|

市場調查報告書

商品編碼

1721477

生物相容性 3D 列印材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biocompatible 3D Printing Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

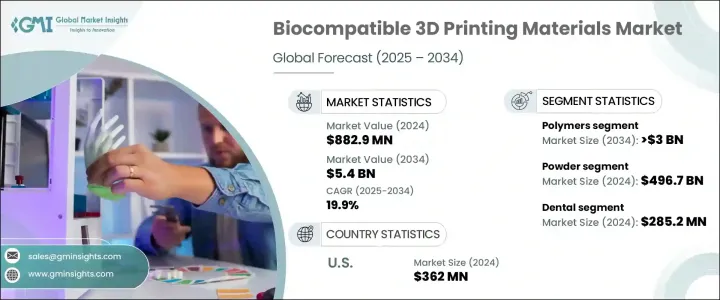

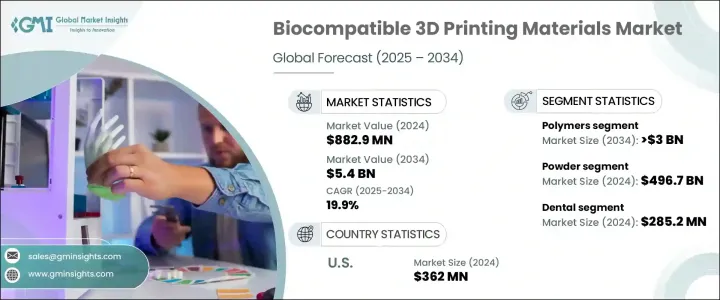

2024 年全球生物相容性 3D 列印材料市場價值為 8.829 億美元,預計到 2034 年將以 19.9% 的複合年成長率成長,達到 54 億美元。這一成長軌跡反映了對具有高精度、高性能和患者相容性的下一代醫療材料日益成長的需求。對先進醫療干預的需求日益成長,尤其是老齡化人口,推動了 3D 列印材料在各種醫療保健應用中的應用。隨著全球醫療保健系統轉向以患者為中心的方法,使用生物相容性 3D 列印材料對於提供客製化、高效和微創的醫療解決方案變得至關重要。除了骨科和義肢之外,這些材料在牙科護理、手術器械、組織支架和再生醫學領域也得到了廣泛的關注。這些材料能夠支持複雜的幾何形狀、改善手術效果並縮短恢復時間,使其成為現代醫療製造中必不可少的組成部分。隨著有利的監管政策、不斷成長的研發投資以及個人化醫療意識的不斷提高,已開發經濟體和新興經濟體的市場繼續呈現強勁發展勢頭。

市場的成長也主要歸因於積層製造技術的快速進步,包括選擇性雷射燒結 (SLS)、立體光刻 (SLA) 和直接金屬雷射燒結 (DMLS)。這些技術能夠生產符合個別解剖要求的高精度、生物相容性的醫療零件。材料創新進一步促進了市場擴張,高性能金屬合金、聚合物和生物墨水的發展提高了印刷生物醫學產品的可靠性、耐用性和相容性。這些突破對於創造具有更高性能和更低併發症發生率的功能性植入物、義肢和手術工具尤其重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.829億美元 |

| 預測值 | 54億美元 |

| 複合年成長率 | 19.9% |

市場分為聚合物、金屬和其他材料類型,其中聚合物類別預計將引領未來成長。預計到 2034 年該領域規模將達到 30 億美元,複合年成長率為 19.9%。在針對特定患者的植入物、牙齒修復體和義肢的生產中,對客製化 3D 列印聚合物的需求不斷成長。聚醚醚酮 (PEEK)、聚乳酸 (PLA) 和生物可吸收聚合物等先進材料因其卓越的強度、生物相容性以及對複雜醫療要求的適應性而越來越受到青睞。

2024 年牙科行業的產值達到 2.852 億美元,並且由於牙齒脫落、牙周病和齲齒等疾病的患病率不斷上升而穩步成長。 SLA、數位光處理 (DLP) 和 SLS 等技術大大提高了牙齒修復的精確度、強度和貼合度,從而推動了牙科專業人士和患者的需求。

2024 年,美國生物相容性 3D 列印材料市場價值為 3.62 億美元,由於老齡化人口患牙科和骨科疾病的風險增加,該市場正在經歷顯著成長。快速製造客製化義肢和植入物的能力加速了全國醫療機構採用 3D 列印技術。

全球市場的主要參與者包括 Stratasys、3D Systems、GE Additive、Formlabs、Materialise、Renishaw、Royal DSM、Arkema、Solvay、Cellink、Concept Laser、EOS、Evonik Industries、EnvisionTEC 和 Hoganas。這些公司正在積極投資先進的高性能材料,以提高生物相容性和應用精度。與醫療保健提供者和研究機構的策略合作有助於擴大 3D 列印的臨床實用性。此外,持續的產品開發專注於創新、針對特定條件的解決方案,使市場領導者能夠增強其全球影響力和競爭地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 醫療保健產業對生物相容性3D列印的需求日益成長

- 3D列印材料的技術進步

- 個人化醫療日益普及

- 產業陷阱與挑戰

- 生物相容性3D列印材料成本高

- 嚴格的監管要求

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 聚合物

- 金屬

- 其他材料類型

第6章:市場估計與預測:依形式,2021 - 2034 年

- 主要趨勢

- 粉末

- 液體

- 其他形式

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 牙科

- 藥物輸送系統

- 手術器械及植入物

- 組織工程

- 心血管

- 骨科

- 其他應用

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Arkema

- BIO INX

- Cellink

- EnvisionTEC

- EOS

- Evonik Industries

- Formlabs

- GE Additive

- Hoganas

- Materialise

- Renishaw

- Royal DSM

- Solvay

- Stratasys

- 3D Systems

The Global Biocompatible 3D Printing Materials Market was valued at USD 882.9 million in 2024 and is estimated to grow at a CAGR of 19.9% to reach USD 5.4 billion by 2034. This growth trajectory reflects the rising demand for next-generation medical materials that offer high levels of precision, performance, and patient compatibility. The increasing need for advanced medical interventions, particularly among the aging population, is fueling the adoption of 3D-printed materials across a variety of healthcare applications. As global healthcare systems pivot toward more patient-centric approaches, the use of biocompatible 3D printing materials is becoming critical in delivering customized, efficient, and minimally invasive medical solutions. In addition to orthopedics and prosthetics, the materials are gaining widespread traction in dental care, surgical tools, tissue scaffolds, and regenerative medicine. The ability of these materials to support complex geometries, enhance surgical outcomes, and reduce recovery times positions them as essential components in modern medical manufacturing. With favorable regulatory policies, growing R&D investments, and expanding awareness about personalized healthcare, the market continues to experience substantial momentum across both developed and emerging economies.

The market's growth is also largely attributed to rapid advancements in additive manufacturing techniques, including Selective Laser Sintering (SLS), Stereolithography (SLA), and Direct Metal Laser Sintering (DMLS). These technologies enable the production of highly accurate and biocompatible medical components that align with individual anatomical requirements. Material innovations further contribute to market expansion, with the development of high-performance metal alloys, polymers, and bioinks improving the reliability, durability, and compatibility of printed biomedical products. These breakthroughs are particularly relevant in creating functional implants, prosthetics, and surgical tools that offer improved performance and reduced complication rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $882.9 Million |

| Forecast Value | $5.4 Billion |

| CAGR | 19.9% |

The market is segmented into polymers, metals, and other material types, with the polymers category expected to lead future growth. This segment is projected to reach USD 3 billion by 2034, growing at a CAGR of 19.9%. The rising demand for customized 3D-printed polymers is evident in the production of patient-specific implants, dental restorations, and prosthetic devices. Advanced materials such as Polyether Ether Ketone (PEEK), Polylactic Acid (PLA), and bioresorbable polymers are gaining ground due to their superior strength, biocompatibility, and adaptability to complex medical requirements.

The dental sector accounted for USD 285.2 million in 2024 and is expanding steadily, driven by the increasing prevalence of conditions like tooth loss, periodontal diseases, and dental caries. Technologies such as SLA, Digital Light Processing (DLP), and SLS have dramatically improved the precision, strength, and fit of dental restorations, boosting demand among dental professionals and patients alike.

The U.S. Biocompatible 3D Printing Materials Market was valued at USD 362 million in 2024 and is experiencing significant growth due to the aging population's heightened risk of dental and orthopedic issues. The ability to rapidly manufacture tailored prosthetics and implants has accelerated the adoption of 3D printing in medical facilities across the country.

Key players in the global market include Stratasys, 3D Systems, GE Additive, Formlabs, Materialise, Renishaw, Royal DSM, Arkema, Solvay, Cellink, Concept Laser, EOS, Evonik Industries, EnvisionTEC, and Hoganas. These companies are actively investing in advanced, high-performance materials to improve biocompatibility and application precision. Strategic collaborations with healthcare providers and research organizations are helping to expand the clinical utility of 3D printing. Moreover, ongoing product development focused on innovative, condition-specific solutions is allowing market leaders to enhance their global footprint and competitive positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand of biocompatible 3D printing in healthcare industry

- 3.2.1.2 Technological advancements in 3D printing materials

- 3.2.1.3 Growing adoption of personalized medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biocompatible 3D printing materials

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Polymers

- 5.3 Metals

- 5.4 Other material types

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Liquid

- 6.4 Other forms

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dental

- 7.3 Drug delivery systems

- 7.4 Surgical tools and implants

- 7.5 Tissue engineering

- 7.6 Cardiovascular

- 7.7 Orthopedic

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arkema

- 9.2 BIO INX

- 9.3 Cellink

- 9.4 EnvisionTEC

- 9.5 EOS

- 9.6 Evonik Industries

- 9.7 Formlabs

- 9.8 GE Additive

- 9.9 Hoganas

- 9.10 Materialise

- 9.11 Renishaw

- 9.12 Royal DSM

- 9.13 Solvay

- 9.14 Stratasys

- 9.15 3D Systems