|

市場調查報告書

商品編碼

1716700

生物農藥市場機會、成長動力、產業趨勢分析及2025-2034年預測Biopesticides Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

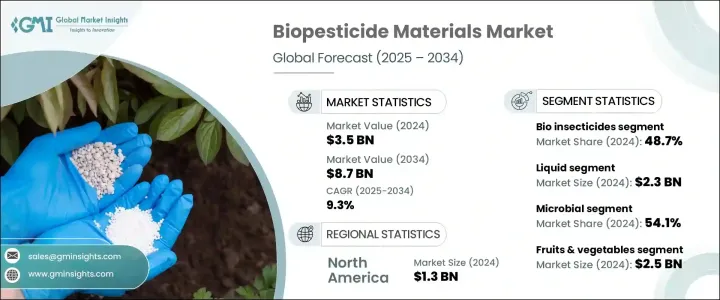

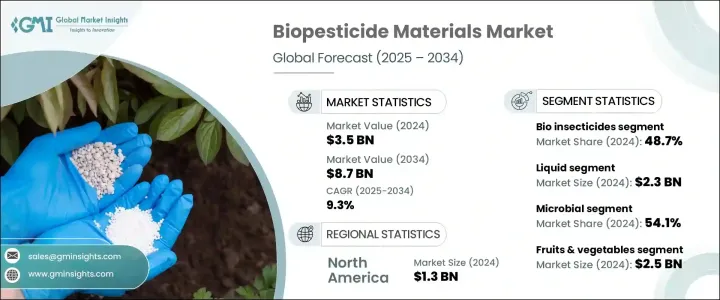

2024 年全球生物農藥市場規模達到 35 億美元,預計 2025 年至 2034 年期間將以 9.3% 的複合年成長率強勁成長,這得益於全球消費者對有機農產品的需求不斷成長和健康意識不斷增強。隨著人們對合成農藥不良影響的擔憂不斷增加,生物農藥正迅速成為更安全、更永續的作物保護替代品。如今,消費者對傳統種植的水果和蔬菜中的農藥殘留有了更多的認知,這極大地推動了有機農業實踐的採用。

由於生物農藥來自細菌、真菌、病毒和植物物質等天然來源,因此它們越來越受到綜合蟲害管理計劃和永續農業的青睞。此外,全球對生態友善農業實踐的關注,加上對化學農藥使用的更嚴格的監管,正在加速向生物農藥的轉變。世界各國政府也透過優惠政策和補貼支持有機農業計畫來推動生物農藥的使用。此外,害蟲對合成農藥的抗藥性日益普遍,迫使農民探索更有效、更環保的解決方案,這為生物農藥市場的成長增添了進一步的動力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 87億美元 |

| 複合年成長率 | 9.3% |

生物農藥市場分為生物殺蟲劑、生物除草劑、生物殺菌劑和其他產品,其中生物殺蟲劑在 2024 年將佔據最大的市場佔有率,為 48.7%。預計到 2034 年,該細分市場將以 9.2% 的複合年成長率擴張,這得益於對在保持高作物產量的同時最大限度地減少環境危害的害蟲防治解決方案的需求不斷成長。生物殺蟲劑由天然微生物或植物活性化合物組成,已成為現代農業的重要組成部分,尤其是在農民尋求減少對化學殺蟲劑依賴的情況下。它們在綜合蟲害管理 (IPM) 系統中發揮的作用以及與有機農業標準的兼容性支持了它們日益廣泛的應用,使其成為傳統種植者和有機種植者的首選。

根據產品形態,市場分為乾製劑和液體製劑,其中液體生物農藥在 2024 年的市場規模為 23 億美元,預計到 2034 年的複合年成長率為 9.4%。液體製劑因其使用方便、功效更高、貨架穩定性優越等特點而越來越受到青睞。這些製劑有懸浮液、乳油和可溶性液體等形式,能夠更好地黏附在植物表面,並且可以使用現有的噴灑設備輕鬆施用,從而在尋求有效害蟲防治的農民中得到廣泛使用。

從地區來看,北美地區 2024 年的生物農藥銷售額為 13 億美元,預計在 2025 年至 2034 年期間的複合年成長率將達到 9%。由於美國和加拿大對農業生物技術的大量投資,該地區在全球市場中保持領先地位。向永續農業方法和有機農業的持續轉變繼續增強北美對生物農藥的需求。此外,先進農業技術和綜合蟲害管理實踐的廣泛實施鞏固了該地區在這個快速擴張的市場中的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 消費者對有機產品的偏好

- 監管支持和政府舉措

- 技術進步

- 產業陷阱與挑戰

- 生產成本高

- 與化學農藥相比作用較慢

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 生物除草劑

- 生物殺蟲劑

- 生物殺菌劑

第6章:市場規模與預測:依形式,2021 年至 2034 年

- 主要趨勢

- 乾燥

- 液體

第7章:市場規模及預測:依來源,2021 年至 2034 年

- 主要趨勢

- 微生物

- 生化

- 其他

第8章:市場規模及預測:依作物,2021 年至 2034 年

- 主要趨勢

- 穀物和油籽

- 水果和蔬菜

- 蘋果

- 葡萄

- 馬鈴薯

- 其他

- 其他

第9章:市場規模及預測:依應用,2021 年至 2034 年

- 主要趨勢

- 種子處理

- 葉面噴施

- 土壤噴灑

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- BASF SE

- Bayer AG

- Syngenta AG

- UPL Limited

- FMC Corporation

- Marrone Bio Innovations

- Novonesis

- Nufarm

- Isagro SpA

- Certis USA LLC

- Koppert Biological Systems

- Biobest Group NV

- Valent BioSciences

- STK Bio-Ag Technologies

The Global Biopesticides Market reached USD 3.5 billion in 2024 and is projected to witness robust growth at a CAGR of 9.3% from 2025 to 2034, fueled by the growing demand for organic produce and increasing health consciousness among consumers worldwide. As concerns over the adverse effects of synthetic pesticides continue to rise, biopesticides are rapidly emerging as a safer and more sustainable alternative for crop protection. Consumers today are more aware of pesticide residues found in conventionally grown fruits and vegetables, which is significantly pushing the adoption of organic farming practices.

Since biopesticides are derived from natural sources such as bacteria, fungi, viruses, and plant-based substances, they are increasingly preferred for integrated pest management programs and sustainable agriculture. Moreover, the global focus on eco-friendly agricultural practices, coupled with stricter regulations against chemical pesticide usage, is accelerating the shift toward biopesticides. Governments worldwide are also promoting biopesticide use through favorable policies and subsidy support for organic farming initiatives. Additionally, the rising prevalence of pest resistance to synthetic pesticides is compelling farmers to explore more effective and environmentally responsible solutions, adding further momentum to the biopesticides market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 9.3% |

The biopesticides market is segmented into bio insecticides, bio herbicides, bio fungicides, and other products, with bio insecticides accounting for the largest market share of 48.7% in 2024. This segment is projected to expand at a CAGR of 9.2% through 2034, driven by the rising need for pest control solutions that minimize environmental harm while maintaining high crop yields. Bio insecticides, composed of natural microorganisms or plant-based active compounds, have become essential components in modern agriculture, especially as farmers seek to reduce dependency on chemical insecticides. Their growing adoption is supported by their role in integrated pest management (IPM) systems and their compatibility with organic farming standards, making them a favored choice for both conventional and organic growers.

Based on product form, the market is divided into dry and liquid formulations, with liquid biopesticides generating USD 2.3 billion in 2024 and anticipated to grow at a CAGR of 9.4% through 2034. Liquid formulations are gaining traction due to their user-friendly application, higher efficacy, and superior shelf stability. Available as suspension concentrates, emulsifiable concentrates, and soluble liquids, these formulations ensure better adherence to plant surfaces and are easily applied using existing spraying equipment, driving widespread usage among farmers seeking efficient pest control.

Regionally, North America generated USD 1.3 billion in biopesticides sales in 2024 and is poised to grow at a CAGR of 9% between 2025 and 2034. The region maintains a leading position in the global market, backed by significant investments in agricultural biotechnology across the United States and Canada. The ongoing shift toward sustainable farming methods and organic agriculture continues to bolster the demand for biopesticides in North America. Furthermore, the widespread implementation of advanced farming techniques and integrated pest management practices reinforces the region's stronghold in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Consumer preference for organic products

- 3.6.1.2 Regulatory support and government initiatives

- 3.6.1.3 Technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High Production Costs

- 3.6.2.2 Slow action compared to chemical pesticides

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Bio herbicides

- 5.3 Bio insecticides

- 5.4 Bio fungicides

Chapter 6 Market Size and Forecast, By Form, 2021 – 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Liquid

Chapter 7 Market Size and Forecast, By Source, 2021 – 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Microbial

- 7.3 Biochemical

- 7.4 Others

Chapter 8 Market Size and Forecast, By Crop, 2021 – 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Grain & oil seeds

- 8.3 Fruit & vegetables

- 8.3.1 Apples

- 8.3.2 Grapes

- 8.3.3 Potatoes

- 8.3.4 Others

- 8.4 Others

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Seed treatment

- 9.3 Foliar spray

- 9.4 Soil spray

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 BASF SE

- 11.2 Bayer AG

- 11.3 Syngenta AG

- 11.4 UPL Limited

- 11.5 FMC Corporation

- 11.6 Marrone Bio Innovations

- 11.7 Novonesis

- 11.8 Nufarm

- 11.9 Isagro S.p.A

- 11.10 Certis USA L.L.C.

- 11.11 Koppert Biological Systems

- 11.12 Biobest Group NV

- 11.13 Valent BioSciences

- 11.14 STK Bio-Ag Technologies