了對常規獸醫護理的投資,導致對保護寵物免受傳染病侵害的疫苗的需求激增。此外,全球動物衛生組織正在推廣早期疫苗接種計劃,強調免疫接種對於減少人畜共通傳染病流行和改善公共衛生結果的重要性。隨著可支配收入的增加和獸醫服務的進步,人們對早期疾病預防的重視程度不斷提高,這為未來十年的持續市場擴張奠定了基礎。

伴侶動物疫苗市場依疫苗類型細分,包括減毒活疫苗、合併疫苗、去活化疫苗、DNA疫苗、重組疫苗等。其中,減毒活疫苗市場在 2024 年的價值為 15 億美元。這些疫苗因其能夠引發強烈的免疫反應並以較少的加強劑量提供持久的免疫力而受到青睞。他們利用弱化形式的病原體來刺激免疫力,從而有效地預防各種傳染病。寵物主人和獸醫繼續選擇這種疫苗類型,因為它具有成本效益、可靠性以及最大限度地減少寵物疾病爆發的能力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 64億美元 |

| 複合年成長率 | 6.5% |

就動物類型而言,市場分為犬科動物、貓科動物、馬科動物和禽科動物。隨著全球犬類數量的增加和人們對犬類健康意識的不斷提高,犬類市場到 2024 年將佔到整體市場佔有率的 53.4%。養狗率高的國家對有針對性的疫苗產品的需求正在不斷成長。製造商不斷創新並擴大專門針對狗的疫苗組合,以支持犬類市場佔據主導地位。

2023 年,美國伴侶動物疫苗市場規模達 12.3 億美元。寵物擁有量高,加上獸醫醫療保健基礎設施先進,推動了疫苗需求的持續成長。寵物人性化趨勢進一步支持了常規檢查和免疫接種的支出。在碩騰、默克動物保健、禮來動物保健等主要製藥公司引領創新的背景下,美國仍是該領域的關鍵市場。

全球市場的主要參與者致力於透過研發、與獸醫診所的合作以及區域擴張來增強其疫苗供應。 Vetoquinol、Virbac、Boehringer Ingelheim International、Bioveta、Sinovac、Biogen Bago、Brilliant Bio Pharma、HIPRA 等公司正在開發有效且經濟實惠的解決方案,以滿足全球寵物主人不斷變化的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有量和寵物消費的增加

- 伴侶動物疫苗接種意識不斷增強

- 受保寵物數量不斷增加

- 人畜共通傳染病發生率上升

- 政府加強對伴侶動物疫苗接種的力度

- 產業陷阱與挑戰

- 疫苗研發成本高昂

- 疫苗研發的嚴格監管環境

- 成長動力

- 成長潛力分析

- 技術格局

- 按動物類型分類的核心疫苗和非核心疫苗清單

- 犬科動物

- 貓科動物

- 馬

- 禽類

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按疫苗類型,2021 - 2034 年

- 主要趨勢

- 減毒活疫苗

- 結合疫苗

- 去活化疫苗

- DNA疫苗

- 重組疫苗

- 其他疫苗類型

第6章:市場估計與預測:依動物類型,2021 - 2034 年

- 主要趨勢

- 犬科動物

- 貓科動物

- 馬

- 禽類

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 腸外

- 口服

- 鼻腔

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 獸醫院藥房

- 零售藥局

- 電子商務

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Boehringer Ingelheim International

- Brilliant Bio Pharma

- Bioveta

- Biogenesis Bago

- Ceva Sante Animale

- Durvet

- Elanco Animal Health

- HIPRA

- Indian Immunologicals

- Merck Animal Health

- Sinovac

- Vetoquinol

- Virbac

- Zoetis

The Global Companion Animal Vaccines Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 6.4 billion by 2034. This promising growth trajectory stems from a combination of factors such as increasing pet ownership, rising awareness around animal health, and the expanding trend of pet humanization. As households across the globe continue to adopt pets at a steady pace, the need for preventive healthcare solutions like vaccinations is growing rapidly. Pet owners are prioritizing the overall health and well-being of their companion animals, often equating their care to that of human family members. This shift in attitude is fueling investments in routine veterinary care, creating a surge in demand for vaccines that protect pets from infectious diseases. Moreover, global animal health organizations are promoting early vaccination programs, reinforcing the importance of immunization in reducing the prevalence of zoonotic diseases and improving public health outcomes. The growing emphasis on early-stage disease prevention, supported by rising disposable incomes and advancements in veterinary services, is setting the stage for sustained market expansion through the next decade.

The companion animal vaccines market is segmented by vaccine type, including attenuated live vaccines, conjugate vaccines, inactivated vaccines, DNA vaccines, recombinant vaccines, and others. Among these, the attenuated live vaccine segment was valued at USD 1.5 billion in 2024. These vaccines are favored for their ability to trigger a strong immune response and deliver long-lasting immunity with fewer booster doses. They use weakened forms of pathogens to stimulate immunity, offering effective protection against a variety of infectious conditions. Pet owners and veterinarians continue to choose this vaccine type for its cost-efficiency, reliability, and ability to minimize disease outbreaks in pets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 6.5% |

In terms of animal type, the market is categorized into canines, felines, equines, and avians. The canine segment accounted for 53.4% of the overall market share in 2024, supported by the increasing global dog population and rising awareness of canine health. Countries with high dog ownership rates are witnessing growing demand for targeted vaccine products. Manufacturers are continuously innovating and expanding their vaccine portfolios tailored specifically to dogs, supporting the dominance of the canine segment in the market.

The U.S. Companion Animal Vaccines Market reached USD 1.23 billion in 2023. High pet ownership, coupled with an advanced veterinary healthcare infrastructure, is driving consistent vaccine demand. The pet humanization trend further supports spending on routine checkups and immunizations. With key pharmaceutical companies like Zoetis, Merck Animal Health, Elanco Animal Health, and others leading innovation, the U.S. remains a pivotal market in this space.

Key players in the global market are focused on enhancing their vaccine offerings through R&D, partnerships with veterinary clinics, and regional expansions. Companies such as Vetoquinol, Virbac, Boehringer Ingelheim International, Bioveta, Sinovac, Biogenesis Bago, Brilliant Bio Pharma, HIPRA, and others are developing effective, affordable solutions to meet the evolving needs of global pet owners.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership and spending

- 3.2.1.2 Growing awareness about companion animal vaccination

- 3.2.1.3 Growing number of insured pets

- 3.2.1.4 Rising prevalence of zoonotic diseases

- 3.2.1.5 Increasing government initiatives for companion animal vaccination

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of vaccine development

- 3.2.2.2 Stringent regulatory scenario for vaccine development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 List of core and non core vaccines by animal type

- 3.5.1 Canine

- 3.5.2 Feline

- 3.5.3 Equine

- 3.5.4 Avian

- 3.6 Regulatory landscape

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Attenuated live vaccine

- 5.3 Conjugate vaccine

- 5.4 Inactivated vaccine

- 5.5 DNA vaccine

- 5.6 Recombinant vaccine

- 5.7 Other vaccine types

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Canine

- 6.3 Feline

- 6.4 Equine

- 6.5 Avian

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Parenteral

- 7.3 Oral

- 7.4 Nasal

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Boehringer Ingelheim International

- 10.2 Brilliant Bio Pharma

- 10.3 Bioveta

- 10.4 Biogenesis Bago

- 10.5 Ceva Sante Animale

- 10.6 Durvet

- 10.7 Elanco Animal Health

- 10.8 HIPRA

- 10.9 Indian Immunologicals

- 10.10 Merck Animal Health

- 10.11 Sinovac

- 10.12 Vetoquinol

- 10.13 Virbac

- 10.14 Zoetis