|

市場調查報告書

商品編碼

1721485

獸醫氧療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Veterinary Oxygen Therapy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

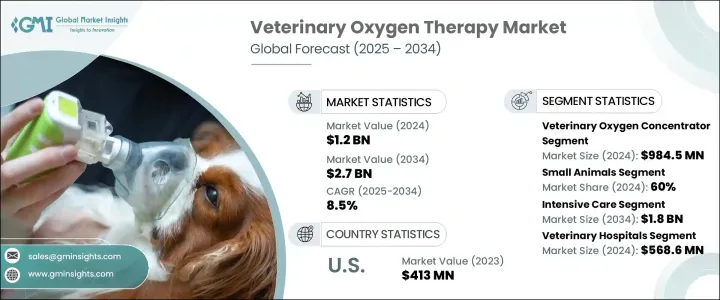

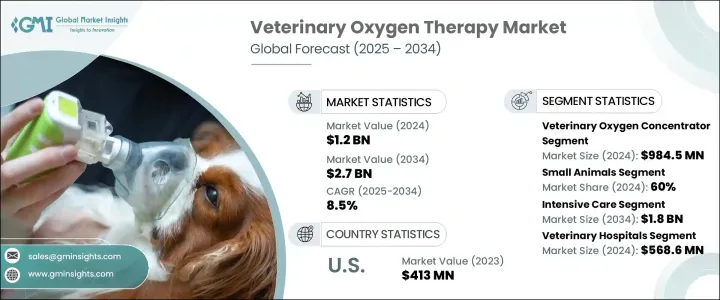

2024 年全球獸醫氧氣治療市場價值為 12 億美元,預計到 2034 年將以 8.5% 的複合年成長率成長,達到 27 億美元。這一成長趨勢反映了獸醫醫療保健的重大轉變,因為氧氣治療已成為治療患有呼吸系統疾病和慢性疾病的寵物的核心組成部分。人們對寵物健康的認知不斷提高,寵物的人性化程度不斷提高,以及寵物主人願意花錢購買先進治療方案的意願不斷增強,這些都加強了獸醫環境中對氧療的採用。肺炎、氣喘、慢性阻塞性肺病 (COPD) 和其他呼吸系統併發症等疾病越來越常見,尤其是在污染程度高的城市環境中。獸醫護理正在向更患者友好、非侵入性的解決方案轉變,氧氣治療已成為術後恢復和重症監護的可靠方法。此外,肥胖相關併發症的盛行率上升以及寵物數量老化也加速了診所和家庭對持續和緊急氧氣支持的需求。

越來越多的獸醫院和專科診所正在採用先進的氧氣治療設備,如濃縮器、鼻導管和高效氧氣面罩,以提高存活率並改善治療效果。術後併發症通常需要氧氣治療才能穩定恢復,這使其成為重症獸醫護理的關鍵部分。技術創新,尤其是攜帶式氧氣濃縮器的引入,顯著改善了護理服務。這些設備提供持續的氧氣流,使其成為診所和家庭護理的理想選擇,特別是對於慢性病患者。與傳統氧氣瓶相比,攜帶式濃縮器更具永續性且維護需求更少,為從業者和寵物主人提供了經濟高效的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 27億美元 |

| 複合年成長率 | 8.5% |

市場按產品類型細分為獸醫氧氣濃縮器和配件。光是氧氣濃縮器領域,2024 年的產值就達 9.845 億美元。這包括固定式和攜帶式設備,由於外科手術和緊急呼吸病例的增加,這些設備的使用也越來越廣泛。老年寵物常會患肺炎、支氣管炎、呼吸窘迫症候群等疾病,而氧氣治療是治療這些疾病的首選方法。濃縮器的便利性、高效性和環保性使其成為獸醫專業人士的首選。

根據動物類型,市場分為小型動物和大型動物,其中小型動物在 2024 年佔 60% 的佔有率。這種主導地位與哈巴狗、鬥牛犬和波斯貓等小型寵物的廣泛飼養有關,這些寵物容易出現呼吸障礙。在北美,由於強大的寵物醫療基礎設施、較高的寵物擁有率以及人們對慢性呼吸系統疾病的認知不斷提高,獸醫氧療市場在 2024 年佔全球佔有率的 39.9%。

Imex Medical Limited、AEOLUS International Pet Products、Drive DeVilbiss International、Koninklijke Philips、Vetland Medical、RWD Life Science、Airnetic、Shinova Systems、BMV Animal Technology 和 Longfian Scitech 等領先公司正在塑造市場格局。這些參與者將創新放在首位,並大力投資研發,以推出更便攜、更具成本效益和更有效率的氧氣治療系統。他們還與獸醫院和診所建立策略聯盟,以加強其服務網路,並推出尖端設備來滿足不斷變化的獸醫護理需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有量和獸醫護理支出的增加

- 動物呼吸道和心臟疾病盛行率上升

- 氧氣濃縮器的技術進步

- 產業陷阱與挑戰

- 獸醫氧氣治療設備成本高

- 發展中地區缺乏意識

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 獸用氧氣濃縮器

- 固定式氧氣濃縮器

- 攜帶式氧氣濃縮器

- 配件

第6章:市場估計與預測:依動物類型,2021 年至 2034 年

- 主要趨勢

- 小動物

- 大型動物

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 重症監護

- 居家照護環境/術後護理

- 其他應用

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 獸醫院

- 獸醫診所

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AEOLUS International Pet Products

- Airnetic

- BMV Animal Technology

- CAIRE

- Drive DeVilbiss International

- Imex Medical Limited

- Koninklijke Philips

- Longfian Scitech

- RWD Life Science

- Shinova Systems

- Vetland Medical

The Global Veterinary Oxygen Therapy Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 2.7 billion by 2034. This growth trend reflects a significant transformation in veterinary healthcare as oxygen therapy becomes a core component in treating pets with respiratory disorders and chronic illnesses. Rising awareness about pet health, the humanization of pets, and increased willingness among pet owners to spend on advanced treatment solutions are reinforcing the adoption of oxygen therapy across veterinary settings. Conditions like pneumonia, asthma, chronic obstructive pulmonary disease (COPD), and other respiratory complications are becoming increasingly common, especially in urban environments where pollution levels are high. Veterinary care is undergoing a shift toward more patient-friendly, non-invasive solutions, with oxygen therapy emerging as a reliable method for post-surgical recovery and critical care. In addition to that, the rising prevalence of obesity-related complications and aging pet populations are accelerating the demand for continuous and emergency oxygen support in clinics and at home.

A growing number of veterinary hospitals and specialty clinics are now incorporating advanced oxygen therapy devices such as concentrators, nasal catheters, and high-efficiency oxygen masks to improve survival rates and enhance treatment outcomes. Post-operative complications often require oxygen therapy for stabilized recovery, making it a critical part of intensive veterinary care. Technological innovations, especially the introduction of portable oxygen concentrators, have significantly improved care delivery. These devices offer continuous oxygen flow, making them ideal for both in-clinic and at-home care, particularly for chronic conditions. Compared to traditional oxygen cylinders, portable concentrators are more sustainable and require less maintenance, offering cost-effective solutions for both practitioners and pet owners.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 8.5% |

The market is segmented by product type into veterinary oxygen concentrators and accessories. The oxygen concentrator segment alone generated USD 984.5 million in 2024. This includes both stationary and portable devices, which are being increasingly used due to a rise in surgical interventions and emergency respiratory cases. Aging pets often suffer from ailments such as pneumonia, bronchitis, and respiratory distress syndrome, for which oxygen therapy is the preferred method of care. The convenience, efficiency, and eco-friendliness of concentrators have made them a preferred choice among veterinary professionals.

By animal type, the market is categorized into small and large animals, with the small animal segment accounting for a 60% share in 2024. This dominance is linked to the widespread ownership of small pets like pugs, bulldogs, and Persian cats, which are prone to breathing disorders. In North America, the veterinary oxygen therapy market accounted for 39.9% of the global share in 2024, thanks to strong pet healthcare infrastructure, higher pet ownership rates, and growing awareness of chronic respiratory conditions.

Leading companies such as Imex Medical Limited, AEOLUS International Pet Products, Drive DeVilbiss International, Koninklijke Philips, Vetland Medical, RWD Life Science, Airnetic, Shinova Systems, BMV Animal Technology, and Longfian Scitech are shaping the market landscape. These players are prioritizing innovation and investing heavily in research and development to introduce more portable, cost-effective, and efficient oxygen therapy systems. They are also forming strategic alliances with veterinary hospitals and clinics to enhance their service networks and launching cutting-edge devices to address the evolving needs of veterinary care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership and spending on veterinary care

- 3.2.1.2 Rising prevalence of respiratory and cardiac diseases in animals

- 3.2.1.3 Technological advancements in oxygen concentrator

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of veterinary oxygen therapy equipment

- 3.2.2.2 Lack of awareness in developing regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Veterinary oxygen concentrator

- 5.2.1 Stationary oxygen concentrator

- 5.2.2 Portable oxygen concentrator

- 5.3 Accessories

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Small animals

- 6.3 Large animals

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Intensive care

- 7.3 Homecare setting/postoperative care

- 7.4 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals

- 8.3 Veterinary clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AEOLUS International Pet Products

- 10.2 Airnetic

- 10.3 BMV Animal Technology

- 10.4 CAIRE

- 10.5 Drive DeVilbiss International

- 10.6 Imex Medical Limited

- 10.7 Koninklijke Philips

- 10.8 Longfian Scitech

- 10.9 RWD Life Science

- 10.10 Shinova Systems

- 10.11 Vetland Medical