|

市場調查報告書

商品編碼

1716635

無線電動工具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cordless Power Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

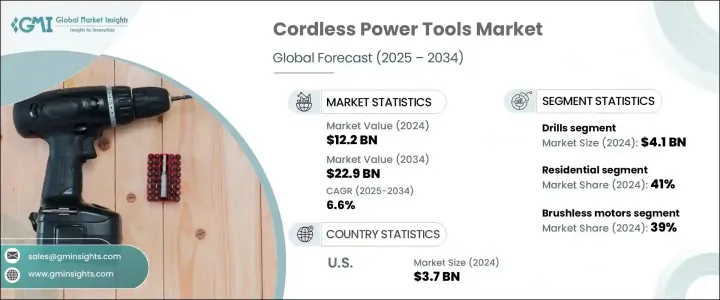

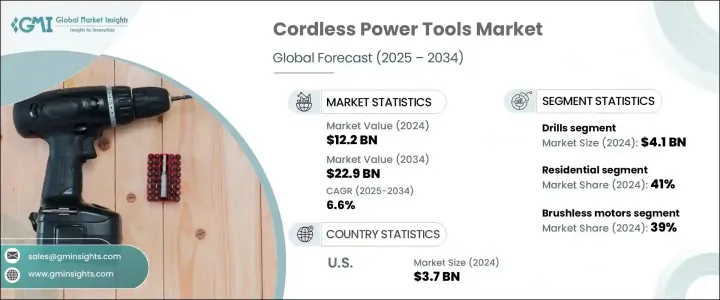

2024 年全球無線電動工具市場價值為 122 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.6%。這一成長得益於電池技術的快速進步、人們對 DIY 家居項目的興趣日益濃厚以及全球建築和工業活動的興起。對便攜、易用、高效工具的需求日益成長,改變了電動工具產業,使無線電動工具成為專業和個人工具包的重要組成部分。從有線到無線的轉變日益頻繁,很大程度上是由於現代無線工具提供的便利性、靈活性和性能,使用戶可以更有效率地工作,而無需擔心電源插座或纏繞的電線。

隨著全球特別是新興經濟體城市化和工業化的加速,建築業和基礎設施建設蓬勃發展,進一步支持了市場成長。此外,隨著消費者擴大尋求能夠提供更高生產力、更好的人體工學和增加安全功能的工具,具有先進功能的智慧連網工具越來越受歡迎,對住宅用戶和專業用戶都有吸引力。人們對環境永續性的日益關注以及對節能解決方案的需求也促使製造商在無線工具生產中採用環保材料和技術。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 122億美元 |

| 預測值 | 229億美元 |

| 複合年成長率 | 6.6% |

鋰離子電池已成為大多數無線工具的主要電源,與傳統電池相比,其運行時間更長、充電速度更快、更有效率。這些電池以其低自放電率而聞名,這使得它們在不活動期間可以保持更長的電量。與鎳鎘或其他舊型電池不同,鋰離子電池不含有害的鎘,因此是更安全、更環保的選擇。先進鋰離子電池技術的整合正在推動無線工具性能、耐用性和永續性的顯著提升,從而吸引從建築專業人士到普通 DIY 愛好者的更廣泛的用戶群。

無線電動工具涵蓋範圍廣泛,包括鑽頭、鋸子、割草機、衝擊扳手、砂光機、磨床等。其中,鑽頭部分在 2024 年創造了 41 億美元的收入,得益於商業和住宅用戶的強勁需求。隨著創新的發展,無線電鑽變得越來越智慧,內建藍牙連接和基於應用程式的控制,使用戶可以追蹤工具使用情況、監控性能,甚至定位丟失的工具。這種程度的智慧和整合正在重塑用戶與工具的互動方式,從而提供更高的便利性和效率。

市場根據最終用戶細分為住宅、商業和工業類別,其中住宅領域在 2024 年將佔據 41% 的佔有率,這得益於家居裝修和 DIY 趨勢的興起。隨著住宅和商業建築項目的不斷成長,對多功能和高性能無線工具的需求也在成長。受先進工具技術、消費者在家居升級方面的支出不斷成長以及 DIY 活動激增的推動,美國無線電動工具市場在 2024 年創造了 37 億美元的收入。更長的電池壽命、快速充電和符合人體工學的設計使無線工具成為各行各業用戶的首選。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 電池技術進步

- DIY 和家居裝修需求增加

- 產業陷阱與挑戰

- 初始成本高

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依工具類型,2021-2034

- 主要趨勢

- 鑽頭

- 鋸子

- 割草機

- 衝擊扳手

- 桑德

- 磨床

- 其他(射釘槍、訂書機等)

第6章:市場估計與預測:依馬達類型,2021-2034

- 主要趨勢

- 有刷電機

- 無刷電機

第7章:市場估計與預測:按電壓,2021-2034

- 主要趨勢

- 12伏

- 18伏

- 20伏

- 40伏

- 40V以上

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第9章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 建造

- 汽車

- 航太

- 能源

- 電子產品

- DIY

- 其他(製造業等)

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- Apex Tool

- Dynabrade Power Tools

- Festool

- Hilti

- Hitachi Koki

- KEN Holding

- Makita

- Robert Bosch

- Ryobi

- Snap-on Tools Company

- Stanley Black & Decker

- Stihl

- Techtronic

- TTI Group

- Yamabiko

The Global Cordless Power Tools Market was valued at USD 12.2 billion in 2024 and is projected to expand at a CAGR of 6.6% from 2025 to 2034. The growth is fueled by rapid advancements in battery technologies, growing interest in DIY home projects, and rising construction and industrial activities worldwide. The growing demand for portable, easy-to-use, and efficient tools has transformed the power tools industry, making cordless power tools an essential part of both professional and personal toolkits. The increasing shift from corded to cordless variants is largely driven by the convenience, flexibility, and performance offered by modern cordless tools, allowing users to work more efficiently without worrying about power outlets or tangled cords.

With urbanization and industrialization accelerating globally, especially in emerging economies, construction, and infrastructure development are surging, further supporting market growth. In addition, the rising popularity of smart and connected tools with advanced features is appealing to both residential and professional users, as consumers are increasingly seeking tools that offer higher productivity, better ergonomics, and added safety features. Growing concerns around environmental sustainability and the need for energy-efficient solutions are also prompting manufacturers to adopt eco-friendly materials and technologies in cordless tool production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $22.9 Billion |

| CAGR | 6.6% |

Lithium-ion batteries have emerged as the dominant power source for most cordless tools, enabling longer operating times, faster charging, and superior efficiency compared to traditional alternatives. These batteries are known for their low self-discharge rates, allowing them to hold a charge longer during inactivity. Unlike nickel-cadmium or other older battery types, lithium-ion batteries do not contain harmful cadmium, making them a safer and more environmentally responsible option. The integration of advanced lithium-ion battery technologies is driving significant improvements in the performance, durability, and sustainability of cordless tools, thus attracting a broader user base ranging from professionals in construction to casual DIY enthusiasts.

Cordless power tools encompass a wide range of equipment, including drills, saws, lawnmowers, impact wrenches, sanders, grinders, and more. Among these, the drills segment generated USD 4.1 billion in 2024, backed by strong demand from both commercial and residential users. As innovation evolves, cordless drills are getting smarter with built-in Bluetooth connectivity and app-based controls, allowing users to track tool usage, monitor performance, and even locate lost tools. This level of intelligence and integration is reshaping how users interact with their tools, delivering enhanced convenience and efficiency.

The market is segmented by end users into residential, commercial, and industrial categories, with the residential segment accounting for a 41% share in 2024, driven by rising home improvement and DIY trends. As residential and commercial construction projects continue to grow, so does the need for multi-functional and high-performing cordless tools. The U.S. Cordless Power Tools Market generated USD 3.7 billion in 2024, supported by advanced tool technologies, growing consumer spending on home upgrades, and surging DIY activities. Enhanced battery life, rapid charging, and ergonomic designs are making cordless tools a preferred choice for users across industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Advancement in battery technological

- 3.6.1.2 Increased demand in DIY and home improvement

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs

- 3.6.2.2 Fluctuations in raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Tool Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Drills

- 5.3 Saws

- 5.4 Lawn mower

- 5.5 Impact wrench

- 5.6 Sander

- 5.7 Grinder

- 5.8 Others (nail guns, staplers etc.)

Chapter 6 Market Estimates & Forecast, By Motor Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Brushed motor

- 6.3 Brushless motor

Chapter 7 Market Estimates & Forecast, By Voltage, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 12V

- 7.3 18V

- 7.4 20V

- 7.5 40V

- 7.6 Above 40V

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Automotive

- 9.4 Aerospace

- 9.5 Energy

- 9.6 Electronics

- 9.7 DIY

- 9.8 Others (manufacturing etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Apex Tool

- 12.2 Dynabrade Power Tools

- 12.3 Festool

- 12.4 Hilti

- 12.5 Hitachi Koki

- 12.6 KEN Holding

- 12.7 Makita

- 12.8 Robert Bosch

- 12.9 Ryobi

- 12.10 Snap-on Tools Company

- 12.11 Stanley Black & Decker

- 12.12 Stihl

- 12.13 Techtronic

- 12.14 TTI Group

- 12.15 Yamabiko